ETF Game

Posted On Friday, April 17, 2009 at at 5:36 PM by Chad Carlson When it comes to making money in a recession, understand two things; it can be done and flexibility.

When it comes to making money in a recession, understand two things; it can be done and flexibility.

For the past two decades, especially the 90’s and the tech boom, it was common to see a stock double or even triple within a short period. There was no major statistical analysis, throw the darts and roll the dice. Things have changed, the pendulum has swung. Our market is not producing the same results, yet we still want our portfolios to increase 10-12% a year. Obviously in a recession that is not going to happen, but our portfolios do not have to be down 40% either.

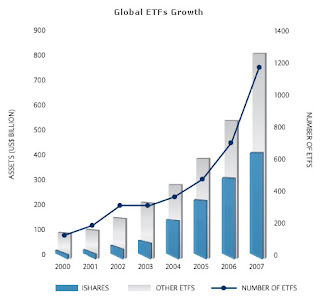

A close confidant of mine with Morgan Stanley has focused on taking advantage of the swings in the market by utilizing leveraged ETFs. The ideology is simple, but the need for flexibility is great. Two ETFs to keep in mind are Direxion 3x FAS and BGU. Both are bullish Financials and Large Cap respectively. But you need to understand exactly how ETFs work. ETFs can be traded just as easily as any other stock. All you need is a brokerage account. Zecco.com has some of the best rates around.They have the diversification of a mutual fund but trade like a stock. The attraction recently to ETFs is their ability to take advantage of volatility, much like an option, but without the hassle of understanding calls and puts. But remember an ETFs whole goal is simply to outperform their respective sector each day, not over a long term basis. When an ETF claims to “double the DOW”, their time horizon is today, not tomorrow. Do not believe if over a five year period the DOW gained 10% that your return should be 20%, it does not work that way.

If you take 10-15% of your portfolio and buy an ETF, place a stop order 20% below your purchase price. This allows you some volatility without losing the entire value. For example, you bought FAS and out the gate the Financials are getting hammered, the ETF will drop, but maybe only 16-17%. During the afternoon, the Financials rebound and all of a sudden the ETF is up 9%. You made good money, with down side protection. But let’s say the Financials continue to get hammered, the ETF drops 25%, your stop order triggers and you lose 20%. It stings, but 20% of 10% of your total portfolio isn’t too bad. Allow yourself some volatility, do not put a stop order for 1% below your purchase price, let it play out.

This may not be your flavor, but it’s one idea that has worked. This is not a long term play; this is a day trade maneuver. There are a number of ETFs that hit on just about every sector of the market; find one and follow the sector for a few weeks. When the market is so inconsistent, taking a protected risk can have huge payouts. This is what “smart money” is doing, think about it.

-Chad Carlson

Are We Reaching The End of the Rally? - Things To Watch

Posted On Thursday, March 26, 2009 at at 5:45 PM by Finance Fanatic Well, we might as well start printing new dollars with Obama's face on them, because by the time we spend our way out of this mess, our current dollar will be worthless. Once again we saw another wacky day of trading. Volume remained light today, which makes me even more suspicious of market manipulation. Today, again, we saw these unnatural spikes throughout different times of the day, suggesting several "lump sums" of buying. Whether it's institutions or Uncle Sam, there is definitely a bullish force turning the market around every time the markets begin to drop and as I said in yesterday's podcast (subscribe here), The Fed has motivation to do so. With the light market volume, institutional trading will cause the market to react much more sensitively, compared to trading days we saw last week.

Well, we might as well start printing new dollars with Obama's face on them, because by the time we spend our way out of this mess, our current dollar will be worthless. Once again we saw another wacky day of trading. Volume remained light today, which makes me even more suspicious of market manipulation. Today, again, we saw these unnatural spikes throughout different times of the day, suggesting several "lump sums" of buying. Whether it's institutions or Uncle Sam, there is definitely a bullish force turning the market around every time the markets begin to drop and as I said in yesterday's podcast (subscribe here), The Fed has motivation to do so. With the light market volume, institutional trading will cause the market to react much more sensitively, compared to trading days we saw last week.

It's amazing to think on days like today, when a 6.3% drop in GDP for the 4th quarter is announced, investors find it a time to buy. We are falling back into the trend we saw back in November and December, where no matter what news is reported, we keep buying. Well, we saw how quickly and violently that caught up with us, and I believe it will be even worse this time around. Once again, we saw this horrible reported number spun as a good sign of the "strengthening" markets. Don't ask me how they come up with that conclusion, but obviously they are using different indicators than I am. There continues to be noise from the government as Geithner described how he plans to apply more transparency for hedge funds dealing with credit default swaps and debt trading. Many are cheering his ability to answer the questions, but application of such plans is a different story. President Obama also had more media time today, hosting the first "web" town hall meeting where he talked about more spending he has planned for programs outside of fixing our economy. Wow.

There continues to be noise from the government as Geithner described how he plans to apply more transparency for hedge funds dealing with credit default swaps and debt trading. Many are cheering his ability to answer the questions, but application of such plans is a different story. President Obama also had more media time today, hosting the first "web" town hall meeting where he talked about more spending he has planned for programs outside of fixing our economy. Wow.

Fort most of the day, the shorts were actually holding up fairly strong. SRS was in the green for most of the day and even FAZ got into positive numbers for a while. However, once again, we found a "mystical" force push all markets up the last hour with no news behind it. Let them move the markets on these low volume days, because when the volume comes strong, it won't be as easy. We are seeing a lot of resistance for SRS at 5o and 18 for FAZ. Tomorrow, should be a good sneak preview of whether this rally still has some legs or if it's running out of gas.

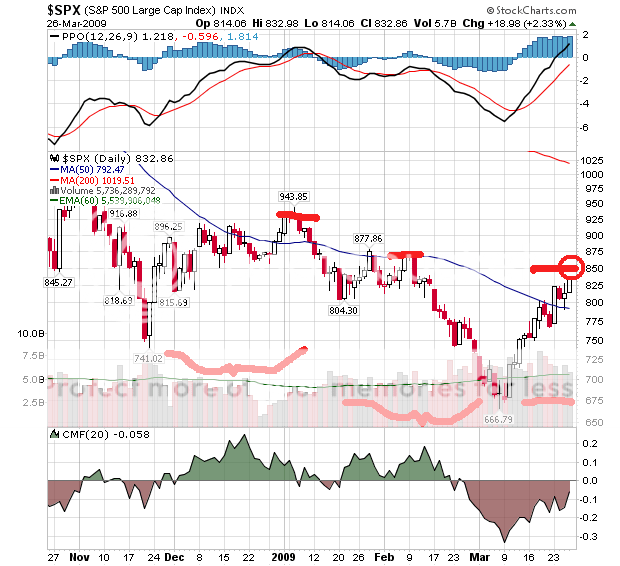

I am feeling a definite slow down in this rally. We may bounce back and forth a bit more around these levels, but as of now I don't see the rally going that much higher. This of course is pending there are no more big government announcements. From below, you can see the moving chart of the S&P. Technicals are showing a definite slow down heading towards that 850 mark. We'll see how close we get to that number or if we begin to retreat from it. If we do indeed push right through it, that's a big move for bulls.

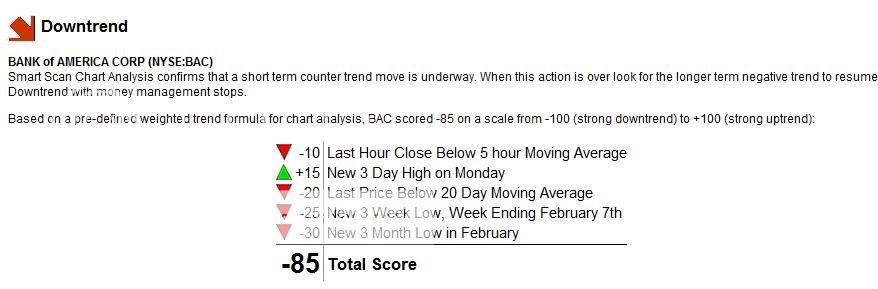

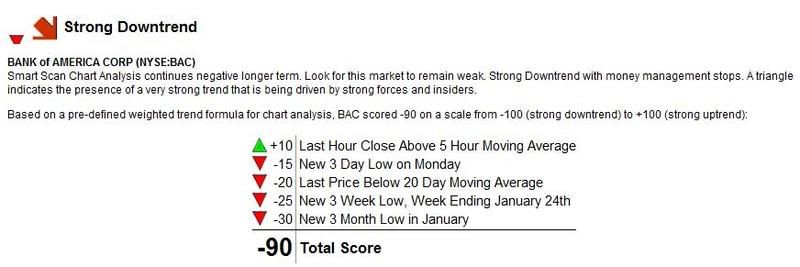

Another factor leading me feel that we're slowing up, is the slow down in financials. Financials have been leading the way in these crashes and rallies. We've seen C and BAC double since their recent lows, which has helped sent the market flying for most of March. However today, even though FAS was up, GS, MS, BAC, C, and WFC were all down, despite the strong day for the Dow. Moody's cut their rating for BAC yesterday, which probably contributed to the sluggish trading, but overall financials are losing their flare. I would expect if this were to continue, eventually we're going to see the Dow follow.

Also, we are beginning to see inflating prices for commodities and energy. Oil continues to rise, despite us heading into the low demand season for oil. Sure, I believe oil should climb back up, but I do think we're a bit overbought at the time. Gold also continues to rise. I love gold, but I feel we will see it dip well below the 900 level before inflation hits. These inflated prices lead me to believe that the market is a bit inflated in general and that we should see some selling soon. This contributes to the deflation, that I feel, will soon take our economy by the horns.

STP saw huge gains today (up over 40%), based on the new announcement that China will be subsidizing solar costs. I had mentioned STP in a few posts a while back as one to watch in the solar field, so keep your eye on that. These gains caused for some big gains for my IRA, which was nice. Speaking of IRA, E*TRADE is offering a great promotion where you can Get 100 Commission Free Trades in an E*TRADE IRA. No-fee, no minimums. Pretty awesome, check it out.

Below is a comparison chart showing the Dow movements from the 1929 crash compared to our most recent bear markets, including our current one. As you can see, and as I have stated before, our current market is tracing very close to the trends of the 1930's market. Although other recent bear markets were bad, there is not nearly the selling volume that we have seen in our current crisis. So, hopefully this can be a reminder for those feeling that we've hit bottom, that it could (and I very much believe) get a lot worse.

Tomorrow should be a very defining day for the rally. If we someone how end over that 850 number, we could see yet another week of gains for the market. However, if bears return to this market and regain control, there is big potential for a strong sell off. We are due for a sell off and I would expect our next one to be pretty significant. I am remaining cautious, with my light short position waiting for a bit more definition. We are getting close. So be alert, Happy Trading, and we'll see you tomorrow.

Miracle Closing Boost Gives Bulls Victory - GDP Expectations

Posted On Wednesday, March 25, 2009 at at 6:12 PM by Finance Fanatic Today's closing was better than the evening fireworks show displayed at the Disney theme parks. I had to double blink a few times just to make sure I was seeing the correct numbers stream across my screen. Definitely, something caused for an absolute V difference in trading, as we saw the Dow go from being down 100 points to closing up 90 in under 30 minutes. The biggest change was made, literally, the last 5 minutes of trading. As I have said before in prior posts, we should expect these violent swings more often and with more volatility. Today reminded much like the V turn around we experienced back in November. It was definitely something to see.

Today's closing was better than the evening fireworks show displayed at the Disney theme parks. I had to double blink a few times just to make sure I was seeing the correct numbers stream across my screen. Definitely, something caused for an absolute V difference in trading, as we saw the Dow go from being down 100 points to closing up 90 in under 30 minutes. The biggest change was made, literally, the last 5 minutes of trading. As I have said before in prior posts, we should expect these violent swings more often and with more volatility. Today reminded much like the V turn around we experienced back in November. It was definitely something to see.

Now my first suspicion of the closing was PPT. The sudden jolts of buying at certain dow markers was very similar to trends that PPT would create. My other theory is that some inside information may have leaked out about the GDP number tomorrow. It kind of felt like there was a party and the whole neighborhood was invited, except for me. Either way, someone is trying to ignite the market in preparations for something, and as for me, it makes me a very cautious investor. Oh yea, and over half of today's volume came from the last two hours of trading...chew on that. It is days like today that more solidify my beliefs in the coming of a strong downward spiral, as clearly there remains significant speculation in the markets. Even after another day of "perceived" strong numbers, the second half of trading (besides the last 20 minutes) was mostly selling. In my opinion, the rally is beginning to run out of steam. We're about 250 points off of my 8000 expectation that I wrote about a couple weeks ago and we could be there by tomorrow. If we break through the 8000 mark, the rally should push onward toward 8300, so keep an eye on that.

It is days like today that more solidify my beliefs in the coming of a strong downward spiral, as clearly there remains significant speculation in the markets. Even after another day of "perceived" strong numbers, the second half of trading (besides the last 20 minutes) was mostly selling. In my opinion, the rally is beginning to run out of steam. We're about 250 points off of my 8000 expectation that I wrote about a couple weeks ago and we could be there by tomorrow. If we break through the 8000 mark, the rally should push onward toward 8300, so keep an eye on that.

As we anticipated, new home sales were better than expected as were the purchase of durable goods. Once again we find ourselves comparing apples to oranges. The better comparison for such numbers is a year over year number instead of a month to month number. As it was reported that durable goods did rise 3.4% from January, from a year to year basis they are still down 28% from last year's March numbers. The same goes for the new housing sales in which we saw had a significant increase from last month's numbers. However, from a year over year standpoint, we are down over 41%! Also, they failed to highlight that the median price declined, once again, over 15%.

Obviously, there is a twisting of the definition of numbers going on to try and propel buying in the markets. There was also some problems with Government bonds and the failure for asking prices to get filled. I go into more detail of this problem in today's podcast (subscribe here), but I feel The Fed has some big motivation to keep the markets looking healthy at this point.

There is an article on CNBC today that almost directly defines the headlines we should expect to see more of in the near future, entitled, "Has Geithner Rescued America?". In the article the writer talks of all that Geithner has done and that we have him to thank for unfreezing the credit markets and turning around this economy. Talk about don't speak too soon. I am amazed that CNBC posts articles such as these on their front page. Sure, give me access to a currency printer and I will get anyone out of their current financial problems...for now. Such nonsense shows the naivety of some of these writers, all of which I take with a very, very small grain of salt.

At one point during the day, SRS and FAZ were both up over 10% which was looking quite well for me. Being only 45 minutes from close, I thought to wait until closer to the closing in order to take some profits (considering my SRS was up over 20% from when I bought it, and my FAZ option up 30%). However, little did I know the storm that was to arrive right before close and flip the market upside down. I ended up not making any trades, which could keep my little stake in short longer than I had originally wanted to hold it. I still remain up in SRS, but if this rally shoots into tomorrow, we could see it back in the mid 40's.

I anticipate the GDP number to follow suit and be "spun" as a good number. Tomorrow is a tough one to call, because honestly I could see us rallying 200 points or even sinking 200 points. Investors are becoming more and more sensitive to market conditions and the littlest breath of new developments can stir things up. We should have a good sense of where things are going in pre-market trading, but I would expect GDP to set the tone for tomorrows trading.

I believe we're getting close to the peak of this rally. I don't mind getting in late on the short side rather than getting in too early. I don't think we are done with seeing these violent green jolts, so I am still being cautious on the allocation of my funds.

So tomorrow acts as a very critical day for trading and I believe we will be able to better tell if this rally is coming to a halt or if it has some more steam left in it. April is getting closer and closer which not only could be new trends for the Dow, but also the dreaded tax season. In this type of economy, there are a lot of ways to save $$$ on tax dollars, so consult with someone. Washington Tax Service is very good, so if you Need Help with Tax Debt? Learn your options for reducing or settling tax debt. Have a Tax Attorney on your side. Get Started Today.

We'll see you all bright and early, Happy Trading.

Rally Hits Wall - More Mumbles From Gov't is Sure to Interfere

Posted On Tuesday, March 24, 2009 at at 5:48 PM by Finance Fanatic The market took a breather today after its huge hike up yesterday, as the Dow closed down 115 points after being up several different times throughout the day. I expected a rather mixed day of trading at some point either today or tomorrow, as there were many still buying to try to catch the soaring rally mixed with those selling to pocket those big profits from yesterday, which bulls hadn't seen for a while. Today, we saw even lower volume than yesterday, which really has me wondering who's trading in this market right now? It doesn't seem to be institutions or hedge funds. I believe it's a world full of day traders...at least at the moment.

The market took a breather today after its huge hike up yesterday, as the Dow closed down 115 points after being up several different times throughout the day. I expected a rather mixed day of trading at some point either today or tomorrow, as there were many still buying to try to catch the soaring rally mixed with those selling to pocket those big profits from yesterday, which bulls hadn't seen for a while. Today, we saw even lower volume than yesterday, which really has me wondering who's trading in this market right now? It doesn't seem to be institutions or hedge funds. I believe it's a world full of day traders...at least at the moment.

Sometimes, in the midst of these violent, bear market rallies, it is easy to forget that indeed we still dwell in a bear market. It was surprising for many to see the Dow end almost 1.5% today, when just two weeks ago we were down over 1.5% almost on a daily basis. It is during these times I continue to remind myself of the actual, fundamental problems that exist in the economy and rely on those measures to make investment decisions instead of what is going on with CNBC and government press conferences.

Of course there needs to be an awareness and recognition for government intervention, as history has shown us, they can cause quite an uproar, for better or for worse. So, I make a lot of my decisions, currently, based on a collage of indicators and trends. So far it's been working pretty well. Since I'm on the topic, lets discuss the important data coming forward this week.Tomorrow, we are getting new home sales reports, which are important, but I believe will take a back seat to all the other media noise going on right now(unless of course we see a really significant number). Then Thursday, we have the GDP report. This one could cause some rallying, as a lot of indicators are based on GDP levels. We saw a horrible number last time around, so it will be hard to top our previous number. However, I still think there will be more sever GDP decline in the future.

So make sure to factor those into your research, along with all the government news. President Obama spoke tonight, trying to convey his confidence in our ability to overcome this crisis. To me, the speech seemed like a campaign for his new "budget", more than a economic update. I don't see much of a response from investors based on the speech tonight, even though after hours are slightly up, but you never know what Bernie or Tiny Tim might have in their pockets.

I made yet another move today. I pulled the trigger on some more FAZ call options with my Zecco.com account (which have great option prices by the way), that I had previous bought last week. They got as low as $4 today in early trading (which is where I got in at) and I felt that this is a great price to lower my basis. Still, nothing significant, but enough to create some cheers for profits. The option closed above $5 by close, so already that's working for me. I am not worrying about this option, as the contract expires in July and as we have seen with FAZ and the past two weeks, it can cover some big ground in a little amount of time.

SRS did very well in the second half of trading, ending up over 10% today. I had a feeling there would be some rebound from its 31% loss yesterday. This is why I ended up buying some yesterday, even though I feel that there may be some rally left. If we see it up yet again tomorrow, I'll begin pocketing some profits. I can't get greedy right?

Today's halt of the rally was indeed significant, but not by much. Proving to keep the market down again tomorrow is a better sign for bears. However, even after the two day halt of buying we saw on Thursday and Friday, we saw how the market responded Monday. So tomorrow's performance could set the tone of how we're going to go into Thursday and Friday with the GDP announcement. There is still no reason for me to think this rally can't hit 8000 and above at this point, so I still remain cautious on my positions.

So that's about it for today. I just wanted to mention some things regarding the chat. I have received a few complaints about the recent content of the chat. I created the chat in order to find good a good network of people, without dealing with crap like you see on Yahoo and Google boards. Please refrain from using profanity or degrading language. I don't mind the use of avatars and would like to keep them, but please use discretion in choosing one. Refrain from using girls, offensive pictures, etc. Remember, there are many people on here during the day that are in a work place and would like a safe, chatting environment. If I do see the problems myself, I will have to resort in banning. Enough with that, just keep the conversations mature and educational and we all can continue to enjoy it as a resource. Happy Trading everyone and have a good night.

New Speculation and New Worries - Who Can Save Us Now?

Posted On Friday, March 20, 2009 at at 4:14 PM by Finance Fanatic President Obama made history last night as he became the first active President of the US to be on a late night talk show, in which he made a visit to The Tonight Show with Jay Leno as his last stop in California. Once again he was quick to describe his disgust for the corruption of Wall Street and the greed of executives. However, he was quickly able to shed that problem onto Tim Geithner, as he kept referring to them as "his" or "Tim's" problems. Good job Obama, I would be doing the same thing in this mess.

President Obama made history last night as he became the first active President of the US to be on a late night talk show, in which he made a visit to The Tonight Show with Jay Leno as his last stop in California. Once again he was quick to describe his disgust for the corruption of Wall Street and the greed of executives. However, he was quickly able to shed that problem onto Tim Geithner, as he kept referring to them as "his" or "Tim's" problems. Good job Obama, I would be doing the same thing in this mess.

After more than a week of rallying, we have now had two days straight of downward trading. Both days being led down by, once again, financials. This is why I did not get too excited to excited to jump into banks after Wednesday's Fed announcement. For even though it looked good on paper and sounded good when it was announced, the consequences of such a move that was and is being made by The Fed, is something our children will also assist in fixing. To take such extreme measures as printing/taxing multiple trillions of dollars for the sole purpose to write off debt that has no intrinsic value, but is just air and numbers on a paper, will be devastating to the economy. It may take a bit for this to come full circle, but in my opinion, we will definitely see it.

So for me, I am remaining distanced from banks for the time being and will most likely be ready for a full entry of short for banks very soon. The recent slaughtering in Treasury interest rates have actually sped up the deflationary process a bit, believe it or not. So the storm is very near in my opinion. Also, having the S&P trading at 13 times its earnings is not very reinforcing that we've reached bottom. That is a very high number for these times.In this type of environment, it's hard to pick stocks to go "long" in, as I feel most, no matter how strong a company's balance sheet is, are vulnerable to being dragged down in this market crash. However, the most healthy companies in this type of market are those that are very cash liquid. Cash is king right now.

Today, Treasure Island of Las Vegas was sold by MGM to a buyer for $775 million. That sounds like a lot of money for some, depending on which market you live in, but is a huge steal for the Las Vegas Strip, considering Treasure Island's rooms were just recently upgraded and their location is center right on the strip. A much more worn down hotel, in a worse location on the strip was sold in 2007 for $1.2 billion. The reason why the buyer of the deal was able to get Treasure Island at such discount is because they had $600 million in cash to put down on the project, in which the rest was financed in a 36 month carry from MGM. Being that MGM is in a heap of debt from their newest project, their problems became someone else's opportunity. The point is, in this market, cash is king, and those companies that are prepared with liquidity, will make a killing the next few years. For some, generations of wealth will be created from just the actions of the next few years.

With this in mind, I feel it is important to be aware of those companies that are cash liquid. Most likely, they will be able to jockey for a larger market share and position themselves as more dominant companies in their sectors (even though most are already dominant). Below are a list of the top cash liquid companies (from Seeking Alpha):

1. Exxon Mobil - (XOM), Chart, Total Cash: $32.007 Billion

2. Cisco Systems - (CSCO), Chart, Total Cash: $29.531 Billion

3. Apple - (AAPL), Chart, Total Cash: $25.647 Billion

4. Berkshire Hathaway - (BRK.A), Chart, Total Cash: $25.539 Billion

5. Pfizer Inc - (PFE), Chart, Total Cash: $23.731 Billion

6. Toyota Motor - (TM), Chart, Total Cash: $23.151 Billion

7. Microsoft - (MSFT), Chart, Total Cash: $20.298 Billion

8. Google - (GOOG), Chart, Total Cash: $15.846 Billion

9. Royal Dutch Shell - (RDS.A), Chart, Total Cash: $15.188 Billion

10. Wyeth - (WYE), Chart, Total Cash: $14.54 Billion

11. IBM - (IBM), Chart, Total Cash: $12.907 Billion

12. Johnson & Johnson - (JNJ), Chart, Total Cash: $12.809 Billion

13. Intel - (INTC), Chart, Total Cash: $11.843 Billion

14. Hewlett Packard - (HPQ), Chart, Total Cash: $11.255 Billion

15. Oracle - (ORCL), Chart, Total Cash: $10.646 Billion

Like I said, I believe everyone is vulnerable to more downside risk, especially if we reach numbers that I believe are coming for the Dow and S&P, but I would also expect some of the companies mentioned above to make some big, critical moves during this time to position them even better in the years to come. So keep an eye on them, and if you're looking to close your eyes for the next few years, and put something in your IRA or 401K, you may want to consider some of the above.

SRS and FAZ enjoyed very large gains today, which I was able to reap with my FAZ call options. However, once again I waited too long for SRS. I still think there is risk for more price slashes to both of these stocks, so I am not loading up quite yet on them.

As I said yesterday, GS has been on my radar for shorting for quite sometime now. Due to the ties that GS has with AIG, their stock has been appreciating, mostly based on the government aid that AIG has received. However, with more problems heading towards AIG, that will most likely reflect back on Goldman's stock price as well. You think it is any coincidence that Ex-Secretary Paulson decided to bailout AIG, when he used to be the Chairman for Goldman Sachs? I believe his retirement is doing much better than others. This is just one example of some of the corruption that has been going on for years now.

I still don't think we're out of the woods yet for this bear market rally. If we continue to see some more downward pressure on trading, my position could swing, but as of now, I still believe there is enough technical support to keep us going a bit longer. However, financials may be sluggish. They're in a league of their own these days. For those looking to trade options, like myself, Zecco.com offers some of the best per contract prices I've seen out there. Worth checking out.

I hope everyone has a good weekend. Next week should be another exciting one. We should expect more news from the government as spending is definitely on their mind. Happy Trading!

Bear Market Rally Catches Fire - Perfect As Planned

Posted On Thursday, March 12, 2009 at at 5:45 PM by Finance Fanatic It seems as though this bear market rally is here to stay for the time being as it made a pretty bold point to investors as the Dow closed up 240 points, getting back above 7000. We also saw the S&P close a hair above 750, which show two strong technical moves indicating that indeed we could be heading back towards that 8000 Dow level again. I would expect resistance to be built up around the 8000 level and at that point it will be very interesting to look at the deflationary models to see if we are indeed on target for capitulation.

It seems as though this bear market rally is here to stay for the time being as it made a pretty bold point to investors as the Dow closed up 240 points, getting back above 7000. We also saw the S&P close a hair above 750, which show two strong technical moves indicating that indeed we could be heading back towards that 8000 Dow level again. I would expect resistance to be built up around the 8000 level and at that point it will be very interesting to look at the deflationary models to see if we are indeed on target for capitulation.

Just as I expected in yesterday's post, we started out pretty flat in the morning. However, more and more "perceived" positive news slowly kept driving the market up until it hit fire around mid day. Financials really caught fire after several banks announced their "stable" state and that they believe they will no longer need aid from the government. The sun must be shining bright wherever they're at, because unless they're lying, that is almost impossible. However, the announcements from Citi and Bank of America helped investors feel comfortable as BAC finished up almost 19% and FAS finished up a whopping 25%. I was a little upset that I had sold a lot of my FAZ put options yesterday, but I was able to sell the rest today at a strong $18.30 a contract (It actually got over $20!). So, I'm glad that worked out, considering they expired next Friday. Talk about a close call. BAC's Market Club report score is a +60, a huge upgrade since last week (get your own symbol analyzed for free, all you need is a name and email, Click Here).Three days of rallying. Something we haven't seen since January. As I anticipated, already we are seeing everybody convert back to bottom believers and are now playing the part as the bull. As for me, I am currently in a "partly bullish" state, but am still very much a bear. As you can see from CNBC's screenshot above, they are already running the headlines "Market Looks For Glimmer of Hope." This alter in psychology is right in line with the expectations of a crash. Having people in "bear mode" like we all have been the past month (even many of the bulls), makes it hard for the market to capitulate, since many people were hedged and in cash. With the hope that we've reaching bottom, we will most likely see the volume start pouring in, and that's when the fear selling can be spawned.

I had a buy order in for SRS at $59 and unfortunately it only got down to $59.70. I may be upset I was off by 70 cents tomorrow, but I am sure I am going to have the opportunity to get it lower than $59. Even though I feel it will probably go lower, I felt it was a good price to begin a light 1st round of buying in case we have an exhaust day tomorrow and decided to take back some profits. I think it is realistic to think that we could be picking up SRS in the $40's. If that's the case, I'm loving it.

As for financials, my only current play is holding onto my BAC. I have some trailing stop losses set in case of a rapid sell off, which I don't really expect, but you can never be to sure. With all this new confidence in BAC, we could see it get back up in the $8 range. However, financials scare me the most, because they are also the most vulnerable in this market and I know of a lot of the troubles that still lie ahead for them. Their loan activity has been almost zero, which means their profits are very low (despite what they say). With more and more debt coming due and becoming delinquent, that will most likely require a significant amount of government aid. So I'm not going anymore long in financials now, and definitely not buying FAZ yet, although it's very tempting at $40 isn't it?

I think the trend will continue upward for the month of March, but we will definitely have our big down days still, so there is still value in trying to play the bumps for the leverage etfs. It just hurts when you play it the wrong way like on days like today for FAZ players. Ending the week with another strong up day will definitely keep that rally spark going into next week. In my opinion, THIS IS NOT THE BOTTOM, not even close. So be careful if you're convinced to load up on all the industrials now for the long haul.

Due to a number of people wanting the podcast, I am in the process of getting it set up. I will give more details when I finalize it. So tomorrow may be another mixed trading day, considering we have now spent 3 days straight buying. I will be ready to pull the trigger on some shorts if they take another pounce tomorrow, but only a light 1st round buying. Have a great night everyone, happy trading and see you tomorrow.

After Many Ups and Downs, Dow Squeaks a Green Close

Posted On Wednesday, March 11, 2009 at at 4:54 PM by Finance Fanatic It is after days like today that I am very glad that I am in the position I am currently in with my portfolio (mostly cash), as I would have most likely had an ulcer with all the volatility we saw today. We had about 8 color changes with the DOW (from green to red) and both sides seemed to be gaining momentum at different points throughout the trading day. The market opened with financials soaring, having BAC over 10% again, as well as FAS up close to 15%. I was oh so close at that point to selling the rest of my FAZ put options as they were up another 35%. I, however, held off thanks to greed and missed the high point to sell. The opening rally slowly started inching its way down until it finally dipped into the red around mid-day. At one point we saw the market almost down 60 points, when it quickly shot back up into the green. After what looked like it was going to be a fairly strong close, a big sell off came right before close, leaving the DOW just slightly up just about 4 points for the day. What a ride. You have to pay $70 bucks for that at Disneyland.

It is after days like today that I am very glad that I am in the position I am currently in with my portfolio (mostly cash), as I would have most likely had an ulcer with all the volatility we saw today. We had about 8 color changes with the DOW (from green to red) and both sides seemed to be gaining momentum at different points throughout the trading day. The market opened with financials soaring, having BAC over 10% again, as well as FAS up close to 15%. I was oh so close at that point to selling the rest of my FAZ put options as they were up another 35%. I, however, held off thanks to greed and missed the high point to sell. The opening rally slowly started inching its way down until it finally dipped into the red around mid-day. At one point we saw the market almost down 60 points, when it quickly shot back up into the green. After what looked like it was going to be a fairly strong close, a big sell off came right before close, leaving the DOW just slightly up just about 4 points for the day. What a ride. You have to pay $70 bucks for that at Disneyland.

First, the goods for the bulls. This is now two consecutive days of a green closing, which we have not seen for weeks now. Although it did not close near its earlier highs, just having two consecutive green days, especially following the massive rally we had yesterday is a good sign for bulls and that this bounce may continue a bit.

Also, financials stay relatively strong throughout the whole day. BAC did trade in the red for some of the day, but financials got a big push towards the end of trading as there may be a temporary return of confidence for the banks. I wouldn't expect that to last long and I'll explain why later on.Techincals still lie with the bull. From a technical standpoint, the market is pushing for a rally. Sure this could easily be over ruled by enough bad news, but it is always a nice extra bonus when you have technicals working for you rather than against you.

Now the good news for the bears (the shortened version). If this rally even does continue, which it may not, it most likely will not last long. Although, many people may have regained some confidence in the banking systems, that may be short lived due to the increasing problems that is heading for banks. Recent news shows some slowing of losses for the banks, which is helping in the rally. Well, of course! The government has spent hundreds of billions of dollars to help absorb those losses. After all the help Freddie has been given, they announced that they are wanting another $30 billion from the Treasury to help balance out their quarterly $24 billion loss.

Not only that, but we have only endured the 1st round of problems for banks. Be assured that the next round is soon following and could have an even worse effect than the sub-prime crisis did. With the derivatives, credit default swaps, and prime loans that will be plaguing us this next round, be sure the the days of asking for help funds are not over. Also, I don't plan on trading JP Morgan's stock anytime soon, even though they have held up pretty well, as they hold a far greater amount of derivatives than the smaller banks such as Citi and Bank of America. So, although financials seem to be gaining some ground, I don't plan that to last very long. Which is why I will be out of my financial longs very shortly.

Another positive for bears was that they showed some aggression at close today. There was definitely some selling motivation going into close, as I feel there were a lot of people who did not want to hold their longs over night. I don't know if it's because of the meeting for Mark to Market (which I don't see them doing much), but in any case the market closed with downward momentum.

I did end up selling most of my FAZ put options during the last run up before close. Although it wasn't at its peak of the day, I made off well enough and am glad to not be in as heavy going into tomorrow. I am holding onto BAC for kicks in giggles, but besides that, I am still waiting. I know some of you fell I am being "too safe", but if indeed we continue to head in the direction I believe we're heading, I believe I will be set up for a very big opportunity to make some solid profits on the short side. It is just like a chess game and I am setting up my pieces. Instead of trying to guess right now, and risk getting killed, I am making smaller moves and waiting for the right time. So you all will be the first to know when that is for me. Check out FAS Market Club report score of -75, which is a pretty big jump from it's previous -100 (get your own symbol analyzed for free, all you need is a name and email, Click Here).

The big question tomorrow is how we respond. I think tomorrow may be another "defining day" where, we may start out flat and bouncing around back and forth, but one direction will take control by close and we should have a pretty significant close either up or down. The big question, is which way? The opening should show us a lot, and if we do indeed open up again, I will probably sell a lot of the longs I have left and be freed from that burdern.

Also, remember, we're creeping up on tax season, and I'm sure all of you look forward to filing these profits as much as I am (dang you Uncle Sam). Anyway, if you have procrastinated like I have, you can file free at H&R Block and find a variety of services there. However, you might as well as pay a bit extra for their premium services, it saves a lot of time! So, File for FREE at hrblock.com and learn more about it.

I have been thinking about shooting out a podcast a few times a week, because there are many different elements about that market that I never get to discussing on this site, due to the length of the posts, and I would much rather speak it. If this is something that you think would be worthwhile, shoot me a quick email at crashmarketstocks@gmail.com and let me know if you'd be interested. If there are enough, I'll get it set up. Have a good evening, Happy Trading, and we'll see you tomorrow.

New S&P Lows in 13 Years - Negative Sentiment Remains

Posted On Monday, March 2, 2009 at at 5:43 PM by Finance Fanatic Any hopes for new beginnings for the stock market this week was quickly put to rest as the markets opened down and didn't manage to get anywhere near green territory throughout the duration of trading hours. The Dow closed under 7,000 at 6,763 and the S&P closed just above the scary line of 700, being the lowest in 13 years.

Any hopes for new beginnings for the stock market this week was quickly put to rest as the markets opened down and didn't manage to get anywhere near green territory throughout the duration of trading hours. The Dow closed under 7,000 at 6,763 and the S&P closed just above the scary line of 700, being the lowest in 13 years.

Starting the week on such a bad note can not be good for traders looking for green in the markets. With unemployment news coming this Friday, starting the week on such a bad note sets a negative tone to a week with what looks to have a bad ending. No doubt, having AIG post the biggest losses ever caused for negative sentiment to last throughout the day. We knew it was coming last week, so I don't know why everyone was so surprised. However, amidst the tumultuous turmoil, my schizophrenic personality still remains. I have indeed been doing pretty well during these down trading days, just not as well as I would have a week ago, when I was still in a lot of my short positions. Even though it seems as though nothing but bad news is swimming around us, I do not feel this is the time for me to push the chips into the short side. Here are a couple reasons why:Deflation

Although we have indeed experienced deflation, we have not to the degree I think we will. A deflationary down spiral was a key factor leading markets down during the crash of the Great Depression. During the crash between 1929-1932, although a big drop happened in 1929, the greatest damage by far was between 1930-1932 following the deflationary down spiral. So, even though it seems that we are in the worst of the storm, I still feel there may be worse times ahead.

Markets Oversold

There are strong technical indicators that point to the markets being oversold. Just today, 97% of volume was down volume. This is a ridiculous number and, historically, is usually followed by a strong rebound rally. Markets did put up a fight at their strong resistance points, however, faulty government plans and strong negative commentary has helped to push markets further down. Just as markets were being over bought towards the end of the year due to these factors, we are experiencing similar trends on the selling side.

This is not to say I don't believe we could keeping selling our way into a crash. Of course that could happen. I just feel that we are not quite there yet. I try not to listen to the banter of commentators and analysts, as they waffle back and forth on positions quicker than John Kerry did. It is amazing to see how quickly they will change their position of whether we've hit bottom or we've got a ways to go. I blame them for a lot of the clouding of judgement for people to make logical, sound investments. However, some of you may feel the same of my "banter", but hopefully you know these are truly my own feelings and thoughts and that of course the market moves at its own desires. I just try to tell it how it is.

People are saying that the S&P closing over 700 todayis a big hold for technicals and shows some strength. I don't know how much I buy into that, as whether it closed at 705 and 695, it was a horrible day for the market. I do think there is potential for a rally at some point this week, but I don't feel it will have much to do with the S&P closing above 700.

Then there is unemployment. Do you remember playing the game Monopoly and approaching that part of the board that was densely owned by your opponent, in which he/she had also put a variety of hotels and houses on the different properties and just praying that you rolled that number that sailed you right through that section or at least landed you on a chance? Well, that's kind of how I feel approaching unemployment. We know it's coming. I feel it is going to bad, as it has been lately and investors are just hoping that somehow we can "roll" right past it this month and hopefully move on until the next announcement. Well, I don't know if that will be the case, but I thought I would share that metaphor. At any rate, I expect there to be negativity with the number.

So I am continuing to wait patiently for a time I am comfortable to take a more aggressive position on the short side. We saw great gains from all the shorts today and are seeing more love roll around for FXP, which is always good to see. Problems seem to be magnifying in Asia, which could bode well for FXP. Believe me, I would like nothing more but to be in a strong short position, but if indeed we are due for a bear market rally, we have seen how fierce they can be and how quickly they can kill profits from the short side. I do not wish to be the "Dump and Dump", single minded bear activist and say nothing but bad things about the market. I try to make money where the momentum is, and right now I see it on the bear side, but with some short term risk of a rally.

So, on that note, have a good night, Happy Trading and we'll see you all tomorrow.

Get your stock symbol's trend analyzed for free, Click Here

Banks Are Back - Investors Finally See Green In Trading

Posted On Tuesday, February 24, 2009 at at 6:03 PM by Finance Fanatic Well, our week long streak of bear hungry selling was finally put to an end on Tuesday as the Dow closed up 236 points (3.32%). Indeed we were overdue for a good rally as I was actually expecting this rally to hit a couple of days ago. Well, it's here now and it will be very interesting to see the strength of it. Will it just be a quick rebound for profit taking, or may we see some continual recovery over the next couple of weeks? A lot has to do with fate of the banks and how the government manages news that continues to hit the public.

Well, our week long streak of bear hungry selling was finally put to an end on Tuesday as the Dow closed up 236 points (3.32%). Indeed we were overdue for a good rally as I was actually expecting this rally to hit a couple of days ago. Well, it's here now and it will be very interesting to see the strength of it. Will it just be a quick rebound for profit taking, or may we see some continual recovery over the next couple of weeks? A lot has to do with fate of the banks and how the government manages news that continues to hit the public.

Many people attribute Bernanke's remarks to big run up in financials. However, I don't think he had much to do with it. In my opinion, the market was oversold, and was just waiting for a bit of a push to get the engine started. I see it as a technical rebound, one of which may stick around for a while, at least that is what I am hoping for. The selling volume was very low and the number of new lows were minimal, which was a sign that we were quite oversold.

After selling a lot of my gold options last week, I went ahead and got out of gold completely this morning. I do feel that gold still has some more up to go, but I feel that it is vulnerable to some losses here in the short term. The market may regain some of its footing this month, which could bring gold down a bit. I plan on getting back in if we see gold get back down to $900 levels, as I feel inflation will be our next beast to slay after we spend our way out of our current problems. 1990's Japan, here we come. However, my first ride was gold was very profitable for me and I enjoyed the ride.

If you haven't already, make sure to check out the 5 Trends Video discussing the momentum of the major 5 sectors investors are watching. It gives good tips about oil, gold and other sectors. Oil still continues to be on my radar, but indicators have not confirmed a bottom yet, so I am still waiting for a good entry. I don't think there is much more downside for oil, but I can wait.As we saw today, these violent bear market rallies can take back profits just as quickly as they are given. FAZ and FAS are both very capable to take some serious slashes at your portfolio if you are caught on the wrong side of the rally, as some of you may have found out today. I plan to be very careful the next couple weeks with the leveraged ETFs. Having the Dow close under the 2002 lows yesterday and the S&P under the November lows confirmed that we are indeed still in a bear market. However, the rebound we received today also confirms that we may indeed be starting another bear market rally. So what does this mean?

This is my plan for coming weeks. I am keeping my FAZ Put options (which is much like owning FAS, just more volatile) along with my remainder of SRS (which currently has a Market Club report trend score of +60. Get your own symbol analyzed for free, all you need is a name and email, Click Here) and SKF, which is not much. Besides my energy stocks and miscellaneous tech stocks, I will be patiently waiting. I am going to be very careful on the short side, as we may see a 15-20% rebound with this rally over the next few weeks. I may make some suttle long moves to take advantage of the rally, but not much. My real goal is to get the shorts back to a point where I can enter at some really low prices and be prepared for the big crash, which I still believe is coming. If we do indeed rally, many will believe the worst is done and that we could be starting the bull back up. Be very careful of what moves you make. As for myself, I feel very strongly that is not the case and will wait until the time is right to get back in heavily in the short position. However, I will be patient.

We may not rally from this point, but we have a lot of indicators that we are oversold at the moment and that we could indeed see a strong bump in the bear market. Like today, these rallies could be violent, so watch out. I will try to make it on chat to keep you all posted daily on my moves.

I am very excited for the times ahead. I believe the opportunity is slowly presenting itself to make a lot of money in this market. It's hard for me to fight off my compulsive nature sometimes, but deep down I believe it will payoff for me. So try not to worry if we do indeed see some green over the next few weeks and just think of it as an opportunity to see good prices for the shorts. At least that's my plan.

Tomorrow, we'll talk about Obama's speech and other new factors as they come up. One more week for the $200 Lending Club promotion. If you haven't checked it out, make sure you do, click here for details. So far, my 10.5% return on investment with them has been picture perfect. It could be a great place to park some cash. Have a good night everyone, Happy Trading and we'll see you tomorrow.

Under 7500 - Here To Stay?

Posted On Thursday, February 19, 2009 at at 3:48 PM by Finance FanaticAnother critical barrier has been surpassed today on the path downward, as we closed under the critical 7500 number, which has been known to be the rubber bottom in previous months. A move to keep us under 7500 would be a big victory for bears going into the weekend, especially after enduring the several new mortgage announcements we have received this week. So we'll see if the bears have it in them to fight one more day.

I do regret having sold some of my SRS at $80 as there is definitely wind behind seller's sails. At this rate, I believe we could see SRS getting into the $100's very shortly. I have not completely abandoned my fears of a rebound rally, but I can definitely see a strong seller's market right now. Tomorrow will act as a critical day, seeing whether or not we can maintain under 7500. By doing so, I will probably find myself buying some options of SKF, SRS, and FAZ.

Oil has been on my radar the last couple months. As we saw today from DXO (up almost 15%) and other oil funds, there is definitely upside there. I recently was introduced to a distant in-law, who has quite extensive experience in the oil sector. Robert Dupree has a Masters Degree in Economics and, for most his career (30+ years), was engaged in developing and managing systems in support of exploration for oil and gas for Amoco. Along the way he was able to learn certain truths about the industry that I felt very applicable to the site and worth sharing. The following are excerpts from what he said from our conversation:"I don't think that fundamentals had much to do with the spike in oil prices last year. I think that oil will play a significant role for decades to come. Our reliance on oil will persist for decades under our existing infrastructure and I don't see significant changes ahead for it. I would be inclined to invest as much in oil services as much as in actual energy companies. Companies in the service segment such as Weatherford or Schlumberger are worth investigating. They're being hit right now but their type of service will be vital for quite some time.

Regarding oil prices, they are run mainly by a cartel which must balance supply with the need for revenue. They cannot afford to be as political with oil as they were in the 1970s and they know it. The biggest factors that might affect oil prices are of the "Black Swan" nature which cannot be predicted. They would likely come from political events that could disrupt supply.

The romantic thrill of drilling and making a major discovery is still in the public's psyche. It's akin to the lust for gold. Politicians play upon it and the oil industry uses those offshore rigs as much for image as for real production. The oil industry is not lukewarm about more offshore drilling in the U.S. There is probably less than a year's supply of oil for the U.S. yet to be tapped in ANWAR and off of our coasts. Also, the lead time to manufacture the offshore rigs and put the infrastructure in place is at least a decade. What you have to watch for is new guys who might bid to acquire those leases. When Bush opened drilling in Utah, for example, the operators that came in were not very nice guys. "

As you can see, there is a lot going on behind the scenes that most people never become aware of, in dealing with oil. I'm getting very close to pulling the trigger on some oil stocks and ETFs. Not just necessarily for a short term gain, but for some long term potential. It is clear that it is still our biggest natural resource demand and is one the hardest, so far, to duplicate. I want to say thanks to Robert for taking the time out to share his thoughts with me and all of you and look forward to continuing our communication. I will be looking for an entry point for DXO shortly, which has a Market Club report score of -90 (get your own symbol analyzed for free, all you need is a name and email, Click Here), but I feel more and more oil has settled near its bottom. Also, OIH or even shorting DUG (Ultra Short Oil ETF) could be in my near future.

Tech is by far holding up better than the rest at this point. I have no faith in any financial institution at this point and don't even trust playing them as a short term bump anymore. I am all out of my FAS now and don't see myself getting back into them anytime soon. If I need to play the long side, I will look to companies in tech or even insurance companies. A breath of nationalization could send banks soaring down on any given day. I will, however, sit on some FAZ or SKF to try and take advantage of the speculative worries.

Keep your eye on the CPI number tomorrow. Expectations are a 0.3% change, which I would be very surprised to see us reach. A bad enough number here, coupled with more aggressive selling, could end the week on a strong selling note. As you can see from below, a force definitely wanted the market to rally right before close, but seller's would not back down. We are in a very different environment than we were in November.

Another critical day tomorrow. I plan to be up early and ready. It's always tough deciding whether to make moves on Friday, but tomorrow may be a day I do. I'll look for you guys on chat tomorrow and keep you posted. Also, yesterday I was asked to write a guest post for INO's Trading blog. So being my "bear" self, I decided to go with a bear topic. You can read it here. Remember to Sign up for the $200 promotion for Lending Club, click here for more info. Happy Trading.

Market Retests Lows... Market Crash?

Posted On Tuesday, February 17, 2009 at at 5:54 PM by Finance Fanatic "Owners of capital will stimulate the working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks, which will have to be nationalized, and the State will have to take the road which will eventually lead to communism"

"Owners of capital will stimulate the working class to buy more and more of expensive goods, houses and technology, pushing them to take more and more expensive credits, until their debt becomes unbearable. The unpaid debt will lead to bankruptcy of banks, which will have to be nationalized, and the State will have to take the road which will eventually lead to communism"

The above quote has been getting a lot of press around the internet, saying that it is a direct quote from Karl Marx, from his works Das Kapital written in 1867. After looking into it further, it is indeed a Hoax and never was in his writings. I did, however, still find the quote applicable to our current markets and actually agree that we are heading closer and closer to "communism" everyday. So we will see how that all plays out.

What a day, right? I was able to share in today's decay with several of you on the chat up until close and marveled at it's selling force, especially closing out the day. I kept waiting for one of those mid-day profit taking bumps to bring the market back up, but the sellers kept dragging it down. My Zecco.com account was bleeding green all day as my shorts were soaring and even some of my longs.

A penny stock, alternative oil (Origin Oil [OOIL]) and R&D company I invested in early, got a huge bump today (+20%) as they announced that they were partnering with the US Department of Energy in plans to work together on future projects. The company is working on the process of growing and transferring Algae to oil. Keep an eye on that one for you penny stock lovers, as it could continue to go up the next couple weeks. If you are interested in a bulk investment, email me (crashmarketstocks@gmail.com) and I can put you in touch with the CEO. The DOE is a great partnership to have going into the future. See www.originoil.com for more.We finally saw the S&P close under 800 today, which is a pretty big technical move. It will be interesting to see if the market is able to sustain these numbers at this time. From a technical standpoint, we aren't seeing the set up of a crash. We are very close, just not quite there. The deflationary down-spiraling is not quite there, from a technical standpoint, for me to be comfortable to take a full position in short. In fact, technicals are actually pointing towards a good possibility of a rebound rally.

As you remember back in November when we reached our previous lows, we saw the market pull a huge 180 degree turn, spurring a 20% rally for the Dow over the next couple months. I do not want to get caught fully short on another 20% Dow rally (as some of you know, is not pretty), which we are very capable of. Indeed, if we do rally back up strongly, the deflationary technicals will be much more favorable for a massive sell off crash. At that point, most would believe the bear is dead and a much more devastating crash could very well happen. At that point, I will plan to unfold a very aggressive short position. This is the technical analysis I have gotten from analysts and the numbers so they are not guaranteed. If indeed we blow past the bottom and maintain there, obviously we will have overruled the technical side. But I will wait and see.

President Obama plans to speak tomorrow concerning his new plan to help slow the massive foreclosures that is plaguing the US. With the right kind of announcement, this could indeed be the action that causes the sharp turn around and propels the market on another bear market rally. However, failure to impress the public on this announcement, could indeed be the bullet that sinks the sub. So, tomorrow acts as a very critical day for investors and what we should expect from the market the next couple weeks.

Tomorrow I plan on waking up early, and buying into some decent, volatile longs to hedge against my shorts. I plan on buying these with a lot of the profits I have made the past couple of trading days off the shorts. One crazy long play I have been eyeballing is Las Vegas Sands Corp (LVS). The Market Club report is -100 (get your own symbol analyzed for free, all you need is a name and email, Click Here), but it is nearing its 52-week low again and has been known to bounce off it. It's a gamble, but if a rally is in our sights, it's bound to get some very big gains. That is one of my more riskier plays, but I plan on going in and buying some longs tomorrow.

The autos are causing noise again claiming they may need $30 to $60 billion more to sustain and not go bankrupt. It will be interesting to see how our government reacts this time and if they are as forgiving. I don't see this causing much noise in the market tomorrow, but is definitely worth noting.

So get a good nights sleep tonight. Be up bright and early and get ready for some action. Either way it should be a violent day, the market is getting antsy. Remember, 1 more week for the $200 Lending Club promotion, see here for more! Happy Trading.

Stimulus Fuels End of Day Buying - "Rumor Has It"

Posted On Wednesday, February 11, 2009 at at 2:10 PM by Finance Fanatic The lovely paradox we have been discussing the past few days of "buy the rumor, sell the news" has been getting thrown around the media, saying that this was the sole purpose for the big sell off we received yesterday. Come on...Sure there was indeed some of that factored in, since much of the buying on Friday and Monday were due to the "rumors" of the stimulus and new bank plan. However, Geithner also went up and disappointed Americans with his lack of answers for the direction the Treasury plans to head in these coming months. I believe Americans are slowly beginning to realize that there is a lot more talk with these politicians than walk.

The lovely paradox we have been discussing the past few days of "buy the rumor, sell the news" has been getting thrown around the media, saying that this was the sole purpose for the big sell off we received yesterday. Come on...Sure there was indeed some of that factored in, since much of the buying on Friday and Monday were due to the "rumors" of the stimulus and new bank plan. However, Geithner also went up and disappointed Americans with his lack of answers for the direction the Treasury plans to head in these coming months. I believe Americans are slowly beginning to realize that there is a lot more talk with these politicians than walk.

It is a very interesting week we have on our hands. After these plans shake out, there is really not much left for the government to unfold. I believe it is after the failure of this next attempt (my personal thoughts, obviously), that we will most likely see a market crash and a new bottom set. Investors are getting more desperate and losing more money, and it is fear that usually leads to the mass selling of a crash. As for now, it seems that stimulus hopes was able to keep the market green for today, but once again, we will see how long that green can maintain. We saw the Dow stay below 8000 two days in a row, which has not happened in a while and we’re heading into retail sales announcements for tomorrow, which could be pretty bad.Strangely enough, there has actually been a reduction in shorting the retailers going into the announcement tomorrow. It seems as if some people feel that they are low enough and don’t want to gamble with them anymore. Shares short in Wal-Mart (WMT) were down 21% to 40.3 million shares. The short interest in Target (TGT) lowered 15% to 39.1 million. Shares short in Home Depot (HD) were also off 8% to 59.8 million. In addition, the short interest in Johnson & Johnson (JNJ) fell 24% to 25.6 million and shares short in P&G (PG) dropped 17% to 30.3 million. Shares short in Coke (KO) lowered 20% to 20.5 million.

The short play on financials was a mixed one. Short shares for Wells Fargo (WFC), were off 11% to 111.7 million. However, the short interest in Citigroup (C) was up 11% to 181 million. GE’s (GE) short interest were higher 17% to 168 million, as it has had increasing concerns. Below is the market trend analysis on WFC (get your own symbol analyzed for free, all you need is a name and email, Click Here).

So indeed it does seem that there was some money moved out of the short side for the time being, but this does not affect my desire to remain mostly short right now. As I did not make many moves today and I still remain mostly in cash and in shorts, I am still waiting for the time that looks good to move in more. I think retail numbers have the potential to be disastrous. If by chance this number does go overlooked, thanks to more bailout fluff, I would expect it to catch up with us much like unemployment did. So, if we stay green tomorrow, shorts here I come.

The government reached an agreement on price for the stimulus at $789 billion. They expect this powerhouse package to create up to 3.5 million jobs over the next 2 years. When doing the numbers, that means that for every position, it averages to be $223,000 per job. Sure, this number is to be over a period of time, but I think there are a lot of Americans who are willing to work for less than $60,000, let alone $223,000.

Also, the government plans to have their plan of new “transparency” with the banks. Beginning next week, the top 20 financial institutions will be submitting a monthly TARP form, hoping to shine light of how much money they are receiving and where the money is going. I know they think of this as a transparency play, but this can also be a bad move by the government. I don’t know if the public is ready to handle some of numbers these banks are going to throw out. It could just make matters worse for banks and lower the consumer’s confidence. So we’ll see how that goes. Below is an example of the form they will be using.

So, there still seems to be more uncertainty out there. The markets are still very vulnerable to violent movements either way. The day panned out much the way I expected it to, however, I did think financials got a bit more love than was due to them, and I was bummed to see SRS end in the red after the strong start this morning. That is slowly becoming a trend for SRS… Buy before close, sell in the morning. So tomorrow will be interesting. I plan to get into more shorts, whether it is red or green, pending some new announcement.

Remember, if you haven’t already, to check out the Lending Club promotion. $200 dollar give away in two weeks. All you need to do is sign up, no money needed, click here to find out more. I’m just trying to give people a chance to check them out. Also, for those paying too much at home or at the office for phone bills, I found these guys a couple days ago and their prices and service beats most anyone out there, get the free trail -Try RingCentral Fax FREE for 30 days . Find me on chat tonight and tomorrow, Happy Trading.

PS – I’m loving my Gold right now, and inflation isn’t even here yet! (GDX, GLD and DGP)

No More "Bad Bank", But More Bad For Banks

Posted On Monday, February 9, 2009 at at 6:14 PM by Finance Fanatic It seems as if Geithner and his crew were unable to get a feasible "bad bank" plan together before tomorrow, as most recent news says that the plan will not be included in tomorrow's announcement, but that an alternative process of helping to buy up toxic debt would still be in place. This is not that all surprising, as I had expressed my doubts about their ability to execute such a plan without having to nationalize major banks when they first announced the possibility of the plan. It seems that they are going to take a more "private equity" approach to buying up the toxic debt and that anywhere from $50 to $100 billion of the remaining TARP funds are evidently being set aside for foreclosures. Surely, this is nowhere the number it needs to be, as I recently discussed the $650 billion deficit in loans due this year compared to what is available. And that is for just this year for commercial real estate! So, I would expect Geithner and company to be back at the drawing board very shortly. So, keep an eye out tomorrow at 11 AM, Eastern, for Mr. Geithner and his bag of tricks.

It seems as if Geithner and his crew were unable to get a feasible "bad bank" plan together before tomorrow, as most recent news says that the plan will not be included in tomorrow's announcement, but that an alternative process of helping to buy up toxic debt would still be in place. This is not that all surprising, as I had expressed my doubts about their ability to execute such a plan without having to nationalize major banks when they first announced the possibility of the plan. It seems that they are going to take a more "private equity" approach to buying up the toxic debt and that anywhere from $50 to $100 billion of the remaining TARP funds are evidently being set aside for foreclosures. Surely, this is nowhere the number it needs to be, as I recently discussed the $650 billion deficit in loans due this year compared to what is available. And that is for just this year for commercial real estate! So, I would expect Geithner and company to be back at the drawing board very shortly. So, keep an eye out tomorrow at 11 AM, Eastern, for Mr. Geithner and his bag of tricks.

As I said on the chat earlier today, it was hard for me to make any moves today, as I can see the market reacting three ways to the announcements. First, such news could build on the excitement of what we have already seen the last two days and send the market up another 200 points. Or, we could see a negative reaction and profit taking from investors as the Geithner breaks down his plan. If indeed there are "questionable" policies, we could see some major bashing from analysts pushing markets down. Last, which I feel could easily happen, is a strong opening until Geithner, with a pretty strong sell off following the remarks. Geithner will be doing a interview with CNBC directly following the 11 AM conference, so be aware of that. Either way, I do feel there is going to be some exhaust selling and profit taking this week as the news is released and we all wake up in the same beds, driving the same cars, with the same credit card bills.

So, all I did today was sell my BAC (see the market trend analysis for BAC below, get your own symbol analyzed for free, all you need is a name and email, Click Here). Yes, it may go up tomorrow, especially in early trading, but come one, I made a 28% profit in 2 days off a bank I don't even know will exist in a year. I cannot be greedy. So, I did sell that and remain in cash from the proceeds. I now own a bulk of shares from my Thursday's FAS purchase and then my Friday's SKF purchase. My plan with them is to set a 5% stop loss on my FAS and a 10% stop loss on my SKF. Indeed, I feel that SKF could be down in the morning, but up by close. I personally feel that if FAS is down to begin the day, it has nowhere to go but more down before close. So, we'll see how it goes, but that's my plan. I just don't see a lot of hope for the banks here in the short term. America's debt accumulation is estimated to be at $294 trillion! Compare that to the $700 billion TARP money, and it's 420 times larger! Couple that with the wealth destruction we have experienced this past year and we have a very, very large hole to fill. So I remain pessimistic.

My QAADB, April expiring Apple call options have been very good the past week as tech has received a huge bounce. I don't know how long I can see this tech dream going, but I don't think I will roll the dice much longer. I plan on selling them before the end of the week. Who said Apple is nothing without Jobs?So I plan to pick up the pace on my portfolio as soon as we see some direction with all these announcements. Remember, we may also have the final vote in for the stimulus as soon as tomorrow, which I think is sure to pass. I don't think Obama would have put it to vote unless he knew he had all the votes. That can also be an influential factor on the market.

Like I have said before, I am hesitant to go all the way short in the current state we're in. I do believe that our market is close, but some things need to be worked out. I feel that after people once again realize that all this spending is not creating the jobs promised, the market will react more violently in the opposite direction. So I will remain patient and wait for deflation and increasing debt show more of its ugly face.

Just a reminder of two more weeks for the $200 Lending Club promotion. You don't need to invest money in it, just sign up. Click here for more details. Have a good evening everyone, I'll jump on chat later tonight and tomorrow morning. Happy Trading.

Mixed Day of Trading - Dow Closes Under 8000

Posted On Monday, February 2, 2009 at at 3:44 PM by Finance Fanatic What an interesting day it was. Today, trading felt like a boat being out in the middle of the ocean looking for wind to take it to shore, but the direction to head is unknown (hence the chosen picture for today). Volume was in the marketplace today, it just seemed like investors couldn't make up their mind of what they wanted to buy and sell. It was a very weird day of trading. The Dow was down 64 points, but the NASDAQ was up 18 points. Some banks were up, some were down big. Some shorts were up, some were down. I was even questioning what moves to make as nothing seemed to be getting wind behind their sails. The market did manage to close under 8000, which is a pretty big technical move, however, the S&P stayed over 820. As the market was looking to be down spiraling, there looked to be some sort of force (can you say PPT?) that came in right before close and tried pushed the market back up, but eventually lost the fight.

What an interesting day it was. Today, trading felt like a boat being out in the middle of the ocean looking for wind to take it to shore, but the direction to head is unknown (hence the chosen picture for today). Volume was in the marketplace today, it just seemed like investors couldn't make up their mind of what they wanted to buy and sell. It was a very weird day of trading. The Dow was down 64 points, but the NASDAQ was up 18 points. Some banks were up, some were down big. Some shorts were up, some were down. I was even questioning what moves to make as nothing seemed to be getting wind behind their sails. The market did manage to close under 8000, which is a pretty big technical move, however, the S&P stayed over 820. As the market was looking to be down spiraling, there looked to be some sort of force (can you say PPT?) that came in right before close and tried pushed the market back up, but eventually lost the fight.

With another down day of trading for Bank of America it made it real tempting for me to pick up some shares, especially with the good possibility of some more bailout news this week (see today's market trend report below, get your own symbol analyzed for free, all you need is a name and email, Click Here). However, there were more forces pushing me away from the buy button for the time being. Sure, I may regret not having bought long in the next few days, but here are a few reasons why I chose to pass today.

Unemployment Data

I believe this month will be our worst month so far. Macy's announced their plans of cutting thousands of jobs. These announcements are going to keep continuing, most likely, at a more rapid rate. With this Friday being unemployment date, I thought I should steer clear for the time being.

Continued Bad Earnings

The only good news from earnings now a days is "beating market expectation." Aside from a few exceptions, no one is posting positive earnings these days and the cut that has been placed to last years profits has been devastating for many companies. Scandisk reported earnings today which initially sent the stock up. However, after looking at the results for a second time, I think investors realized it was not as good they had originally though, as the stock is down over 16% in after hours.

Forced Selling