Banks Are Back - Investors Finally See Green In Trading

Posted On Tuesday, February 24, 2009 at at 6:03 PM by Finance Fanatic Well, our week long streak of bear hungry selling was finally put to an end on Tuesday as the Dow closed up 236 points (3.32%). Indeed we were overdue for a good rally as I was actually expecting this rally to hit a couple of days ago. Well, it's here now and it will be very interesting to see the strength of it. Will it just be a quick rebound for profit taking, or may we see some continual recovery over the next couple of weeks? A lot has to do with fate of the banks and how the government manages news that continues to hit the public.

Well, our week long streak of bear hungry selling was finally put to an end on Tuesday as the Dow closed up 236 points (3.32%). Indeed we were overdue for a good rally as I was actually expecting this rally to hit a couple of days ago. Well, it's here now and it will be very interesting to see the strength of it. Will it just be a quick rebound for profit taking, or may we see some continual recovery over the next couple of weeks? A lot has to do with fate of the banks and how the government manages news that continues to hit the public.

Many people attribute Bernanke's remarks to big run up in financials. However, I don't think he had much to do with it. In my opinion, the market was oversold, and was just waiting for a bit of a push to get the engine started. I see it as a technical rebound, one of which may stick around for a while, at least that is what I am hoping for. The selling volume was very low and the number of new lows were minimal, which was a sign that we were quite oversold.

After selling a lot of my gold options last week, I went ahead and got out of gold completely this morning. I do feel that gold still has some more up to go, but I feel that it is vulnerable to some losses here in the short term. The market may regain some of its footing this month, which could bring gold down a bit. I plan on getting back in if we see gold get back down to $900 levels, as I feel inflation will be our next beast to slay after we spend our way out of our current problems. 1990's Japan, here we come. However, my first ride was gold was very profitable for me and I enjoyed the ride.

If you haven't already, make sure to check out the 5 Trends Video discussing the momentum of the major 5 sectors investors are watching. It gives good tips about oil, gold and other sectors. Oil still continues to be on my radar, but indicators have not confirmed a bottom yet, so I am still waiting for a good entry. I don't think there is much more downside for oil, but I can wait.As we saw today, these violent bear market rallies can take back profits just as quickly as they are given. FAZ and FAS are both very capable to take some serious slashes at your portfolio if you are caught on the wrong side of the rally, as some of you may have found out today. I plan to be very careful the next couple weeks with the leveraged ETFs. Having the Dow close under the 2002 lows yesterday and the S&P under the November lows confirmed that we are indeed still in a bear market. However, the rebound we received today also confirms that we may indeed be starting another bear market rally. So what does this mean?

This is my plan for coming weeks. I am keeping my FAZ Put options (which is much like owning FAS, just more volatile) along with my remainder of SRS (which currently has a Market Club report trend score of +60. Get your own symbol analyzed for free, all you need is a name and email, Click Here) and SKF, which is not much. Besides my energy stocks and miscellaneous tech stocks, I will be patiently waiting. I am going to be very careful on the short side, as we may see a 15-20% rebound with this rally over the next few weeks. I may make some suttle long moves to take advantage of the rally, but not much. My real goal is to get the shorts back to a point where I can enter at some really low prices and be prepared for the big crash, which I still believe is coming. If we do indeed rally, many will believe the worst is done and that we could be starting the bull back up. Be very careful of what moves you make. As for myself, I feel very strongly that is not the case and will wait until the time is right to get back in heavily in the short position. However, I will be patient.

We may not rally from this point, but we have a lot of indicators that we are oversold at the moment and that we could indeed see a strong bump in the bear market. Like today, these rallies could be violent, so watch out. I will try to make it on chat to keep you all posted daily on my moves.

I am very excited for the times ahead. I believe the opportunity is slowly presenting itself to make a lot of money in this market. It's hard for me to fight off my compulsive nature sometimes, but deep down I believe it will payoff for me. So try not to worry if we do indeed see some green over the next few weeks and just think of it as an opportunity to see good prices for the shorts. At least that's my plan.

Tomorrow, we'll talk about Obama's speech and other new factors as they come up. One more week for the $200 Lending Club promotion. If you haven't checked it out, make sure you do, click here for details. So far, my 10.5% return on investment with them has been picture perfect. It could be a great place to park some cash. Have a good night everyone, Happy Trading and we'll see you tomorrow.

Doom in Detroit - Profits Taken After 3 Day Rally

Posted On Monday, January 5, 2009 at at 2:51 PM by Finance Fanatic Welcome back for everyone that was enjoying the past few weeks traveling or spending time with the family. While you were gone, there wasn't much you missed in the market. Just a few more record low index numbers and a bit of buying, kind of paradoxical isn't it? At any rate, it is good to finally be getting close to normal volume numbers as people are slowly staggering back to their lonely offices. Here in my office building, I am slowly seeing more parking spaces open up, less competition for the elevators, and almost no line for the lunch counter. We are truly sinking into this recession.

Welcome back for everyone that was enjoying the past few weeks traveling or spending time with the family. While you were gone, there wasn't much you missed in the market. Just a few more record low index numbers and a bit of buying, kind of paradoxical isn't it? At any rate, it is good to finally be getting close to normal volume numbers as people are slowly staggering back to their lonely offices. Here in my office building, I am slowly seeing more parking spaces open up, less competition for the elevators, and almost no line for the lunch counter. We are truly sinking into this recession.

It was a disaster of a day for autos as their December numbers all came out. It’s funny, because even with the numbers reported, they were “better than expected” numbers for some analysts, somehow making some think this was a “positive day.” I’m glad these people aren’t my fund managers, because there is nothing to cheer about the numbers that were given today. Here are most of them for your review:

Daimler (Mercedes) -23.5%

Audi -9.3%

Porsche -25.5%

BMW -36%

Ford -37.4%

GM -31%

Honda -35%

Toyota -37%

Nissan -30%

Kia -39%

Chrysler -53%

Sure, but everything is fine, right? Whatever the case, after these reports, don’t ask me how Chrysler survives to February. Even with the bridge loans, with those amount of losses in one month, I see a very slim chance of keeping them a float. I see them going under very shortly. The companies that surprised me were the Asian autos. Usually Toyota is among the top sellers, but they were down more than the American autos. Either way, I’m steering very clear from autos, no matter what analysts say about them.

I continue to stick strong with my inverse etfs. It is good for investors to know that these are big momentum movers. There has been some negative articles written up about some of these leveraged etfs and that you can’t make money over time. This is not true. I have made very good money from them and plan on making a lot more. They are strong momentum movers. Bears have not had momentum since almost mid November. As soon as that momentum is back, we should see some serious strong gains in the inverse etfs. Yes, trade them with discretion, but please know YOU CAN MAKE MONEY WITH THEM! A lot of it if you time it right. I try not to stay in them very long, and buy and sell on the bumps, but they can be very rewarding. The critics of these funds are those that bought at the wrong time. I mean if I bought SKF at $250, I would be cursing them too! SRS would have had a very big day, if it were not for the gains in home builders (due to another better than expected number, still bad), we probably would have seen a 10%+ day today, instead of only 3.8%. No worries for me, because SRS is still my favorite for beginning 2009.

The traffic at retail centers for post holiday season has been horrific. I am lucky to see more than 20-30 cars in front of department stores. Even worse, when I am in the actual stores, there are no lines at the registers. Sure, people are still looking, but who’s buying. In my opinion, we are in for one of the worst years for retail bankruptcies in US history. As these retailers close, it is going to kill the bottom line of these REITS and property owners. Then to top that off, these 5 year conduit loans that were bought from 2001-2005, that were also leveraged 80-90% at 5% interest rates are all coming due, and where are they going to get financing for all these properties that are now 20-30% vacant? Commercial real estate is in for a horrible year in 2009. SRS is $150+ in my book. It may take until February after the Obama cheers settle down, but it’s coming in my opinion.

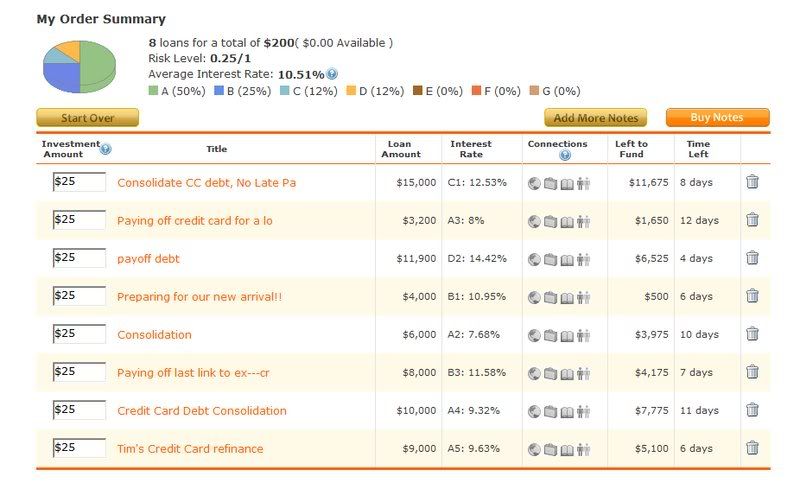

I was successful in my first Lending Club loan today. This program is one of many I will try out on this site and give you any success updates I find, as I like getting creative, with discretion, to try and spread out my risk and returns. As a trial, I allocated $200 to loan. The interface is very user friendly and I was able to do everything in under five minutes. I selected my target return I was aiming for (10.5%), and it automatically generated loan suggestions for me to use with a balance of A-D rated loans. I did a maximum of $25 in every loan, spreading out my risk and my final portfolio looked like this:

So as you can see, all the loans are due within 2 weeks, so I will know by then whether I am successful in my returns. So far, I love it. Hopefully, I can average out with at least an 8% return, the returns are the key. Slowly, I will put more money into it if I find success. You can sign up as a lender or borrower very quickly at Lending Club. I will continue to keep you all informed.

So we push on with volume back into the market. I still believe we are going to have bearish tendencies in this market until we get closer to Obama’s move in date. I think it’s a bit early to start cheering for that. Even so, I’ve got my SRS and FXP ready to go and am also looking to get into either SKF or FAZ, as commercial banks are bound to go through another round of hardships with these commercial loans. Good evening all, Happy Trading, and we’ll see you tomorrow.

Holiday Woes Continue - Bailout Bids Grow Larger

Posted On Tuesday, December 23, 2008 at at 2:45 PM by Finance FanaticWell, so far it seems as our S&P test we discussed last week has proven to be correct thus far, as the market experienced another down day of trading during the holiday week. In the morning, it looked as if we maybe would have a day in the green, but sure enough the sellers persisted as the Dow closed down 1.18% today. In fact, I believe we are lucky that it is a holiday week, because if we had higher volume levels, we would maybe be seeing these numbers doubled, as our volume is about half as much as it usually is. Either way, I think it's safe to say that we have definitely flipped momentum since Friday and have some downward momentum for the time being. Now, how long that lasts, who knows with all the government promises that are announced every week.

Despite the down market, some of the shorts, like SRS were down. This may have caused some frustration for some of you. The main reason for today's drop was that SRS, along with others, were funds announced today by Proshares that distributed a dividend. This was the main cause for the down day, coupled with this still lingering bailout issue for commercial developers. I still believe we should see a lot of strong days for SRS here in the near future. You can see a full list of the funds that are distributing dividends here.

FXP had yet another strong day of green as low oil prices and failing banks continue to punish Asia. Many investors are taking their profits from the end of the year rally we just had as well. The selling could continue strongly into 2009, as stability continues to deterriorate.

American Express got a little piece of bailout money today, receiving $3.39 billion from the Fed. I can't complain about that, as I feel that short term lending is something that can help the market a bit. However, I still feel that people should not be bailed out of their existing credit card debt, unless it's me of course. In any case, another company to add to my list of companies I have ownership in.

Other woes to hit today's market was another month of worse than expected home sales. This should be no surprise for anyone, as consumer sentiment is weakening and a lack of lending still exists with the banks. Many people think the housing market will reach bottom during the end of summer/fall of 2009. I think it may be a bit longer than that. They also announced today the suicide of a hedge fund executive who lost millions in Madoff's scheme. That kind of news can't help the already suffering hedge fund market. Either way, there is not much to cheer for this week. Autos were slaughtered today, continuing from yesterdays bad Toyota numbers. At this rate, all three of the companies will be out of business before New Years.

In any case, the rest of the week should be much of the same as we have seen the last two days. We may have a little green day soon, just to reverse the direction for a bit, but I doubt if it will be anything substantial. Remember, tomorrow is a short closing day, so make sure you don't miss the close. As for me, I am holding back at the moment, until the volume comes back after the holidays. I feel I am in a good position for the direction we're heading into 2009. This is a good week to take positions, if you haven't already, as volatility is down due to the holidays. Have a great night tonight, Happy Trading and I'll see you tomorrow.

What Is An Inverse ETF?

Posted On Friday, November 21, 2008 at at 10:08 AM by Finance FanaticI have been receiving several emails asking to know more about these inverse ETFs that I talk about so frequently on this site. So I thought I would do a little mid day bonus to discuss them, and dive into them into a little more detail. Sorry, if this is elementary for some of you guys out there, I just thought it would be a worthwhile reference to many out there.

First, lets start with the basics. What is an ETF? ETF or Exchange Traded Funds, are a portfolio of different stocks, industries, or bonds that are traded much like a regular stock is. ETFs are very similar to index mutual funds, but I prefer playing ETFs more than mutual funds. The biggest reason is that you can trade an ETF at any time during the day, much like a stock. Mutual Funds you buy into, most likely doesn't process until the following day(same with selling it). Also, usually the expense fees are smaller with ETFs, so I prefer to stick with them.

With ETFs you are able to buy into sector or industry by buying only 1 fund. You can buy into the Nasdaq, Dow, or even foreign markets. ETFs started in the 90's (SPDR's) and have grown tremendously in poularity the past few years. It is a great way to ride the bumps with more volatility rather than just trading stocks.

In this market I like to stick with Proshares ETFS. By looking at their ETFS, you can see they have several options to choose from. One of the options you will see is their list for Short Proshares, which are known on Wall Street as Inverse ETFS (analysts don't like using the word "short", it's like Voldermort in Harry Potter). These short proshares perform well as their focused benchmark goes down. For instance the short proshare DOG shorts the Dow 30. So as that sector goes down, DOG goes up.

There are also proshares called Ultra Proshares (which I usually like to trade), which are doubled leveraged ETFs that are more volatile. So an ultra short proshare like DXD, which shorts the Dow at double leverage will most likely be double the inverse of the Dow 30. They now even have triple leveraged shares, which I do not deal with much. Too risky for my blood and the volume isn't their for me yet. Just remember, the leverage is a two edged short. It goes up twice as much and then goes down twice as much.

Here are some Top ETFs I like to track and play on the bumps in this market.

SRS - My favorite Ultra Short Proshare. This is an ultra short to the real estate index. Having the Real Estate market a big part of my life, I find this as one of my niches. I was trading SRS 6 months ago, when I saw early signs of real estate failure for the next few years. SRS shorts big REITS, retailers, brokerage companies and others which most are all struggling right now. It is no coincidence that this has been a rock star ETF.

SKF - Another fabulous one. SKF is an ultra short for the DOW financial indexes. You can probably guess that it has been performing quite well that last couple months (almost hit $300 today).

FXP - An ultra short to the China FTSE/Xinhua China 25 Index, which consists mostly of Chinese financials, energy, and communications. I believe this one is pretty undervalued, considering what China's growth rate was and what the inverse of that looks like.

EEV - An ultra short for Emerging Markets. Being a "global crisis" now, many other countries, along with US, will be hurting the next couple of years.

Other short proshares to note that I like are SDS and QID. As of now, there are only a few on the long side that I trade.

GDX - A gold miners ultra long fund. This tracks the gold sector and gets strong gains when it's up. With the almost sure thing of another rate cut, look for gold to keep getting stronger.

DIG - An ultra long oil fund. Oil has been hammered the past few months. With a cold winter months ahead, I can't see oil staying at these values for very long, no matter how many people car pool in a Prius.

UYG - Ultra long financials (opposite of SKF). This one will be a great buy in a few months to come when banks begin to get their act together. Keep your eye on it for the long haul for the ride back up.

Here are a few that I like to keep my eye on for the time being being. I thought it would be good to get this post out, for those that have been incquiring of what ETFs are and which ones I look at. It's been another volatile day again today and it looks to be unsure where we'll end at. I believe we will get a pretty strong run, which ever way we decide to go (up or down), towards the end of the day. I will give the weekly wrap up later.