Jobs Steps Aside – Turmoil Brews For Tomorrow

Posted On Wednesday, January 14, 2009 at at 3:50 PM by Finance Fanatic It couldn’t have come at a worse time for Apple and for the rest of the market. On Wednesday, Steve Jobs (CEO of Apple) announced that he would be taking a leave of absence from his duties at the company until the end of June to focus on getting back to health. He said major decisions would still run through him, but day to day operations would be handled by the COO. This news sent Apple stock down as bad as 10% in after hours trading. Just rumors of bad health with Jobs caused the stock to drop 5%. I would expect a very serious blow to apple’s stock price tomorrow.

It couldn’t have come at a worse time for Apple and for the rest of the market. On Wednesday, Steve Jobs (CEO of Apple) announced that he would be taking a leave of absence from his duties at the company until the end of June to focus on getting back to health. He said major decisions would still run through him, but day to day operations would be handled by the COO. This news sent Apple stock down as bad as 10% in after hours trading. Just rumors of bad health with Jobs caused the stock to drop 5%. I would expect a very serious blow to apple’s stock price tomorrow.

Given that, if Apple gets hammered too much tomorrow, I actually may pick some up. I mean come on, I know the company is Job’s baby, but lets be honest, they’re not going anywhere for a while. Plus, they have $25 billion of cash in the bank! Just their cash on hand along with their other liquid assets has got to be worth at least $40 per share. So I will keep my eye on that. It was bad news for me, as I still have a couple of apple options. Thanks Steve.

Well, I’m sure we can certainly expect this to affect the market tomorrow as there are plenty of other things going wrong around us. Good luck Obama. Steve had to wait until after the worst trading day since December 1st (-248 pts) to break the news. Even without the announcement, things were not looking good for tomorrow. There is serious downside momentum and as we near breaking the 8000 (we could reach tomorrow) mark again, people are starting to anticipate a new bottom. Possibility in the 6000’s.

Today, retail sales was also confirmed to be horrible for December, as the National Retail Federation announced a 2.8% decline in retail sales for the month of December. This being the first time there has been a decrease since they started tracking the number in 1995. We also had two more members join the bankruptcy club today. Retailers Gottschalks and Goody’s filed for BK today, which is just the beginning of which I feel by the end of the year will be a club with standing room only. With those, comes more job losses. Motorola announced a 4,000 job cut today. As I have said before, this year, the retail will be the backbone of this downfall. With the failure of the retailers, will come the failure of the real estate. Then the trillions in outstanding debt will turn into the bank’s problem once again. What does this mean. Long on SRS and SKF. In fact all of the inverse etfs were up big today. My portfolio is starting to look like it did back in October. And I still feel we’re ankle deep.

I expect to see a horrific day of trading tomorrow. Apple has become the face of the US market, especially the NASDAQ, and such a devastating day is bound to bring down the rest of trading, let alone all the other crap that is present. I don’t know how long this selling spree will go until we get an up day, but as of now, I can’t perceive anything that people can find as “good news.” Even Bank of America getting more aid from the Fed. At any rate, I’m hoping to see another big day for my inverse etfs. If they go big enough, I may consider shaving some of my SRS earnings and putting them into Apple. We’ll see.

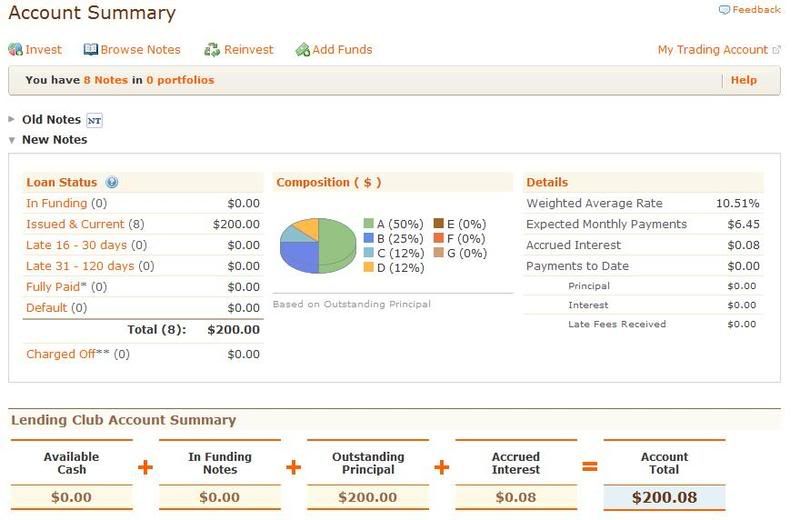

I also wanted to give a little update on my Lending Club experience. As you can see I have received my first interest payment. Big money! But as you can see, the platform is very easy to use and makes tracking your investments quite simple. It looks like my monthly payment is just over $6. So lets hope my 10.5% return stays in tact. So far so good.

I hope everyone has a good evening. We have been talking about these problems for some time on this site and are just now finally starting to see the market begin to suffer the symptoms of our economy. There is still a ways to go. Happy Trading and we’ll see you tomorrow.

I hope everyone has a good evening. We have been talking about these problems for some time on this site and are just now finally starting to see the market begin to suffer the symptoms of our economy. There is still a ways to go. Happy Trading and we’ll see you tomorrow.