Treasury News Sparks Huge Rally, But Be Sure To Read Between The Lines

Posted On Monday, March 23, 2009 at at 3:42 PM by Finance Fanatic There are many parading the streets today cheering that the recession is over and nothing but green pastures are waiting for us in the future. I could even see it at lunch. People were offering to buy for one another again, everyone seemed to smile a lot more, and I was often catching mumbled conversations involving "I bought more...today" and "I wish I would have bought such and such at..." Are we really surprised? I mean come on, I wrote in this post back on March 2 that I felt a strong bear market was coming. We were oversold and technicals had been pushing for a good, strong bear market rally for sometime.

There are many parading the streets today cheering that the recession is over and nothing but green pastures are waiting for us in the future. I could even see it at lunch. People were offering to buy for one another again, everyone seemed to smile a lot more, and I was often catching mumbled conversations involving "I bought more...today" and "I wish I would have bought such and such at..." Are we really surprised? I mean come on, I wrote in this post back on March 2 that I felt a strong bear market was coming. We were oversold and technicals had been pushing for a good, strong bear market rally for sometime.

It is very common during strong bear markets to see these very violent rallies. We saw the same movements in the 30's, 70's, 80's and 90's. However, never in the history of the Dow have we seen such volatile swings that we have experienced the past year. This is even more of a reason why we should expect these violent rallies to be even strong than past times. So the key, for me, is to be aware of them and to be careful around them until there is more clear direction given from technicals that the rally is easing. We are not at bottom. No actual economic data has given such evidence. You may be saying, well what about the uptick in housing sales released today? That is an increase from the previous month. There are many variables that can cause for that monthly uptick. When dealing with this data, it is better to compare apples to apples by taking year over year data instead of month over month. Year over year we are still down. Oh, and nobody is focusing on the 15% decrease in median housing prices announced today. That should help sell a bit more. So, even though I am not positioned in short quite yet, I am still very much a believer that this is a short term, bear market rally that will hit a wall and a much more stronger sell off will occur, giving me a more clear path to make much more profits than the current position we are in.

So, even though I am not positioned in short quite yet, I am still very much a believer that this is a short term, bear market rally that will hit a wall and a much more stronger sell off will occur, giving me a more clear path to make much more profits than the current position we are in.

I was asked many times today, what should I do? Are you buying FAZ? Should I go long? I do not have a crystal ball and too be honest, at this point in the rally you might as well flip a coin, because there is a big cloud in trading due to these government announcements mixed with a technical rebound. I don't need to make trades right this second. I have been very patient over the past three weeks and have preserved my capital, for the reason of taking advantage of good buy in points when the market is in a much more "clearer" position and trends are easier to read. That point is not right now. Tomorrow can go either way as far as I am concerned and it doesn't matter that much to me which direction it goes. This rally will take its course, then I will make my move more aggressively.

For those that have been keeping up with my site know that I said there would come a time when many would begin saying the worst is over. Well, I believe we are already there. Even many of you which read that post 3 weeks ago, have now changed your mind and believe the worst is over. That is fine and I hope the best for everyone's trading. I just feel that events are lining up just as I expected in which ends with a capitulating crash of serious lows for the market. I know it's hard to believe such things in the midst of such strong, optimistic trading, but two weeks ago, almost everybody thought it was coming. It is amazing what a little bit of time can do to perception.

I go into more detail on today's podcast about my thoughts and beliefs about continuing to have a very sluggish economy and why this new plan that the Treasury has unfolded doesn't necessarily do much for the bottom line of GDP (if you are not subscribed to the podcast and want to be, you can subscribe here). I believe once again the government has taken a loan from taxpayers to attempt to eliminate debt. Not stimulate spending of consumers.

Amidst all my doubts of a progressive economy, I am now a minority in my thinking. This rally could very well last throughout the week. I believe, eventually, investors will have to take profits and we should see some selling days, but I don't see a lot negative sentiment in a 500 point trading day. We have seen moves like this before in November, so people should not consider it "impossible" to drop off after such strong buying. As a side note, the volume was much lower than you would expect on such a big day. That is another thing to gnaw on.

With such fireworks, I did have to pull the trigger today. For those on the chat today at close, saw that I ended up buying a first "light" round of SRS today right before close for $49.80. Sure, we may see it go down a bit more the next couple days, I don't know, but at such a low price I felt like I could easily afford to buy some shares. That way, if we do steam off some of these profits tomorrow or Wednesday, I could pocket some quick gains. I mean come on, it was down 30% today!

My SSO was up almost 15%, so that helps swallow the loss from that small amount of FAZ options I picked up. I set a trailing stop loss on my SSO to protect my profits in case a burn off comes. I didn't expect to make such a killing so quickly with that ETF, but I'll take it.

So those are my thoughts for today. Remember the $25 Start Up Promotion for Lending Club. I'm only running it for a couple weeks, so if you are interested, sign up through the above link and you will start out with $25 in your investment account for free. Good deal. Happy Trading and see you tomorrow.

Toxic Debt Program To Cause Some Noise

Posted On Sunday, March 22, 2009 at at 3:00 AM by Finance FanaticHowever, history has shown us that investors can get revved up on rumor and speculation. Buy the rumor, sell the news. This toxic plan could be another trillion dollar plan announced over the podium at some point this week. Obama did refer to the plan a few weeks back, but failed to go into much detail of what it would consist of. I would expect some optimistic trading as a result of the rumors. At least for a day or two, maybe. Either way, I feel it will be short lived and cause more problems for the market down the road.

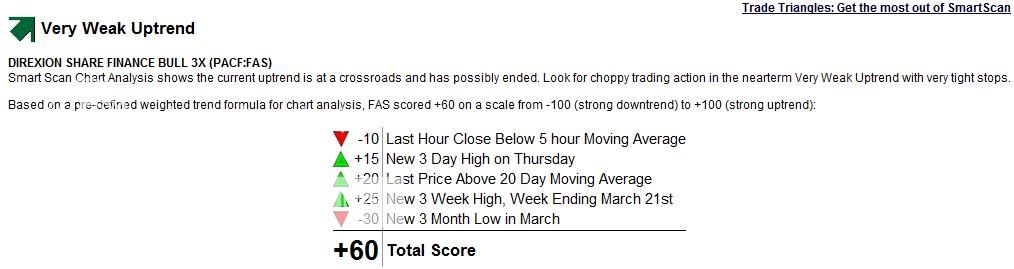

This could be the news that could propel us into the high 7000's, before seeing some more serious selling. If that is the case, plan on me starting to pick up some short positions this week. I just wanted to give a quick update. The FAS trend analysis above is looking pretty impressive for the time being, however, I'm not a buyer. Happy Trading.