Mixed Day of Trading - Dow Closes Under 8000

Posted On Monday, February 2, 2009 at at 3:44 PM by Finance Fanatic What an interesting day it was. Today, trading felt like a boat being out in the middle of the ocean looking for wind to take it to shore, but the direction to head is unknown (hence the chosen picture for today). Volume was in the marketplace today, it just seemed like investors couldn't make up their mind of what they wanted to buy and sell. It was a very weird day of trading. The Dow was down 64 points, but the NASDAQ was up 18 points. Some banks were up, some were down big. Some shorts were up, some were down. I was even questioning what moves to make as nothing seemed to be getting wind behind their sails. The market did manage to close under 8000, which is a pretty big technical move, however, the S&P stayed over 820. As the market was looking to be down spiraling, there looked to be some sort of force (can you say PPT?) that came in right before close and tried pushed the market back up, but eventually lost the fight.

What an interesting day it was. Today, trading felt like a boat being out in the middle of the ocean looking for wind to take it to shore, but the direction to head is unknown (hence the chosen picture for today). Volume was in the marketplace today, it just seemed like investors couldn't make up their mind of what they wanted to buy and sell. It was a very weird day of trading. The Dow was down 64 points, but the NASDAQ was up 18 points. Some banks were up, some were down big. Some shorts were up, some were down. I was even questioning what moves to make as nothing seemed to be getting wind behind their sails. The market did manage to close under 8000, which is a pretty big technical move, however, the S&P stayed over 820. As the market was looking to be down spiraling, there looked to be some sort of force (can you say PPT?) that came in right before close and tried pushed the market back up, but eventually lost the fight.

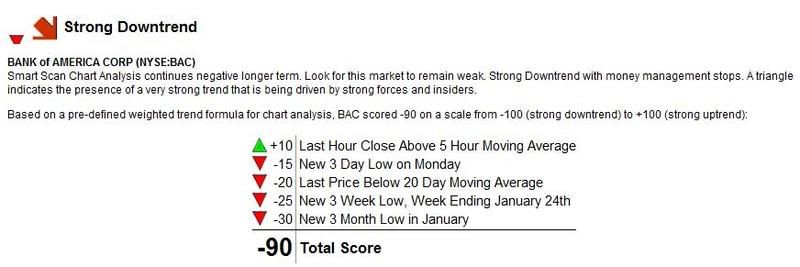

With another down day of trading for Bank of America it made it real tempting for me to pick up some shares, especially with the good possibility of some more bailout news this week (see today's market trend report below, get your own symbol analyzed for free, all you need is a name and email, Click Here). However, there were more forces pushing me away from the buy button for the time being. Sure, I may regret not having bought long in the next few days, but here are a few reasons why I chose to pass today.

Unemployment Data

I believe this month will be our worst month so far. Macy's announced their plans of cutting thousands of jobs. These announcements are going to keep continuing, most likely, at a more rapid rate. With this Friday being unemployment date, I thought I should steer clear for the time being.

Continued Bad Earnings

The only good news from earnings now a days is "beating market expectation." Aside from a few exceptions, no one is posting positive earnings these days and the cut that has been placed to last years profits has been devastating for many companies. Scandisk reported earnings today which initially sent the stock up. However, after looking at the results for a second time, I think investors realized it was not as good they had originally though, as the stock is down over 16% in after hours.

Forced Selling

Although we have seen some strong selling, we haven't seen as much"forced selling" as I would think at this stage in the recession/depression. Much of the selling has been elective selling from anticipation of lower future markets. There have been some hedge fund liquidations, but not many. Many analysts believe upcoming redemptions could be significantly larger this year and take a big toll for hedge funds causing some more selling. As these markets keep creeping down near the previous bottom levels, people most likely will become more fearful, which can result in panic, forced selling. These two forces are usually the fuel behind a capitulating crash.

Obama's bailout is looking to be voted on sometime next week, so we should expect several press conferences and and press releases with updating news that could potentially influence momentum. I would like to have some financials picked up a bit before voting to try and take advantage of a possible short term, violent rally. I just feel that right now is not the time for me.

So for today, I stayed with my shorts, Gold, and other investments. Like I said this weekend, I feel we are getting very close to a defining bottom. I believe as deflation takes this market by the horns, we will see capitulation where we can finally exhaust this guessing game and I can begin going long again. I enjoy making money on the long side much better. It is good for all parties.

Due to last minute popularity and some late emails, I have decided to extend the deadline for the Lending Club promotion to the end of the February and up the promotional prize money to $200. I have gotten a few emails of good feedback from some of your involvement and I, myself, am continuing to enjoy the experience in my investment with them. They can also benefit you as a borrower if you are looking to consolidate some of that nasty credit card debt. Click here to learn more about the promotion.

Tomorrow, I would expect some more violent movements in trading than we saw today. We should start seeing an increase in volatility at these lower levels. The question is whether it will be up or down. I will be up very early tomorrow. Let's see if we see the S&P close under 820. If so, we could have a new wind of selling. I will be making comments on my moves tomorrow. Have a good night, Happy Trading and we'll see you tomorrow.

Free Trading Analysis Video click here