Market Retests Lows... Market Crash?

Posted On Tuesday, February 17, 2009 at at 5:54 PM by Finance Fanatic "Owners of capital will stimulate the working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks, which will have to be nationalized, and the State will have to take the road which will eventually lead to communism"

"Owners of capital will stimulate the working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks, which will have to be nationalized, and the State will have to take the road which will eventually lead to communism"

The above quote has been getting a lot of press around the internet, saying that it is a direct quote from Karl Marx, from his works Das Kapital written in 1867. After looking into it further, it is indeed a Hoax and never was in his writings. I did, however, still find the quote applicable to our current markets and actually agree that we are heading closer and closer to "communism" everyday. So we will see how that all plays out.

What a day, right? I was able to share in today's decay with several of you on the chat up until close and marveled at it's selling force, especially closing out the day. I kept waiting for one of those mid-day profit taking bumps to bring the market back up, but the sellers kept dragging it down. My Zecco.com account was bleeding green all day as my shorts were soaring and even some of my longs.

A penny stock, alternative oil (Origin Oil [OOIL]) and R&D company I invested in early, got a huge bump today (+20%) as they announced that they were partnering with the US Department of Energy in plans to work together on future projects. The company is working on the process of growing and transferring Algae to oil. Keep an eye on that one for you penny stock lovers, as it could continue to go up the next couple weeks. If you are interested in a bulk investment, email me (crashmarketstocks@gmail.com) and I can put you in touch with the CEO. The DOE is a great partnership to have going into the future. See www.originoil.com for more.We finally saw the S&P close under 800 today, which is a pretty big technical move. It will be interesting to see if the market is able to sustain these numbers at this time. From a technical standpoint, we aren't seeing the set up of a crash. We are very close, just not quite there. The deflationary down-spiraling is not quite there, from a technical standpoint, for me to be comfortable to take a full position in short. In fact, technicals are actually pointing towards a good possibility of a rebound rally.

As you remember back in November when we reached our previous lows, we saw the market pull a huge 180 degree turn, spurring a 20% rally for the Dow over the next couple months. I do not want to get caught fully short on another 20% Dow rally (as some of you know, is not pretty), which we are very capable of. Indeed, if we do rally back up strongly, the deflationary technicals will be much more favorable for a massive sell off crash. At that point, most would believe the bear is dead and a much more devastating crash could very well happen. At that point, I will plan to unfold a very aggressive short position. This is the technical analysis I have gotten from analysts and the numbers so they are not guaranteed. If indeed we blow past the bottom and maintain there, obviously we will have overruled the technical side. But I will wait and see.

President Obama plans to speak tomorrow concerning his new plan to help slow the massive foreclosures that is plaguing the US. With the right kind of announcement, this could indeed be the action that causes the sharp turn around and propels the market on another bear market rally. However, failure to impress the public on this announcement, could indeed be the bullet that sinks the sub. So, tomorrow acts as a very critical day for investors and what we should expect from the market the next couple weeks.

Tomorrow I plan on waking up early, and buying into some decent, volatile longs to hedge against my shorts. I plan on buying these with a lot of the profits I have made the past couple of trading days off the shorts. One crazy long play I have been eyeballing is Las Vegas Sands Corp (LVS). The Market Club report is -100 (get your own symbol analyzed for free, all you need is a name and email, Click Here), but it is nearing its 52-week low again and has been known to bounce off it. It's a gamble, but if a rally is in our sights, it's bound to get some very big gains. That is one of my more riskier plays, but I plan on going in and buying some longs tomorrow.

The autos are causing noise again claiming they may need $30 to $60 billion more to sustain and not go bankrupt. It will be interesting to see how our government reacts this time and if they are as forgiving. I don't see this causing much noise in the market tomorrow, but is definitely worth noting.

So get a good nights sleep tonight. Be up bright and early and get ready for some action. Either way it should be a violent day, the market is getting antsy. Remember, 1 more week for the $200 Lending Club promotion, see here for more! Happy Trading.

"Bad Bank" Plan Bad Idea?

Posted On Wednesday, January 28, 2009 at at 4:13 PM by Finance FanaticThere sure was a lot of hustle and bustle on the floor today as hopes for Obama's new plan filled buyers with confidence, especially concerning financials. Sure, myself was included in the mass of buyers, but for me it was not an emotional buy. It was purely just buying knowing that there would be many believing that Obama's new plans will push us through this depression and financials crisis and on to greener pastures. I surely did enjoy profiting off of the emotional compulsiveness of other investors and plan to do it more often. So what was today all about?

Wells Fargo up 30%, Citi up 20%, and Bank of America up 15%. Wow, that's some strong pushes, what on earth could have happened today? To be frank, not much. Sure there were a lot of talks and whispers in headlines throughout the day, but fundamentally, not much changed and unfortunately these kind of "emotional rallies" can really tee up a strong market crash.

First, news came last night that Obama plans to push this stimulus through ASAP. No need to cross the T's and dot the I's, just get it signed. Considering "checks and balances" no longer exist in our government currently (as democrats control all the powers), there shouldn't be much delay in getting this passed. Some may think this is just the beginning of the road back up, especially with the banks. As for me, I took most of my profits and ran.

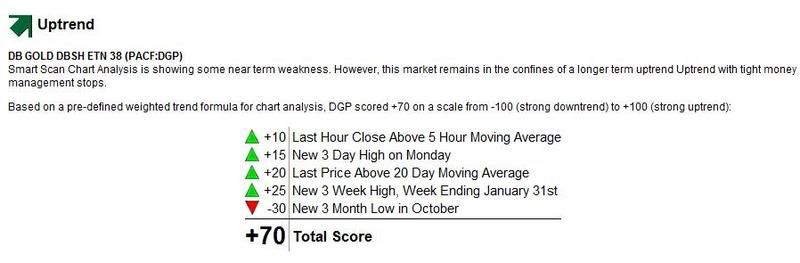

So, yes, I did get out of most of my position in financials today, before the close. What I have learned recently is that you can't be greedy in this market, and getting a 14% return in a day is fine by me. So I took most of my money out, just leaving some in case of another day running. Believe it or not, but I took a lot of my earnings and put it into SRS and DGP (a Deutsche Bank Double Gold fund, see trend analysis below, get your own symbol analyzed for free, all you need is a name and email, Click Here). I think we went a bit overboard in the buying today and I expect some serious pull back either tomorrow or Friday, especially with GDP news coming up, and here's why.

One announcement that has seemed to cause excitement with financials is the new "bad bank" plan. This is, in a sense, a plan for the FDIC to take control of the bad assets and hold on to them until values once again appreciate. So far, the way of doing this is unclear, but many speculate that many of the banks deemed "bad banks" would essentially be temporarily ran by The FDIC, or in a sense, the government. So in other terms, "nationalizing" a lot of these banks. A similar program was adapted during the last real estate catastrophe, where the government issued an RTC program to buy back troubled assets. The problem is that our debt is far greater than that of the RTC days and our length of this recession/depression is unknown and is most likely to much, much longer. What I don't get is why are so many people buying up financials, when in fact if some of these banks do become nationalized, shareholder's equity most likely will get wiped out? Analysts are warning (well the smart ones) of this, but investors have tuned them out as they listen to the new songs of "bank bailouts". My point is, I do not want to be stuck with a slue of bank stocks as the governmental begins to experiment with different nationalizing ideas.

Then we go on to the new Obama stimulus plan itself. Have you read it? This thing is suppose to be devoted to assist in job creation and we're spending $350 million of tax dollars on STD education and prevention? How is that going to help? I mean at least if STD's are still flourishing there will be money spent on pharmaceuticals and doctor visits (a joke). Also, there's a allocation of funds to landscaping the capital building. Who cares? We are in a depression and you want to worry about landscaping. Truly, there is a lot of wasted money in this bill and if we are only dedicating 50 cents to the dollar to actually assisting in job creation and the buying of bad debt, it will take over $5 trillion in bailout funds to begin to do something. Get it together guys.

I do believe that above all, banks need keep the consumer's confidence. That was the biggest cause of the Great Depression. People lost faith in the banks and banks failed. However, I believe there are many ways to keep banks lending, and help manage their current "over leveraged" state. They just need to tweak things back at the drawing board.

Starbucks gave some more bad news today as they are looking to close even more stores down. The worst part about these rallies, is many times, real economic data sometimes gets tossed aside as people are"high" with emotion. Hey, even the US mail is struggling. They are toying with the idea of only delivering mail five days a week instead of six. The point is the rest of the world is going on behind this bailout fluff, and it doesn't look pretty.

At any rate, I'm glad to be out. Sure, we may indeed rally more tomorrow, but like I said, I can't be greedy. Indeed I feel if our government is not careful with how we spend these next trillions, we could end up spending our way to death. Hopefully, Obama can round his people together to find a good solution, I just still believe there is A LOT of work to be done to their proposed plans. Tomorrow should be interesting. Seeing how we open will determine whether I make any moves, but as for now, my Zecco.com account is staying put. I will keep you updated on what I do in the comments section. I hope everyone has a good evening, Happy Trading and we'll see you tomorrow.