Under 7500 - Here To Stay?

Posted On Thursday, February 19, 2009 at at 3:48 PM by Finance FanaticAnother critical barrier has been surpassed today on the path downward, as we closed under the critical 7500 number, which has been known to be the rubber bottom in previous months. A move to keep us under 7500 would be a big victory for bears going into the weekend, especially after enduring the several new mortgage announcements we have received this week. So we'll see if the bears have it in them to fight one more day.

I do regret having sold some of my SRS at $80 as there is definitely wind behind seller's sails. At this rate, I believe we could see SRS getting into the $100's very shortly. I have not completely abandoned my fears of a rebound rally, but I can definitely see a strong seller's market right now. Tomorrow will act as a critical day, seeing whether or not we can maintain under 7500. By doing so, I will probably find myself buying some options of SKF, SRS, and FAZ.

Oil has been on my radar the last couple months. As we saw today from DXO (up almost 15%) and other oil funds, there is definitely upside there. I recently was introduced to a distant in-law, who has quite extensive experience in the oil sector. Robert Dupree has a Masters Degree in Economics and, for most his career (30+ years), was engaged in developing and managing systems in support of exploration for oil and gas for Amoco. Along the way he was able to learn certain truths about the industry that I felt very applicable to the site and worth sharing. The following are excerpts from what he said from our conversation:"I don't think that fundamentals had much to do with the spike in oil prices last year. I think that oil will play a significant role for decades to come. Our reliance on oil will persist for decades under our existing infrastructure and I don't see significant changes ahead for it. I would be inclined to invest as much in oil services as much as in actual energy companies. Companies in the service segment such as Weatherford or Schlumberger are worth investigating. They're being hit right now but their type of service will be vital for quite some time.

Regarding oil prices, they are run mainly by a cartel which must balance supply with the need for revenue. They cannot afford to be as political with oil as they were in the 1970s and they know it. The biggest factors that might affect oil prices are of the "Black Swan" nature which cannot be predicted. They would likely come from political events that could disrupt supply.

The romantic thrill of drilling and making a major discovery is still in the public's psyche. It's akin to the lust for gold. Politicians play upon it and the oil industry uses those offshore rigs as much for image as for real production. The oil industry is not lukewarm about more offshore drilling in the U.S. There is probably less than a year's supply of oil for the U.S. yet to be tapped in ANWAR and off of our coasts. Also, the lead time to manufacture the offshore rigs and put the infrastructure in place is at least a decade. What you have to watch for is new guys who might bid to acquire those leases. When Bush opened drilling in Utah, for example, the operators that came in were not very nice guys. "

As you can see, there is a lot going on behind the scenes that most people never become aware of, in dealing with oil. I'm getting very close to pulling the trigger on some oil stocks and ETFs. Not just necessarily for a short term gain, but for some long term potential. It is clear that it is still our biggest natural resource demand and is one the hardest, so far, to duplicate. I want to say thanks to Robert for taking the time out to share his thoughts with me and all of you and look forward to continuing our communication. I will be looking for an entry point for DXO shortly, which has a Market Club report score of -90 (get your own symbol analyzed for free, all you need is a name and email, Click Here), but I feel more and more oil has settled near its bottom. Also, OIH or even shorting DUG (Ultra Short Oil ETF) could be in my near future.

Tech is by far holding up better than the rest at this point. I have no faith in any financial institution at this point and don't even trust playing them as a short term bump anymore. I am all out of my FAS now and don't see myself getting back into them anytime soon. If I need to play the long side, I will look to companies in tech or even insurance companies. A breath of nationalization could send banks soaring down on any given day. I will, however, sit on some FAZ or SKF to try and take advantage of the speculative worries.

Keep your eye on the CPI number tomorrow. Expectations are a 0.3% change, which I would be very surprised to see us reach. A bad enough number here, coupled with more aggressive selling, could end the week on a strong selling note. As you can see from below, a force definitely wanted the market to rally right before close, but seller's would not back down. We are in a very different environment than we were in November.

Another critical day tomorrow. I plan to be up early and ready. It's always tough deciding whether to make moves on Friday, but tomorrow may be a day I do. I'll look for you guys on chat tomorrow and keep you posted. Also, yesterday I was asked to write a guest post for INO's Trading blog. So being my "bear" self, I decided to go with a bear topic. You can read it here. Remember to Sign up for the $200 promotion for Lending Club, click here for more info. Happy Trading.

Banks Bounce Back Thanks To Obama Fever - Apple Crushes Earnings

Posted On Wednesday, January 21, 2009 at at 1:34 PM by Finance Fanatic It didn't take long to get speculative hopes back in the market. Today, the market got off to a bit of a slow start and even went red for a bit, but after the remarks of Geithner (the new secretary), investors felt a lot more comfortable with the future of the banks. Almost everything that was taken away yesterday was given right back. I was very happy to have sold out of most of my SKF before the aftermath, however, SRS had a much less than stellar day and I chose to hold on to those, my mistake. I did get the gains I was finally looking for out of Citi, but not much after the crash yesterday. It did help the banks that many of the CEO's bought back lots of shares to help instill confidence. I still ended up quite positive in my Zecco.com account after the two days and look to reboot my strategies as we are kind of at ground zero again. However, I think I am going to transfer some more money over from my ING Direct savings account to trade with, as the next few weeks could be prime for good money making.

It didn't take long to get speculative hopes back in the market. Today, the market got off to a bit of a slow start and even went red for a bit, but after the remarks of Geithner (the new secretary), investors felt a lot more comfortable with the future of the banks. Almost everything that was taken away yesterday was given right back. I was very happy to have sold out of most of my SKF before the aftermath, however, SRS had a much less than stellar day and I chose to hold on to those, my mistake. I did get the gains I was finally looking for out of Citi, but not much after the crash yesterday. It did help the banks that many of the CEO's bought back lots of shares to help instill confidence. I still ended up quite positive in my Zecco.com account after the two days and look to reboot my strategies as we are kind of at ground zero again. However, I think I am going to transfer some more money over from my ING Direct savings account to trade with, as the next few weeks could be prime for good money making.

It is funny, because during the interview, Geithner did not want to speculate on timelines and likely avenues the government would be taking, saying that by doing so in the past had caused premature speculations and radically effected the market. Well, even by avoiding the questions, he was still able to help radically move the market. How ironic. People are looking for the slightest bit of hope to help spur optimism.

So even though the Obama rally showed up a day late, it's here. Now, how long will it last is the magic question. Anytime momentum like that is stopped in its tracks and reversed to the degree we saw today causes some serious jolts in technicals. Although this rally should and could very well lead on into tomorrow, there are some deafening news that could reverse this day of high hopes. One day of Obama in office did not make the bank crisis's everyone feared yesterday go away. The debt outstanding is still substantially more than they can handle, and commercial vacancies haven't even hit half the number they're expected too. We're not out of the woods yet.

Google announces earnings tomorrow. This outcome could provide a big influence on where the market moves. With massive budget cuts, be assured that "online advertising" is one of the first things crossed off the list. Being that advertising revenue is a bulk of Google's earnings, they may struggle a bit. We lucked out this week with not much economic data being reported, but tomorrow we do have housing starts, which I cannot see being a strong number. That could effect some trading, but I don't expect it to be that influential. People should be clinging to headlines tomorrow to try and pull out any sort of negative or positive perception they can find. Whatever the case may be, I think the outcome will be very volatile, bouncing from red to green and higher volume. Did you see today? 408M trading volume, wow. This is the most we have seen in a while. With volume back and volatility increasing, we're heading back into market crash danger zone. Stay on your toes.

Apple knocked earnings out of the park after close today, sending after hours trading up almost 10%. This is not surprising to me, as I have liked apple all year (one of my top picks for long). All this news of Job's health and their ability to stay competitive is nonsense. Too much cash on hand and too much innovation. Apple should leap quite a bit and could definitely set the standard for up trading tomorrow. Lets see if Google can follow.

Due to the extreme uncertainty and volatility right now I am playing my bets with energy and commodities. Obama's only ammo to throw at this beast is more government spending (and even that can only slow the pain in my mind). He is going to have to spend trillions just to make a dent. Doing so is going to give gold, silver, and other commodities a pretty face of value. I'm bulling up on a lot of gold, DIG, and other commodities tomorrow to keep during this time of uncertainty. I've lowered my short position (still plenty left) until some definition is back and have a little bit of long financials as a hedge. Either way, tomorrow should pave the way of some new momentum.

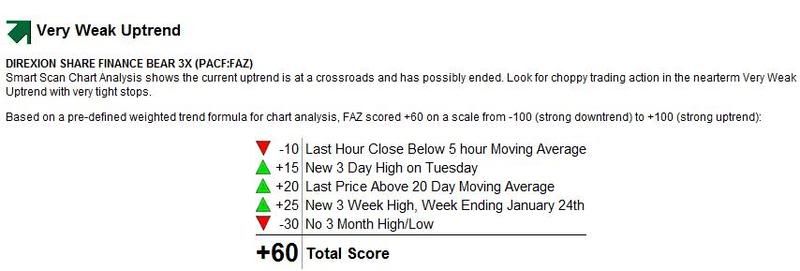

Like I said yesterday, don't expect Obama to roll over and die his first few months in office. He should be working around the clock to ways to pump this market up. I still think we're heading to new lows shortly, we just need the Obama fluff to wear off a bit. Below is the market trend score (analyze a symbol here free) and movement for FAZ, which momentum score is still relatively strong at +60.

I hope everyone has a good evening. With this volatility, we are able to make some serious cash in quick moves. It's all about timing the bumps right. Happy Trading and see you tomorrow. Check out the new videos at INO TV, great stuff and it's free.