Welcome Back Foreclosures

Posted On Monday, October 18, 2010 at at 1:12 PM by Finance Fanatic Once again, I apologize for my limited updates to the site, as times continue to be busy. As we can see, there has definitely been upward movements in stock prices. In fact, with my last post, the Dow was lingering around the 10000 mark at which I said that I expected a "rubber bottom" at around that point and expected to see a rather steep jump from there. As of now, we can clearly see that has been the case. Now the question is how much is left as we begin to head near the always interesting "end of year" times.

Once again, I apologize for my limited updates to the site, as times continue to be busy. As we can see, there has definitely been upward movements in stock prices. In fact, with my last post, the Dow was lingering around the 10000 mark at which I said that I expected a "rubber bottom" at around that point and expected to see a rather steep jump from there. As of now, we can clearly see that has been the case. Now the question is how much is left as we begin to head near the always interesting "end of year" times.

One luxury that the housing market has enjoyed throughout most of the summer months was the lack of foreclosing from banks. Hundreds of thousands of potential foreclosed homes have been delayed due to a variety of reasons. Now, we are starting to see the banks move forward more aggressively. In fact, Bank of America announced today that it plans to resume paperwork for over 100,000 cases of foreclosures in 23 different states. Not only will the housing market now have to endure the off season, they will also have to do it while competing with a fresh load of foreclosed homes. Let the auctions begin!

The housing market will not be the only sector to get affected by the change. For several months now, hundreds of thousands (if not millions) have enjoyed the extra disposable income that has been generated from not having to pay their mortgage. This can be quite significant. As banks begin to foreclose more aggressively, this means that more and more people will be forced to pay occupancy costs again (duh!), which in turn will affect several other sectors. We have seen in recent studies that much of the recent economic activity is a result from government stimulus. If these go away, market growth goes away with it. So now the decision is, when do we make the decision to pay the bill of this party we have been enjoying for the last year and a half.

As of now, I believe we are nearing a rather aggressive pullback. November is known for the massive hedge fund redemptions that take place before year end as well as other year end pressures begin to pile up. Shorts should perform well during the end of October/beginning of November. Happy Trading.

Are We Reaching The End of the Rally? - Things To Watch

Posted On Thursday, March 26, 2009 at at 5:45 PM by Finance Fanatic Well, we might as well start printing new dollars with Obama's face on them, because by the time we spend our way out of this mess, our current dollar will be worthless. Once again we saw another wacky day of trading. Volume remained light today, which makes me even more suspicious of market manipulation. Today, again, we saw these unnatural spikes throughout different times of the day, suggesting several "lump sums" of buying. Whether it's institutions or Uncle Sam, there is definitely a bullish force turning the market around every time the markets begin to drop and as I said in yesterday's podcast (subscribe here), The Fed has motivation to do so. With the light market volume, institutional trading will cause the market to react much more sensitively, compared to trading days we saw last week.

Well, we might as well start printing new dollars with Obama's face on them, because by the time we spend our way out of this mess, our current dollar will be worthless. Once again we saw another wacky day of trading. Volume remained light today, which makes me even more suspicious of market manipulation. Today, again, we saw these unnatural spikes throughout different times of the day, suggesting several "lump sums" of buying. Whether it's institutions or Uncle Sam, there is definitely a bullish force turning the market around every time the markets begin to drop and as I said in yesterday's podcast (subscribe here), The Fed has motivation to do so. With the light market volume, institutional trading will cause the market to react much more sensitively, compared to trading days we saw last week.

It's amazing to think on days like today, when a 6.3% drop in GDP for the 4th quarter is announced, investors find it a time to buy. We are falling back into the trend we saw back in November and December, where no matter what news is reported, we keep buying. Well, we saw how quickly and violently that caught up with us, and I believe it will be even worse this time around. Once again, we saw this horrible reported number spun as a good sign of the "strengthening" markets. Don't ask me how they come up with that conclusion, but obviously they are using different indicators than I am. There continues to be noise from the government as Geithner described how he plans to apply more transparency for hedge funds dealing with credit default swaps and debt trading. Many are cheering his ability to answer the questions, but application of such plans is a different story. President Obama also had more media time today, hosting the first "web" town hall meeting where he talked about more spending he has planned for programs outside of fixing our economy. Wow.

There continues to be noise from the government as Geithner described how he plans to apply more transparency for hedge funds dealing with credit default swaps and debt trading. Many are cheering his ability to answer the questions, but application of such plans is a different story. President Obama also had more media time today, hosting the first "web" town hall meeting where he talked about more spending he has planned for programs outside of fixing our economy. Wow.

Fort most of the day, the shorts were actually holding up fairly strong. SRS was in the green for most of the day and even FAZ got into positive numbers for a while. However, once again, we found a "mystical" force push all markets up the last hour with no news behind it. Let them move the markets on these low volume days, because when the volume comes strong, it won't be as easy. We are seeing a lot of resistance for SRS at 5o and 18 for FAZ. Tomorrow, should be a good sneak preview of whether this rally still has some legs or if it's running out of gas.

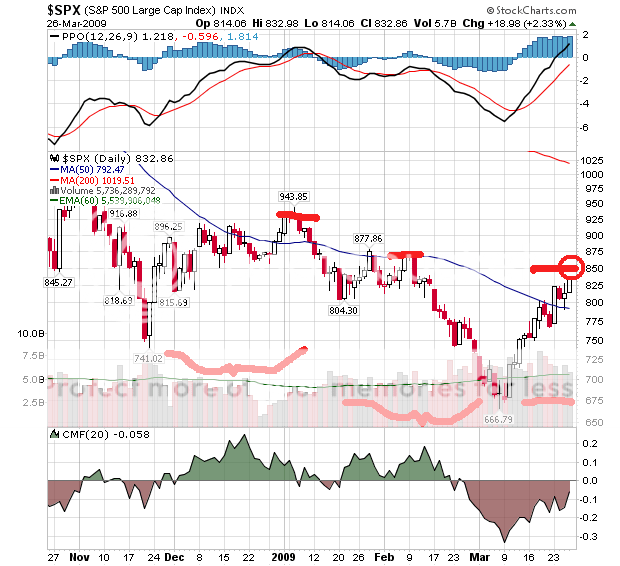

I am feeling a definite slow down in this rally. We may bounce back and forth a bit more around these levels, but as of now I don't see the rally going that much higher. This of course is pending there are no more big government announcements. From below, you can see the moving chart of the S&P. Technicals are showing a definite slow down heading towards that 850 mark. We'll see how close we get to that number or if we begin to retreat from it. If we do indeed push right through it, that's a big move for bulls.

Another factor leading me feel that we're slowing up, is the slow down in financials. Financials have been leading the way in these crashes and rallies. We've seen C and BAC double since their recent lows, which has helped sent the market flying for most of March. However today, even though FAS was up, GS, MS, BAC, C, and WFC were all down, despite the strong day for the Dow. Moody's cut their rating for BAC yesterday, which probably contributed to the sluggish trading, but overall financials are losing their flare. I would expect if this were to continue, eventually we're going to see the Dow follow.

Also, we are beginning to see inflating prices for commodities and energy. Oil continues to rise, despite us heading into the low demand season for oil. Sure, I believe oil should climb back up, but I do think we're a bit overbought at the time. Gold also continues to rise. I love gold, but I feel we will see it dip well below the 900 level before inflation hits. These inflated prices lead me to believe that the market is a bit inflated in general and that we should see some selling soon. This contributes to the deflation, that I feel, will soon take our economy by the horns.

STP saw huge gains today (up over 40%), based on the new announcement that China will be subsidizing solar costs. I had mentioned STP in a few posts a while back as one to watch in the solar field, so keep your eye on that. These gains caused for some big gains for my IRA, which was nice. Speaking of IRA, E*TRADE is offering a great promotion where you can Get 100 Commission Free Trades in an E*TRADE IRA. No-fee, no minimums. Pretty awesome, check it out.

Below is a comparison chart showing the Dow movements from the 1929 crash compared to our most recent bear markets, including our current one. As you can see, and as I have stated before, our current market is tracing very close to the trends of the 1930's market. Although other recent bear markets were bad, there is not nearly the selling volume that we have seen in our current crisis. So, hopefully this can be a reminder for those feeling that we've hit bottom, that it could (and I very much believe) get a lot worse.

Tomorrow should be a very defining day for the rally. If we someone how end over that 850 number, we could see yet another week of gains for the market. However, if bears return to this market and regain control, there is big potential for a strong sell off. We are due for a sell off and I would expect our next one to be pretty significant. I am remaining cautious, with my light short position waiting for a bit more definition. We are getting close. So be alert, Happy Trading, and we'll see you tomorrow.

DOW: Higher Volume + Higher Volaitility = Scary Market

Posted On Tuesday, November 18, 2008 at at 3:06 PM by Finance FanaticWell, as we discussed yesterday, we saw another similar day today that we did yesterday, except for much higher volume and much more volatility. These signs just reinforce my feelings of a near capitulation for the market. We saw the market get off to an uncertain start as everyone tried to digest the earnings report for HP and Home Depot. At first, we saw the market react negatively to the missed earnings, but later in the day, the better than expected report as well with their 4th quarter outlook helped fuel the market back into green.

I also don't find much coincidence that the market pulled a 180 degree turn with about a half hour until close. Some people thought the earnings report fueled it all, or some said hedge funds came in. Looking at the volume influx at the end of the day and the degree of turnaround (as you can see from the chart below), my thinking is that it was good ole Uncle Sam and the PPT. With their current congressional meetings going on discussing the bailout disbursement, we can't afford to have these continual downward days. This little bump at the end of the day and showing that we ended green will do a lot for the global economy tonight. Europe and Asia could not afford back to back days like we saw last night. Also, talks of bailing out the auto industry is becoming more and more difficult. If the government passes on bailing GM out, I don't see them hesitating very long to file Chapter 11. This would be World War III for Wall Street. Speaking of bankruptcy, Circuit City's current Chapter 11 filing will become a Chapter 7 by January. Wait and see.

As you can see from the chart above, notice the steeper and longer slopes toward the close of the market. This represents a higher influx of volume as well as much stronger support on the buy side. This usually represents either a mass rally (which I doubt) or some market manipulation. The way we were heading we could have easily reached 8000 by the end of the day.

With that said, overall it was a pretty strong day for me. Almost everything made me some money. Like I expected from the horror of a day for China yesterday, FXP remained very strong throughout all times of the day. We saw it almost touch 80 today at one point. It did die down with the rally towards the end, but overall held its own pretty strongly. SKF broke 200 today, while SRS was just under it. I also saw some pretty strong gains in my Apple and DIG options. I did not choose to sell out of any of my long options yet, because I didn't feel like this was the "bear rally" I am looking for. I still feel there is potential for a pretty strong bear rally before capitulation. So overall it was a pretty strong day for me.

For tomorrow, I think we have a chance to see this rally extend. Foreign markets should react pretty positively to the momentum swing we saw today, whether it was real or not. This could tee us up for a relatively strong day tomorrow. However, with the GM woes still lingering as well as more retailers that are to announce earnings tomorrow, we could also see a down day. Whatever the case, expect higher volume and even more volatility. With China showing its vulnerability last night, this should now make FXP a stronger performer for me the next few weeks.

Also, keep in mind, we do have CPI and housing starts economic data announced tomorrow. If these announcements are worse than expected, expect a pretty negative response, and vice versa. Either way, my portfolio should benefit on both ends. If we do indeed rally strong, I can sell out of my options and throw them back into EEV and SRS. The market is becoming more and more unstable, which makes me wonder how on earth the few analysts out there that are calling this a market to buy in can justify that. I think we have a bit more defining to do. Have a good night everyone, thanks for the comments and Happy Trading. See you tomorrow.

More Bad News In Wall Street Means More Bad Days To Come

Posted On Monday, November 17, 2008 at at 4:22 PM by Finance FanaticYou have to love Mondays. Everyday, more and more, we see the market struggle to find stability. This makes us more and more vulnerable for capitulation, which is why I have been slightly adjusting my portfolio to be ready. We continued to see 3-400 point swings throughout the whole day of trading. The market was never satisfied wherever it was at. Unfortunately, for those looking for rescue from their portfolio losses, may not find rescue anytime soon.

Today we had some more great news. Citigroup plans to cut 50,000 jobs and Japan joined the club by officially declaring their entrance into a recession. Who needs doom and gloom to bring down the market when the standard, normal announcements are doing just that. The market still wants to do another bear market rally, but can't manage to pull it off. You can see the tendencies throughout the day. The sell off is just too powerful. All in all, it was a pretty non eventful day for me as I wait to see where we head this week.

FXP continued to struggle today, mostly still due to the stimulus money that was announced last week. There is a lot of speculation of where the money will be spent, that is giving a lot of Chinese stocks undue stock appreciation. However, FXP was still able to fight into the green and close at $70. I am more than fine with FXP, as I still am expecting slow gains for another week or so, until this bailout high begins to fizzle. I did pick up some long options. Even though I believe we will net red this week, I think we will have a pretty strong bear market rally one day this week. So I bulked up on some GDX, DIG, and APPLE options, mostly expiring next year, to help give me a little pop during those rallies.

I would like to see a rally either tomorrow or Wednesday to lower EEV and SRS, so I feel better about getting into them. I just think all these inverse ETF's are going to be the money makers from Dec-April. It is funny how some speculate China to not be that bad off, because their consumer savings are much better off than Europe and the US. However, when your #1 lender (The US) shuts down, and your #1 customer (The US) goes away, then you will stumble. Everyone around them is experiencing pain, they just have been covering it up the past two weeks with this stimulus package. So don't fret about FXP. It is ROCK STAR status.

Tomorrow should be another day like today. Everyday now is a possibility for capitulation. News such as GM going under, or another bank failure, or more recession/depression news could put the market into an unstoppable tail spin. We are walking on ice and it is slowly beginning to crack. And everyday that goes by with uncertainty, like today, the market gets that much more closer to a downfall. However, the littlest good news, could send us flying into another short term bear rally. Whatever the case, we will be trending downward. If we do indeed get a rally tomorrow, I will try and get out of most of my options. Long options act as a great hedge for a strong short position, because you have more time flexibility, less downside risk, and more volatility. It has worked great for me while buying short. Whenever/If we have this rally this week, I believe the next day will be BAD, so I want to be completely short, that's right, COMPLETELY by that time. I think after this next rally, we are prime for capitulation.

Even if we don't rally, a majority of my positions are short and I will perform very well. For December QID, SDS, FXP, SRS, SKF, and EEV will all be Rock Stars. I just want to be in as many of them, at a good basis, as I can. So, stay on your toes this week and watch the bumps. It is a dangerous market to "day trade" in because of the volatility. Every five minutes looks like the market is either going to tank or take off. Either way, you get the most definition of the day within the last 5 minutes of trading. I would try to be in your short position by now, because any day could be the day. Remember, until Januray 20, 2009, we will not see very many changes in policy with the current division of the law makers. This also gives momentum to a pesimistic outlook. Happy Trading and we'll see you tomorrow.

Volatility Returns To Wall Street - Capitulation Could Be Near

Posted On Saturday, November 15, 2008 at at 1:32 AM by Finance FanaticJust when everyone thought the market was finding its footing and becoming more stable, once again we see aggressive volatility back in the market. The lead up is much similar to the one we saw leading up to our lowest point back in mid October. This causes me to speculate a little and discuss some interesting concepts.

As we know, there is a lot of technical analysis that goes into analyzing market trends and movements and determining bottoms and capitulation. The vertical rebound we experienced Thursday, and the volatility of Friday has set up the perfect scenario for what many believe are the gates to capitulation. So I thought I would share what I have learned.

The "G20", consisting of major global emerging markets leaders, are meeting this weekend to discuss the global crisis and maybe some possible resolutions to slow the bleeding. Some expect a small band aide announcement will be made, causing a strong emotional rally on Monday. From there, many technical analysts feel that this is where we will see the bottom fall out. Some expect it to drop like a tank. By analyzing graphical trends, some believe we could reach anywhere from 6500-7500 by the end of next week and experience our first capitulation of this recession/depression. Bear in mind these are technical analytics that may not apply to this crazy market we're currently in, but it's good food for thought.

So what did I do with this news? Obviously, I am keeping my shorts. Thankfully, we saw FXP gain back a lot of ground it loss from Thursday. As expected, we saw a massive sell off the last 5 minutes before the market closed (probably from the mass hedge fund liquidations). All the other usual suspects for inverse ETFs did great as well. One new one I am adding to my list that I have been eyeing (probably picking some up on Monday) is EEV. EEV is an inverse ETF shorting the emerging markets sector. Now, with the "G20", involving many of these emerging market leaders, we should be seeing some good gains out of this as we continue to see these quick fixes fail. We see similar trends with this ETF as we do with FXP, but it seems to be holding up slightly stronger.

Considering that I feel we could be in for a short term rally on Monday, I picked up some DIG options on Friday, expiring in December as well as some more of my .QAADB April expiring Apple options. With this volatility coming back, I'm looking to play both sides a little bit more. I am not 100% sold of this technical prediction, but I feel good about picking up these options at these prices anyway. If we do indeed get this rally on Monday, I will look to liquidate all of my long positions, with the exception of maybe my GDX options and throw my profits into EEV and some SKF or SRS. I believe next week will be a pretty monumental week. I think we will see A LOT of activity go on. So stay on your toes and try and catch the openings and closings of the market. That is usually when the deals are. Thanks to those that commented, I enjoy your insights. I hope everyone has a good weekend and Happy Trading. We will see you Monday.

Rally Comes Early For Hedge Funds Despite Bad News Across The Board

Posted On Friday, November 7, 2008 at at 1:41 PM by ChrisThis is why I prefaced this week with "Rave Week." News today consisted of:

- Slightly higher than expected job loss reports

- GM and Ford earnings horrible

- Retail sales lowest in 35 years

- Dollar weakening in strength

- Oil went up

So what do I do? I load up more. I am going to wait and see how we react Monday, but if we see FXP go lower, I would love top pick up some more shares. Also, my .QAADB Apple option is getting pretty close to buy price again. I usually wait for that to get down to $10, where then I load up and sell at $20.

We could very well see this market shoot up close to 10000 next week. This does not mean FXP will go to $40. FXP was especially rocked today, because of the strong performance of the China Market last night. SKF and SRS were not hurt nearly as much by the gains today. I don't see FXP going much lower than the high 60's (if that) and if I can get my hands on some shares at that price, I will be quite pleased.

For those that just got into FXP, be patient. It pays off. Today may have caused some to make a mess in their pants, but don't panic. Just as hard as it gets hit it goes up. We are still experiencing some market uncertainty with the elections and these redemptions. Like I've said before, give it a month or two on this go around. We were fortunate enough last time to have 100% gains in a week, but that was a gift. Financials got hit pretty hard today and with talks of a second bailout being discussed, UYG is a good stock to look at for next week. I still like GDX, even though it was down today. STP was up over 20% today. Solar should remain very volatile until Obama is in office. This stock is still very undervalued.

So not the kind of day I was hoping to end on for the week, but what could I expect from Rave Week? Next week should be interesting and I would love to see the S&P get a strong bump so I could load up on SDS. If we can see these shorts get slammed next week, that will tee us up perfectly for loading up for the end of year. There is no stopping the storm ahead. Have a great weekend and I will see you on Monday. Depending on the weekend, I may give a Sunday evening update. Happy Trading.

Obama Hangover - Dow Plunges Due To Continual Global Economic Strain

Posted On Wednesday, November 5, 2008 at at 2:48 PM by Chris It seems as if reality struck a day sooner than expected. After seeing global markets reacting the way they did last night, I was surprised to see us down this morning. I thought we would maybe get a little rally today, followed by this massacre tomorrow or Friday. This just goes to show how grim the forecast looks for the next year. I am not blaming today's mishap on Obama, however, I knew yesterday's gains were a bit overzealous for the current situation we are in.

It seems as if reality struck a day sooner than expected. After seeing global markets reacting the way they did last night, I was surprised to see us down this morning. I thought we would maybe get a little rally today, followed by this massacre tomorrow or Friday. This just goes to show how grim the forecast looks for the next year. I am not blaming today's mishap on Obama, however, I knew yesterday's gains were a bit overzealous for the current situation we are in.

GDX actually weathered pretty well today and I was able to liquidate all my shares of AIG this morning before it got too nasty. Although I was hoping for a near $3 sale, I was able to sell at $2.30, yielding a 43% return in 3 days. Not too bad. So now, I am completely out of my long positions and will stay that way for the next month or two. Not too say I don't think we will have anymore green days. I just think if we do, they will be in result to a manipulated short squeeze or a reaction to some new stimulous plan that gets everyone all riled up again. Either way, they will be very, very short term.

I said not to lose faith in FXP, today we saw it up over 15%. SKF and SRS also saw huge gains. My large position in FXP ended giving me a pretty good day today, overall. And I believe it's going to be tough to slow this downward train.

Tomorrow, we have retail news. If it's anything close to last months, it will be bad. Consumer sediment has almost been completely wiped out and with the recent earnings reports from several retailers, I'm guessing this to be a bad month. Look for SRS to take a pretty healthy jump tomorrow, as most of their shorts are with real estate REITS. This stock is still a strong buy! I believe by January, we will see it back at $200+. With this news, we should probably see another down day tomorrow and even Friday. Our short term rally could be wiped out as soon as Monday.

It is still possible that today was a lot of profit taking. Solar stocks were crushed today, which was surprising, because with the election of Obama, (who is a strong supporter of alternative energy) you would expect a bounce. However, yesterday there was such strong gains that almost was overzealous. But don't be overly shocked if we somehow make it into the green tomorrow. People still are on this buzz of change with Obama.

Stay with your short positions, they will be what makes you a lot of money the next two months. If you haven't bought FXP, it is still a good buy. It was a lot better at $75, but under $100, it is still a great buy.

If you feel uncomfortable only in a short position, look to buy April contracts of GDX ($26) or GLD ($82), or look to get into some solar. STP is a great undervalued solar company. A few months ago, Morningstar had a 5 star rating with a target price of $92. Today, it closed at $16.35. I believe this stocks should be at $30-$40 by February. With the help of Obama's alternative energy crush, we should see strength in the big solar players. This is if you HAVE to go long. I would prefer to just hold short for now. This credit crisis we are in will most likely not BEGIN to get better by early 2010. So enjoy these inverse ETF's, because there are not a lot of guarantees in life! Have a good night and Happy Trading. We'll see you tomorrow.

Obama Wins - Wall Street Loses

Posted On Tuesday, November 4, 2008 at at 1:14 PM by Chris

As we progress further into "Rave Week", we continue to find surprises. Although, we did anticipate a rally this week, with the fact that historically stocks have rallied following elections. One thing is for sure, Wall Street does not like uncertainty, which is why in most cases there is a slowing prior before elections. However, with certainty comes a rally. In this case, with the polls strongly favoring Obama to win today, it seems as though Wall Street has already made up its mind, finishing the day over 9600. It seems as if they feel the uncertainty is over. Remember, I cautioned for the possibility of a rally towards 10000, since the 9200 threshold was reached. But tomorrow will be tricky. As when news is expected to be announced, like the Fed Rate cut, or high earnings, there is usually a bigger run before hand factoring in the expectations. I believe we have experienced that "anticipation" of the election today. However, when the excitement settles and America "sobers" up, we will still be in the same financial crisis we started months ago, and this time Head Deep. Look for a new bottom to be established in December or January.

Tomorrow, I believe we have a good chance to keep this rally going. Foreign markets should respond well this evening to the election and strong performance in Wall street, which should carry over into tomorrow. However, I think this rally could be put to a sharp halt on Thursday and/or Friday. Like I said yesterday, employment news is announced on Friday, and that can't be good.

The only thing keeping the market above 9000 the next couple of weeks will be the short squeeze we are experiencing, because of Redemptions due in Mid November. Until then, we may see this awkward stimulated market, with the help of some market manipulation. Just remember, we aren't even labeled a "recession" yet. We have a ways to go.

So what to do. As expected, we saw big moves in GDX and AIG. I think I will look to sell AIG as it approaches $3. GDX looks like a good sell for me at $25. Both have been great this past week and still should move. GDX has moved 30% in the past few days where AIG has almost doubled.

LOAD UP ON FXP, Wow! I was extactic to see it go below $80 today. I picked up another good load of shares today at $74. People, I know it's hard to see the sharp decline in buy into it, but this is a steal. The harsh times that lie ahead for the end of the year will directly show in the value of FXP. I believe we will hit the $200 price by January.

For Tomorrow, expect another rally, maybe not as strong as today. This may be the last day to get FXP at this strong, discounted price. If you still are in GDX or AIG, you may want to consider selling of some if not all your shares tomorrow, before the market gets struck. SKF and SRS are getting very close to purchasing price, I'm just waiting a bit longer (although that is a gamble, because this could be the lowest it goes). Be patient, like I said in prior posts, in this round of FXP, we aren't going to see a double in a week like we did last time. We may have to wait a month or two this time. So be patient, Happy Trading and we'll look to see what this market does tomorrow. Oh and if McCain somehow wins tomorrow, who knows what the market will do, all bets are off. See you Tomorrow.

Stocks May Rally - Halloween Sparks Confidence

Posted On Friday, October 31, 2008 at at 4:10 PM by Chris Despite continual economic woes, we still see the marketing battling hard to stay above water. This is exactly why I said we're heading into "Rave Week". On the bright side, even in the up day, we still saw FXP take a little hop from yesterday's closing. That should show you the resilience of this ETF. Today, the market broke a critical barrier of 9300, which some believe was a threshold the market needed to beat to see a healthy run. Many believe that the market may rally close to 10000 this next week because this threshold was reached. As for me, it's Rave Week, so I won't bet on it.

Despite continual economic woes, we still see the marketing battling hard to stay above water. This is exactly why I said we're heading into "Rave Week". On the bright side, even in the up day, we still saw FXP take a little hop from yesterday's closing. That should show you the resilience of this ETF. Today, the market broke a critical barrier of 9300, which some believe was a threshold the market needed to beat to see a healthy run. Many believe that the market may rally close to 10000 this next week because this threshold was reached. As for me, it's Rave Week, so I won't bet on it.

I am very happy to only be in FXP currently. In fact I would not mind a healthy rally on Monday to send the shorts down further to lower my basis. Currently, SRS is becoming very tempting at $115, but I am going to continue to wait until it is under $100.

As I have said before, historically, the stock market takes a little bounce after an election and with the short squeeze on going with the Hedge Funds, we are set up for a nice little rally. Even though I am predicting a rally next week, I am going to wait on the sidelines and only stock up on my short position if prices fall. Look to continue to pick up shares of FXP if they fall $85 and below as well as SRS if it falls below $100. An investment to be considering in the near future is Gold. Next week I will discuss why it is a buy and how we can make some quick cash on it. We ended the week with a little bit of unexcitement, but we are set up to do quite well this next month. Have a Good Halloween and lets make some money next week. We'll see you Monday.

Asia Down For Friday - Looks To Spread Into US Markets Tomorrow

Posted On Thursday, October 30, 2008 at at 11:18 PM by ChrisAfter 3 days straight of a strong rally, Asian markets run was put to a stop on Friday. Even though Japan is still expected to cut their rate, many gathered the profits they could find in case their is not a cut made, which would send Asia into a big down spin. So I don't know if FXP will get much lower to make a second buy in. Who knows though, US is a market of it's own so it could be up, but usually the Asian market is a good factor in driving FXP.

I would guess we will see the same "profit taking" trend tomorrow in our own markets unless some significant announcement is made. We have had three pretty strong days, which is more we can ask for in this market. We may begin the day up, but I think we are going to see a pretty strong sell off before the close, which could push the market down 3-4%. Be careful this next week, during "Rave Week", and get into FXP while it is still below $100. If it's below $90 tomorrow, even better! See you tomorrow.

BUY BUY BUY - The Stock Market is Creating Better Illusions Than Houdini

Posted On at at 2:10 PM by ChrisQuickly, go all in. We have reached the bottom. Not so fast. In our current market, emotions are playing as a higher factor than fundamentals. But like a heroin high, it's only going to last a bit and then cruel reality will once again set in.. Yesterday, I discussed the probability of a green day, especially in Asian stocks dealing with the possibility of a rate cut in Japan. That possibility is still lingering.

Today, we officially found out we had a contracting economy(one more quarter of those and we've officially got ourselves a recession) with the GDP report, but the "bad news" was better than expected. With that, surprisingly, came a pretty well stimulated day. Good enough that I unloaded the rest of my Apple $110 strike price contracts for double what I bought into them for. And with those proceeds I'm back in heavy to FXP at $90. Ahhh, I feel so much better now. It's like coming in from a rain storm. Getting back on the short side is so much more comfortable in this market than playing the long. Let's take a look at where we're at:

With that, surprisingly, came a pretty well stimulated day. Good enough that I unloaded the rest of my Apple $110 strike price contracts for double what I bought into them for. And with those proceeds I'm back in heavy to FXP at $90. Ahhh, I feel so much better now. It's like coming in from a rain storm. Getting back on the short side is so much more comfortable in this market than playing the long. Let's take a look at where we're at:

See the trend? It looks like a long hike up, but it goes by faster than you think. Let me be frank. We may see FXP cut in price even further before it explodes. This is because next week looks to be what I call a "Rave Week." A Rave Week is when there is so many things going on you don't know whats going to happen. Lets not forget the short squeeze we are feeling for the redemptions coming in Mid November. Also, elections are next week, and with Obama leading, who knows what kind of response that will cause. And of course, everyday new bad news will loom over the market trying to bring it down. We may be told next week that all are banks go under and we will still see green. We may have the best news ever, only to find red in the market. Whatever the case, there will be a lot of noise during next weeks trading. Tomorrow will be a telling day.

So why buy FXP now? Because in December, watch out! I would love to see the market rally all next week. That way, SRS, SKF, and SDS will all be prime for buying, because I believe our big, bad tidal wave is coming in December and January. The holiday season the last hurrah for a lot of retailers. When they see the horrible sales volume the holidays bring, out go the lights. We are going to see a lot of big, national retailers go under next year (my picks: Circuit City, Office Max, Office Depot just to name a few). The ones that remain will be hurting, bad. So, if I continue to see FXP drop, I will continue to buy in $10 increments. I bought today at $90, if we see it reach $80, I buy more, $70 again, etc... Remember I have a nice pile of cash of GAINS sitting on the sidelines from the past two weeks. We've got room to wiggle.

I don't feel comfortable with any longs at this point. I almost do about GDX (Gold ETF), but I like their options, when their price is below $20. With all the Federal help in the credit markets, we are bound for inflation. SRS and SKF have come down significantly, but not near as much for a buy for me. Remember if you choose to buy FXP now, realize we may not see big gains for another couple of weeks. Don't worry, the gains will come, but maybe not until late November. You may see it go down another 20% before going up again. Like I said before, this ETF is not for the faint of heart. Be patient. I hope you all are riding these waves with me. It's been a great ride so far. Just don't hate me if I'm not 100% right. I will try to be 80%. You never always know what this market will do.

I will give another special update this evening to discuss how the Asian markets are doing. Usually, we get a pretty good idea of how FXP will perform from looking at how the Asian market does. This Rally should not last long. Upcoming news will prove that. Just wait until the next job report comes out. Check back tonight for the Special evening update. Happy trading.

Almost Back To Ground Zero - Shorts Here We Come

Posted On Wednesday, October 29, 2008 at at 11:59 PM by ChrisWell, as we expected, The Fed went through with their cut of 50 basis points. We saw the market rally in anticipation of the cut as well as stay fairly strong after, until the last 10 minutes where we saw a lot of profits being taken. I sold out of most of my call options, because DIG, RIMM, and UYG were all up strong and yielded strong gains. I gained a 90% return on my Nov. expiring RIMM option, 70% on my DIG option, 60% on my UYG option, and I kept my .QAADB, April expiring call option which I bought for $9 (It closed today at $15), because I believe Apple will continue to go up. They are cash liquid, have no debt, and continue to rise above with their innovation.

Now what goes on tomorrow? Usually, I would expect a pretty strong sell off, considering we had two pretty strong days of green. In this market, that's more we can ask for. However, Japan looks to make their own Fed Cut, which if they make a strong one, would most likely send our market skying tomorrow, especially Asia stocks. In fact, as we speak, Hong Kong's SSE is up quite a bit off of anticipation.

So for me, Tomorrow is a measuring day. Another day in the green, expect our short positions to be in prime position to buy back into. Personally, I feel it will be a green day, so I will be looking to get back into FXP or SKF if it gets in the low $90's or below. Also, I will maybe to look to get out of my Apple (AAPL) option if we see it go up another 50%. If for some chance, the sell off is stronger and pushes the market down, tomorrow will end up being an "observance day" for me. Remember though, to not give up on the market. You cannot count on how the market is going to finish until watching it five minutes before it's going to close. We saw a 300 point swing today in 7 minutes. The market is very volatile and a Red Morning can be a huge Green Afternoon, so keep tabs.

So keep your eye out and if we see another strong green day, look to building up your short FXP position, because as we saw from last week, that's a great wave to ride in this market. If it's red, don't worry about it, because election week is next week and I think we'll see some more green next week. Happy trading and we'll see you tomorrow.

The Dow up over 10% - Did You Get On The Wave?

Posted On Tuesday, October 28, 2008 at at 6:02 PM by ChrisLike I said patience is a virtue. You should have not been too surprised, because we here at Crash Market Stock said it was coming. In any regard, I hope that you are finding ways to make money in this market, because the opportunities are ALL AROUND YOU!

So here we are, a huge rally, up over 10% for the Dow today. All of the options we discussed are up anywhere from 30-90% depending on which ones you bought. And after completely liquidating my FXP, there was not any downside today. So what now...

Tomorrow will be a very interesting day and I'm going to be very cautious to what I advise. There are many elements constantly pounding on the market everyday telling us Bad News. I mean, even today we got the worst consumer sediment report in 30 years. You would think that would devastate a market. However, this time, I believe there was more positive pounding, temporarily, to give us this huge run. But there is a lot less positive to work with than negative, which is why we need to be careful when playing the long. In fact, GDP reports come out Thursday, which I am sure will now show a recession.

As for tomorrow, we have the big announcement. Now, no doubt most of the reaction of the cut was factored today, but not all. This puts us in a sticky situation. Most are expecting around a 50 basis point cut in the rate. Anything less than that, will probably send this market down tanking (coupled with the people taking profits from today). If they cut to expectations or more, I believe we'll see another healthy rally tomorrow. Remember, there are billions of dollars out there sitting on the sidelines waiting for the "bottom", and as soon as they see signs of life, they dump it in.

As For me, I plan on keeping my option contracts and hopefully selling them tomorrow for a healthy gain. Then, depending on how the market moves, I would love to get back into a short position. Notice below the chart for FXP. See the trends? As you can see, there is a pretty correlating trend with spikes in this ETF. Good fluctuation from $80-90 up to $190. For me, as soon as it gets below $100, its a buy, and look what we found last week. The great news is after today, it took such a beating, its back down to $113. Another day of that and I am back in. For your options, look to hold on tomorrow and think about liquidating at the peak of the day tomorrow. Remember, it may be better to sell it before the Fed's announcement, because as we saw from the Bailout vote, action can cause the market to move down. If we see FXP hit $92 or below, I would get back in. There is too much bad news to come to keep that stock below $150. Good luck, Happy Trading, and we will see you tomorrow.

As you can see, there is a pretty correlating trend with spikes in this ETF. Good fluctuation from $80-90 up to $190. For me, as soon as it gets below $100, its a buy, and look what we found last week. The great news is after today, it took such a beating, its back down to $113. Another day of that and I am back in. For your options, look to hold on tomorrow and think about liquidating at the peak of the day tomorrow. Remember, it may be better to sell it before the Fed's announcement, because as we saw from the Bailout vote, action can cause the market to move down. If we see FXP hit $92 or below, I would get back in. There is too much bad news to come to keep that stock below $150. Good luck, Happy Trading, and we will see you tomorrow.

The Dow is still going Down, Down and Down. More Opportunity For You!

Posted On Friday, October 24, 2008 at at 9:09 PM by ChrisWell, we have seen yet another Red day in the Stock Market and while most people are outside banging their heads on the wall, I am excited for the new opportunities that are presented to make some money in the market. It is for this reason why I recommended the initial load up of FXP. Today, we did see a decline of the Apple (AAPL) options, however, FXP hit $160, still giving us strong gains for the day. It is essential in this market (at least at this point), that whenever you are long, also hedge it with a short position, because for the next year I see this market struggling.

Because of continual days of red in the market, I think we are due for a rally. I did say yesterday that I thought that rally would have been today, but that's ok. KEY DATE: The Fed meets October 30 to discuss the economy. You can bet that if the market is still trending downward, we may see a historical 1 point cut to the fed funds rate. If so, watch out! We will probably see a 1000 + day movement on the DOW. So I foresee some expectation of the cut beforehand.

I think some opportunities to look at are Gold. Commodities have been slammed this month and gold is at a 52 week low. With the FED cutting the rate, some will fear inflation, boosting up Gold. On Monday, look to see the trend of the market. If it looks to be up in the pre-market, considering selling a big portion of your short position and maybe load up on some January expiring, either GLD or GDX options. This should give you plenty of time for a nice good pop in gold. If it looks to be down on Monday, let FXP make you some more thousands and towards the end of the day, maybe look into loading up on the Gold options. I think next week is a Green Week. See you Monday.

Take A Ride On the Dow Roller Coaster

Posted On Thursday, October 23, 2008 at at 3:22 PM by Chris

Return Update - Did you make money this week?

Posted On Wednesday, October 22, 2008 at at 11:09 AM by Chris It has been 2 days since my advice of positions to take and although it may seem like it's too soon to discuss big returns, this is the market we are in today.

It has been 2 days since my advice of positions to take and although it may seem like it's too soon to discuss big returns, this is the market we are in today. Wall Street Update - How to make money in the stock market right now?

Posted On Monday, October 20, 2008 at at 3:56 PM by ChrisSELL! SELL! SELL! That's what everyone's been saying the past few months, and with the Dow Jones still under 10,000, it seems as thought that is what people have been doing. Many people have already seen their retirement accounts cut in half or even worse. Is there any hope? Should I liquidate everything I have, take my losses, and walk away? These have been the questions several of you have been asking yourself the past 6 months. Hopefully, I can show you some things that have been working for me.

Right now, the volatility of the stock market is like nothing we have ever seen. Today the VIX closed at 52.97 (down 24%), giving this market a wide range of trading area. Just within the past two weeks, I have seen several days where the market has had over 700 point swings in the same day. For some, this causes them to grind their teeth and pull out there hair. For others, it creates a great opportunity to make some good cash in a short period of time. Day traders have switched from Penny Stocks to Apple. What you need to make sure of is to be on the right side of the bump. If you are, you chance at making anywhere from 30-300% return on your investment, all in one day.

In days to come, I will keep you up to date of information on stocks that I am playing in my portfolio. Currently, Year to date, I am up 20% in my porfolio, which some may find impossible. There are ones to play on the long side, and ones to play on the short. With the help of ETF funds, people can play the short side without having to go naked on stocks. It's great. And as we continue to see our market get worse and worse, these short positions will take off. For starters, take a look at the ETF, FXP. It closed today around $90. Let's return to this stock in a week and see where it is, my guess is that it will be much higher in between now and then. Continue to check back for other ideas for your portfolio. There are ways to make A LOT of money in this market.