8000/825 Seem To Be The Magic Number - Forces Colliding

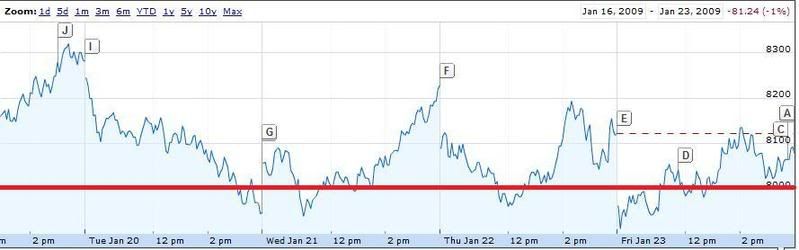

Posted On Friday, January 23, 2009 at at 3:53 PM by Finance Fanatic Whether it be 8000 for the Dow or 825 for the S&P, it seems as though investors have found a base to set up camp as the market may go up and down a bit, but is staying close to those numbers. The continual battle between stimulus hopes and deflation depression is causing some violent jolts in volatility, as people are not quite sure what to believe or if things are going to get a lot worse. Even if the largest stimulus considered is passed, history has shown us that in most cases, there is severe lag time for the economy to respond to an economic stimulus. Also, let me remind you that our current situation is very unique as it is a global crisis, so I would expect that lag time to be much more severe. There seems to be a definite mood change currently that is very similar to the one back in November. Even with today's Friday wanting to rally, there was a strong opposing force selling. Currently, much of the movement is a result from all the day traders, as the momentum is moving like clock work as the shorts are covered. With next week thick of economic news and earnings, including GDP, I would expect a serious move to be made.

Whether it be 8000 for the Dow or 825 for the S&P, it seems as though investors have found a base to set up camp as the market may go up and down a bit, but is staying close to those numbers. The continual battle between stimulus hopes and deflation depression is causing some violent jolts in volatility, as people are not quite sure what to believe or if things are going to get a lot worse. Even if the largest stimulus considered is passed, history has shown us that in most cases, there is severe lag time for the economy to respond to an economic stimulus. Also, let me remind you that our current situation is very unique as it is a global crisis, so I would expect that lag time to be much more severe. There seems to be a definite mood change currently that is very similar to the one back in November. Even with today's Friday wanting to rally, there was a strong opposing force selling. Currently, much of the movement is a result from all the day traders, as the momentum is moving like clock work as the shorts are covered. With next week thick of economic news and earnings, including GDP, I would expect a serious move to be made.

I personally feel we are getting closer and closer to retesting the bottom and this time when we're down there, we're going to go straight through it. All of the focus is on the banks right now, and everyone's chips go with them. Let me give a few reasons why I believe the banks have much more problems ahead and why I link SKF (Financials Short) and SRS (Real Estate Short) directly go together and why I am bullish on both.

Bank of America has an estimated $64.7 billion in commercial debt and says that it considers $3.9 billion or 6% currently non-performing. Most of this current delinquency they say is from home builders who are struggling with cash flow. This doesn't even take into account the other several billions that are just now beginning to default on their loans. You can expect that number to rise dramatically. Lately it seems as if these banks are more concerned with using the TARP funds to furnish new executive offices and payoff their chauffeur. It's ridiculous. Check out the latest free videos from INO, good stuff, click here.US Bancorp's delinquencies jumped to 3.34% during Q4, which was way up from the 1% reported the year prior. It is expected that these default rates should increase for at least the next 12 months in the commercial sector. It is also projected that over $400 billion worth of debt is to come due during this year and that there is a refinancing shortfall of anywhere between $125 to $150 billion. Where's that money going to come from? Obama perhaps? These aren't even including all of the other defaults going on behind the scenes. It is also estimated that there is over $3.5 trillion in outstanding commercial debt and that 40% of that are on bank's balance sheets, while 26% as CMBS debt. I can assure you that most of those loans are very high leveraged, anywhere from 70-80% LTV. Banks aren't lending like that anymore.

With these kind of numbers it is no wonder why I am long on SKF and SRS. I believe there is going to be more bank consolidation and maybe some government controlling until this debt problem can be sorted out. The residential credit crunch was the a taste of what is to come.

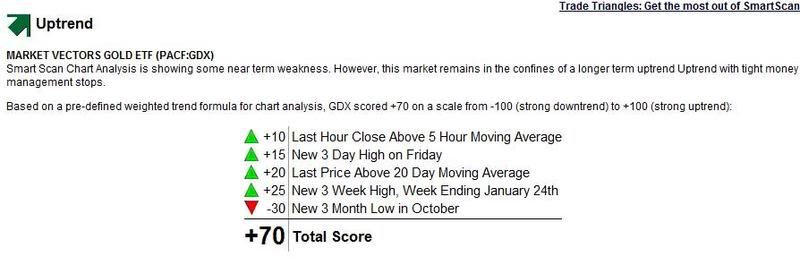

Another significant trend to note today was that Gold and the value of the dollar were not inversely related. This is very good news for my GDX and GLD options. Having GDX up almost 9%, with the dollar being up as well, shows that the inverse relationship may be breaking and they may be taking their own paths. Plus check out the fundamentals for GDX below(Click Here to analyze a symbol for free, you just need a name and an email!). I have great hope for my gold. DIG could be also taking this same route, as we saw oil jump with another OPEC cut.

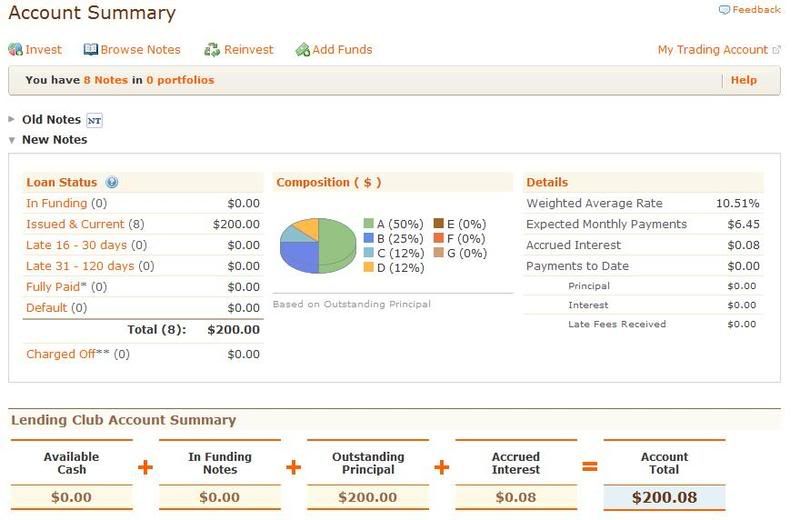

Big week next week with big news. GDP should be a momentum changer, whatever it may be. I would expect some sorry numbers to set the mood for selling next week. I did put some more money into my Lending Club investment, as my 10.5% return has held up thus far, and if I can keep that consistent, it can be a good buffer for my portfolio. My $100 promotional contest I am running for them ends next week, so get in it for free for a chance to win an easy $100, click here for more. I got out of my Citi today, as I feel Monday is going to be bloody (unless of course Obama has a weekend secret for everyone which, recently, they have loved doing). Time shall tell. Have a great weekend everyone and Happy Trading.

Big week next week with big news. GDP should be a momentum changer, whatever it may be. I would expect some sorry numbers to set the mood for selling next week. I did put some more money into my Lending Club investment, as my 10.5% return has held up thus far, and if I can keep that consistent, it can be a good buffer for my portfolio. My $100 promotional contest I am running for them ends next week, so get in it for free for a chance to win an easy $100, click here for more. I got out of my Citi today, as I feel Monday is going to be bloody (unless of course Obama has a weekend secret for everyone which, recently, they have loved doing). Time shall tell. Have a great weekend everyone and Happy Trading.

Volume & Volatility on The Rise - Two Critical Elements of a Crash

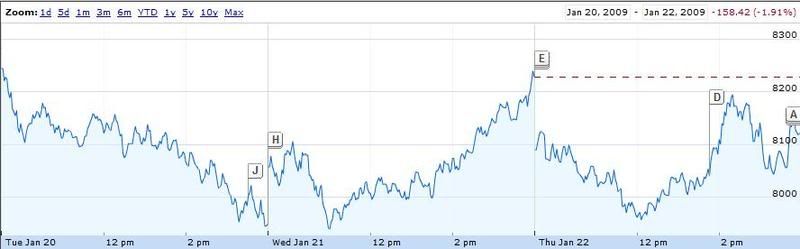

Posted On Thursday, January 22, 2009 at at 4:50 PM by Finance FanaticBy looking at today's Dow graph (below), it seems as the violent volatility is getting more and more every day. That coupled with the strong influx of volume we have received the past couple days can be a combination of disaster when tip toeing around a financial depression. With all the uncertainties out there, a big failure could send this market tanking. Lucky for the market, we happen to be in a week with almost no economic data reported, aside from our horrible home starts for December reported today, but no one pays attention to that right? Just to note it, they were expecting 605K in new housing starts for December. The actual number was only 550k. Even though many of these numbers are cast aside and not paid attention to, I definitely make note of the continual problems our market is seeing, because sooner or later it will catch up with us.

Google came in today with what they're calling good news by "beating market expectation." As a result, investors are cheering and buying up GOOG in after hours. Sure, they have beat SOME of the analyst's forecasts, but the fact is they're net still plunged 68%. So if you think that's something to cheer about go ahead and buy. A lot of times people become so caught up on the wording of events like "they beat market expectations" or "beat earnings" and they just turn around and buy without reading in between the lines. They're net income for Q4 fell from $1.2 billion to $382 million  from the same time period just last year. OUCH. Some are calling it good news, but as for myself, I'm steering clear.

from the same time period just last year. OUCH. Some are calling it good news, but as for myself, I'm steering clear.

Check out the updated Market Trend graph for SKF after today's trading (Click Here to analyze a symbol for free, you just need a name and an email!). +100, which is the highest momentum rating the tool can rank. The fundamentals are definitely pointing upward and with the continual woes hitting the banks, I have to think it's going nowhere but up this month.

It was good to see SRS get a nice bounce back today as well as FXP. Asia has been having a disaster of a time trying to explain their horrible fourth quarter reports. I will touch more on that tomorrow. Watch out for our usual Friday rallies tomorrow. As I've mentioned before, Fridays have a tendency to be bullish. Especially with the downward day today, Google's "positive earnings" and the slight pullback towards the end, we may find ourselves in the green. I didn't buy anything else to prepare for it, as I already have a small position of C and UYG. A down day would definitely yield me stronger returns, but I have some long just in case.

In any case, I would expect higher volatility levels as there remains a lot of uncertainty. With that in mind, the increasing volatility is going to make the leveraged etfs extremely volatile, as prices for options should continue to shoot up with the "fear index" increasing. This is a great time to make quick 10% profits in a short amount of time. It can be very risky, but with the use of stop losses and buying on the right bumps, you can hedge some risks and make some profits.

Warren Buffet said today that he feels the credit crisis is "softening" (ha, maybe for billionaires), but that business has slowed more. He says that the negative sentiment has really slowed down consumer spending and has made it very difficult for businesses to survive. He said he expects the recession to last a while, but wouldn't speculate when. Obviously, I think that means he's planning on it being around a couple years. I like to listen to these old dogs as they're probably the only ones who's been close to experiencing what we're in.

If tomorrow does indeed rally, I plan on bulking up a bit more on SKF and FXP. I still have a ton of shares of SRS, as I still feel there is a lot of potential for profits there. If we go down once again tomorrow, I will enjoy another day in the green for my Zecco.com trading account. That coupled with my strong Lending Club returns is making it a pretty good month for me. Here are some great free videos on stock analysis you can watch click here, definitely worth watching. Happy trading everyone, have a good evening and we'll see you tomorrow.

Banks Bounce Back Thanks To Obama Fever - Apple Crushes Earnings

Posted On Wednesday, January 21, 2009 at at 1:34 PM by Finance Fanatic It didn't take long to get speculative hopes back in the market. Today, the market got off to a bit of a slow start and even went red for a bit, but after the remarks of Geithner (the new secretary), investors felt a lot more comfortable with the future of the banks. Almost everything that was taken away yesterday was given right back. I was very happy to have sold out of most of my SKF before the aftermath, however, SRS had a much less than stellar day and I chose to hold on to those, my mistake. I did get the gains I was finally looking for out of Citi, but not much after the crash yesterday. It did help the banks that many of the CEO's bought back lots of shares to help instill confidence. I still ended up quite positive in my Zecco.com account after the two days and look to reboot my strategies as we are kind of at ground zero again. However, I think I am going to transfer some more money over from my ING Direct savings account to trade with, as the next few weeks could be prime for good money making.

It didn't take long to get speculative hopes back in the market. Today, the market got off to a bit of a slow start and even went red for a bit, but after the remarks of Geithner (the new secretary), investors felt a lot more comfortable with the future of the banks. Almost everything that was taken away yesterday was given right back. I was very happy to have sold out of most of my SKF before the aftermath, however, SRS had a much less than stellar day and I chose to hold on to those, my mistake. I did get the gains I was finally looking for out of Citi, but not much after the crash yesterday. It did help the banks that many of the CEO's bought back lots of shares to help instill confidence. I still ended up quite positive in my Zecco.com account after the two days and look to reboot my strategies as we are kind of at ground zero again. However, I think I am going to transfer some more money over from my ING Direct savings account to trade with, as the next few weeks could be prime for good money making.

It is funny, because during the interview, Geithner did not want to speculate on timelines and likely avenues the government would be taking, saying that by doing so in the past had caused premature speculations and radically effected the market. Well, even by avoiding the questions, he was still able to help radically move the market. How ironic. People are looking for the slightest bit of hope to help spur optimism.

So even though the Obama rally showed up a day late, it's here. Now, how long will it last is the magic question. Anytime momentum like that is stopped in its tracks and reversed to the degree we saw today causes some serious jolts in technicals. Although this rally should and could very well lead on into tomorrow, there are some deafening news that could reverse this day of high hopes. One day of Obama in office did not make the bank crisis's everyone feared yesterday go away. The debt outstanding is still substantially more than they can handle, and commercial vacancies haven't even hit half the number they're expected too. We're not out of the woods yet.

Google announces earnings tomorrow. This outcome could provide a big influence on where the market moves. With massive budget cuts, be assured that "online advertising" is one of the first things crossed off the list. Being that advertising revenue is a bulk of Google's earnings, they may struggle a bit. We lucked out this week with not much economic data being reported, but tomorrow we do have housing starts, which I cannot see being a strong number. That could effect some trading, but I don't expect it to be that influential. People should be clinging to headlines tomorrow to try and pull out any sort of negative or positive perception they can find. Whatever the case may be, I think the outcome will be very volatile, bouncing from red to green and higher volume. Did you see today? 408M trading volume, wow. This is the most we have seen in a while. With volume back and volatility increasing, we're heading back into market crash danger zone. Stay on your toes.

Apple knocked earnings out of the park after close today, sending after hours trading up almost 10%. This is not surprising to me, as I have liked apple all year (one of my top picks for long). All this news of Job's health and their ability to stay competitive is nonsense. Too much cash on hand and too much innovation. Apple should leap quite a bit and could definitely set the standard for up trading tomorrow. Lets see if Google can follow.

Due to the extreme uncertainty and volatility right now I am playing my bets with energy and commodities. Obama's only ammo to throw at this beast is more government spending (and even that can only slow the pain in my mind). He is going to have to spend trillions just to make a dent. Doing so is going to give gold, silver, and other commodities a pretty face of value. I'm bulling up on a lot of gold, DIG, and other commodities tomorrow to keep during this time of uncertainty. I've lowered my short position (still plenty left) until some definition is back and have a little bit of long financials as a hedge. Either way, tomorrow should pave the way of some new momentum.

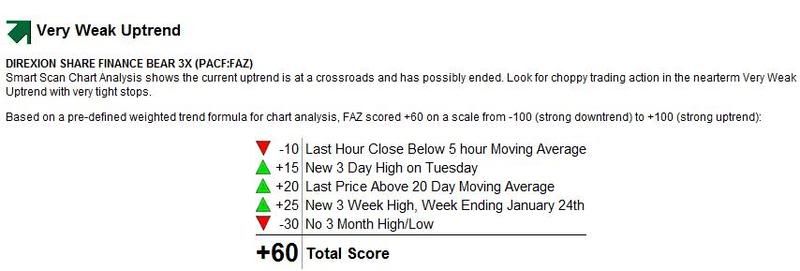

Like I said yesterday, don't expect Obama to roll over and die his first few months in office. He should be working around the clock to ways to pump this market up. I still think we're heading to new lows shortly, we just need the Obama fluff to wear off a bit. Below is the market trend score (analyze a symbol here free) and movement for FAZ, which momentum score is still relatively strong at +60.

I hope everyone has a good evening. With this volatility, we are able to make some serious cash in quick moves. It's all about timing the bumps right. Happy Trading and see you tomorrow. Check out the new videos at INO TV, great stuff and it's free.

Bailout Breaths Cause For Market Turnaround

Posted On Thursday, January 15, 2009 at at 7:05 PM by Finance FanaticI don't know whether it was Bush's departure speech or our newest fix of bailouts that pulled off a huge momentum change in the middle of day today. The Dow dipped below 8000, before immediately turning around and actually closing up at 8212. Amazing, especially after the series of events which have transpired throughout the week. These days I never underestimate the market's ability to start buying out of pure speculation. In any event, today's miracle puts a bit of a different light of what I was planning to do with my portfolio the next couple weeks. This turnaround today, could indeed be the ones that continues to go on into Obama's inauguration. Once again, it is all based on government intervention, no actual numbers, and a false hope that, in my opinion, is once again just going to temporarily slow the pain.

So what happened today? Well, one item that seemed to make people happy is that Congress did not pass the bill that would put a hold on the remaining $350 billion of the TARP funds. This tees up Obama quite well to do whatever pleases him with the remaining funds. Lets hope that the second half of the funds go a bit farther than the first did. The problem is that there is such a big deficit of debt to fill, it's like trying to fill a meteor crater with shovels of dirt. It's going to take a long time.

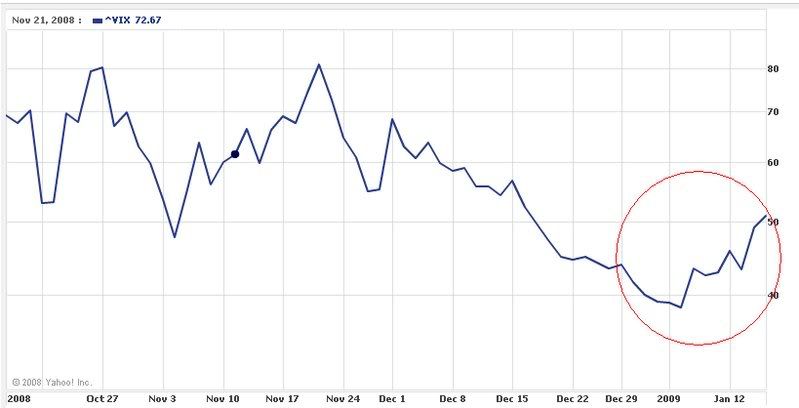

Another element worth noting is the VIX level slowly climbing up. Many people say we are not vulnerable for a crash right now, because the volume's not there and the volatility is not there. As that can be partially true, the VIX level has definitely been rising the past week and should continue to rise as uncertainty continues and more woes hit the headlines. If volatility levels do indeed reach those October levels and beyond, watch out.

Citi is expecting a loss in their earnings tomorrow, which could be bad for their already $3.83 stock price. Call me crazy, but Citi is becoming appealing to me as a buy. I know people worry of another Lehman, but I do not feel the government will let this one go. Sure they're going to have their continual share of problems, but if they have another beating of a day with their stock price tomorrow due to earnings, I plan on picking up 1000 shares. With an announcement from Obama, as well as the probability of Bank of America getting $15 billion more from the Fed, Citi is very capable of having a 50%+ day, easily. So we'll see how tomorrow plays out, but it is definitely on the radar. For you first time traders or those that are unhappy with your online accounts, you can get free monthly trades at Zecco.com, worth checking out.

Well, Fridays can be interesting. It wasn't long back that every Friday was a rally. That hasn't been the case lately, but today's powerful turnaround could bring some optimism to end the week. However, a bad enough number from Citi could definitely set a selling tone for the day. Either way, I'm happy about my current position and hope for some good gains tomorrow. Definitely watch SKF and FAZ tomorrow. Have a great night and Happy Trading.

Jobs Steps Aside – Turmoil Brews For Tomorrow

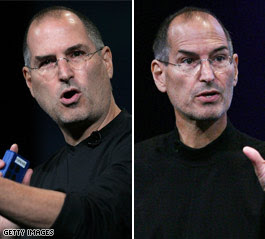

Posted On Wednesday, January 14, 2009 at at 3:50 PM by Finance Fanatic It couldn’t have come at a worse time for Apple and for the rest of the market. On Wednesday, Steve Jobs (CEO of Apple) announced that he would be taking a leave of absence from his duties at the company until the end of June to focus on getting back to health. He said major decisions would still run through him, but day to day operations would be handled by the COO. This news sent Apple stock down as bad as 10% in after hours trading. Just rumors of bad health with Jobs caused the stock to drop 5%. I would expect a very serious blow to apple’s stock price tomorrow.

It couldn’t have come at a worse time for Apple and for the rest of the market. On Wednesday, Steve Jobs (CEO of Apple) announced that he would be taking a leave of absence from his duties at the company until the end of June to focus on getting back to health. He said major decisions would still run through him, but day to day operations would be handled by the COO. This news sent Apple stock down as bad as 10% in after hours trading. Just rumors of bad health with Jobs caused the stock to drop 5%. I would expect a very serious blow to apple’s stock price tomorrow.

Given that, if Apple gets hammered too much tomorrow, I actually may pick some up. I mean come on, I know the company is Job’s baby, but lets be honest, they’re not going anywhere for a while. Plus, they have $25 billion of cash in the bank! Just their cash on hand along with their other liquid assets has got to be worth at least $40 per share. So I will keep my eye on that. It was bad news for me, as I still have a couple of apple options. Thanks Steve.

Well, I’m sure we can certainly expect this to affect the market tomorrow as there are plenty of other things going wrong around us. Good luck Obama. Steve had to wait until after the worst trading day since December 1st (-248 pts) to break the news. Even without the announcement, things were not looking good for tomorrow. There is serious downside momentum and as we near breaking the 8000 (we could reach tomorrow) mark again, people are starting to anticipate a new bottom. Possibility in the 6000’s.

Today, retail sales was also confirmed to be horrible for December, as the National Retail Federation announced a 2.8% decline in retail sales for the month of December. This being the first time there has been a decrease since they started tracking the number in 1995. We also had two more members join the bankruptcy club today. Retailers Gottschalks and Goody’s filed for BK today, which is just the beginning of which I feel by the end of the year will be a club with standing room only. With those, comes more job losses. Motorola announced a 4,000 job cut today. As I have said before, this year, the retail will be the backbone of this downfall. With the failure of the retailers, will come the failure of the real estate. Then the trillions in outstanding debt will turn into the bank’s problem once again. What does this mean. Long on SRS and SKF. In fact all of the inverse etfs were up big today. My portfolio is starting to look like it did back in October. And I still feel we’re ankle deep.

I expect to see a horrific day of trading tomorrow. Apple has become the face of the US market, especially the NASDAQ, and such a devastating day is bound to bring down the rest of trading, let alone all the other crap that is present. I don’t know how long this selling spree will go until we get an up day, but as of now, I can’t perceive anything that people can find as “good news.” Even Bank of America getting more aid from the Fed. At any rate, I’m hoping to see another big day for my inverse etfs. If they go big enough, I may consider shaving some of my SRS earnings and putting them into Apple. We’ll see.

I also wanted to give a little update on my Lending Club experience. As you can see I have received my first interest payment. Big money! But as you can see, the platform is very easy to use and makes tracking your investments quite simple. It looks like my monthly payment is just over $6. So lets hope my 10.5% return stays in tact. So far so good.

I hope everyone has a good evening. We have been talking about these problems for some time on this site and are just now finally starting to see the market begin to suffer the symptoms of our economy. There is still a ways to go. Happy Trading and we’ll see you tomorrow.

I hope everyone has a good evening. We have been talking about these problems for some time on this site and are just now finally starting to see the market begin to suffer the symptoms of our economy. There is still a ways to go. Happy Trading and we’ll see you tomorrow.

Signs of Deflation - Are We Here?

Posted On Tuesday, January 13, 2009 at at 5:15 PM by Finance FanaticToday there was a lot of mixed trading as we saw the Dow teeter-totter from red to green throughout the day. The Dow dipped as low as 8376 but ended a bit higher (still down) at 8448. I was pretty surprised to see the resistance today, especially since there was really not that bad of news today, and even a little good news. This is really telling of the bear motivation in the market right now and that the momentum is definitely downward. In fact, another day of selling tomorrow (I'd say more than 100 points), we could be on a steep path downward. Obama may not provide as big of bump as some people hoped, although I do still feel there will be some green next week.

It's looking more and more that Citi will be splitting up their different branches. Quite frankly, I don't know how Citi is going to survive this year. If it were not for the government having their back, they would have been gone a while ago. At any case, we should probably expect some serious job cuts, everywhere. I'm sure sites like RiseSmart.com (Job Finders for $100K + jobs) are probably spilling with business as more and more executives are looking for jobs.

One issue that seems to be more and more of an issue is the risk of deflation that, in my opinion, is very near if not already here. I feel we are going to start experiencing some serious deflation and then catapult straight into inflation. Anyway, here are some signs of deflation, how it effects us, and some of my plans to hedge against it.

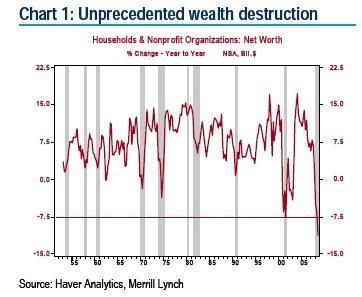

First, as you can see from the graph, the wealth destruction is far greater than any bailout plan that has been proposed. At the rate we're going, we can expect a $7.8 trillion in total wealth loss, which would be about 8 times larger than the biggest stimulus that has been proposed thus far. You can very well expect deflation to creep up with those numbers as upcoming stimulus plans won't put dents in that number.

Another factor is that government programs are showing that they are not doing much good. The first $600 per person stimulus was quickly swallowed up by paying off debt or buying a plasma. The $700 billion hasn't shown its face or made any change to the lending markets. These signs can also contribute to a deflationary market.

One of the biggest signs is the huge amount of debt liquidation that has been going on. We are especially seeing big activity in the short-term commercial paper. In Q3 of 2008 mortgage debt outstanding lessened at an annual rate of $317 billion, while corporate bonds lessened at an annual rate of $755 billion! They call this a credit crunch, but a better term for it is debt liquidation. Instead of creating debt, we have destroyed it. In turn this is what is killing the residential and commercial property prices.

Lastly, we have already been experiencing pricing deflation. Copper -66%, Oil -73%, lead and nickel -73%, and platinum -66%. Ya, so that pretty much proves that point. These deflationary prices are also what contributed to the Dow downfall. At any rate, I believe the signs are here and deflation is inevitable.

To help hedge against deflation, I plan on picking up some UUP (US dollar Index Bullish Fund). As the dollar gains on competing currencies, this fund is bound to get some bounce. Hopefully, I can profit off this as well as my short inverse funds, as we are bound to continue to see severe job loss and turmoil in the financial and real estate markets. Forexmentor.com can be a great tool for those interested in trading currencies. It can get confusing, but a lot of money can be made, especially in this market.

Well, tomorrow will be a telling day for the market. There has been a lot of bearish movements and if this continues into tomorrow, we could be heading down for a while. In the end, I still expect to see gains from FXP, SRS and SKF as we head down a bit more. It will be interesting to see if we start to retest some bottoms that we saw back in October. Have a good night everybody, Happy Trading and We'll see you tomorrow.

Market Trades Lower To End The Week - As Bad News Continues

Posted On Friday, January 9, 2009 at at 7:34 PM by Finance Fanatic It seems as if normality is slowly returning to the market as trading trends are starting to reflect economic conditions more and more. Today, they announced the employment numbers, and surprisingly it was less than expected. I am not that surprised, as I feel not many people like to terminated their employees during December. However, still realizing the detrimental impact of the number, investors seem to have realized the actual impact of the number, as the Dow traded down again to end the week. I do feel January is going to be devastating for employment numbers. In December, 524,000 we're claimed jobless as the unemployment rate has now shot to 7.2%. I expect this number to be reaching double digits very shortly. As company executives meet this month to do budget revisions and write up their new business plans, you can expect many divisions to be cut out for 2009. Q1 2009 will be extremely tough for the US.

It seems as if normality is slowly returning to the market as trading trends are starting to reflect economic conditions more and more. Today, they announced the employment numbers, and surprisingly it was less than expected. I am not that surprised, as I feel not many people like to terminated their employees during December. However, still realizing the detrimental impact of the number, investors seem to have realized the actual impact of the number, as the Dow traded down again to end the week. I do feel January is going to be devastating for employment numbers. In December, 524,000 we're claimed jobless as the unemployment rate has now shot to 7.2%. I expect this number to be reaching double digits very shortly. As company executives meet this month to do budget revisions and write up their new business plans, you can expect many divisions to be cut out for 2009. Q1 2009 will be extremely tough for the US.

Well, with the three days straight of down trading, momentum is definitely bearish. Sure, we have Obama taking over in two weeks, but the sentiment is beginning to get to the point where I think even the ignorant are starting to realize we're in one big mess. For the next six months, we are going to be in uncharted territory for economic data and there is not much the government can do to fix it. They will try, but there are too many cooks in the kitchen with to many messes to clean up at once.

This week we also started the bad earnings train. Wal-Mart, Coach, and Chevron started off the new year with disappointing earnings. Wal-Mart is one of my few choices for a decent performing stock and one I'm keeping in the IRA this year. If their struggling, I can't imagine what others are doing. Companies like Nordstrom, Macys, Best Buy, and Bed Bath and Beyond (just to name a few) should see a dramatic decrease in sales. I have liquidated any and all of my retail stocks.

I did utilize the last of my monthly free Zecco.com trades (I only get 10!) to pick up some more GDX and more SKF. I still love gold and cannot see how banks are going to get out of the mess they're in anytime soon. Especially now, as we are seeing them start to conform to mortgage restructuring like Citi has done.

The motivation has definitely shifted and I expect the panic selling to continue into next week. I am still not ruling out a temporary Obama rally that I am sure is bound to make a couple days green, but I think for the most part, people's hopes of Obama immediately turning this thing around is all but gone. Good week for me and my portfolio. My GDX has done very well for me and SRS and FXP should keep climbing as the turmoil continues (I need them too!). Make sure to check back this weekend as I am going to report on my phone call with Lending Club. He answered a lot of the questions I had and discussed other ways I can maximize my investment with the company. They even have a secondary market for re-selling or buying existing loans for discount. The post will definitely be worth reading. Check them out if you haven't. Have a great weekend and Happy Trading.

American Jobs Continue To Diminish, As Market Fights To Stay Green

Posted On Tuesday, January 6, 2009 at at 5:20 PM by Finance Fanatic Another day of nothing much but bad news hit Wall Street today, but it seems as if the hope of Obama and his plans for a new (much larger) stimulus plan seems to be keeping the market a float, even in the midst of continual turmoil. He is also warning that our deficit is nearing 1 trillion dollars. I'm sure another round of almost a trillion in bailouts will help that. That number could be doubled or tripled by 2010. As the new congress was sworn in today(mostly democrats), it seemed as though new life was breathed into financials in hopes for new USS (Uncle Sam Support), which in turn made it a big day for banks and commercial REITS and a bad day for my SRS. As frustrating as it may be for me, I have to stick by my gut, my knowledge of the real estate market, and the hope that eventually, fundamentals will move the market again, because despite what some people think and in my opinion, our current economic condition has definitely not been fully factored into this market. We’ve been given a lot of emotional morphine to dull the pain the past couple months, but there are definitely troubled times ahead.

Another day of nothing much but bad news hit Wall Street today, but it seems as if the hope of Obama and his plans for a new (much larger) stimulus plan seems to be keeping the market a float, even in the midst of continual turmoil. He is also warning that our deficit is nearing 1 trillion dollars. I'm sure another round of almost a trillion in bailouts will help that. That number could be doubled or tripled by 2010. As the new congress was sworn in today(mostly democrats), it seemed as though new life was breathed into financials in hopes for new USS (Uncle Sam Support), which in turn made it a big day for banks and commercial REITS and a bad day for my SRS. As frustrating as it may be for me, I have to stick by my gut, my knowledge of the real estate market, and the hope that eventually, fundamentals will move the market again, because despite what some people think and in my opinion, our current economic condition has definitely not been fully factored into this market. We’ve been given a lot of emotional morphine to dull the pain the past couple months, but there are definitely troubled times ahead.

This shouldn’t be news to anyone, as everyone has been announcing warnings the past couple days. The Fed, Corporate Execs, Obama, some analysts, and about every legitimate website. Bank of America’s CEO wrote a letter to executives warning them of their poor performance results of 2008 and urged them (including himself) not to take bonuses this year. Well, at least some companies aren’t totally greedy. AIG, learn by example. Alcoa also announced today that they will be cutting anywhere from 13,000 to 15,000 jobs to help guard from their recent hardships. This sent their stock crashing into after-hours and may have contributed to the down market as a whole in after-hours as well. The job cuts that should continue the first half of 2009 should be pretty horrific. It is scary to think of how high the unemployment rate will hit before beginning to recover. All I know is very little businesses are making a lot of money right now. I mean over $7 trillion of household wealth was wiped out by Q3 2008. That’s 11%. Some expect this number to have almost doubled just by Q4, bringing the total loss to about 20%. That decrease is going to have serious effects on our small and large businesses, especially luxuries. And some people feel we aren't even near the bottom.

Alcoa also announced today that they will be cutting anywhere from 13,000 to 15,000 jobs to help guard from their recent hardships. This sent their stock crashing into after-hours and may have contributed to the down market as a whole in after-hours as well. The job cuts that should continue the first half of 2009 should be pretty horrific. It is scary to think of how high the unemployment rate will hit before beginning to recover. All I know is very little businesses are making a lot of money right now. I mean over $7 trillion of household wealth was wiped out by Q3 2008. That’s 11%. Some expect this number to have almost doubled just by Q4, bringing the total loss to about 20%. That decrease is going to have serious effects on our small and large businesses, especially luxuries. And some people feel we aren't even near the bottom.

Even as the market may cheer a bit as Obama is sworn in, in hopes for some more help. If Obama does end up passing his possible $850 billion stimulus plan, it is going to be quickly squelched by the $13 trillion loss in household wealth. This is why I don’t find much hope or optimism in these talks of bailouts. They're just lost tax dollars.

In addition to decrease in wealth, there will also be a decrease in spending. We are in a recession, a dollar made is a dollar saved right now. Very few people are finding a lot of extra cash to take to the mall every month. As worth of houses have been slashed and IRA accounts cut in half, people will be extra frugal in saving the next few years. By doing so, this will lower the monetary flow of the markets and bring more turmoil and frozen lending to the market. No one is being convinced to spend money right now. Even with a stimulus checks, much of that goes to paying off debt and savings.

It is very clear that problems are not retreating anytime soon. There will definitely be buying opportunities in the market. As I have said in past posts, I like energy and commodities. The dollar has experienced a surprising recent boost the past month. I don’t expect this to continue and see a lot upside still in Gold (GDX), Silver(SLVR), Oil(DIG), and agriculture(POT). Alternative energy is also on my radar (STP). During these harsh times, I expect to see a big boost in popularity in E-commerce. I see companies like Amazon and Overstock almost doubling their customer base the next couple of years. Sure, transaction volume will go down per person, but when the market does come back, they should be front runners in my book. Also, people are going to have to shop somewhere. That’s why I stick with Wal-Mart, Payless Shoe, and Old Navy brands for retailers. Discount retailers should still be doing sales.

Well, everyday becomes more interesting and a bit more scary. I just get this weird feeling like one day the market just may crash. I know the signs aren’t here at the moment, but the market is still very sensitive and the signs don't necessarily have to be here. On another note, no loans have defaulted on me yet in my Lending Club portfolio. Only a week and a half remains until all my invested loans are to begin and I am hoping I can maintain near that 10.5% return I opted for when I began. I believe my first loan payment is due in 3 days, so I will take a new screenshot and update you on what happens from there. I hope everyone is finding their own successes out there. It should be on heck of a year. Happy Trading and we’ll see you tomorrow.

Doom in Detroit - Profits Taken After 3 Day Rally

Posted On Monday, January 5, 2009 at at 2:51 PM by Finance Fanatic Welcome back for everyone that was enjoying the past few weeks traveling or spending time with the family. While you were gone, there wasn't much you missed in the market. Just a few more record low index numbers and a bit of buying, kind of paradoxical isn't it? At any rate, it is good to finally be getting close to normal volume numbers as people are slowly staggering back to their lonely offices. Here in my office building, I am slowly seeing more parking spaces open up, less competition for the elevators, and almost no line for the lunch counter. We are truly sinking into this recession.

Welcome back for everyone that was enjoying the past few weeks traveling or spending time with the family. While you were gone, there wasn't much you missed in the market. Just a few more record low index numbers and a bit of buying, kind of paradoxical isn't it? At any rate, it is good to finally be getting close to normal volume numbers as people are slowly staggering back to their lonely offices. Here in my office building, I am slowly seeing more parking spaces open up, less competition for the elevators, and almost no line for the lunch counter. We are truly sinking into this recession.

It was a disaster of a day for autos as their December numbers all came out. It’s funny, because even with the numbers reported, they were “better than expected” numbers for some analysts, somehow making some think this was a “positive day.” I’m glad these people aren’t my fund managers, because there is nothing to cheer about the numbers that were given today. Here are most of them for your review:

Daimler (Mercedes) -23.5%

Audi -9.3%

Porsche -25.5%

BMW -36%

Ford -37.4%

GM -31%

Honda -35%

Toyota -37%

Nissan -30%

Kia -39%

Chrysler -53%

Sure, but everything is fine, right? Whatever the case, after these reports, don’t ask me how Chrysler survives to February. Even with the bridge loans, with those amount of losses in one month, I see a very slim chance of keeping them a float. I see them going under very shortly. The companies that surprised me were the Asian autos. Usually Toyota is among the top sellers, but they were down more than the American autos. Either way, I’m steering very clear from autos, no matter what analysts say about them.

I continue to stick strong with my inverse etfs. It is good for investors to know that these are big momentum movers. There has been some negative articles written up about some of these leveraged etfs and that you can’t make money over time. This is not true. I have made very good money from them and plan on making a lot more. They are strong momentum movers. Bears have not had momentum since almost mid November. As soon as that momentum is back, we should see some serious strong gains in the inverse etfs. Yes, trade them with discretion, but please know YOU CAN MAKE MONEY WITH THEM! A lot of it if you time it right. I try not to stay in them very long, and buy and sell on the bumps, but they can be very rewarding. The critics of these funds are those that bought at the wrong time. I mean if I bought SKF at $250, I would be cursing them too! SRS would have had a very big day, if it were not for the gains in home builders (due to another better than expected number, still bad), we probably would have seen a 10%+ day today, instead of only 3.8%. No worries for me, because SRS is still my favorite for beginning 2009.

The traffic at retail centers for post holiday season has been horrific. I am lucky to see more than 20-30 cars in front of department stores. Even worse, when I am in the actual stores, there are no lines at the registers. Sure, people are still looking, but who’s buying. In my opinion, we are in for one of the worst years for retail bankruptcies in US history. As these retailers close, it is going to kill the bottom line of these REITS and property owners. Then to top that off, these 5 year conduit loans that were bought from 2001-2005, that were also leveraged 80-90% at 5% interest rates are all coming due, and where are they going to get financing for all these properties that are now 20-30% vacant? Commercial real estate is in for a horrible year in 2009. SRS is $150+ in my book. It may take until February after the Obama cheers settle down, but it’s coming in my opinion.

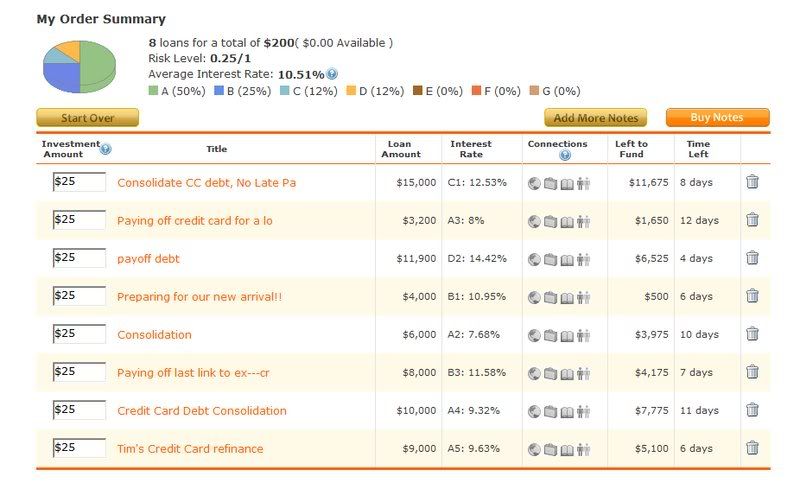

I was successful in my first Lending Club loan today. This program is one of many I will try out on this site and give you any success updates I find, as I like getting creative, with discretion, to try and spread out my risk and returns. As a trial, I allocated $200 to loan. The interface is very user friendly and I was able to do everything in under five minutes. I selected my target return I was aiming for (10.5%), and it automatically generated loan suggestions for me to use with a balance of A-D rated loans. I did a maximum of $25 in every loan, spreading out my risk and my final portfolio looked like this:

So as you can see, all the loans are due within 2 weeks, so I will know by then whether I am successful in my returns. So far, I love it. Hopefully, I can average out with at least an 8% return, the returns are the key. Slowly, I will put more money into it if I find success. You can sign up as a lender or borrower very quickly at Lending Club. I will continue to keep you all informed.

So we push on with volume back into the market. I still believe we are going to have bearish tendencies in this market until we get closer to Obama’s move in date. I think it’s a bit early to start cheering for that. Even so, I’ve got my SRS and FXP ready to go and am also looking to get into either SKF or FAZ, as commercial banks are bound to go through another round of hardships with these commercial loans. Good evening all, Happy Trading, and we’ll see you tomorrow.

Investors Hope 2009 Brings New Hope For Wall Street

Posted On Saturday, January 3, 2009 at at 10:22 AM by Finance Fanatic As volume is slowly returning back to the market, we experienced our third day in a row of green trading as the market ended up almost 3% at Friday's close. Many are cheering this three day streak, hoping it is a sign for new beginnings for Wall Street and that maybe we can see positive growth after seeing the market get demolished in 2008. However, as I say time and time again on this site, I believe this "hope" is more like a prayer, as in my opinion, it's a long shot for anything positive to come out of 2009. Let's examine the facts.

As volume is slowly returning back to the market, we experienced our third day in a row of green trading as the market ended up almost 3% at Friday's close. Many are cheering this three day streak, hoping it is a sign for new beginnings for Wall Street and that maybe we can see positive growth after seeing the market get demolished in 2008. However, as I say time and time again on this site, I believe this "hope" is more like a prayer, as in my opinion, it's a long shot for anything positive to come out of 2009. Let's examine the facts.

Everyone is talking about the biggest thing in 2009. Obama taking over the presidency. Sure, this event is bound to stir up some positive movement (which maybe is behind this recent rally, a bit early in my opinion, but maybe), but I don't care if it's Gandhi, I can't see one man turning around this economic crisis anytime soon. Sure, the damage can be lessened, but there will be pain and struggling. That's what comes with a cyclical economy.

The market cheered Friday, as Obama spoke of a strong, aggressive stimulus plan to be passed ASAP. People think that as soon as he takes office, money will be handed out to everyone. Even if it is, to an extent, that money is going to have to come from somewhere and it's certainly not coming from tax dollars, as no one is making money these days (except bankruptcy attorneys). So even if new money is printed to support the economy, that event in itself will eventually take a toll on the economy.

I wanted to share a portion of an interview that CNBC conducted on Friday with Martin Feldstein, a very well respected economist that has seen much in his days. In times like these, we really do need to listen to these old dogs, who have seen times near to the ones we are currently in. I do feel like these times are like none other we've been in, but I also think there is wisdom to be learned from mistakes of our past. This is what he said:

"I think we'll be lucky if by this time next year we see the economy having hit the bottom and starting up, and that's still going to leave us at a very low level of economic activity even if the turn has come at that point," Feldstein said during a live interview. "But there's no guarantee that all of this put together is going to achieve that."

Government will have to change the tax structure for capital gains and corporations while also exercising caution against inflation, added Feldstein, an economist at Harvard and president emeritus of the National Bureau of Economic Research.

"We are facing an economic downturn that is worse than anything I have seen in the post-war period," Feldstein said. "American households have lost more than $10 trillion of net worth in the stock market and housing prices. They are cutting back on their spending...Where's the demand going to come from?"

He also addressed the severe problem of these home mortgages and that a process needs to be taken to get these loans re-written. Either way, he feels we are a long way from even hitting bottom! These are why I like these old guys, they stick to facts. They are not easily wavered by the emotional wind that blows the markets. In the end, fundamentals will show through.

This coupled with the the lowest manufacturing data we've received since 1980 (ISM index hit 32.4 on Friday) still makes me a bear in 2009. Sure, I plan on buying some stocks here shortly, to take advantage of some short term Obama gains, but overall, I don't see us out of the trenches yet.

This is a great time to get into this market and prepare to make some money. If you aren't in, I would encourage you to consider tracking it and think about getting in soon. If you don't have an account, Zecco.com is a great place to start as they offer free monthly trades and incentives for new investors. A lot of money will be made in the next three years. As for an update on my mission with Lending Club, I have submitted an application for a lender (they have a reviewing process to make sure my credit is good enough). As I start lending, and hopefully make some good gains, I will keep you all updated. Keep up the comments, I enjoy hearing other voices in this market. Have a good weekend and we'll see you Monday.

2008 Concludes - What To Expect From Stocks In 2009?

Posted On Wednesday, December 31, 2008 at at 4:21 PM by Finance Fanatic Finally we can bid farewell to this crazy market year we call 2008. It seems as if investors felt a little optimistic seeing the year end not completely in shambles as we saw the Dow end up another percent today. To be honest, I'm glad the year is over. It's almost as if people have been waiting until 2009 to see everything change. I am sure we, as a country, will have another pretty strong reality check as we continue to see things not get better around here anytime soon. But for now, I cheer with the investors to hopefully be able to find greener pastures in 2009, as I do prefer to make money on the way up, than on the way down.

Finally we can bid farewell to this crazy market year we call 2008. It seems as if investors felt a little optimistic seeing the year end not completely in shambles as we saw the Dow end up another percent today. To be honest, I'm glad the year is over. It's almost as if people have been waiting until 2009 to see everything change. I am sure we, as a country, will have another pretty strong reality check as we continue to see things not get better around here anytime soon. But for now, I cheer with the investors to hopefully be able to find greener pastures in 2009, as I do prefer to make money on the way up, than on the way down.

Consumer Confidence Gets Killed, Yet Market Still Buys

Posted On Tuesday, December 30, 2008 at at 3:45 PM by Finance Fanatic I thought this picture would be appropriate, as this is what I think investors are doing who feel like it is time to buy. Wow, today smelled a lot like manipulation again. Maybe the Fed felt like they had seen enough red lately. Whatever the case, the market had no business being up over 2% today. By the way, since we have been discussing Lending Club lately, the P2P lending site that can generate 10%+ returns, I saw that they were featured on CBS news, see here. I plan on lending just a little at first to see how it works. I will keep you all updated. As CNBC headlines said today, stocks are probably not the place to look to make money for 2009, unless your short (in my opinion), so I encourage any other options that can bring me good returns.

I thought this picture would be appropriate, as this is what I think investors are doing who feel like it is time to buy. Wow, today smelled a lot like manipulation again. Maybe the Fed felt like they had seen enough red lately. Whatever the case, the market had no business being up over 2% today. By the way, since we have been discussing Lending Club lately, the P2P lending site that can generate 10%+ returns, I saw that they were featured on CBS news, see here. I plan on lending just a little at first to see how it works. I will keep you all updated. As CNBC headlines said today, stocks are probably not the place to look to make money for 2009, unless your short (in my opinion), so I encourage any other options that can bring me good returns.

Well, Uncle Sam extended their arm again today to the dying American autos, which seems to be the cause of the buying spark today. I don't know how people take this as good news. Late last night, the Bush administration allocated 6 billion dollars to GMAC, GM's equity in auto to help in assisting to better their bottom lines. Now, GM claims to be able to give loans to lower credit customers and issue car loans anywhere from 75-80% LTV, compared to their recent 40%. Ha, we will see about that and just how long that lasts.

Tech had strong gains, as they seemed to have been killed the past week. I still think tech is one of the most vulnerable to this worsening market, as most technologies are a luxury. People will probably not by that extra computer, or the suped up processor chip this year. It's back to basics for me and my IRA for 2009. McDonald's, Wal Mart, and Johnson & Johnson are some of the only companies I dare hold long for the beginning half of 2009.

Of course, people choose to ignore other news, that in my opinion, affect our economy far greater than people's ability to getter better loans on a new Suburban. Consumer confidence fell to a record low in December, having the index fall to 38 from 44.7 from November's numbers. This is largely due to the huge job loss we have seen the past month. As layoffs are sure to continue, I expect the confidence to get even worse. Yes, even with Mr. Obama at the helm. Employers chopped 533,000 jobs in November alone, the most in 34 years. Yet, there are some out there that feel it is time to buy. Go on ahead. I can't even begin to think why that is the case. We have some serious tough times ahead of us.

Not only did that hurt, but the prices of US single-family homes in October fell 18% from last year! So this surely squelches some people's hopes that maybe the housing market was reaching close to bottom. I think not. I have said it before and I will say it again, the housing market led us into this catastrophe and I believe it will lead us out. I don't see any light at the end of the tunnel as long as housing prices remain at record lows.

So we move on. I think today was just a short term fluke, as people cheered Uncle Sam's intervention and hope for more. These days can be crippling to the market in the long term, as I feel some people are duped into buying, even though there are serious negative data released that needs to eventually be factored in. Oh well, you never know. Investors may entirely ignore these continual, harsh economic conditions, but I very much doubt it.

I expect to start seeing some serious drops in the Dow the next couple of weeks, before we start to work through Obama's honeymoon. As we grow nearer, I will probably look to pick up some longs to ride that short bubble and pick up some quick gains, but we'll dive more into that as we get closer. Have a good night everyone, Happy Trading and have a good evening.

Low Market Volume Continues As Retailer's Future Looks Grim

Posted On Monday, December 29, 2008 at at 5:33 PM by Finance Fanatic

Well, to most people it looked like just another uneventful, holiday trading day. However, there were some strong moves in some sectors, especially for those that own SRS. A lot of bad retail news circulated the media today, as analysts begin to evaluate holiday retail sales and predict their future performance for 2009. And most everyone agrees, it does not look good. Even though we have been discussing this principle here for months, it seems as if it is now beginning to hit the market again as almost every big commercial REIT got slammed today, having SRS end up over 10% today. This should be just the beginning.

As for me, I plan on steering clear of almost every type of retailer you can think other than discount retailers like Wal Mart or Old Navy. The projected numbers don't look good, and we seem to have a trend of performing worse than expectations lately. At the end of October, ICSC (International Council of Shopping Centers) forecasted 6,100 stores closing in 2008 and 3,200 stores closing in the first half of 2009. This was before big retailers such as Circuit City, Office Max and a few others announced their mass closings. I'm sure this forecast has been revised since then. Mind you, these are national retailers and do not factor the mom and pop retailers that will also be going dark. In fact, I attended the ICSC national conference this past year in Las Vegas and it was pretty dead. All of the retailers said they were done expanding for 2008 and probably most for 2009. Many of the booths were empty and, frankly, aside from losing money at the tables, there wasn't much to talk about.

Some have asked me why I focus so much on retailer's performance. Aside from actually tracking their stock performance, retailers are the life and blood to shopping center owners. As they go down, so does the real estate. With the ammount of leverage that has been placed on these conduit loans, just losing 10% of your tenants can put you in the red. So the fate of retailers are very much tied to the fate of SRS and even financial etfs such as SKF and FAZ. As these properties will most likely be given back to the bank, a new round of bailouts will be need to cover the billions of dollars of outstanding loans that are coming due. Our greedy leverage is going to kill the US for the next few years.

So I continue to be bullish on SRS. Also, another good stock to watch that I received a tip from a reader is XRT. It is a retail etf fund which seems to be moving a bit more stable with the market, for those who have become skittish with the Proshares etfs (I have not). Using a put on XRT could be coming up very soon for me.

I still can't find many reasons to buy long here in the short term other than some commodities. GDX, SLVR, DIG(or other oil etfs), and POT are ones on my radar if I have to eventually go long. Financials scare me to death as I feel they have a whole new disease to deal with when commercial loans hit their books. Why do you think they're still not lending?

Anyway, like we expected volume should continue to stay low until after the new year. People may begin to slowly drag themselves back into the office this week, but I am not expecting much. I am excited to get volume back in this market and see where it takes us. Bear tendencies have definitely returned to the market and should continue for a bit longer. Aside from Obama's inauguration, I don't see a lot left to spark buying for a while.

I hope everyone had a good weekend. Thanks for the comments about Lending Club. I also got some emails verifying that returns in the teens had been reached with their initial investment returned. That's the key, getting back what you put in. Nine out of ten people seemed to have something positive to say, so thats pretty good, in my mind. So I think I am planning on allocating some funds there, nothing big at first, to see if I can get myself some 10%+ returns. Everything counts. Have a good night, Happy Trading and we'll see you tomorrow.

No Santa For Retail, But Hope For E-Commerce

Posted On Friday, December 26, 2008 at at 1:46 PM by Finance Fanatic

Early reports from MasterCard are showing retail sales down for November and December anywhere from 5.5% to 8%. They contribute a large portion of this to the 40% decline in gasoline prices, saying that in reality, the number is closer to 2%-4%. Do keep in mind that this is still with the fact of huge discounted prices we saw this year, which will cause profit margins to be slashed. So, when calculating actual net income, the number has to be pretty scary.

Whatever it may be, people just weren't shopping that much. Not only were they not shopping as much, but when they were, they were not going to malls. Amazon is claiming to have its best holiday season yet. As people are becoming more discount aware, they are flocking to the online discounts. I am looking for companies like amazon to make a big push the next couple of years. The biggest barrier to E-commerce was the lack of comfort many people (mostly older) had from buying from online vendors. Well, people are now biting the bullet, putting their prejudices aside, and going where the discount is. I had to people in my immediate family who had never even thought of shopping online before, get most of their gifts this year from online retailers. I'll be keeping my eye on more e-commerce companies like Amazon and Overstock for potential buys for my portfolio. We could see a strong push for these companies in 2009 and 2010.

Overall, the day as a whole was pretty boring and lethargic. I assume most people won't be back at their computers trading until at least Monday, if not after New Year's. The Dow finished up another moderate .56% with the trading volume at about 86.6M, extremely low. At any rate, I don't see any big moves being made until the volume comes back.

It is not good to see these early signs of suffering from the retailers as it should only get worse in 2009. I expect this to directly affect SRS, as vacancy, in my opinion, for commercial retail will surely bounce anywhere from 15-30% depending on the market, which should lead to a lot of defaults on these conduit loans that come due this next year and in 2010. This is why I chose SRS as my number 1 pick for 2009, despite the few negative articles which have been written on the inverse etfs. I feel very comfortable with it.

Well, we all have a lot of things to discuss in the near future as we begin to tackle this beast called 2009. I appreciate the input from all of you. There are a lot of smart investors out there that can bring some great concepts to this forum. Please feel free to contribute and share your own successes. Also, several of the readers of this site have joined up with Lending Club, the p2p lending site we discussed last week. I would also like to hear from those that have and any successes or frustrations you have had from them. As I have heard from few, it has been a great source for some serious returns(anywhere from 6-15%), which may seem impossible in this market, which is also why I would like to hear from you that have been involved. Please comment below and let us know of your experience, and if you're interested in joining, see Lending Club for more information.

I hope everyone had a great holiday. There should be some serious discounts at the malls this week, as retailers will be desperate to liquidate some of this year end inventory to pay for their new inventory purchases. So get out and get some goods. Happy Trading.

JPMorgan Warns of Tough Times Ahead - Wall Street Reacts

Posted On Thursday, December 11, 2008 at at 2:20 PM by Finance FanaticWell, it seems as if winter may be ending early as there was some movement from the hibernating bears today. Finally, we saw some strong movements from most of the inverse etfs today. As I said yesterday, the “Holiday High” may not sustain into the new year. Negative outlook persisted as Jamie Dimon, the CEO of JPMorgan, went on record to say that they had a “horrible” November and are having a “horrible” December. I can’t imagine the kind of numbers they are performing if the CEO has to prepare the market the way they did today. Like I have been saying all along, financials are definitely not out of the woods yet. The $700 billion was chump change just to help cover their bad debt. It has not stimulated any new lending, and in my opinion, much more “tarp money” will be needed if they expect the banks to start lending anytime soon. Wait until the consumer starts pulling out their money next year, because of the massive job loss. The banks are getting desperate. You can actually find pretty decent rates if you’re willing to work with the banks. This is a pretty cool site where you can have different FDIC insured banks bid for your business. It usually results in better rates. Visit MoneyAisle.com for more info.

KB Toys and EZ Lube were new members of the Bankrupt club this week, which is slowly becoming standing room only. Office Depot said they plan to close 112 under performing stores in North America, as well as six distribution centers. They are also going to cut spending by $200 million. These are the beginning signs of business failure. If only businesses new that you should cut spending in the high times and begin to contract their operations and use the recession times as building, they would be far better off. Many American businesses will now suffer from their past five years of greed. This should add another log to the Unemployment fire as we are looking to have one heck of a Q1 2009.

The auto bailout is still pending as it is finding some adversity in the Senate. Sure, they may have to go back in tweak some things, but I still don’t see how they won’t pass this bridge loan. Media likes to keep people on edge, but I believe it is a lot farther coming along than media plays it out to be. The auto bailout is the one lurking variable I still feel has the power to keep the bull running for a bit longer. I just wish it would be done and over with, so that we all could move on with more normal market movement.

One thing to look out for is next week when The Fed meets to discuss the rate cut. Sure, we most likely will see yet another cut to our already very low discount rate. However, don’t be surprised to see The Fed disappoint the market. The market expects a 50 basis point cut. In doing so, The Fed would be flirting awfully close with inflation and also needs room for emergency rate cuts, as I believe they know we have harsher times ahead. If we indeed see a lower than expected rate cut, that could cause for some negative trading and set a bad mood for next week. At any case, I believe the bears are ramping up soon to take control back of this market.

SRS showed today why I deem it the “Rock Star” out of all of the ETFs. We saw it just about touch $100 today (close to 30%), which I would say is pretty strong. In my opinion, SRS is just getting started. Wait until the commercial loans come do. 200+ stock in my book. SKF and FAZ also had high gains due to the negative outlook given by Mr. Dimon. FXP gained pretty well as Asian markets are continuing to show doubt to investors of their ability to grow in these tough times. Hey, maybe people are beginning to do their research.

I would like to say the selling will continue into tomorrow, but there are a couple of elements that could stir that up. First, we still have the auto bailout lingering out there. If a deal is cracked tomorrow, expect a pretty strong cheer rally. For you gamblers, picking up some GM or F stock may not be a bad idea. Just get out fast again. The second element is that it is Friday. Recently we have seen big runs on Fridays, despite whatever bad news the economy can throw at the market. For some reason, investors have found Friday a good day to buy, although I do believe the bulls are not as ramped as prior weeks. I still like YHOO as a pick up, as I believe it is only a matter of time until a deal is struck. At any case, I am glad to be short right now, and expect pretty strong gains from them the next few weeks. Happy Trading and see you tomorrow.

Five Reasons I am Thankful To Be Short In This Market

Posted On Wednesday, November 26, 2008 at at 1:59 PM by Finance FanaticKermit The Frog said it best when he said, "it's not easy being green." Christmas came early today for the bulls, as we saw government intervention all across the world. It must be everyone's holiday cheer. Even with some of the worst economic data we have received all year, we were still able to close at 8726. We expected this rally, however, I personally felt that it would come more aggressively in a smaller time frame, than spread out into more days. This was the exact reason why I held on to most of my long options, and good thing. The November and December months have a history of ignoring outside data and bulling forward. The big question is, will it last? My thoughts, even after today, are NOT A CHANCE! If the policy continues, over time, the rest of the world "will own more of our farm" and future generations will resent that they spend part of their workweek paying off those costs of consumption, he said. We have been mortgaging off our "farm" for years now and our national debt proves it. There is no way the government can conjure up all the money needed to free Americans from our debt dilemma. Pretty soon, us as Americans are going to be feeling this first hand. 3) Housing Market Leads The Way

By now, many of you may think I am just a pessimist, and I'm not, I swear. I have made just as much money on the long side than I have short. There are just too many reasons that exist to make me feel comfortable with going long again. Sure, we had some great rallies this week, and you know what, I think it will continue for a bit. But there is too much hype derived by speculative announcements and mythical figures to be anything solid.

China made a HUGE rate cut, which of course is going to send them flying a day or two. Europe also joined in the cheer by adding more money to the bailout pile. These two announcements of course killed FXP and EEV for today. Which with those two, I just have to sit back and wait. It could be December; it could be January. But I'm still backing them 100%. Cheers to the people that are just starting to buy these at their low rates!

Many agree this rally may continue for another 1000 points or so, so those of you skeptical about shorting, you may want to wait another week. However, if you miss the boat, don't blame it on me. However, most also agree that we have not hit bottom and that the rally will end with an even worse sell off. So I will just utilize this time to make even more money on my long options until we see it come down again. In the midst of all this green, I'd like to give my five reasons I am thankful I'm short on this Thanksgiving week.

1) This Is A Global Recession

These days we're in aren't like the recessions of the 70's-90's, where we are feeling an isolated recession, and we can look to other flourishing countries to help bail us out. It's everyone for themselves right now. With our economy now being a global economy, this does not give us many to people to go to for temporary relief. All nations are feeling pain right now. Although, most people may seem optimistic of China, China is struggling. Several Chinese toy companies, which is a prominent trade for China, have either shut down or have laid off several employees. Yesterday, there was a huge riot of employees claiming they had been wronged. Get use to seeing that.

2) The Warren Buffett Farm Analogy

A couple months ago, the all wise Warren Buffett gave a great analogy to what is going on with our nation's economic position. He said, "We're like a very rich family; we own a farm the size of Texas but want to consume more" than the farm generates, he said. "Every day, we sell off or mortgage a piece of the farm."

Today's housing announcement should have shown everyone just how bad of a position we are still in and should be in for quite some time. The point is, even if it turned into a buyers market tomorrow, it would take us 6 years just to buy all the inventory that is currently on the market, without bringing in new inventory. Housing prices have a direct correlation with consumer sentiment. No one likes to know the value of their house (usually people's main source of equity) has been cut in half. Everyone now feels they are invincible to foreclosure and bills, thanks to Uncle Sam. This is not the case. A majority of people will not be bailed out of their mortgages and credit card bills. Once this sets in and creditors come knocking, this sediment will charge downward. The housing market led us into this crisis and I believe it will lead us out.

There is a lot of money still sitting on the sidelines. In fact, most hedge funds still are sitting on the sidelines. Despite the rally today, the volume was very low. This is not the sign of a turnaround. A lot of the market is being dictated by uneducated yahoos, feeding off emotion. It is no wonder there is no correlation in the market right now. So why are hedge funds sitting on the sidelines or staying very conservative? I think because they know we've still got a ways to go.

5) No Banks and No Money

Last, but probably most important, No money! Nobody can get money right now. Most American business buy their inventory on margin (or on loan). With the big drop in sales, many retailers cannot make their margins to buy new inventory. This is what exactly happened to Mervyn's. This is also the problem with small business owners, real estate owners, joint venture funds, commercial REITS, Insurance and pension funds and others. When the financial markets went away, these all went away. If you talk to any banks, especially in their underwriting department, you will find that they don't plan on giving out many loans for a while now. This lack of liquidity will continue to hammer down on our economy.

These are the main reason I cannot jump on the green band wagon. Even though I am hurting in my shorts, I will just wait. I am making great money in my long positions and will look to liquidate those, probably next week. I was able to begin my SRS purchasing today. I will continue to buy SRS if it continues to go down. Q1 2009 should be a horrible quarter for retail sales and real estate owners. If you want to be long, for comfort, I like VMW, VZ, DIG, and GDX (these are most that I am in). We will continue to get more "Obama promises", but as conditions continue to get worse in the US, and these problems begin to hit people's homes, we as a county will become a lot more skeptical. I hope everyone has a good Thanksgiving and has something to be thankful for. Have a good rest of the week and Happy Trading.