More Market Confusion - More Confusion For Me

Posted On Monday, March 9, 2009 at at 9:42 PM by Finance Fanatic Fog continues to dawn on the market as we yet again experienced another up and down day of trading, showing that investors have not quite made up their mind of what they want to do. It also shows that day traders are still very strongly running the show as it seems institutions are still sitting on the sidelines. I was surprised to see a lower volume today, compared to the last few recent trading days.

Fog continues to dawn on the market as we yet again experienced another up and down day of trading, showing that investors have not quite made up their mind of what they want to do. It also shows that day traders are still very strongly running the show as it seems institutions are still sitting on the sidelines. I was surprised to see a lower volume today, compared to the last few recent trading days.

The market spent most of the morning trading in the green as there were numerous talks of several very large mergers, including the Genentech buyout. Also, banks received a lot of love with some help from Mr. Buffett expressing some kind words about Wells Fargo in his interview this morning with CNBC. He also said that banks were in pretty good shape and that they should be able to "earn" their way out of this, but that banks need to get back to banking. Buffett went on to say that indeed our economy has "fallen off a cliff", but that there is a lot of hope for us in the future. I love how the market reacts more from encouraging words from a corporate executive than our own President and Secretary of Treasury. Shows how much confidence we have in them. The market did rather well during the Buffett interview, only to fall when Obama showed his face to talk about the approval of stem cell research. Thanks Obama.

It was nice to see a good bounce from oil and financials, considering that 80% of my long positions are of the two. We also saw more love for the US dollar, which weathered well for my UUP shares. Gold took another hit, edging its way down near that $900 level, which makes me very tempted to pick up some shares. Another strong down day for gold, and I am most likely getting in.Other than that, I can't find much to extract from today's trading. This market is wanting to rally, you can see it. It just lacks a spark to do so and until then, unfortunately we may see these flat trading days where short traders dominate the close. If indeed a spark does come (don't ask me what that will be, I think Buffett tried today), the rally could take off pretty aggressively. However, we are running out of time. Sooner or later, more bad news is going to hit the market. That is what happens when you are in a recession/depression. So each day that goes by without bulls pushing this market up, is one more day closer to a big sell off day. I would have think if bulls don't make their move this week, this market may be toast. This would not be good for me as I am not prepared full for the market to crash. Well, at least I wouldn't be losing my shirt either.

So again, I wait patiently for the market to make a direct move. Although some may argue that having us close another day in the red is showing more signs of the crash, there were enough positive movement to unable me to come to a clear conclusion. The rally for financials was big, considering that it has been financials that has been the downward driving force for the market in recent weeks. If financials can continue to gain ground and investor confidence, this could be what sparks the rally.

NASDAQ has been recently showing weakness in trading after its rather strong trading month in February. I think the NASDAQ could be the next to get hit hard. For many people's portfolio, some of the only stocks that still have value are their tech stocks. If they need to liquidate their stocks for cash, they will most likely to sell their GOOG rather than their BAC, considering GOOG is still in the high 200's. QID is one that I am most definitely considering to get in as well, when I find it a good time to load up heavily on shorts again. It had a nice 4.21% bounce today. So we'll see how that goes. QID's Market Club report score is a +70. Looking very strong and I only see it getting stronger (get your own symbol analyzed for free, all you need is a name and email, Click Here).

Tomorrow should be interesting to see what the market does. For those that emailed me about Carbon Sciences and Origin Oil, you should have received a response from me giving you more information. If you did not, please email me again and I will get you the information. Also, my Lending Club continues to yield very strong returns. It can also be a great source for those of you needing to consolidate your debt and not get caught with the very large credit card interest rates. You can get a loan as low as 7.5% to pay off that 15% and higher debt. Below is a recent news video that CBS featured on the company Lending Club

and their successes.

Have a great night everyone, Happy Trading and we'll see you tomorrow.

PS, I apologize for the late post tonight. I spent the evening with my wife for her birthday and not even the market crashing keeps me away from that. See you tomorrow.

Jobs Steps Aside – Turmoil Brews For Tomorrow

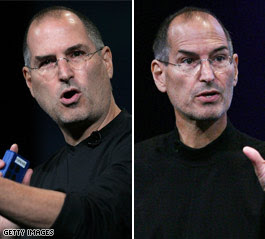

Posted On Wednesday, January 14, 2009 at at 3:50 PM by Finance Fanatic It couldn’t have come at a worse time for Apple and for the rest of the market. On Wednesday, Steve Jobs (CEO of Apple) announced that he would be taking a leave of absence from his duties at the company until the end of June to focus on getting back to health. He said major decisions would still run through him, but day to day operations would be handled by the COO. This news sent Apple stock down as bad as 10% in after hours trading. Just rumors of bad health with Jobs caused the stock to drop 5%. I would expect a very serious blow to apple’s stock price tomorrow.

It couldn’t have come at a worse time for Apple and for the rest of the market. On Wednesday, Steve Jobs (CEO of Apple) announced that he would be taking a leave of absence from his duties at the company until the end of June to focus on getting back to health. He said major decisions would still run through him, but day to day operations would be handled by the COO. This news sent Apple stock down as bad as 10% in after hours trading. Just rumors of bad health with Jobs caused the stock to drop 5%. I would expect a very serious blow to apple’s stock price tomorrow.

Given that, if Apple gets hammered too much tomorrow, I actually may pick some up. I mean come on, I know the company is Job’s baby, but lets be honest, they’re not going anywhere for a while. Plus, they have $25 billion of cash in the bank! Just their cash on hand along with their other liquid assets has got to be worth at least $40 per share. So I will keep my eye on that. It was bad news for me, as I still have a couple of apple options. Thanks Steve.

Well, I’m sure we can certainly expect this to affect the market tomorrow as there are plenty of other things going wrong around us. Good luck Obama. Steve had to wait until after the worst trading day since December 1st (-248 pts) to break the news. Even without the announcement, things were not looking good for tomorrow. There is serious downside momentum and as we near breaking the 8000 (we could reach tomorrow) mark again, people are starting to anticipate a new bottom. Possibility in the 6000’s.

Today, retail sales was also confirmed to be horrible for December, as the National Retail Federation announced a 2.8% decline in retail sales for the month of December. This being the first time there has been a decrease since they started tracking the number in 1995. We also had two more members join the bankruptcy club today. Retailers Gottschalks and Goody’s filed for BK today, which is just the beginning of which I feel by the end of the year will be a club with standing room only. With those, comes more job losses. Motorola announced a 4,000 job cut today. As I have said before, this year, the retail will be the backbone of this downfall. With the failure of the retailers, will come the failure of the real estate. Then the trillions in outstanding debt will turn into the bank’s problem once again. What does this mean. Long on SRS and SKF. In fact all of the inverse etfs were up big today. My portfolio is starting to look like it did back in October. And I still feel we’re ankle deep.

I expect to see a horrific day of trading tomorrow. Apple has become the face of the US market, especially the NASDAQ, and such a devastating day is bound to bring down the rest of trading, let alone all the other crap that is present. I don’t know how long this selling spree will go until we get an up day, but as of now, I can’t perceive anything that people can find as “good news.” Even Bank of America getting more aid from the Fed. At any rate, I’m hoping to see another big day for my inverse etfs. If they go big enough, I may consider shaving some of my SRS earnings and putting them into Apple. We’ll see.

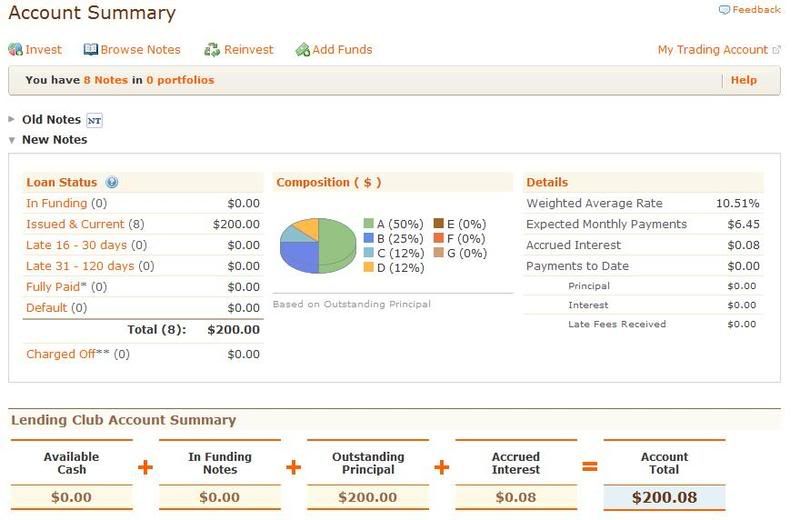

I also wanted to give a little update on my Lending Club experience. As you can see I have received my first interest payment. Big money! But as you can see, the platform is very easy to use and makes tracking your investments quite simple. It looks like my monthly payment is just over $6. So lets hope my 10.5% return stays in tact. So far so good.

I hope everyone has a good evening. We have been talking about these problems for some time on this site and are just now finally starting to see the market begin to suffer the symptoms of our economy. There is still a ways to go. Happy Trading and we’ll see you tomorrow.

I hope everyone has a good evening. We have been talking about these problems for some time on this site and are just now finally starting to see the market begin to suffer the symptoms of our economy. There is still a ways to go. Happy Trading and we’ll see you tomorrow.

My Lending Club Interview - Answers to Many of Your Questions

Posted On Saturday, January 10, 2009 at at 8:59 PM by Finance FanaticSo what is Lending Club

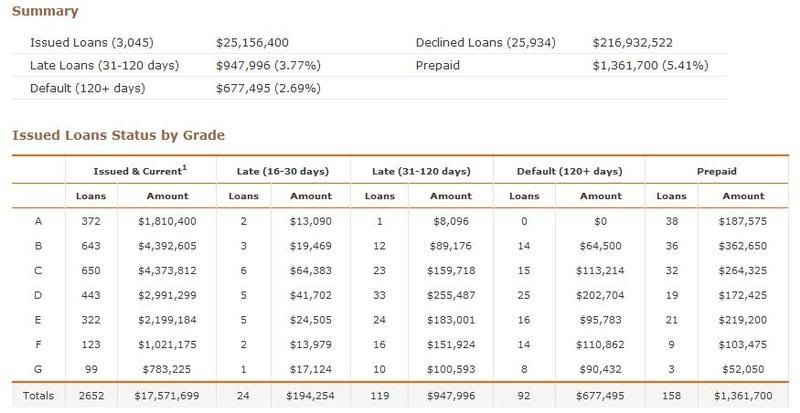

The biggest question I got from all of you which I passed on to Rob was what is the default rate? The first thing Rob said is that Lending Club prides themselves in the transparency of their information. As I went through the different links they have, I found this to be very true. For instance, the graph below shows the total amount of loans Lending Club has issued since its beginning. As you see, out of the $25,156,400 worth of loans they have issued since June of 2007, only $677,495 (or 2.69%) have defaulted. They define default as failure to make a payment over 120 days. This was a lot lower than I originally thought and actually made me feel a bit more comfortable with my invested funds, since I did not choose that risky of loans.

Lending Club does go after defaulted loans and are sometimes able to recover the funds. They continually update their collection process with every phone call they make all the way to the final bankruptcy judgement decision. They do a great job of keeping you updated.

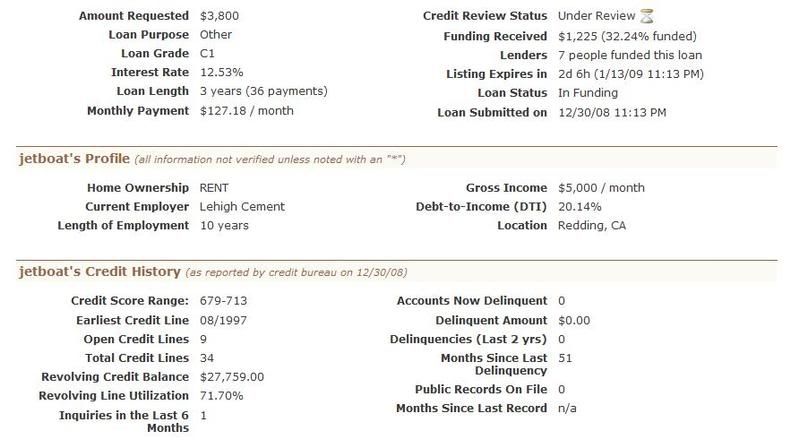

Now, when choosing a loan to invest in, Lending Club does a pretty good job of getting a lot of information from their background checks on individuals and disclosing this to the investor. Below is an example of someone who is looking for a $3800 loan.

As you can see, they have their current employment, length of employment, credit score, credit balance, etc. All of the loans issued on Lending Club are 36 month (3 year loans). So one downside, is that your money is invested for a longer term. However, as I will talk about in another post, you can sell out of your position in a loan through their secondary market to liquidate your investment.

As you can see, they have their current employment, length of employment, credit score, credit balance, etc. All of the loans issued on Lending Club are 36 month (3 year loans). So one downside, is that your money is invested for a longer term. However, as I will talk about in another post, you can sell out of your position in a loan through their secondary market to liquidate your investment.I asked Rob of loans that seem to perform better than others and he said, debt consolidation, car loans, and paying off credit cards were some that stood out as top performing loans. I did ask him ones that have not performed well and although he said nothing was black and white, he did say that a lot of wedding debt (found that funny) and student loans had some problems in the past.

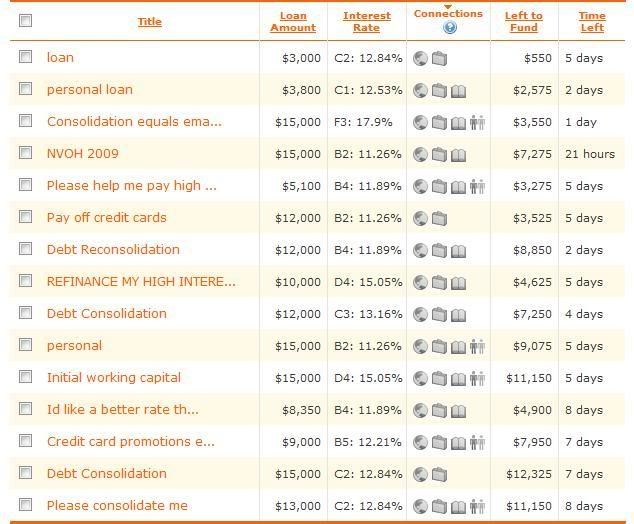

Below is a picture of what it looks like when initially browsing the loans to choose to invest in. You can either choose a target investment yield and they will automatically choose a portfolio of loans for you to approve, or you can go through individually and manually choose them. As you can see, it gives the loan description, loan balance, Lending Club's value rating of the loan along with the interest rate (the larger the interest rate, the lower the value rating). It also shows how much is left to fund and the time left until the loan is issued.

To sum things up for this first post, I asked Rob to give a couple points that separates them from competitors. First off, is that they are actually registered with SEC. Although, they haven't registered with all states, they have registered Lending Club

To sum things up for this first post, I asked Rob to give a couple points that separates them from competitors. First off, is that they are actually registered with SEC. Although, they haven't registered with all states, they have registered Lending ClubThe other big one was their platform. They are very transparent with their information and try to give the investor as much information about the loan they are investing in. The ease of use is very significant, as I was able to sign up, find loans to invest in and be finished all within 10 minutes.

I didn't want all the information crammed in a post, so I will stop here and talk more on another day about some positives about this program I have found. I see these P2P programs becoming more popular as banks continue to struggle to lend. My biggest concern is regulation, but so far I am very impressed with Lending Club

Market Trades Lower To End The Week - As Bad News Continues

Posted On Friday, January 9, 2009 at at 7:34 PM by Finance Fanatic It seems as if normality is slowly returning to the market as trading trends are starting to reflect economic conditions more and more. Today, they announced the employment numbers, and surprisingly it was less than expected. I am not that surprised, as I feel not many people like to terminated their employees during December. However, still realizing the detrimental impact of the number, investors seem to have realized the actual impact of the number, as the Dow traded down again to end the week. I do feel January is going to be devastating for employment numbers. In December, 524,000 we're claimed jobless as the unemployment rate has now shot to 7.2%. I expect this number to be reaching double digits very shortly. As company executives meet this month to do budget revisions and write up their new business plans, you can expect many divisions to be cut out for 2009. Q1 2009 will be extremely tough for the US.

It seems as if normality is slowly returning to the market as trading trends are starting to reflect economic conditions more and more. Today, they announced the employment numbers, and surprisingly it was less than expected. I am not that surprised, as I feel not many people like to terminated their employees during December. However, still realizing the detrimental impact of the number, investors seem to have realized the actual impact of the number, as the Dow traded down again to end the week. I do feel January is going to be devastating for employment numbers. In December, 524,000 we're claimed jobless as the unemployment rate has now shot to 7.2%. I expect this number to be reaching double digits very shortly. As company executives meet this month to do budget revisions and write up their new business plans, you can expect many divisions to be cut out for 2009. Q1 2009 will be extremely tough for the US.

Well, with the three days straight of down trading, momentum is definitely bearish. Sure, we have Obama taking over in two weeks, but the sentiment is beginning to get to the point where I think even the ignorant are starting to realize we're in one big mess. For the next six months, we are going to be in uncharted territory for economic data and there is not much the government can do to fix it. They will try, but there are too many cooks in the kitchen with to many messes to clean up at once.

This week we also started the bad earnings train. Wal-Mart, Coach, and Chevron started off the new year with disappointing earnings. Wal-Mart is one of my few choices for a decent performing stock and one I'm keeping in the IRA this year. If their struggling, I can't imagine what others are doing. Companies like Nordstrom, Macys, Best Buy, and Bed Bath and Beyond (just to name a few) should see a dramatic decrease in sales. I have liquidated any and all of my retail stocks.

I did utilize the last of my monthly free Zecco.com trades (I only get 10!) to pick up some more GDX and more SKF. I still love gold and cannot see how banks are going to get out of the mess they're in anytime soon. Especially now, as we are seeing them start to conform to mortgage restructuring like Citi has done.

The motivation has definitely shifted and I expect the panic selling to continue into next week. I am still not ruling out a temporary Obama rally that I am sure is bound to make a couple days green, but I think for the most part, people's hopes of Obama immediately turning this thing around is all but gone. Good week for me and my portfolio. My GDX has done very well for me and SRS and FXP should keep climbing as the turmoil continues (I need them too!). Make sure to check back this weekend as I am going to report on my phone call with Lending Club. He answered a lot of the questions I had and discussed other ways I can maximize my investment with the company. They even have a secondary market for re-selling or buying existing loans for discount. The post will definitely be worth reading. Check them out if you haven't. Have a great weekend and Happy Trading.

Mixed Trading as Citi Plans To Restructure Loans

Posted On Thursday, January 8, 2009 at at 6:04 PM by Finance Fanatic Well, well, another interesting day of trading while the world sits and waits for our dreaded employment numbers to be announced. Some are expecting the numbers to be the worst since World War 2. However, it probably won't matter, because our market has become so interested in "projected numbers" than what the actual number dictates. For example, Target announces earnings with a 4.1% drop in sales, but the stock goes up almost 3%, having the announcement better than market expectations. On the flip side, Wal-Mart announced an increase in sales of 1.7%, but because this was below market expectations, there stock goes down 7.5%. The market is becoming more concerned about the numbers relationship to expectations instead of the actual performance of the number itself. It can be very, very frustrating.

Well, well, another interesting day of trading while the world sits and waits for our dreaded employment numbers to be announced. Some are expecting the numbers to be the worst since World War 2. However, it probably won't matter, because our market has become so interested in "projected numbers" than what the actual number dictates. For example, Target announces earnings with a 4.1% drop in sales, but the stock goes up almost 3%, having the announcement better than market expectations. On the flip side, Wal-Mart announced an increase in sales of 1.7%, but because this was below market expectations, there stock goes down 7.5%. The market is becoming more concerned about the numbers relationship to expectations instead of the actual performance of the number itself. It can be very, very frustrating.

So even if we do see a horrific number for employment, unless it's the worst since World War 2, I'm sure the media will spin it off to be a positive sign, and somehow millions of people out there will buy into it. Not me, I expect the number to be very bad and as a result it reminds me of just how big of a mess we're in.

After the close, Chevron warned of probable lower earnings due to the large drop in gasoline prices. I'm sure they're doing just fine as they made mounds of cash the past two years off our $4.50+ gas prices. Still, this news could bring some more negative sentiment for energy sectors during trading tomorrow.

CITI BAILOUT A big announcement today, was that Citi has agreed to participate in mortgage adjustments for distressed housing loans. Are you serious? I don't mean to sound unsympathetic as I am aware there are many people suffering. However, this move will support the 90 10 rule. Probably, only about 10% of the people receiving this help have actually a legitimate case to argue of their current position, while the other 90% will be bailing out people who bought out of greed and poor choices. One of the great principals this nation was founded on was a free economy. It is also known as the American dream. You can do whatever you want to do with enough work. Another element of the American dream is failure. Without failure, we have no successes. Call it survival of the fittest, yin and yang, or whatever. The point is not every business is meant to succeed, just as every choice isn't suppose to be the right one. If we don't learn from our mistakes, how will we change the future?

A big announcement today, was that Citi has agreed to participate in mortgage adjustments for distressed housing loans. Are you serious? I don't mean to sound unsympathetic as I am aware there are many people suffering. However, this move will support the 90 10 rule. Probably, only about 10% of the people receiving this help have actually a legitimate case to argue of their current position, while the other 90% will be bailing out people who bought out of greed and poor choices. One of the great principals this nation was founded on was a free economy. It is also known as the American dream. You can do whatever you want to do with enough work. Another element of the American dream is failure. Without failure, we have no successes. Call it survival of the fittest, yin and yang, or whatever. The point is not every business is meant to succeed, just as every choice isn't suppose to be the right one. If we don't learn from our mistakes, how will we change the future?

I could go on for hours about this, I just feel that this move (and whatever else is to come) undermines the people that were patient and worked hard for what they have. I mean, heck, if I knew the Government was going to bail me out, I would have bought three houses, knowing eventually, the Government would bail me out. If you take away accountability, you take away that spirit of free economy that originally made this country what it is. So, I'll get off my soapbox, that's just my feeling on the situation.

So to summarize this move, bankruptcy courts can alter the loans based on certain conditions. These being:

1) Only mortgages entered into prior to the date of enactment of the bill would be eligible for the treatment. All loans, and not just subprime, are eligible.

2) Borrowers have to show they made a “good faith”(What does "good faith" entail? Who knows.) attempt to work with the lender before considering this bankruptcy provision. Bankruptcy cannot be the first option, and borrowers have to prove it wasn’t.

3) Bankruptcy judges can strip away a lender’s credit or rights if they violated the Truth in Lending Act or other state and federal laws.

Many are still against such moves, but it will be interesting to see who else joins the wonderful bailout club. I would expect this to probably cause some optimistic trading tomorrow, especially in home builders and maybe some REITS. I don't know what this will do for financials, considering in the end, this will be reducing their investment. I see it as bad news, but you never know how the media will spin it.

As I have received many emails with questions about Lending Club, I was able to talk to one of the Directing managers of the site today, who answered several of mine and your questions about the program and their success. I plan on writing a post about it this weekend, sharing some of the numbers he gave me, but all in all, it was a great call and really increased my confidence in the company. I realize the risks of consumer lending, but after the call, I am a lot more comfortable with the underwriting and screening process and now believe I have a really good chance of receiving close to my 10.5% targeted returns. Definitely worth looking into.

Well, the end of the week rally could be in session tomorrow, very much depending on employment numbers. I really do think this number is going to be very, very bad and only getting worse. I would expect the market to react negatively to the number, but with the help of the Citi announcement and market manipulation, who knows, maybe somehow we'll end in the green. Happy Trading and we'll see you tomorrow.

A Frightening Anticipation of Jobless Reports Drop Confidence

Posted On Wednesday, January 7, 2009 at at 2:46 PM by Finance Fanatic Finally, we saw more than average volume return to the market today, as the fear for increasing unemployment as well as worsening economic conditions took the wind out of buyer’s sails. To be honest, I believe the market should be reacting like this every day, considering the mess we’re in. It’s still hard to say whether this will begin the next crash, as Obama hope still lingers, but it indeed made a statement that the bear is still out there.

Finally, we saw more than average volume return to the market today, as the fear for increasing unemployment as well as worsening economic conditions took the wind out of buyer’s sails. To be honest, I believe the market should be reacting like this every day, considering the mess we’re in. It’s still hard to say whether this will begin the next crash, as Obama hope still lingers, but it indeed made a statement that the bear is still out there.

Everyone is talking about the upcoming jobless reports coming out Friday. Some analysts are saying that this month we could see a jobless count of 670,000 for December (today’s ADP report showed that we slashed 693,000 jobs in the private sector). I personally feel that we will be even worse than that number and have a lot more to go. We haven’t even begun liquidating the retailer positions. Once more of these big retailers go down, we should see some absurd unemployment numbers. In fact, in regards to that subject, North Carolina had an interesting experience this past week. North Carolina, being headquarters for a lot of major commercial and investment bankers had some problems with their unemployment office. It seems that their unemployment computer service was overloaded, because over 50,000 people were trying to access it at once. After fixing it and adding room to the server, the server was overloaded a second time due to over 70,000 simultaneous requests. The actual phone number to call was down as well. I believe the reality of our situation is slowly beginning to settle in with people.

I wanted to share an article from the Boston Globe dealing with commercial real estate. Myself being a big proponent of SRS, I thought it would be appropriate. It said, “If you think selling a home was tough in 2008, be thankful you weren't trying to unload an office building.

Sales of Boston-area commercial properties plummeted 86.5 percent last year, with about $1.35 billion in property changing hands compared to $10 billion in a red-hot 2007, according to the global real estate firm Jones Lang LaSalle.

The drop-off portends a turbulent 2009. Now, real estate investors don't have data to guide them in pricing properties in the soft economy, making it less likely that buyers will come forward out of fear of overpaying.

"Its a huge challenge right now for investors to figure out if they're getting a fair price," said Lisa Campoli, executive vice president at commercial brokerage Colliers Meredith & Grew. "During the last downturn in the 1990s, we had the S&L crisis and some banks went under, but there wasn't the global lack of confidence we're seeing right now."

Commercial real estate is the latest sector to be hit by the deepening recession, with the fallout just now sweeping through Boston and other markets. Rents are starting to fall sharply as vacancies pile up.

The impact is especially severe in New York City, where there is a large increase in space available for subleasing, a key measure of weakness in the office market. Available sublease space in Manhattan has increased 43 percent from the end of 2007 as foundering financial companies have rapidly shed jobs and floors of offices.” All over the country real estate is dying. Just remember, most of these properties that are dying have very high leveraged loans on them. Eventually, this should come back to haunt the banks again. This is why I still can’t even closely be comfortable with buying financials right now.

As a result of the -2.72% day for the Dow, almost all of the shorts were up today. SRS had a moderate 5.5% up day as hopes for more Obama bailouts keep investors a little confident in some of these REITS. Don’t ask me why. FXP had some enormous gains, closing over 15%, as China continues to have problems with their businesses. The element that is killing China is their enormously large work force. I mean, just to give everyone jobs, they need to be exporting into almost every nation. As demand is going down, this is killing their employment. Their unemployment number may be higher than our actual population. Also, if any of you have dealt with the Chinese culture you will know that when times get tough, they close the door to spending COMPLETELY. Here in the US, we love to use our credit cards, and dig us into more debt. With the Chinese culture, most people choose to save than to spend. This lack of spending and lack of exports should bring a lot of hardships for their country and businesses.

I wouldn’t be surprised to see this sell off continue tomorrow. As more negative employment numbers come out and other sore economic data, I don’t see a lot of optimistic buying going on. We could rebound a bit either tomorrow or Friday, but I still feel the bear is here right now. The only thing keeping me from putting all my chips into the short side is Obama and his list of bailouts. I’m going to let that ride out a bit, plus I’ve got enough currently in SRS, SKF, FXP and EEV.

I also wanted to clarify some things with my Lending Club investment. The times that were given in my portfolio is when the loan is set to begin, not mature. So my money will be tied up longer than I originally anticipated. However, I will still be shooting for that 10.5% return, it is just going to take longer. Anyway, I love looking into these different investment opportunities. If you know of some that have worked for you, please share. Have a great night everybody, keep up the pace. Happy Trading and we’ll see you tomorrow.

Investors Hope 2009 Brings New Hope For Wall Street

Posted On Saturday, January 3, 2009 at at 10:22 AM by Finance Fanatic As volume is slowly returning back to the market, we experienced our third day in a row of green trading as the market ended up almost 3% at Friday's close. Many are cheering this three day streak, hoping it is a sign for new beginnings for Wall Street and that maybe we can see positive growth after seeing the market get demolished in 2008. However, as I say time and time again on this site, I believe this "hope" is more like a prayer, as in my opinion, it's a long shot for anything positive to come out of 2009. Let's examine the facts.

As volume is slowly returning back to the market, we experienced our third day in a row of green trading as the market ended up almost 3% at Friday's close. Many are cheering this three day streak, hoping it is a sign for new beginnings for Wall Street and that maybe we can see positive growth after seeing the market get demolished in 2008. However, as I say time and time again on this site, I believe this "hope" is more like a prayer, as in my opinion, it's a long shot for anything positive to come out of 2009. Let's examine the facts.

Everyone is talking about the biggest thing in 2009. Obama taking over the presidency. Sure, this event is bound to stir up some positive movement (which maybe is behind this recent rally, a bit early in my opinion, but maybe), but I don't care if it's Gandhi, I can't see one man turning around this economic crisis anytime soon. Sure, the damage can be lessened, but there will be pain and struggling. That's what comes with a cyclical economy.

The market cheered Friday, as Obama spoke of a strong, aggressive stimulus plan to be passed ASAP. People think that as soon as he takes office, money will be handed out to everyone. Even if it is, to an extent, that money is going to have to come from somewhere and it's certainly not coming from tax dollars, as no one is making money these days (except bankruptcy attorneys). So even if new money is printed to support the economy, that event in itself will eventually take a toll on the economy.

I wanted to share a portion of an interview that CNBC conducted on Friday with Martin Feldstein, a very well respected economist that has seen much in his days. In times like these, we really do need to listen to these old dogs, who have seen times near to the ones we are currently in. I do feel like these times are like none other we've been in, but I also think there is wisdom to be learned from mistakes of our past. This is what he said:

"I think we'll be lucky if by this time next year we see the economy having hit the bottom and starting up, and that's still going to leave us at a very low level of economic activity even if the turn has come at that point," Feldstein said during a live interview. "But there's no guarantee that all of this put together is going to achieve that."

Government will have to change the tax structure for capital gains and corporations while also exercising caution against inflation, added Feldstein, an economist at Harvard and president emeritus of the National Bureau of Economic Research.

"We are facing an economic downturn that is worse than anything I have seen in the post-war period," Feldstein said. "American households have lost more than $10 trillion of net worth in the stock market and housing prices. They are cutting back on their spending...Where's the demand going to come from?"

He also addressed the severe problem of these home mortgages and that a process needs to be taken to get these loans re-written. Either way, he feels we are a long way from even hitting bottom! These are why I like these old guys, they stick to facts. They are not easily wavered by the emotional wind that blows the markets. In the end, fundamentals will show through.

This coupled with the the lowest manufacturing data we've received since 1980 (ISM index hit 32.4 on Friday) still makes me a bear in 2009. Sure, I plan on buying some stocks here shortly, to take advantage of some short term Obama gains, but overall, I don't see us out of the trenches yet.

This is a great time to get into this market and prepare to make some money. If you aren't in, I would encourage you to consider tracking it and think about getting in soon. If you don't have an account, Zecco.com is a great place to start as they offer free monthly trades and incentives for new investors. A lot of money will be made in the next three years. As for an update on my mission with Lending Club, I have submitted an application for a lender (they have a reviewing process to make sure my credit is good enough). As I start lending, and hopefully make some good gains, I will keep you all updated. Keep up the comments, I enjoy hearing other voices in this market. Have a good weekend and we'll see you Monday.