What Unemployment? We've Got Obama

Posted On Saturday, February 7, 2009 at at 8:55 AM by Finance FanaticFrom trading on Friday, you would have never guessed that we received the worse job loss report in 34 years as the market blew right past that number on Friday and turned to new hope for bailouts and freedom from debts by closing the Dow up 217 points. As I said last week, currently, we are very vulnerable to these short term, violent rallies as speculation has become the steering wheel to market trading. As I also discussed earlier in the week, we knew we were expecting something from Obama to combat the dreaded unemployment number that everyone expected to be devastating. The term "Buy the rumor, Sell the news" seems to be in effect currently as everyone jumped on the bank buy train on Friday(including myself) hoping for some serious news over the weekend. The only news that happened Friday, was a pretty mediocre press conference from Obama talking about his "plan" to stimulate the economy, and the rest were a bunch of leaks that made it to the news talking about what is suppose to be announced Monday (I'm sure the government didn't mean to leak that, right?!). They estimate that over 3 million jobs have been lost since we began the "recession in December of 2007. Over half of these jobs have been lost the past three months. This is a very bad sign, as it clearly shows we have not reached the crest of this job crisis. So I continue to believe this rally will be short lived.

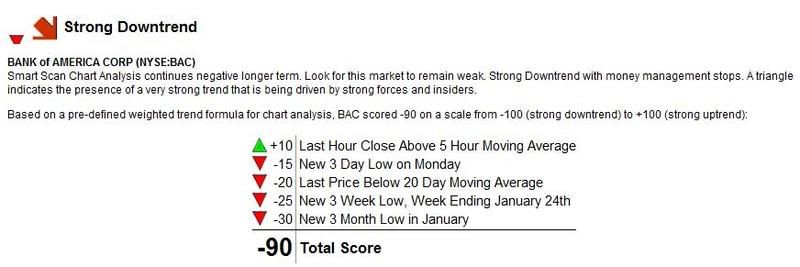

I woke up early on Friday in anticipation to the big day. Seeing the futures trading up, I had a feeling we were going to be experiencing the day we did. I also knew that Ken Lewis, Bank of America's CEO, was planned to be interviewed on CNBC. In most cases, CEO's go on air to sell a company to the public. If it is bad news, they usually send the accountants or lawyers. I knew Lewis would be selling B of A to death and that's exactly what he did. So, I ended up buying into BAC in the morning, even though it was already up 14%. Lewis talked of their successes and that he has not once talked of or been talked to about nationalizing Bank of America. He also said that the plan was to pay back TARP funds by three years. Just during his speech, the stock jumped another 7% and eventually got as high as 33% up. As for the validity of his words, who knows and frankly I don't plan to be in his stock for very long.

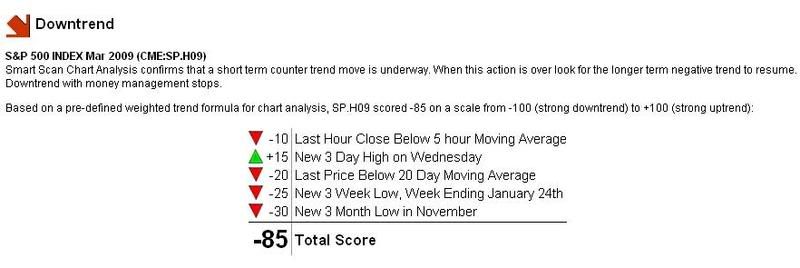

My stop loss came into effect with my FAZ and I ended up making a pretty good profit, considering FAS ended up almost 20%. Sometimes, this strategy doesn't work if we reach a volatile day with the Dow bouncing back in forth. However, I felt that Friday was going to go only one direction, and it would go that way with conviction. The market trend FAS technical score is -75, so I don't know how excited I am to stay in it much longer (get your own symbol analyzed for free, all you need is a name and email, Click Here). However, as for now, I am remaining in both my BAC and FAS for the time being.

SRS was showing a lot of strength in early hours of trading as you can see from the chart. However, during mid-day, a big sell off began. I think bailout hopes and more rumors surfacing convinced many investors to get out for the time being. I am remaining in SRS, as I feel it is one of the better shorts for 2009. I do think they are vulnerable to some losses during all this mess, so I may be averaging down as it may continue to go down.

Obama's bailout team has revisited their original stimulus plan over the weekend and have supposedly made some changes (I personally feel they did because they knew they didn't have the vote!). Anyway, it seems as if the bailout amount will be reduced to $750 billion and that there have been a lot of changes to the "bad bank" plan, which wasn't getting a lot of popularity with the media and republicans. They still will supposedly have a toxic asset protection program but are straying from the "bad bank" plan and working on a "ring fence" concept. In a sense, the "bad bank" would buy up to $500 billion in troubled assets and then perform stress test on banks to see if they need more.

Now, where market to market accounting gets changed is when these assets are transferred. As of now, a bank would have to take a loss on their books to transfer these assets, which would kill bank's balance sheets to transfer a lot of these toxic assets. So, rumor is that they may be altering the accounting system where they can "carry market value" in hopes to keep bank's balance sheets healthy. A lot of moving pieces are in this plan and a lot can go wrong. Let's hope they know what they're doing. Secretary Geithner is suppose unveil the plan on Monday. These kind of announcements make me very timid in this market, which is why I am pretty hedged right now and sitting in a lot of cash at the moment. So we'll see how it goes. That mixed with the stimulus vote, which is planned for Tuesday, could cause one crazy trading week next week. In the end, the fundamentals are still very bear, so that is where I remain. I am just waiting for the right time to get in my bear positions fully, and that time may be coming soon.

So, it will be another early morning for me on Monday. I am expecting more volatility this next week in the market as I believe there could be a lot of "exhaust selling" after all of these announcements are done with. "Buy the rumor, sell the news."

I wanted to end with a clip from CBS news featuring the Lending Club we've been talking about. They have been getting a lot of publicity lately, which continues to reinforce my decision to invest in them. So far so good! Remember, the now $200 promotion ends this month for Lending Club, so check it out if you haven't already, click here.

So, we wait until Monday. Hopefully next week yields some serious green for my Zecco.com trading account. This last week wasn't too shabby, although I could have done without Friday. Happy Trading and have a good weekend. Oh and PS, I did pick up some SKF right before close on Friday, just in case...

Unemployment vs Stimulus - Who Will Get There First?

Posted On Thursday, February 5, 2009 at at 2:53 PM by Finance Fanatic It looks as if Obama is planning and arsenal and doesn't want to tell anybody about it. There are numerous rumors going around right now of different potential plans and strategies he may be using soon to try and combat this financial crisis. In my opinion, I think he's holding his trump card for a time when he really needs it...and that time may be tomorrow.

It looks as if Obama is planning and arsenal and doesn't want to tell anybody about it. There are numerous rumors going around right now of different potential plans and strategies he may be using soon to try and combat this financial crisis. In my opinion, I think he's holding his trump card for a time when he really needs it...and that time may be tomorrow.

My first suspicion is wondering what caused the huge reversal this morning (see below). The Dow jumped over 150 points in less than 20 minutes, just when it was looking like another day of selling. I personally believe PPT has a nice camp set up on Hogan's bottom waiting to push it back up. If indeed selling would have continued, it would have marked our first two day closing under 8000 in a long time as well as a possible sub 820 close for the S&P. Both of these could have spurred one heck of a selling day on Friday coming into unemployment numbers. However, has history has shown us, nature most like won't take it's course and once again the inevitable will probably be delayed for a bit longer. If we could just capitulate and get over it, I believe we would be better off.

So yes, unemployment is tomorrow. Part of me wants to get a big loan from these guys, and just put it all into FAZ. If only I was that compulsive. The market expects a 7.5% unemployment rate with an expectation of -540,000 loss of non-farm payroll jobs. I am sorry, but if the number is below this or even close to it, I am going to suspect the government of fudging numbers. January has been horrific with headline after headline preaching new job cuts. I think the number should be at least in the high 600,000's if not 700,000's. We'll see what is said, but at this current state, tomorrow is a critical day for the market. I wouldn't be surprised to see Obama have something up his sleeve.

I was pleased to see SRS hold up as good as it did for an up day like today. I was hoping to see us go back into the red, because SRS could have had a 10%+ day if that would have been the case. It almost hit $70 in the morning.

If indeed unemployment numbers do prove to be worse off, that doesn't mean we're on for a selling day. Obama may choose to unveil his great and mighty stimulus which has been brewing a lot of curiosity from investors. Talks of doing away with market to market (which I will give my opinion on that tomorrow!) accounting and extra funds for mortgage backed securities could quickly heal the pains of a bad unemployment number in turn Friday into a rally of epic proportions. I indeed do not hope for the latter, but I took some minor precautions, just in case.

First off, I did end up purchasing some FAZ (see market trend analysis below, get your own symbol analyzed for free, all you need is a name and email, Click Here) earlier in the day at $49. I thought whether or not we rally tomorrow, this is a low enough price, especially if we see a big sell off tomorrow. Towards the end of close, I felt the need to hedge myself to some degree, so I went in and bought some FAS at $8.95. I put stop losses of 5% for each of them as I believe whichever is up tomorrow, will most likely be up big. So hopefully the gains of the winner will outdo the losses of the loser. We'll see.

As I said in the chat, if for some reason indeed there is a vote on the bailout and it fails, watch out. We saw what happened last time the proposed bailout failed in voting. It tanked the market almost 400 points. With so much riding on this stimulus and in the current fragile market we are in, the result could be even more devastating. I believe there is a small chance for that happening, but there are senators out there who believe the Democrats do not have all the votes to pass it. Food for thought.

I also wanted to share a bit of this article I found on Harvard Business Review website talking about Lending Club, he said: "So what? A profound secondary effect of the down market will be an increase in the availability of peer-to-peer finance and its convergence with traditional lending. My bet is that mainstream investors and banks will cherry-pick the best investors in Lending Club and other systems – reducing risk by tapping their superior credit-assessment capabilities – and fund them to grant more and bigger loans. Moreover, within five years every major bank will probably have its own peer-to-peer lending network.

If innovative legislation were drafted to allow peer-to-peer risk coverage, similar transactions might begin to flourish in the insurance market. Precise knowledge of local conditions would allow individuals to band together in order to underwrite the cost of insuring properties in safe neighborhoods or to make insurance more widely available in higher-risk neighborhoods.

The current economic constraints will only accelerate the growth of these new entities. I predict that they will be among the most important financial-services innovations in the coming decade." You can read the full article here. I agree that investment vehicles like these will become more popular in the future. If you haven't checked it out, go to Lending Club for more.

Early morning for everyone tomorrow, I'm sure. Either way, I believe we're going to see a big trading day for whichever side it decides to go. We may see a bit of both green and red, but I see us trading big in one direction by close. So set your alarms, Happy Trading, and we'll see you tomorrow. I'll try to be on the chat later.

5 Things On My Mind For This Week

Posted On Wednesday, February 4, 2009 at at 5:47 PM by Finance Fanatic Just as I anticipated, we encountered a pretty volatile day which made a sharp u-turn around mid-day, resulting in a pretty strong sell off of most everything, tech holding up the best. Once again we have dipped below the 8000 mark and may stay there to end the week, pending some big announcement that I am not foreseeing. Talk of the town today has been Obama's decision to regulate bank executive's salaries to a maximum of $500,000 annual. They do have stock option bonuses, but there are still lots of restrictions of when they can cash in on those. Sure, there is a need to regulate some of the antics that are going on around some of these companies and an accountability for spending, but I don't know if this is the right move.

Just as I anticipated, we encountered a pretty volatile day which made a sharp u-turn around mid-day, resulting in a pretty strong sell off of most everything, tech holding up the best. Once again we have dipped below the 8000 mark and may stay there to end the week, pending some big announcement that I am not foreseeing. Talk of the town today has been Obama's decision to regulate bank executive's salaries to a maximum of $500,000 annual. They do have stock option bonuses, but there are still lots of restrictions of when they can cash in on those. Sure, there is a need to regulate some of the antics that are going on around some of these companies and an accountability for spending, but I don't know if this is the right move.

I worry about Obama attempting to go to war with the upper class as he will most likely lose. There has to be a cohesive plan that can benefit all parties without dragging the upper class through the mud. We will see what response is given from the banks and the market dealing with this new development.

It has been a different week for the market and there are a few things on my mind which will most influence my upcoming trading. These 5 things are:

Effects of Restricted Bank Salaries

This may look like a good plan on paper, but there could be some pretty bad consequences if this plan backfires. No doubt there has been ridiculous spending by some executives that should result in some accountability. The problem I am worried about are banks losing their top executives to foreign competition. I mean how easy is it for foreign countries to match the $500k cap, not to say blow it out of the water. This filter will not only put a leash on the bad-performing executives, but also the good ones. If we risk losing some of our top executives, I can't see that being a good sign for banks and our overall economy.

S&P Closing Below 820

It has been a while since we have seen a sub 820 close for the S&P. Knowing the technicals are pretty strong at that point, I am very curious to see if we close under 820 sometime this week. If this is the case, I would expect there to be some extra downward momentum, possibly sending the S&P close to 800. Below is the recent market trend analysis for the S&P (get your own symbol analyzed for free, all you need is a name and email, Click Here).

Unemployment - Record Setting

Unemployment - Record Setting

I am very curious to see what unemployment numbers we see reported on Friday, as I personally feel they will be record setting. If you have been tracking the layoffs as I have, you have noticed the daily massive job cuts which have been going on. This is not to mention all of the mom and pop layoffs that are going on behind the scenes. This could be a big drag on the market.

Bad Bank - Nationalization?

I have not been able to wrap my fingers around this bad bank plan. I see them wanting to set up a similar system as the RTC program in the 80's and 90's, but I don't see how this plan works without instilling the nationalization of banks. And if that's the case, I would think that most of the shareholder's equity would be wiped out. Having Citi's or BAC's equity wiped out would most likely kill confidence in the financial markets and maybe cause a market crash.

Stimulus & Government Intervention

I still am waiting for Obama's bag of tricks. He has a good gift of linguistics and can do a great job of selling the country on hope. However, he has been very careful of not leading people's hopes astray. I think that's good. More false hope can cause even more problems in the long run. Still, I can't help but think that Obama has something brewing to attempt to counter this plunge and try to spark a big rally.

These things have been going in and out of my thoughts and continue to keep me guarded of what to buy. Indeed I am still heavily short, but have not gone as short as I would like because of some uncertainties. Hopefully, more clarity is brought the next couple of days and I can get back on track. Until then, I guess these thoughts keep creeping. Your Thoughts? Happy Trading.

PS - Seems as though the chat is working good. Good call on the recommendation. I will try to comment as much as I can during the day, however, I am often away for other business. By the way to clear some of your questions, Zecco.com is still offering free monthly trades, you just need to have more than 25 trades a month, which I'm sure most of you, like me, are doing. Just to answer those that thought the promotion was over.

Free Trading Analysis Video click here

Dow Rallies - Banks Fail - What To Do?

Posted On Tuesday, February 3, 2009 at at 6:38 PM by Finance FanaticWe experienced another complex day of trading as once again the under 8000 scenario proves to be not sustainable for the time being. Just as the market breaks the 8000 threshold, it continues to retreat back up. The Dow rallied for most of the day as well as tech, however, banks were in for a rude awakening as many were down anywhere from 5-15%. Speculation of just how good this upcoming stimulus really is for the economy and if the "bad bank" plan can actually work seemed to bring down confidence in bank's ability to survive this crisis. In fact, I heard a report today from a top commercial real estate economist that the default rate for commercial loans is not expected to PEAK until to the end of 2011. Also, the default rate is suppose to increase almost three times at that point than it is now. If this is the case, I would expect banks to continue to have serious problems.

I ended up watching most of the day and even moves that I did end up making, I didn't buy much, as I am fearing this current stagnant market we have been trading in the past couple days. Volume was up today, but there really was nothing moving the market and not much significant news released today, aside from auto sales...ouch. Indeed, with more negative news, I think we'll see some more definition in trading. Until then, I plan on making small moves and waiting. You can't lose with patience.

So what did I do? For those on the comments today, you saw that just at the end of trading, I picked up some UYG and some BAC call options. By all means, this does not reflect my perspective on the current state of the banks, I just feel we have a potential for a quick bank rebound. It is indeed pretty close to a gamble, and to hedge it I set stop losses so that there is a limit to my downside risk. I was surprised to see how cheap some of the BAC options were. If we are indeed up tomorrow, I plan on selling pretty quickly. The last thing I want is to be stuck long in financials going into unemployment numbers. Both BAC and UYG have very strong negative momentum on their Market Trend analysis, which usually means they are due for some gains (get your own symbol analyzed for free, all you need is a name and email, Click Here).

Autos released devastating numbers all across the board making it another horrible month for buying cars. I don't see how this trend gets better, especially as disposable income is getting eaten up more and more as well as auto loans getting harder and harder to get. Even Toyota was down over 30%. Chrysler over 50%! If this keeps up much longer, we may only end up with three automobile companies.

Tomorrow I am expecting a mixed day of trading. I won't be surprised to see us continually going from green to red. There are relatively strong forces on both the bull and bear sides and A LOT of spectators sitting on the sidelines. When those guys get in, either with the spark of a rally or the force of selling, there should be some violent movements.

I am expecting my next round of payments from Lending Club this week. I have decided to reinvest the interest to increase my return in the end. I don't need it for the time being and would rather remain diversified. So we'll see how that works. I will be on tomorrow morning and am looking to put up a chat to make mid-day conversing easier for you. Happy Trading and see you tomorrow.

Mixed Day of Trading - Dow Closes Under 8000

Posted On Monday, February 2, 2009 at at 3:44 PM by Finance Fanatic What an interesting day it was. Today, trading felt like a boat being out in the middle of the ocean looking for wind to take it to shore, but the direction to head is unknown (hence the chosen picture for today). Volume was in the marketplace today, it just seemed like investors couldn't make up their mind of what they wanted to buy and sell. It was a very weird day of trading. The Dow was down 64 points, but the NASDAQ was up 18 points. Some banks were up, some were down big. Some shorts were up, some were down. I was even questioning what moves to make as nothing seemed to be getting wind behind their sails. The market did manage to close under 8000, which is a pretty big technical move, however, the S&P stayed over 820. As the market was looking to be down spiraling, there looked to be some sort of force (can you say PPT?) that came in right before close and tried pushed the market back up, but eventually lost the fight.

What an interesting day it was. Today, trading felt like a boat being out in the middle of the ocean looking for wind to take it to shore, but the direction to head is unknown (hence the chosen picture for today). Volume was in the marketplace today, it just seemed like investors couldn't make up their mind of what they wanted to buy and sell. It was a very weird day of trading. The Dow was down 64 points, but the NASDAQ was up 18 points. Some banks were up, some were down big. Some shorts were up, some were down. I was even questioning what moves to make as nothing seemed to be getting wind behind their sails. The market did manage to close under 8000, which is a pretty big technical move, however, the S&P stayed over 820. As the market was looking to be down spiraling, there looked to be some sort of force (can you say PPT?) that came in right before close and tried pushed the market back up, but eventually lost the fight.

With another down day of trading for Bank of America it made it real tempting for me to pick up some shares, especially with the good possibility of some more bailout news this week (see today's market trend report below, get your own symbol analyzed for free, all you need is a name and email, Click Here). However, there were more forces pushing me away from the buy button for the time being. Sure, I may regret not having bought long in the next few days, but here are a few reasons why I chose to pass today.

Unemployment Data

I believe this month will be our worst month so far. Macy's announced their plans of cutting thousands of jobs. These announcements are going to keep continuing, most likely, at a more rapid rate. With this Friday being unemployment date, I thought I should steer clear for the time being.

Continued Bad Earnings

The only good news from earnings now a days is "beating market expectation." Aside from a few exceptions, no one is posting positive earnings these days and the cut that has been placed to last years profits has been devastating for many companies. Scandisk reported earnings today which initially sent the stock up. However, after looking at the results for a second time, I think investors realized it was not as good they had originally though, as the stock is down over 16% in after hours.

Forced Selling

Although we have seen some strong selling, we haven't seen as much"forced selling" as I would think at this stage in the recession/depression. Much of the selling has been elective selling from anticipation of lower future markets. There have been some hedge fund liquidations, but not many. Many analysts believe upcoming redemptions could be significantly larger this year and take a big toll for hedge funds causing some more selling. As these markets keep creeping down near the previous bottom levels, people most likely will become more fearful, which can result in panic, forced selling. These two forces are usually the fuel behind a capitulating crash.

Obama's bailout is looking to be voted on sometime next week, so we should expect several press conferences and and press releases with updating news that could potentially influence momentum. I would like to have some financials picked up a bit before voting to try and take advantage of a possible short term, violent rally. I just feel that right now is not the time for me.

So for today, I stayed with my shorts, Gold, and other investments. Like I said this weekend, I feel we are getting very close to a defining bottom. I believe as deflation takes this market by the horns, we will see capitulation where we can finally exhaust this guessing game and I can begin going long again. I enjoy making money on the long side much better. It is good for all parties.

Due to last minute popularity and some late emails, I have decided to extend the deadline for the Lending Club promotion to the end of the February and up the promotional prize money to $200. I have gotten a few emails of good feedback from some of your involvement and I, myself, am continuing to enjoy the experience in my investment with them. They can also benefit you as a borrower if you are looking to consolidate some of that nasty credit card debt. Click here to learn more about the promotion.

Tomorrow, I would expect some more violent movements in trading than we saw today. We should start seeing an increase in volatility at these lower levels. The question is whether it will be up or down. I will be up very early tomorrow. Let's see if we see the S&P close under 820. If so, we could have a new wind of selling. I will be making comments on my moves tomorrow. Have a good night, Happy Trading and we'll see you tomorrow.

Free Trading Analysis Video click here