My Lending Club Interview - Answers to Many of Your Questions

Posted On Saturday, January 10, 2009 at at 8:59 PM by Finance FanaticSo what is Lending Club

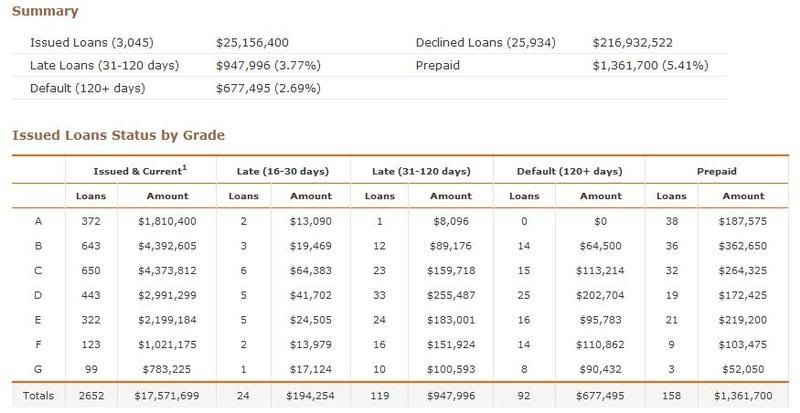

The biggest question I got from all of you which I passed on to Rob was what is the default rate? The first thing Rob said is that Lending Club prides themselves in the transparency of their information. As I went through the different links they have, I found this to be very true. For instance, the graph below shows the total amount of loans Lending Club has issued since its beginning. As you see, out of the $25,156,400 worth of loans they have issued since June of 2007, only $677,495 (or 2.69%) have defaulted. They define default as failure to make a payment over 120 days. This was a lot lower than I originally thought and actually made me feel a bit more comfortable with my invested funds, since I did not choose that risky of loans.

Lending Club does go after defaulted loans and are sometimes able to recover the funds. They continually update their collection process with every phone call they make all the way to the final bankruptcy judgement decision. They do a great job of keeping you updated.

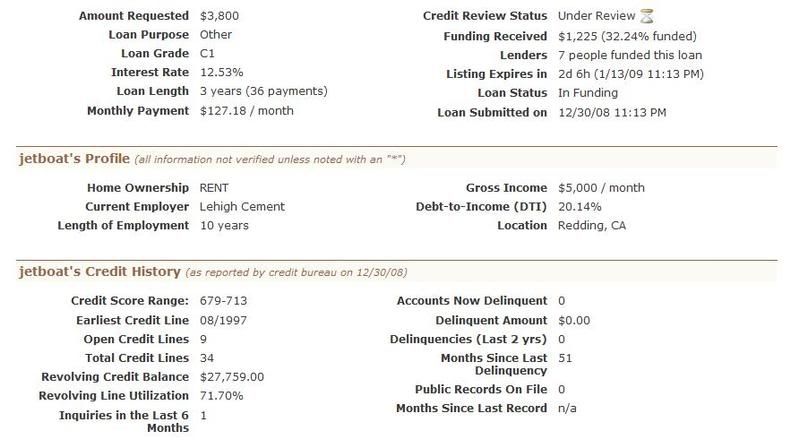

Now, when choosing a loan to invest in, Lending Club does a pretty good job of getting a lot of information from their background checks on individuals and disclosing this to the investor. Below is an example of someone who is looking for a $3800 loan.

As you can see, they have their current employment, length of employment, credit score, credit balance, etc. All of the loans issued on Lending Club are 36 month (3 year loans). So one downside, is that your money is invested for a longer term. However, as I will talk about in another post, you can sell out of your position in a loan through their secondary market to liquidate your investment.

As you can see, they have their current employment, length of employment, credit score, credit balance, etc. All of the loans issued on Lending Club are 36 month (3 year loans). So one downside, is that your money is invested for a longer term. However, as I will talk about in another post, you can sell out of your position in a loan through their secondary market to liquidate your investment.I asked Rob of loans that seem to perform better than others and he said, debt consolidation, car loans, and paying off credit cards were some that stood out as top performing loans. I did ask him ones that have not performed well and although he said nothing was black and white, he did say that a lot of wedding debt (found that funny) and student loans had some problems in the past.

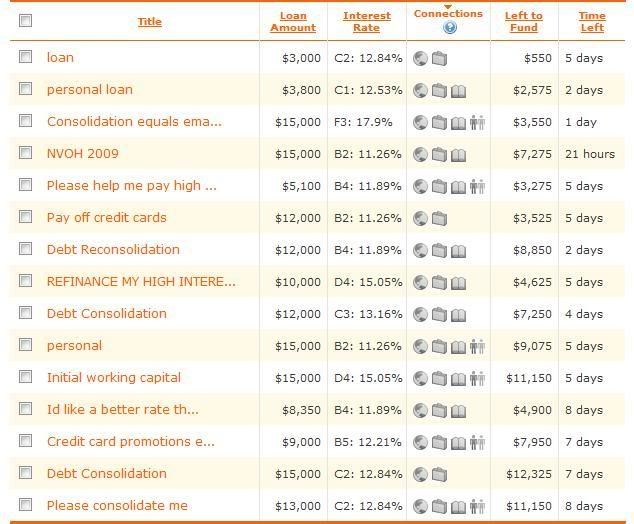

Below is a picture of what it looks like when initially browsing the loans to choose to invest in. You can either choose a target investment yield and they will automatically choose a portfolio of loans for you to approve, or you can go through individually and manually choose them. As you can see, it gives the loan description, loan balance, Lending Club's value rating of the loan along with the interest rate (the larger the interest rate, the lower the value rating). It also shows how much is left to fund and the time left until the loan is issued.

To sum things up for this first post, I asked Rob to give a couple points that separates them from competitors. First off, is that they are actually registered with SEC. Although, they haven't registered with all states, they have registered Lending Club

To sum things up for this first post, I asked Rob to give a couple points that separates them from competitors. First off, is that they are actually registered with SEC. Although, they haven't registered with all states, they have registered Lending ClubThe other big one was their platform. They are very transparent with their information and try to give the investor as much information about the loan they are investing in. The ease of use is very significant, as I was able to sign up, find loans to invest in and be finished all within 10 minutes.

I didn't want all the information crammed in a post, so I will stop here and talk more on another day about some positives about this program I have found. I see these P2P programs becoming more popular as banks continue to struggle to lend. My biggest concern is regulation, but so far I am very impressed with Lending Club

Market Trades Lower To End The Week - As Bad News Continues

Posted On Friday, January 9, 2009 at at 7:34 PM by Finance Fanatic It seems as if normality is slowly returning to the market as trading trends are starting to reflect economic conditions more and more. Today, they announced the employment numbers, and surprisingly it was less than expected. I am not that surprised, as I feel not many people like to terminated their employees during December. However, still realizing the detrimental impact of the number, investors seem to have realized the actual impact of the number, as the Dow traded down again to end the week. I do feel January is going to be devastating for employment numbers. In December, 524,000 we're claimed jobless as the unemployment rate has now shot to 7.2%. I expect this number to be reaching double digits very shortly. As company executives meet this month to do budget revisions and write up their new business plans, you can expect many divisions to be cut out for 2009. Q1 2009 will be extremely tough for the US.

It seems as if normality is slowly returning to the market as trading trends are starting to reflect economic conditions more and more. Today, they announced the employment numbers, and surprisingly it was less than expected. I am not that surprised, as I feel not many people like to terminated their employees during December. However, still realizing the detrimental impact of the number, investors seem to have realized the actual impact of the number, as the Dow traded down again to end the week. I do feel January is going to be devastating for employment numbers. In December, 524,000 we're claimed jobless as the unemployment rate has now shot to 7.2%. I expect this number to be reaching double digits very shortly. As company executives meet this month to do budget revisions and write up their new business plans, you can expect many divisions to be cut out for 2009. Q1 2009 will be extremely tough for the US.

Well, with the three days straight of down trading, momentum is definitely bearish. Sure, we have Obama taking over in two weeks, but the sentiment is beginning to get to the point where I think even the ignorant are starting to realize we're in one big mess. For the next six months, we are going to be in uncharted territory for economic data and there is not much the government can do to fix it. They will try, but there are too many cooks in the kitchen with to many messes to clean up at once.

This week we also started the bad earnings train. Wal-Mart, Coach, and Chevron started off the new year with disappointing earnings. Wal-Mart is one of my few choices for a decent performing stock and one I'm keeping in the IRA this year. If their struggling, I can't imagine what others are doing. Companies like Nordstrom, Macys, Best Buy, and Bed Bath and Beyond (just to name a few) should see a dramatic decrease in sales. I have liquidated any and all of my retail stocks.

I did utilize the last of my monthly free Zecco.com trades (I only get 10!) to pick up some more GDX and more SKF. I still love gold and cannot see how banks are going to get out of the mess they're in anytime soon. Especially now, as we are seeing them start to conform to mortgage restructuring like Citi has done.

The motivation has definitely shifted and I expect the panic selling to continue into next week. I am still not ruling out a temporary Obama rally that I am sure is bound to make a couple days green, but I think for the most part, people's hopes of Obama immediately turning this thing around is all but gone. Good week for me and my portfolio. My GDX has done very well for me and SRS and FXP should keep climbing as the turmoil continues (I need them too!). Make sure to check back this weekend as I am going to report on my phone call with Lending Club. He answered a lot of the questions I had and discussed other ways I can maximize my investment with the company. They even have a secondary market for re-selling or buying existing loans for discount. The post will definitely be worth reading. Check them out if you haven't. Have a great weekend and Happy Trading.

Mixed Trading as Citi Plans To Restructure Loans

Posted On Thursday, January 8, 2009 at at 6:04 PM by Finance Fanatic Well, well, another interesting day of trading while the world sits and waits for our dreaded employment numbers to be announced. Some are expecting the numbers to be the worst since World War 2. However, it probably won't matter, because our market has become so interested in "projected numbers" than what the actual number dictates. For example, Target announces earnings with a 4.1% drop in sales, but the stock goes up almost 3%, having the announcement better than market expectations. On the flip side, Wal-Mart announced an increase in sales of 1.7%, but because this was below market expectations, there stock goes down 7.5%. The market is becoming more concerned about the numbers relationship to expectations instead of the actual performance of the number itself. It can be very, very frustrating.

Well, well, another interesting day of trading while the world sits and waits for our dreaded employment numbers to be announced. Some are expecting the numbers to be the worst since World War 2. However, it probably won't matter, because our market has become so interested in "projected numbers" than what the actual number dictates. For example, Target announces earnings with a 4.1% drop in sales, but the stock goes up almost 3%, having the announcement better than market expectations. On the flip side, Wal-Mart announced an increase in sales of 1.7%, but because this was below market expectations, there stock goes down 7.5%. The market is becoming more concerned about the numbers relationship to expectations instead of the actual performance of the number itself. It can be very, very frustrating.

So even if we do see a horrific number for employment, unless it's the worst since World War 2, I'm sure the media will spin it off to be a positive sign, and somehow millions of people out there will buy into it. Not me, I expect the number to be very bad and as a result it reminds me of just how big of a mess we're in.

After the close, Chevron warned of probable lower earnings due to the large drop in gasoline prices. I'm sure they're doing just fine as they made mounds of cash the past two years off our $4.50+ gas prices. Still, this news could bring some more negative sentiment for energy sectors during trading tomorrow.

CITI BAILOUT A big announcement today, was that Citi has agreed to participate in mortgage adjustments for distressed housing loans. Are you serious? I don't mean to sound unsympathetic as I am aware there are many people suffering. However, this move will support the 90 10 rule. Probably, only about 10% of the people receiving this help have actually a legitimate case to argue of their current position, while the other 90% will be bailing out people who bought out of greed and poor choices. One of the great principals this nation was founded on was a free economy. It is also known as the American dream. You can do whatever you want to do with enough work. Another element of the American dream is failure. Without failure, we have no successes. Call it survival of the fittest, yin and yang, or whatever. The point is not every business is meant to succeed, just as every choice isn't suppose to be the right one. If we don't learn from our mistakes, how will we change the future?

A big announcement today, was that Citi has agreed to participate in mortgage adjustments for distressed housing loans. Are you serious? I don't mean to sound unsympathetic as I am aware there are many people suffering. However, this move will support the 90 10 rule. Probably, only about 10% of the people receiving this help have actually a legitimate case to argue of their current position, while the other 90% will be bailing out people who bought out of greed and poor choices. One of the great principals this nation was founded on was a free economy. It is also known as the American dream. You can do whatever you want to do with enough work. Another element of the American dream is failure. Without failure, we have no successes. Call it survival of the fittest, yin and yang, or whatever. The point is not every business is meant to succeed, just as every choice isn't suppose to be the right one. If we don't learn from our mistakes, how will we change the future?

I could go on for hours about this, I just feel that this move (and whatever else is to come) undermines the people that were patient and worked hard for what they have. I mean, heck, if I knew the Government was going to bail me out, I would have bought three houses, knowing eventually, the Government would bail me out. If you take away accountability, you take away that spirit of free economy that originally made this country what it is. So, I'll get off my soapbox, that's just my feeling on the situation.

So to summarize this move, bankruptcy courts can alter the loans based on certain conditions. These being:

1) Only mortgages entered into prior to the date of enactment of the bill would be eligible for the treatment. All loans, and not just subprime, are eligible.

2) Borrowers have to show they made a “good faith”(What does "good faith" entail? Who knows.) attempt to work with the lender before considering this bankruptcy provision. Bankruptcy cannot be the first option, and borrowers have to prove it wasn’t.

3) Bankruptcy judges can strip away a lender’s credit or rights if they violated the Truth in Lending Act or other state and federal laws.

Many are still against such moves, but it will be interesting to see who else joins the wonderful bailout club. I would expect this to probably cause some optimistic trading tomorrow, especially in home builders and maybe some REITS. I don't know what this will do for financials, considering in the end, this will be reducing their investment. I see it as bad news, but you never know how the media will spin it.

As I have received many emails with questions about Lending Club, I was able to talk to one of the Directing managers of the site today, who answered several of mine and your questions about the program and their success. I plan on writing a post about it this weekend, sharing some of the numbers he gave me, but all in all, it was a great call and really increased my confidence in the company. I realize the risks of consumer lending, but after the call, I am a lot more comfortable with the underwriting and screening process and now believe I have a really good chance of receiving close to my 10.5% targeted returns. Definitely worth looking into.

Well, the end of the week rally could be in session tomorrow, very much depending on employment numbers. I really do think this number is going to be very, very bad and only getting worse. I would expect the market to react negatively to the number, but with the help of the Citi announcement and market manipulation, who knows, maybe somehow we'll end in the green. Happy Trading and we'll see you tomorrow.

A Frightening Anticipation of Jobless Reports Drop Confidence

Posted On Wednesday, January 7, 2009 at at 2:46 PM by Finance Fanatic Finally, we saw more than average volume return to the market today, as the fear for increasing unemployment as well as worsening economic conditions took the wind out of buyer’s sails. To be honest, I believe the market should be reacting like this every day, considering the mess we’re in. It’s still hard to say whether this will begin the next crash, as Obama hope still lingers, but it indeed made a statement that the bear is still out there.

Finally, we saw more than average volume return to the market today, as the fear for increasing unemployment as well as worsening economic conditions took the wind out of buyer’s sails. To be honest, I believe the market should be reacting like this every day, considering the mess we’re in. It’s still hard to say whether this will begin the next crash, as Obama hope still lingers, but it indeed made a statement that the bear is still out there.

Everyone is talking about the upcoming jobless reports coming out Friday. Some analysts are saying that this month we could see a jobless count of 670,000 for December (today’s ADP report showed that we slashed 693,000 jobs in the private sector). I personally feel that we will be even worse than that number and have a lot more to go. We haven’t even begun liquidating the retailer positions. Once more of these big retailers go down, we should see some absurd unemployment numbers. In fact, in regards to that subject, North Carolina had an interesting experience this past week. North Carolina, being headquarters for a lot of major commercial and investment bankers had some problems with their unemployment office. It seems that their unemployment computer service was overloaded, because over 50,000 people were trying to access it at once. After fixing it and adding room to the server, the server was overloaded a second time due to over 70,000 simultaneous requests. The actual phone number to call was down as well. I believe the reality of our situation is slowly beginning to settle in with people.

I wanted to share an article from the Boston Globe dealing with commercial real estate. Myself being a big proponent of SRS, I thought it would be appropriate. It said, “If you think selling a home was tough in 2008, be thankful you weren't trying to unload an office building.

Sales of Boston-area commercial properties plummeted 86.5 percent last year, with about $1.35 billion in property changing hands compared to $10 billion in a red-hot 2007, according to the global real estate firm Jones Lang LaSalle.

The drop-off portends a turbulent 2009. Now, real estate investors don't have data to guide them in pricing properties in the soft economy, making it less likely that buyers will come forward out of fear of overpaying.

"Its a huge challenge right now for investors to figure out if they're getting a fair price," said Lisa Campoli, executive vice president at commercial brokerage Colliers Meredith & Grew. "During the last downturn in the 1990s, we had the S&L crisis and some banks went under, but there wasn't the global lack of confidence we're seeing right now."

Commercial real estate is the latest sector to be hit by the deepening recession, with the fallout just now sweeping through Boston and other markets. Rents are starting to fall sharply as vacancies pile up.

The impact is especially severe in New York City, where there is a large increase in space available for subleasing, a key measure of weakness in the office market. Available sublease space in Manhattan has increased 43 percent from the end of 2007 as foundering financial companies have rapidly shed jobs and floors of offices.” All over the country real estate is dying. Just remember, most of these properties that are dying have very high leveraged loans on them. Eventually, this should come back to haunt the banks again. This is why I still can’t even closely be comfortable with buying financials right now.

As a result of the -2.72% day for the Dow, almost all of the shorts were up today. SRS had a moderate 5.5% up day as hopes for more Obama bailouts keep investors a little confident in some of these REITS. Don’t ask me why. FXP had some enormous gains, closing over 15%, as China continues to have problems with their businesses. The element that is killing China is their enormously large work force. I mean, just to give everyone jobs, they need to be exporting into almost every nation. As demand is going down, this is killing their employment. Their unemployment number may be higher than our actual population. Also, if any of you have dealt with the Chinese culture you will know that when times get tough, they close the door to spending COMPLETELY. Here in the US, we love to use our credit cards, and dig us into more debt. With the Chinese culture, most people choose to save than to spend. This lack of spending and lack of exports should bring a lot of hardships for their country and businesses.

I wouldn’t be surprised to see this sell off continue tomorrow. As more negative employment numbers come out and other sore economic data, I don’t see a lot of optimistic buying going on. We could rebound a bit either tomorrow or Friday, but I still feel the bear is here right now. The only thing keeping me from putting all my chips into the short side is Obama and his list of bailouts. I’m going to let that ride out a bit, plus I’ve got enough currently in SRS, SKF, FXP and EEV.

I also wanted to clarify some things with my Lending Club investment. The times that were given in my portfolio is when the loan is set to begin, not mature. So my money will be tied up longer than I originally anticipated. However, I will still be shooting for that 10.5% return, it is just going to take longer. Anyway, I love looking into these different investment opportunities. If you know of some that have worked for you, please share. Have a great night everybody, keep up the pace. Happy Trading and we’ll see you tomorrow.

American Jobs Continue To Diminish, As Market Fights To Stay Green

Posted On Tuesday, January 6, 2009 at at 5:20 PM by Finance Fanatic Another day of nothing much but bad news hit Wall Street today, but it seems as if the hope of Obama and his plans for a new (much larger) stimulus plan seems to be keeping the market a float, even in the midst of continual turmoil. He is also warning that our deficit is nearing 1 trillion dollars. I'm sure another round of almost a trillion in bailouts will help that. That number could be doubled or tripled by 2010. As the new congress was sworn in today(mostly democrats), it seemed as though new life was breathed into financials in hopes for new USS (Uncle Sam Support), which in turn made it a big day for banks and commercial REITS and a bad day for my SRS. As frustrating as it may be for me, I have to stick by my gut, my knowledge of the real estate market, and the hope that eventually, fundamentals will move the market again, because despite what some people think and in my opinion, our current economic condition has definitely not been fully factored into this market. We’ve been given a lot of emotional morphine to dull the pain the past couple months, but there are definitely troubled times ahead.

Another day of nothing much but bad news hit Wall Street today, but it seems as if the hope of Obama and his plans for a new (much larger) stimulus plan seems to be keeping the market a float, even in the midst of continual turmoil. He is also warning that our deficit is nearing 1 trillion dollars. I'm sure another round of almost a trillion in bailouts will help that. That number could be doubled or tripled by 2010. As the new congress was sworn in today(mostly democrats), it seemed as though new life was breathed into financials in hopes for new USS (Uncle Sam Support), which in turn made it a big day for banks and commercial REITS and a bad day for my SRS. As frustrating as it may be for me, I have to stick by my gut, my knowledge of the real estate market, and the hope that eventually, fundamentals will move the market again, because despite what some people think and in my opinion, our current economic condition has definitely not been fully factored into this market. We’ve been given a lot of emotional morphine to dull the pain the past couple months, but there are definitely troubled times ahead.

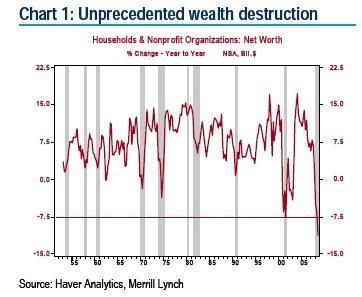

This shouldn’t be news to anyone, as everyone has been announcing warnings the past couple days. The Fed, Corporate Execs, Obama, some analysts, and about every legitimate website. Bank of America’s CEO wrote a letter to executives warning them of their poor performance results of 2008 and urged them (including himself) not to take bonuses this year. Well, at least some companies aren’t totally greedy. AIG, learn by example. Alcoa also announced today that they will be cutting anywhere from 13,000 to 15,000 jobs to help guard from their recent hardships. This sent their stock crashing into after-hours and may have contributed to the down market as a whole in after-hours as well. The job cuts that should continue the first half of 2009 should be pretty horrific. It is scary to think of how high the unemployment rate will hit before beginning to recover. All I know is very little businesses are making a lot of money right now. I mean over $7 trillion of household wealth was wiped out by Q3 2008. That’s 11%. Some expect this number to have almost doubled just by Q4, bringing the total loss to about 20%. That decrease is going to have serious effects on our small and large businesses, especially luxuries. And some people feel we aren't even near the bottom.

Alcoa also announced today that they will be cutting anywhere from 13,000 to 15,000 jobs to help guard from their recent hardships. This sent their stock crashing into after-hours and may have contributed to the down market as a whole in after-hours as well. The job cuts that should continue the first half of 2009 should be pretty horrific. It is scary to think of how high the unemployment rate will hit before beginning to recover. All I know is very little businesses are making a lot of money right now. I mean over $7 trillion of household wealth was wiped out by Q3 2008. That’s 11%. Some expect this number to have almost doubled just by Q4, bringing the total loss to about 20%. That decrease is going to have serious effects on our small and large businesses, especially luxuries. And some people feel we aren't even near the bottom.

Even as the market may cheer a bit as Obama is sworn in, in hopes for some more help. If Obama does end up passing his possible $850 billion stimulus plan, it is going to be quickly squelched by the $13 trillion loss in household wealth. This is why I don’t find much hope or optimism in these talks of bailouts. They're just lost tax dollars.

In addition to decrease in wealth, there will also be a decrease in spending. We are in a recession, a dollar made is a dollar saved right now. Very few people are finding a lot of extra cash to take to the mall every month. As worth of houses have been slashed and IRA accounts cut in half, people will be extra frugal in saving the next few years. By doing so, this will lower the monetary flow of the markets and bring more turmoil and frozen lending to the market. No one is being convinced to spend money right now. Even with a stimulus checks, much of that goes to paying off debt and savings.

It is very clear that problems are not retreating anytime soon. There will definitely be buying opportunities in the market. As I have said in past posts, I like energy and commodities. The dollar has experienced a surprising recent boost the past month. I don’t expect this to continue and see a lot upside still in Gold (GDX), Silver(SLVR), Oil(DIG), and agriculture(POT). Alternative energy is also on my radar (STP). During these harsh times, I expect to see a big boost in popularity in E-commerce. I see companies like Amazon and Overstock almost doubling their customer base the next couple of years. Sure, transaction volume will go down per person, but when the market does come back, they should be front runners in my book. Also, people are going to have to shop somewhere. That’s why I stick with Wal-Mart, Payless Shoe, and Old Navy brands for retailers. Discount retailers should still be doing sales.

Well, everyday becomes more interesting and a bit more scary. I just get this weird feeling like one day the market just may crash. I know the signs aren’t here at the moment, but the market is still very sensitive and the signs don't necessarily have to be here. On another note, no loans have defaulted on me yet in my Lending Club portfolio. Only a week and a half remains until all my invested loans are to begin and I am hoping I can maintain near that 10.5% return I opted for when I began. I believe my first loan payment is due in 3 days, so I will take a new screenshot and update you on what happens from there. I hope everyone is finding their own successes out there. It should be on heck of a year. Happy Trading and we’ll see you tomorrow.