Lesser Sentiment

Posted On Tuesday, September 29, 2009 at at 5:05 PM by Finance Fanatic After what looked to be a strong rebound in the markets yesterday, red trading continued on for Tuesday, as consumer sentiment begins to weaken once more. Analysts were hoping for the consumer confidence numbers to continue to increase into September, however, they have begun to trace back as we saw from today's released study. It was the positive performance of this number which sparked so much buying in the first place, but as I have always warned, sustainability is the key.

After what looked to be a strong rebound in the markets yesterday, red trading continued on for Tuesday, as consumer sentiment begins to weaken once more. Analysts were hoping for the consumer confidence numbers to continue to increase into September, however, they have begun to trace back as we saw from today's released study. It was the positive performance of this number which sparked so much buying in the first place, but as I have always warned, sustainability is the key.

With consumer confidence numbers weakening, investors are worried for the upcoming unemployment data that gets released later on this week. Sure, the rate of job losses has consistently been decreasing the past few months, but we are still experiencing very high amounts of monthly job losses that will eventually take its toll. Speaking of job losses, one important element to keep in mind is taxes. In recent months, we have seen record amounts of government spending. Coupled with that, we have also seen a record amount of job losses which in turn will directly effect tax dollars. The amount of tax revenue received for the government has to be at record low levels, which is not good when you consider just how much debt spending is being done. This will be a problem that will carry into our children's generation to deal with the national debt.

Nike reported better than expected earnings today after the close, so markets could easily find there way back into the green tomorrow. However, the big question everyone is waiting for is the job losses released this Friday. UUP has been looking like a great buy as the dollar is beginning to rebound. In my opinion, as deflationary pressures continue to mount, the dollar should perform quite well. DRV is the new Direxion 3x inverse Real estate ETF. It has definitely been on the radar for me, as I believe we are near this turn in the market. Real estate is on the top of the list for next sectors to suffer, as property owners have been bunkering up the past 9 months for the storm that lies ahead. Indeed the opportunity is coming soon. Happy Trading.

Is Red Here to Stay?

Posted On Monday, September 21, 2009 at at 5:29 PM by Finance Fanatic

IMF Joins Bandwagon

Posted On Tuesday, August 18, 2009 at at 11:30 AM by Finance Fanatic Oliver Blanchard, a top economist for the International Monetary Fund (IMF), declared on Tuesday that indeed the global recession has ended and a slow recovery has begun. This announcement, of course, is following one of the largest one day declines in the Shanghai Composite as well as a rather strong sell off in the US markets. All of these "public declarations" are done very carefully with strong warnings. It feels much like a catchy slogan one would find on a medicine bottle, followed by all of the side effects and warnings that could accompany you if you decide to take the drug.

Oliver Blanchard, a top economist for the International Monetary Fund (IMF), declared on Tuesday that indeed the global recession has ended and a slow recovery has begun. This announcement, of course, is following one of the largest one day declines in the Shanghai Composite as well as a rather strong sell off in the US markets. All of these "public declarations" are done very carefully with strong warnings. It feels much like a catchy slogan one would find on a medicine bottle, followed by all of the side effects and warnings that could accompany you if you decide to take the drug.

I found the following phrase comical, considering that it was found in the same address that declared the global recession is over:

"The United States can't rely on low interest rates to sustain the recovery, nor can it rely on consumer spending or investment filling the gap. Consumers are likely to save more in coming years. Businesses don't need to invest much for the next few years, because so much of their capacity is idle."At least they are admitting that we cannot rely on the consumer to bail us out of this. However, unfortunately, our GDP is 70% based on the actions of the consumer. So to say such things is an oxymoron. After the very positive headline, the rest of his remarks consisted of explanations of how slow the recovery would be and how we may never return to the growth levels we were at originally.

It is clear that indeed it is the goal of government and political figures to maintain the confidence of consumers throughout the world. But I take these "declarations" with the smallest grain of salt.

More Lost Numbers

Posted On Monday, August 10, 2009 at at 11:07 AM by Finance Fanatic With all the chatter and cheering going on by Friday's "better than expected" unemployment number, many failed to catch the almost doubled then expected consumer credit loss report, which came in at a loss of $10.3 billion. Keep in mind, last month's the number was later revised from an announced loss of $3.2 billion to $5.4. You can only imagine what this number will be revised to.

With all the chatter and cheering going on by Friday's "better than expected" unemployment number, many failed to catch the almost doubled then expected consumer credit loss report, which came in at a loss of $10.3 billion. Keep in mind, last month's the number was later revised from an announced loss of $3.2 billion to $5.4. You can only imagine what this number will be revised to.

Sure, the number is not as significant as the unemployment, but the huge miss in expectations tells a story of where a lot of this money is coming from in the economy. More debt. Just as the popular "cash for clunkers" is temporarily bringing relief to the battered auto industry, it is also piling up more debt for the consumer into one of the biggest money pit purchases people can make. A car is not an investment, it is an income eating luxury.

Thus far today, markets have been down, mostly due to profit taking and more weakening commodities. Financials still continue to perform, with help from Freddie Mae claiming profits as well as stating their cutting the umbilical chord from the government (we'll see about that). Hopefully, we'll see a pullback here, as we are far overdue. I still remain very bearish.

Upcoming Bear Speed Bumps

Posted On Saturday, March 28, 2009 at at 4:49 PM by Finance Fanatic Finally, we reached the end of a crazy week of trading. There were many times during the day on Friday where I worried about another 200 point reversal like we saw the day before. However, bears were able to maintain control of the market for pretty much the whole day and end the Dow lower 144 points, which is a good sign that indeed this rally may be slowing. But before I go and position myself in a strong short position, there are a few speed bumps for bears that are definitely worth discussing. I discuss them in more detail on today's podcast (subscribe here), but lets cover some of them right now:

Finally, we reached the end of a crazy week of trading. There were many times during the day on Friday where I worried about another 200 point reversal like we saw the day before. However, bears were able to maintain control of the market for pretty much the whole day and end the Dow lower 144 points, which is a good sign that indeed this rally may be slowing. But before I go and position myself in a strong short position, there are a few speed bumps for bears that are definitely worth discussing. I discuss them in more detail on today's podcast (subscribe here), but lets cover some of them right now:

Technicals

Although the bear market rally was expected, the strength of the rally has been much stronger than anticipated. The angle of the upswing is much more vertical than that of the rally we experienced back in November. We have retraced our previous sell off about 50%, which is usually normal in an environment like this. This could mean that the rally has opportunities to creep up into the mid 8000 Dow levels. 8000-9000 are the key technical numbers I keep hearing about this rally. If we indeed are heading to mid 8000 levels, I definitely don't want to be caught short. Now, I do think we won't be as violent as we've been and may bobble around up around 8000, but the risk is still there.

Mark to Market MeetingOn April 2, there will be a meeting to discuss the altering of mark to market accounting, which would cause for a big help for bank's balance sheets. This obviously won't be the savior for banks, but it should definitely spark some buying for at least a few of days. This is all depending whether they actually go forward with some alteration in the accounting method (which I believe they will). So keep your eyes on that date, because that could most definitely shake some things up.

Bank's Earnings

This is a side bonus for bulls if the mark to market accounting does get altered. By changing it, most likely bank's will begin, at least on paper, to start to show some profits. GS is the first of the bunch to report on April 13th, which I feel regardless of the accounting change will show positive numbers. Multiple positive earnings reports could continue to pull this rally into the mid 8000's.

Uptick Rule

This is the least of my worries out of the bunch. Sure, reinstating it may cause some positive trading for a short term, but I feel the effect it has on the market is minimal. In 2005 they ran a test to gauge the uptick's influence on market manipulation, and concluded that that the rule did not prevent manipulation. Bears will always short, with or without the uptick.

So there definitely exists enough variables to keep me from fully positioning myself short. Indeed, if conditions get worse enough we could sell right through these speed bumps, but I do feel there will still remain some buying. So, I don't feel we're at the position yet for me to be comfortable getting into a much stronger short position. I do have some, but not near as much as I will have when I feel it's time. There are a lot of signs that we are close, but not quite there. Next week will be an important week in defining the remaining strength of the rally, especially how we react to the mark to market meeting on April 2nd, which I believe should cause the biggest shake in the markets out of all the news.

So gear up for another exciting week. I think the VIX may take a ride this week as I believe our daily spreads are going to start increasing dramatically very soon. Have a great weekend and Happy Trading.

Toxic Debt Program To Cause Some Noise

Posted On Sunday, March 22, 2009 at at 3:00 AM by Finance FanaticHowever, history has shown us that investors can get revved up on rumor and speculation. Buy the rumor, sell the news. This toxic plan could be another trillion dollar plan announced over the podium at some point this week. Obama did refer to the plan a few weeks back, but failed to go into much detail of what it would consist of. I would expect some optimistic trading as a result of the rumors. At least for a day or two, maybe. Either way, I feel it will be short lived and cause more problems for the market down the road.

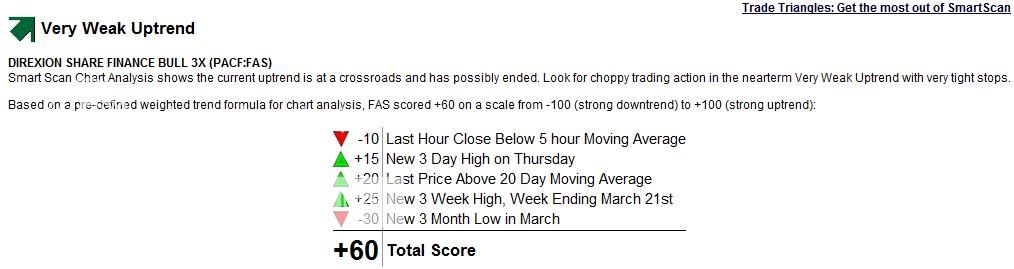

This could be the news that could propel us into the high 7000's, before seeing some more serious selling. If that is the case, plan on me starting to pick up some short positions this week. I just wanted to give a quick update. The FAS trend analysis above is looking pretty impressive for the time being, however, I'm not a buyer. Happy Trading.

New Speculation and New Worries - Who Can Save Us Now?

Posted On Friday, March 20, 2009 at at 4:14 PM by Finance Fanatic President Obama made history last night as he became the first active President of the US to be on a late night talk show, in which he made a visit to The Tonight Show with Jay Leno as his last stop in California. Once again he was quick to describe his disgust for the corruption of Wall Street and the greed of executives. However, he was quickly able to shed that problem onto Tim Geithner, as he kept referring to them as "his" or "Tim's" problems. Good job Obama, I would be doing the same thing in this mess.

President Obama made history last night as he became the first active President of the US to be on a late night talk show, in which he made a visit to The Tonight Show with Jay Leno as his last stop in California. Once again he was quick to describe his disgust for the corruption of Wall Street and the greed of executives. However, he was quickly able to shed that problem onto Tim Geithner, as he kept referring to them as "his" or "Tim's" problems. Good job Obama, I would be doing the same thing in this mess.

After more than a week of rallying, we have now had two days straight of downward trading. Both days being led down by, once again, financials. This is why I did not get too excited to excited to jump into banks after Wednesday's Fed announcement. For even though it looked good on paper and sounded good when it was announced, the consequences of such a move that was and is being made by The Fed, is something our children will also assist in fixing. To take such extreme measures as printing/taxing multiple trillions of dollars for the sole purpose to write off debt that has no intrinsic value, but is just air and numbers on a paper, will be devastating to the economy. It may take a bit for this to come full circle, but in my opinion, we will definitely see it.

So for me, I am remaining distanced from banks for the time being and will most likely be ready for a full entry of short for banks very soon. The recent slaughtering in Treasury interest rates have actually sped up the deflationary process a bit, believe it or not. So the storm is very near in my opinion. Also, having the S&P trading at 13 times its earnings is not very reinforcing that we've reached bottom. That is a very high number for these times.In this type of environment, it's hard to pick stocks to go "long" in, as I feel most, no matter how strong a company's balance sheet is, are vulnerable to being dragged down in this market crash. However, the most healthy companies in this type of market are those that are very cash liquid. Cash is king right now.

Today, Treasure Island of Las Vegas was sold by MGM to a buyer for $775 million. That sounds like a lot of money for some, depending on which market you live in, but is a huge steal for the Las Vegas Strip, considering Treasure Island's rooms were just recently upgraded and their location is center right on the strip. A much more worn down hotel, in a worse location on the strip was sold in 2007 for $1.2 billion. The reason why the buyer of the deal was able to get Treasure Island at such discount is because they had $600 million in cash to put down on the project, in which the rest was financed in a 36 month carry from MGM. Being that MGM is in a heap of debt from their newest project, their problems became someone else's opportunity. The point is, in this market, cash is king, and those companies that are prepared with liquidity, will make a killing the next few years. For some, generations of wealth will be created from just the actions of the next few years.

With this in mind, I feel it is important to be aware of those companies that are cash liquid. Most likely, they will be able to jockey for a larger market share and position themselves as more dominant companies in their sectors (even though most are already dominant). Below are a list of the top cash liquid companies (from Seeking Alpha):

1. Exxon Mobil - (XOM), Chart, Total Cash: $32.007 Billion

2. Cisco Systems - (CSCO), Chart, Total Cash: $29.531 Billion

3. Apple - (AAPL), Chart, Total Cash: $25.647 Billion

4. Berkshire Hathaway - (BRK.A), Chart, Total Cash: $25.539 Billion

5. Pfizer Inc - (PFE), Chart, Total Cash: $23.731 Billion

6. Toyota Motor - (TM), Chart, Total Cash: $23.151 Billion

7. Microsoft - (MSFT), Chart, Total Cash: $20.298 Billion

8. Google - (GOOG), Chart, Total Cash: $15.846 Billion

9. Royal Dutch Shell - (RDS.A), Chart, Total Cash: $15.188 Billion

10. Wyeth - (WYE), Chart, Total Cash: $14.54 Billion

11. IBM - (IBM), Chart, Total Cash: $12.907 Billion

12. Johnson & Johnson - (JNJ), Chart, Total Cash: $12.809 Billion

13. Intel - (INTC), Chart, Total Cash: $11.843 Billion

14. Hewlett Packard - (HPQ), Chart, Total Cash: $11.255 Billion

15. Oracle - (ORCL), Chart, Total Cash: $10.646 Billion

Like I said, I believe everyone is vulnerable to more downside risk, especially if we reach numbers that I believe are coming for the Dow and S&P, but I would also expect some of the companies mentioned above to make some big, critical moves during this time to position them even better in the years to come. So keep an eye on them, and if you're looking to close your eyes for the next few years, and put something in your IRA or 401K, you may want to consider some of the above.

SRS and FAZ enjoyed very large gains today, which I was able to reap with my FAZ call options. However, once again I waited too long for SRS. I still think there is risk for more price slashes to both of these stocks, so I am not loading up quite yet on them.

As I said yesterday, GS has been on my radar for shorting for quite sometime now. Due to the ties that GS has with AIG, their stock has been appreciating, mostly based on the government aid that AIG has received. However, with more problems heading towards AIG, that will most likely reflect back on Goldman's stock price as well. You think it is any coincidence that Ex-Secretary Paulson decided to bailout AIG, when he used to be the Chairman for Goldman Sachs? I believe his retirement is doing much better than others. This is just one example of some of the corruption that has been going on for years now.

I still don't think we're out of the woods yet for this bear market rally. If we continue to see some more downward pressure on trading, my position could swing, but as of now, I still believe there is enough technical support to keep us going a bit longer. However, financials may be sluggish. They're in a league of their own these days. For those looking to trade options, like myself, Zecco.com offers some of the best per contract prices I've seen out there. Worth checking out.

I hope everyone has a good weekend. Next week should be another exciting one. We should expect more news from the government as spending is definitely on their mind. Happy Trading!

Green Energy Investing - Penny Stocks Worth Looking Into

Posted On Sunday, March 8, 2009 at at 11:36 PM by Finance Fanatic Due to popular demand and a lot of interest from many of you, I thought I would take a non eventful Sunday evening to expound a bit more on a couple companies that I invested in last year that have been showing recent signs of strength. As I have always said, I try to remain as diversified as I can when dealing with my portfolio. I always like to have a small portion of my portfolio invested in IPO or R&D penny stock companies that I feel have great potential in the future. I allocate enough to these companies where if they hit big, the reward is very big. However, I always invest an amount that if I were to lose everything, it wouldn't kill me, because more risk comes with these smaller companies. Historically, I have found that if I invest in 10 IPO's or start up companies, I usually see the following results: 3 end up dead beat stocks (pump and dump), 4 I break even or get close to breaking even, and 2 or 3 I make good revenues, with 1 being very profitable. So, for me it's a numbers game and has worked quite well.

Due to popular demand and a lot of interest from many of you, I thought I would take a non eventful Sunday evening to expound a bit more on a couple companies that I invested in last year that have been showing recent signs of strength. As I have always said, I try to remain as diversified as I can when dealing with my portfolio. I always like to have a small portion of my portfolio invested in IPO or R&D penny stock companies that I feel have great potential in the future. I allocate enough to these companies where if they hit big, the reward is very big. However, I always invest an amount that if I were to lose everything, it wouldn't kill me, because more risk comes with these smaller companies. Historically, I have found that if I invest in 10 IPO's or start up companies, I usually see the following results: 3 end up dead beat stocks (pump and dump), 4 I break even or get close to breaking even, and 2 or 3 I make good revenues, with 1 being very profitable. So, for me it's a numbers game and has worked quite well.

I wanted to focus on two different companies that I invested in last year that I see a great potential in, given our current government in office. Some of you have heard me talk about them on the chat, so I apologize for the replication for some of you. The two companies I will be talking about are Origin Oil (OOIL) and Carbon Sciences (CABN).

Origin Oil

Origin Oil is a company that is currently developing the technology to transform Algae into oil. The procedure is much more effective than the current "ethanol" procedure, which can be harmful to the environment and is very costly. Origin Oil has the patent-pending technology that transforms algae to oil in a much more cost effective procedure than ethanol. The big question is being if they can do this on a mass scale and breaking down the cell wall. However, if it is scalable, the reward could be very big.

Oil giants like Chevron have already shown great interest in pursing algae driven oil (http://www.bizjournals.com/eastbay/stories/2008/01/21/daily22.html). Origin Oil's technology acts as a compliment to their research as their plan is to license the technology (their technology develops the oil faster and helps in self-generating the algae) in the future to companies such as Chevron and Exxon.

Origin Oil recently partnered with The Department of Energy which was a very big step in their development and shows the progress of their research (http://www.bizjournals.com/eastbay/stories/2008/01/21/daily22.html) . They are probably a year or so out from marketing the technology, but there is a lot of upside for this company. Here are a couple video clips from Fox News and other news programs on Origin Oil - (http://www.originoil.com/latest-news/moneytv.html).

Carbon Sciences

The other company I see great potential in is Carbon Sciences. Carbon Sciences is a company which is developing the patent-pending technology of transforming harmful CO2 emissions into usable fuel. Sounds too good to be true, huh? You would be surprised at how far along they are at getting there. In fact, last week they announced that their prototype had been completed and that it indeed works. This caused for the stock price to bounce 60%. The big question for them is also if it's scalable. They will be demonstrating the model probably later this month, but their next step is attempting to get this model to work on a large scale so that it may work with large plants.

Carbon Sciences also plans to license out the technology eventually and will most likely be bought out, if indeed the technology becomes scalable. Last week, USA Today featured Carbon Sciences, talking about their innovative technology (http://www.usatoday.com/money/industries/energy/environment/2009-02-24-carbon-dioxide-gasoline_N.htm). Here is also a link that features Byron Elton, President and COO of Carbon Sciences, on Money TV (http://www.carbonsciences.com/01/news.php).

Both of these companies are top on my list of penny stock companies with strong potential in the future. If either of these prove to be scalable and can accomplish their goal, I honestly believe they could be a $15-$20 stock, easy. Sure, this is a big if, and if it were already decided, the stocks wouldn't be currently available under $1. I invested in both before they went public and they both have been very profitable for me thus far. Instead of cashing out of my already earned profits, I plan on sticking with them for the next couple years and see if I can get the much larger upside.

I've tried to allocate some money to green energy as I believe it's the oil of the future. Sure, alternative energy has taken a back seat, lately, due to lower energy costs and the massive reduction in oil prices. However, sooner or later oil will be back at higher prices and once again people will become more aware of alternative energy. Also, with the current administration, there are very large incentives coming to companies that are willing to participate in green practices and alternative energy.

If you are interested in investing in either of these companies, they are traded on the OTC markets (over the counter) and symbols are CABN and OOIL. I know there are tens of thousands of penny stocks out there and most seem like "pump and dump" companies that end up going nowhere, but these are two gems that stick out to me and has already proven that they are players in the market and I really feel there is great potential with both companies.

If you are interested in a special investment opportunity with either of these two companies, I can put you in touch with them about a special limited opportunity they are having with private investors, that could be very profitable. Email me with subject line CABN or OOIL to crashmarketstocks@gmail.com and I will forward you more information of who to get in contact with to find out more about the opportunity. It is worth looking in to if you enjoy these stocks that are under $1.

Chinese markets are getting killed right now, so it will be interesting to see how US markets respond. I'm hoping to continue to see green in my Zecco.com account and maybe find some new entry points for some stocks. Have a good night everyone and see you tomorrow bright and early. Happy Trading.

Market Crash of 2009 - Are We Close?

Posted On Saturday, March 7, 2009 at at 12:53 PM by Finance Fanatic It seems as if one main theme is being broadcast over all the networks and even if it is not being said directly, it is usually being implied. Are we going to be seeing a market crash with the stock market? Well, I'm not afraid to say the words (in fact they make up my domain name :) ), but my thoughts with any subject is that if it is worth talking about, and is applicable to our current market, I don't care if it's good or bad for people to hear, I'm going to talk about it. I try not flower things or be careful with my words, because my income is not based on whether or people are actively trading in the market like most analysts that are shown on CNBC.

It seems as if one main theme is being broadcast over all the networks and even if it is not being said directly, it is usually being implied. Are we going to be seeing a market crash with the stock market? Well, I'm not afraid to say the words (in fact they make up my domain name :) ), but my thoughts with any subject is that if it is worth talking about, and is applicable to our current market, I don't care if it's good or bad for people to hear, I'm going to talk about it. I try not flower things or be careful with my words, because my income is not based on whether or people are actively trading in the market like most analysts that are shown on CNBC.

I like to think of myself as an optimist, so I am sure some people would find it ironic that I run a website called Crash Market Stocks. I am not a "stubborn bear", meaning that no matter what, I am not going to preach you doom and gloom, even when signs point to strengthening markets. If indeed I see the opportunity once again to make money on the long side, I will say so. However, at this current time, and as you can tell if you have been following this site, I cannot find any reasons to hope for good things in the market and in the overall economy for quite some time.

It is unfortunate that our economy has found ourselves in our current economic decay and I feel sorry for those who have been wronged or taken advantage of by the greed of government and Wall Street, but I choose not to join the popular party of finger pointing and blaming, trying to figure out how and when it wrong. Instead, I continue to try and find unique ways to make money in this economy. Yes it can very well be done, and it is being done as we speak. So I'll get off the soapbox now and continue, but hopefully I have conveyed to you as a reader that there are honest, intelligent ways to make money in our current market crisis.

So are we crashing right now? I have had countless conversations with people this week all asking, what should I do? Should I pull all my money out? Are we going to rally? Should I go all out short? Well, every year I continue to ask Santa for a crystal ball and he has still yet to deliver on the request, but there are signs we are seeing in the market that can shed some light and maybe help answer the crash question.

First off, it is hard to predict a crash, because usually it comes when people least expect it. That is why it is so devastating. It comes much like a terrorist attack, and what makes it continually devastating is that people begin to react on fear, which can distort your reasoning more than your worst drunken stated. From there it's a ripple effect which creates a force like nothing we've seen recently, even in our recent large sell off days.

My personal feeling, we're not here yet. I believe we're very close, but not quite. The biggest element we are lacking in our current economy compared to the Great Depression of the 1930's, is the huge deflationary down spiraling. That was the engine behind the crash. We are indeed experiencing deflationary problems in our economy, but I believe it is going to get much worse. This is what I am mainly waiting for as a predecessor to the crash.

Another reason I feel we're not quite there yet is that everyone is expecting it. This recent sell off has lasted too long. People have altered their portfolio, been sitting in cash, putting money in treasuries and other low risk investment vehicles. I think a crash will come much more fierce and hit us when we least expect it. I think we are very close. Many signs are here. Bank failure, wide sector losses, rapid index declines, high trading volume and others. However, we're still early in this economic crisis and have plenty of time to struggle through this.

This leads me into my next thought. I believe we have a very good chance of seeing a strong bear market rally this month. The market performance from Friday does not have much to do with my belief, as I feel it was a very mild victory for bulls, but there are many readings which point to a rally this month. After dealing with GDP and unemployment news, we have some breathing room to work with where the market could gain some ground. Sure, there is always earnings reports and more new bankruptcies(GM) and bank problems, but I believe the government will also take this time to try and gain some ground with confidence. So as I have said in prior posts, I am prepared for either scenarios, rally or tank. Neither scenarios have made me confident enough, at this point, to go from cash to major positions. So I continue to wait.

If we indeed see a rally come this month, I think we could be that much closer to a market crash. Most likely if markets do begin to rally, once again people will believe the market have bottomed out and confidence would return to investing once again (people change their minds do easily). It is in that state where I believe we will see more vulnerability for a true market crash and where I will begin to prepare more fully. If that is the case, these recent lows we have been seeing will be nothing compared to what will come.

As always, these are my thoughts, and yes, we could see the market crash next week or not at all. I just don't see it likely at this point. From the graph below, you see that big turn around at the end of trading on Friday. My thoughts, PPT, but it could have bee a variety of things: Institutions getting in at new lows for some industrial stocks, shorts profit taking, or Uncle Sam. At any rate, it could spur something, but once again, maintaining is the key, so we'll see what happens Monday.

Gold starting to get some love again as the dollar begins to finally slow down. DGP's Market Club report score is +70, compared to GDX's -55 (get your own symbol analyzed for free, all you need is a name and email, Click Here), so DGP still catches my eye for re-entry. If we see Gold get closer to 900 again, I think I may get in.

I've been getting a lot of inquiries on some of the green energy stocks I've been investing in so I will make a post tomorrow talking about a couple of them as well as a possible good opportunity for those of you looking to make an investment. I like to keep myself diversified and R&D penny stock companies always interest me and can be very profitable if picking the right companies. Also more risky too, so I factor that into my investment.

I've also enjoyed meeting a lot of good traders at the UpDown social network. Great place to interact with some good traders and share thoughts. If you haven't already, check them out and Join The Investing Social Network. It's free and worth poking around.

I hope everyone has a good weekend and is ready for some fireworks next week. It will be interesting to see how we react and if the market actually does get steam behind a rally. Happy Trading and we'll see soon.

What Can I Say? GDP No Bueno - Buffett Admits Mistakes

Posted On Saturday, February 28, 2009 at at 10:43 AM by Finance Fanatic Buyers were out of luck before the market even opened on Friday, having to compete with some horrific GDP numbers. Although, it did look at times as though buyers were maybe going to get the market in the green (NASDAQ did go green for a while), lets be honest, at a -6.2% drop in GDP, no good news can be derived out of that. We once again, saw a pretty strong battle close to neutral grounds for a large portion of the trading day, but as has been the trend lately, bears came in with the last word during the last hour of trading. The new numbers for analysis are critical, and depending on next week's performance, we are becoming very close to some very dangerous numbers.

Buyers were out of luck before the market even opened on Friday, having to compete with some horrific GDP numbers. Although, it did look at times as though buyers were maybe going to get the market in the green (NASDAQ did go green for a while), lets be honest, at a -6.2% drop in GDP, no good news can be derived out of that. We once again, saw a pretty strong battle close to neutral grounds for a large portion of the trading day, but as has been the trend lately, bears came in with the last word during the last hour of trading. The new numbers for analysis are critical, and depending on next week's performance, we are becoming very close to some very dangerous numbers.

With the bad GDP announcement, it was no surprise to me to see us close at where we did, just over 1% on the Dow. In fact, at opening, it was much worse and I even thought of the possibility of a 3% or more down day to close the week. I was a bit surprised at the strength to bring the market back at midday, but both sides has shown their ability to be violent lately. If anything, we are in even more dangerous waters, no matter which side you're on, because there still exists the feud of technicals vs emotion. With this battle going on, a very violent rally could exist on either side, which could be bad being caught going in the wrong direction.

A critical reading from Friday is that we did indeed close the S&P under the original November 20th lows. Being as big of a move as that is, however, it is even more critical to see if this position can hold going into Monday. We did see the market reach this low Monday, only to bounce right off it the next day and rally over 3%. So, Monday acts as a very critical day for these market tests and I will be interested to see if they hold up. With the GDP numbers, consumer spending was down considerably, as was the prices of common goods. I will be very interested to see how the level of the drop in prices affects the deflationary models. We won't be able to tell for a couple weeks, but these new numbers could indeed confirm my suspicions of a near coming deflationary spiral, which could propel us into capitulation. So I will be watching that very, very closely.

Warren Buffett got a letter out to his shareholders telling them, he had made some mistakes during 2009. Didn't we all? I respect the old man for being frank with his investors and admitting to the wrong moves he made the year prior. If only there were more Buffetts out there. He speaks of his bad decision to enter into Conoco Phillips last year at such high prices. He didn't believe that energy would get killed as much as it did, but still feels oil has a lot of upside from its recent low levels. In fact, I love Conoco right now. I threw it in my IRA a couple weeks ago. COP has a Market Club report score of -100, but they have shown they are a strong company even in tough economic conditions (get your own symbol analyzed for free, all you need is a name and email, Click Here).

He also spoke of putting $244 million into Irish banks, which he felt like was cheap enough at the time. However, the value of that investment has been reduced to $27 million. As big as the mistakes may seem and even having the worst year for his company since he took over in 1965, he beats out most major indexes for performance for last year.

Buffett also feels that we should continue to experience a rough 2009 throughout the rest of the year and that economically, we should have problems for the next few years. However, he does not feel that it necessarily means in the stock market. He finishes off to say that the best days for America still lie ahead.

So, a big Monday awaits the market. Once again, no big moves for me. I wait in mostly cash until I can get some readings from the models. I just feel we are in a dangerous, volatile time where either way I position myself, whether it be long or short, I am very vulnerable to an opposite rally. So, I am just holding with my municipals, few short positions, as well as my very small long positions. Have a great weekend, Happy Trading and see you Monday.

Banks Are Back - Investors Finally See Green In Trading

Posted On Tuesday, February 24, 2009 at at 6:03 PM by Finance Fanatic Well, our week long streak of bear hungry selling was finally put to an end on Tuesday as the Dow closed up 236 points (3.32%). Indeed we were overdue for a good rally as I was actually expecting this rally to hit a couple of days ago. Well, it's here now and it will be very interesting to see the strength of it. Will it just be a quick rebound for profit taking, or may we see some continual recovery over the next couple of weeks? A lot has to do with fate of the banks and how the government manages news that continues to hit the public.

Well, our week long streak of bear hungry selling was finally put to an end on Tuesday as the Dow closed up 236 points (3.32%). Indeed we were overdue for a good rally as I was actually expecting this rally to hit a couple of days ago. Well, it's here now and it will be very interesting to see the strength of it. Will it just be a quick rebound for profit taking, or may we see some continual recovery over the next couple of weeks? A lot has to do with fate of the banks and how the government manages news that continues to hit the public.

Many people attribute Bernanke's remarks to big run up in financials. However, I don't think he had much to do with it. In my opinion, the market was oversold, and was just waiting for a bit of a push to get the engine started. I see it as a technical rebound, one of which may stick around for a while, at least that is what I am hoping for. The selling volume was very low and the number of new lows were minimal, which was a sign that we were quite oversold.

After selling a lot of my gold options last week, I went ahead and got out of gold completely this morning. I do feel that gold still has some more up to go, but I feel that it is vulnerable to some losses here in the short term. The market may regain some of its footing this month, which could bring gold down a bit. I plan on getting back in if we see gold get back down to $900 levels, as I feel inflation will be our next beast to slay after we spend our way out of our current problems. 1990's Japan, here we come. However, my first ride was gold was very profitable for me and I enjoyed the ride.

If you haven't already, make sure to check out the 5 Trends Video discussing the momentum of the major 5 sectors investors are watching. It gives good tips about oil, gold and other sectors. Oil still continues to be on my radar, but indicators have not confirmed a bottom yet, so I am still waiting for a good entry. I don't think there is much more downside for oil, but I can wait.As we saw today, these violent bear market rallies can take back profits just as quickly as they are given. FAZ and FAS are both very capable to take some serious slashes at your portfolio if you are caught on the wrong side of the rally, as some of you may have found out today. I plan to be very careful the next couple weeks with the leveraged ETFs. Having the Dow close under the 2002 lows yesterday and the S&P under the November lows confirmed that we are indeed still in a bear market. However, the rebound we received today also confirms that we may indeed be starting another bear market rally. So what does this mean?

This is my plan for coming weeks. I am keeping my FAZ Put options (which is much like owning FAS, just more volatile) along with my remainder of SRS (which currently has a Market Club report trend score of +60. Get your own symbol analyzed for free, all you need is a name and email, Click Here) and SKF, which is not much. Besides my energy stocks and miscellaneous tech stocks, I will be patiently waiting. I am going to be very careful on the short side, as we may see a 15-20% rebound with this rally over the next few weeks. I may make some suttle long moves to take advantage of the rally, but not much. My real goal is to get the shorts back to a point where I can enter at some really low prices and be prepared for the big crash, which I still believe is coming. If we do indeed rally, many will believe the worst is done and that we could be starting the bull back up. Be very careful of what moves you make. As for myself, I feel very strongly that is not the case and will wait until the time is right to get back in heavily in the short position. However, I will be patient.

We may not rally from this point, but we have a lot of indicators that we are oversold at the moment and that we could indeed see a strong bump in the bear market. Like today, these rallies could be violent, so watch out. I will try to make it on chat to keep you all posted daily on my moves.

I am very excited for the times ahead. I believe the opportunity is slowly presenting itself to make a lot of money in this market. It's hard for me to fight off my compulsive nature sometimes, but deep down I believe it will payoff for me. So try not to worry if we do indeed see some green over the next few weeks and just think of it as an opportunity to see good prices for the shorts. At least that's my plan.

Tomorrow, we'll talk about Obama's speech and other new factors as they come up. One more week for the $200 Lending Club promotion. If you haven't checked it out, make sure you do, click here for details. So far, my 10.5% return on investment with them has been picture perfect. It could be a great place to park some cash. Have a good night everyone, Happy Trading and we'll see you tomorrow.

Broke Back Market - And The Oscar Goes To...Sellers

Posted On Monday, February 23, 2009 at at 6:29 PM by Finance Fanatic Last night, Hollywood seemed at ease as they put on their 81st annual Academy Awards. Little did they know of the storm brewing for the stock market the day after. In fact, besides the "red carpet", the only other red out there is from all the selling in Wall Street. This morning, we actually experienced our first few moments in the green, but proceeded to spend the rest of the day heading downward. Buyers and government intervention (PPT) didn't stand a chance in turning this train around right from the get go. Any sort of attempt of a turn around, was quickly denied, sending the market down further. Finally, in my attempts to try and figure out what the heck is going on, I resorted to the "they must know something I don't know."

Last night, Hollywood seemed at ease as they put on their 81st annual Academy Awards. Little did they know of the storm brewing for the stock market the day after. In fact, besides the "red carpet", the only other red out there is from all the selling in Wall Street. This morning, we actually experienced our first few moments in the green, but proceeded to spend the rest of the day heading downward. Buyers and government intervention (PPT) didn't stand a chance in turning this train around right from the get go. Any sort of attempt of a turn around, was quickly denied, sending the market down further. Finally, in my attempts to try and figure out what the heck is going on, I resorted to the "they must know something I don't know."

Indeed I am a very strong bear right in this market, but by now, I almost feel overfed from the recent down trading days and keep waiting for the days where I start throwing everything up. But that day still never comes. I caught something very interesting that made me quite curious. Indeed, as I said in previous posts, we are long overdue for a "technical rally". However, there has been no such rally and looks that it may not come for a bit. Whenever technicals are over ruled, I try to figure out why. On Thursday and Friday, many of the sellers were hedge funds liquidating positions in preparations for redemptions. This mass selling was a strong contributor to keeping the markets down, even in the face of strong buying surges.So who was selling today? Believe it or not, but a lot of today's sellers were institutions. Many long term holders found themselves selling today in the midst of the downward treading market. For those of you that don't have upper level trading, you should have seen the bulks being sold. I had not seen anything like it, not even in November. With selling like this, clearly "they must know something I don't know." These guys don't like selling unless they absolutely have to. Towards the end of the day, I think we saw what it was. AIG needing up to $60 billion of new capital to stay a float. They announced that they will be announcing the largest loss in corporate history on Monday. Just what this market needs. Being that the US already has its maximum allowed stake in the company, they are seeking for alternative capital to keep them afloat. Good luck! This news indeed could have been the devastating news spurring the recent sell-a-thon that has taken place the last 5-6 days. I do not see how this news does not continue to linger with us all the way to Monday's announcement.

As of now, we have pretty much passed every major downward indicator for most every major indices. With S&P closing under 750 today and the Dow getting dangerously close to 7000, we are in very dangerous grounds for what could eventually lead into a downward crash. The big question is, can we hold? I have expressed my doubt about this being "the crash" of this market, as the deflationary indicators just aren't hitting. However, that does not mean that it can't happen. Even though we seem low at these current numbers, I honestly feel that when the big storm comes, we will see 500 S&P numbers and it will come fast. By that time I hope to be fully positioned in my portfolio. For now, I will continue with my current shorts I have (SRS, FXP, and SKF), along with my DGP, GDX, TBT, and UUP. I still have some FAZ put options, which I will keep just in case of a strong rebound rally, but for the most part, I remain in cash. I still enjoy green on days like today in my Zecco.com account, as most of my positions remain short.

Tomorrows reaction to today is so, so critical. A failure to hold these numbers may spur a bit of a rally, which I don't see lasting long, but definitely possible. However, another strong day of selling, depending on how aggressive the markets are, may result in beginning days of capitulation. I cannot stress the importance of the day tomorrow, as all analyst's eyes will be on trading. Keep your eye out for some fireworks. FAZ continues to soars with a Market Club report score of +70! (get your own symbol analyzed for free, all you need is a name and email, Click Here).

I hope to see you all up early and on chat (located on the right side of the site, towards the top). It should be an exciting one. Please keep in mind, President Obama is set to speak tomorrow at 6:00 PM eastern tomorrow. So something could be up. Maybe it is the "something I don't know." At any rate, I think it's clear that we have "Broke the Back" of this market and that if anyone still believes in the "buy and hold" theory for stocks, I am sorry, for you have probably lost value in your stocks since 1997, ouch! Also, HBSC is offering some good rates right now, so if you're looking, go to Earn 2.25% APY* at www.hsbcdirect.com for more info. Happy Trading and we'll see you all tomorrow.

PS... You should really check out the newest Big Five Trends Video, awesome and free 5 Trends Video