Rally Hits Wall - More Mumbles From Gov't is Sure to Interfere

Posted On Tuesday, March 24, 2009 at at 5:48 PM by Finance Fanatic The market took a breather today after its huge hike up yesterday, as the Dow closed down 115 points after being up several different times throughout the day. I expected a rather mixed day of trading at some point either today or tomorrow, as there were many still buying to try to catch the soaring rally mixed with those selling to pocket those big profits from yesterday, which bulls hadn't seen for a while. Today, we saw even lower volume than yesterday, which really has me wondering who's trading in this market right now? It doesn't seem to be institutions or hedge funds. I believe it's a world full of day traders...at least at the moment.

The market took a breather today after its huge hike up yesterday, as the Dow closed down 115 points after being up several different times throughout the day. I expected a rather mixed day of trading at some point either today or tomorrow, as there were many still buying to try to catch the soaring rally mixed with those selling to pocket those big profits from yesterday, which bulls hadn't seen for a while. Today, we saw even lower volume than yesterday, which really has me wondering who's trading in this market right now? It doesn't seem to be institutions or hedge funds. I believe it's a world full of day traders...at least at the moment.

Sometimes, in the midst of these violent, bear market rallies, it is easy to forget that indeed we still dwell in a bear market. It was surprising for many to see the Dow end almost 1.5% today, when just two weeks ago we were down over 1.5% almost on a daily basis. It is during these times I continue to remind myself of the actual, fundamental problems that exist in the economy and rely on those measures to make investment decisions instead of what is going on with CNBC and government press conferences.

Of course there needs to be an awareness and recognition for government intervention, as history has shown us, they can cause quite an uproar, for better or for worse. So, I make a lot of my decisions, currently, based on a collage of indicators and trends. So far it's been working pretty well. Since I'm on the topic, lets discuss the important data coming forward this week.Tomorrow, we are getting new home sales reports, which are important, but I believe will take a back seat to all the other media noise going on right now(unless of course we see a really significant number). Then Thursday, we have the GDP report. This one could cause some rallying, as a lot of indicators are based on GDP levels. We saw a horrible number last time around, so it will be hard to top our previous number. However, I still think there will be more sever GDP decline in the future.

So make sure to factor those into your research, along with all the government news. President Obama spoke tonight, trying to convey his confidence in our ability to overcome this crisis. To me, the speech seemed like a campaign for his new "budget", more than a economic update. I don't see much of a response from investors based on the speech tonight, even though after hours are slightly up, but you never know what Bernie or Tiny Tim might have in their pockets.

I made yet another move today. I pulled the trigger on some more FAZ call options with my Zecco.com account (which have great option prices by the way), that I had previous bought last week. They got as low as $4 today in early trading (which is where I got in at) and I felt that this is a great price to lower my basis. Still, nothing significant, but enough to create some cheers for profits. The option closed above $5 by close, so already that's working for me. I am not worrying about this option, as the contract expires in July and as we have seen with FAZ and the past two weeks, it can cover some big ground in a little amount of time.

SRS did very well in the second half of trading, ending up over 10% today. I had a feeling there would be some rebound from its 31% loss yesterday. This is why I ended up buying some yesterday, even though I feel that there may be some rally left. If we see it up yet again tomorrow, I'll begin pocketing some profits. I can't get greedy right?

Today's halt of the rally was indeed significant, but not by much. Proving to keep the market down again tomorrow is a better sign for bears. However, even after the two day halt of buying we saw on Thursday and Friday, we saw how the market responded Monday. So tomorrow's performance could set the tone of how we're going to go into Thursday and Friday with the GDP announcement. There is still no reason for me to think this rally can't hit 8000 and above at this point, so I still remain cautious on my positions.

So that's about it for today. I just wanted to mention some things regarding the chat. I have received a few complaints about the recent content of the chat. I created the chat in order to find good a good network of people, without dealing with crap like you see on Yahoo and Google boards. Please refrain from using profanity or degrading language. I don't mind the use of avatars and would like to keep them, but please use discretion in choosing one. Refrain from using girls, offensive pictures, etc. Remember, there are many people on here during the day that are in a work place and would like a safe, chatting environment. If I do see the problems myself, I will have to resort in banning. Enough with that, just keep the conversations mature and educational and we all can continue to enjoy it as a resource. Happy Trading everyone and have a good night.

Toxic Debt Program To Cause Some Noise

Posted On Sunday, March 22, 2009 at at 3:00 AM by Finance FanaticHowever, history has shown us that investors can get revved up on rumor and speculation. Buy the rumor, sell the news. This toxic plan could be another trillion dollar plan announced over the podium at some point this week. Obama did refer to the plan a few weeks back, but failed to go into much detail of what it would consist of. I would expect some optimistic trading as a result of the rumors. At least for a day or two, maybe. Either way, I feel it will be short lived and cause more problems for the market down the road.

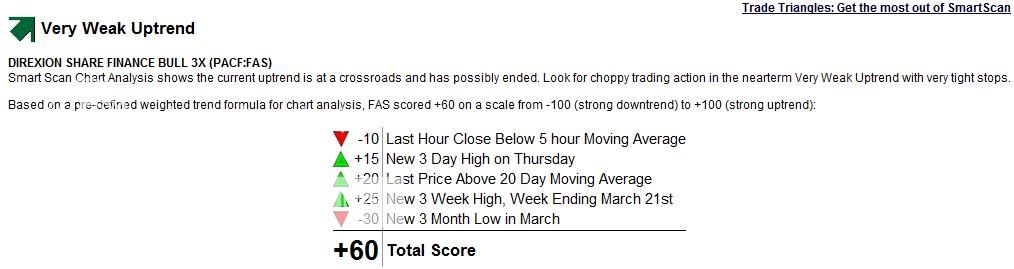

This could be the news that could propel us into the high 7000's, before seeing some more serious selling. If that is the case, plan on me starting to pick up some short positions this week. I just wanted to give a quick update. The FAS trend analysis above is looking pretty impressive for the time being, however, I'm not a buyer. Happy Trading.

Investors Begin To Doubt Fed Plan...With Good Reason

Posted On Thursday, March 19, 2009 at at 6:10 PM by Finance Fanatic Peer Pressure. It was mostly present during our years in middle and high school, when someone or a group of people were able to convince others that doing something (which usually was bad) would be good for you and help you be popular or successful. Yesterday, it seemed as though many were "peer pressured" into buying after the announcement of the FOMC meeting results, believing that it had to be good news. But was it? I mean over a trillion dollars to go to the purchase of bad debt and US government bonds. It sounds the savior of the economy. Just breathing the words of the announcement caused a huge jump in the Dow. So it has to bee good right? What many didn't see yesterday, may have been shown to them later on as they began to break down exactly what the Fed was doing and what that meant regarding our economy. I don't give all the credit of today's red trading to a change of mind about the Fed meeting, but as it usually does, investors seemed to return to reality.

Peer Pressure. It was mostly present during our years in middle and high school, when someone or a group of people were able to convince others that doing something (which usually was bad) would be good for you and help you be popular or successful. Yesterday, it seemed as though many were "peer pressured" into buying after the announcement of the FOMC meeting results, believing that it had to be good news. But was it? I mean over a trillion dollars to go to the purchase of bad debt and US government bonds. It sounds the savior of the economy. Just breathing the words of the announcement caused a huge jump in the Dow. So it has to bee good right? What many didn't see yesterday, may have been shown to them later on as they began to break down exactly what the Fed was doing and what that meant regarding our economy. I don't give all the credit of today's red trading to a change of mind about the Fed meeting, but as it usually does, investors seemed to return to reality.

Lets be honest, financials have had one heck of a run. Sure, they were oversold a bit to begin with, but we were beginning to hit the overbought range after yesterday's trading. Let me give that friendly reminder that, without default, there is a $450 billion dollar gap of debt coming due this year alone for refinance and that is available in the lending markets. Having the CMBS markets and the sloppy underwriting that prevailed in the valuing of the assets, has put us in such a deep mess, not even $3 trillion of Fed spending has put bank's problems to rest.We saw a big 16% gain from FAZ today as financials finally showed its first strong day of weakness in over a week. I don't think this puts an end to the rally, but I think we've pulled the parachute out. I still think the high 7000's, creeping to 8000, is still very much attainable, before we see some more serious selling. The government is not done handing out its bailout coupons and I think we may find some more of these "false" reasons to cheer. So, although the strong gains from the shorts today could be encouraging for some to jump on in, as for me, I'm holding tight. I do still own my FAZ options from Tuesday, but I'm still catching up from yesterday's slaughter.

I woke up with another treat today. A few weeks back, I had purchased some DUG put options for $25, expiring tomorrow at $ .80 per contract. Well, oil had not performed as well as I had hoped for March, and as of Tuesday, I was looking to write the option off as it was trading for only $.05 per contract. However, with the help of Uncle Bernie and his plan to print our way out of this, we saw very big gains in crude prices yesterday and today. Well, this morning, I was able to sell my options for a healthy profit at $1.15 per contract. If only I would have gotten in at $.05, right? Oh well, I had already considered those funds lost and to end up turning it for a pretty strong profit is unbelievable in my mind, especially a day before expiration.

Gold continues to be on fire and with good reason, as we passed the $11 trillion mark with our national deficit and are still spending like it's 1993 in Japan. In fact, gold passed big technical markers today, which could mean even more gains for gold next week. I have recently mentioned three times now on this site of gold being on my "radar", but had failed to pull the trigger every time. Maybe I'll learn from my mistakes next time.

So, still staying put at the time being. If we see a rebound tomorrow and next week and FAZ, SRS, and QID continue to get hammered, I will look to start buying in lightly into them. Also, buying some GS put options are becoming very appealing to me as well. GS has received a lot of love lately, especially because of their ties to AIG and all the help they've been getting, but at over $100, I think that's becoming shorting season for GS.

I am excited to let you all know, that I was able to negotiate a special promotion for those who are interested in Lending Club (click here to read my write up about the company if you don't know about them already). For those who are interested, Lending Club will help start off your investment by giving you $25 to start in your investment account. I was excited to hear about this and hope that for those of you who are interested in it, will take advantage of this promotion. I have been invested in it now for a few months and have been on target to receive my 10.5% return I had opted to receive from the beginning. Rob, my contact at Lending Club recently emailed me this, "Lately, we have observed increased interest from traditional stock investors," said Rob Garcia, Director of Product Strategy at Lending Club, "With average returns of 9.05%, low volatility (0.35%), and little to no correlation to the stock market (Beta is -0.08), Lending Club is quickly becoming a perfect investment opportunity for those looking to diversify or migrate current investments in today's environment."

So if you are interested in this promotion, click Lending Club $25 promotion, and following your sign up process, you will begin your investment account with $25 in it. I hope to offer more promotions like these in the future to help stimulate interest in new investment vehicles. As always, I would love your feedback. Also, a new podcast update is available for those who are subscribed, which you can listen to here. If you are not subscribed, you can try it free by CLICKING HERE. So on that note, Happy Trading and have a great night.

Buying Streak Ends - March Perspective

Posted On Monday, March 16, 2009 at at 6:01 PM by Finance Fanatic

Nothing significant came from the FASB meeting on mark to market, as expected, which could have contributed to slow up in financials today. I didn't see much that they would be able to do, but of course we had to hype it up. These hype rallies can be dangerous.

So what kind of perspective does this last hour sell off give me for tomorrow? Not much. The trailing trend looked like your standard, profit taking slope to close out the day. Even though after-hours is also down, I do not necessarily believe that this trend means that we open up tomorrow in the red. The profit selling was, in my mind, overdue and Mondays always like to start out the week with some adversity. I am not ruling out a red day for tomorrow, as always, there are continuing negative influences that keep surfacing. In fact, as I said on the chat today, my plan was after selling my BAC, to buy a light round of FAZ and SRS, this being earlier in the day when FAZ was at $35. However, due to a forgotten immediate lunch meeting appointment and some technical difficulties with my Blackberry, I was unable to buy either of two. This was too bad, considering that now FAZ is at $42 and SRS is at $72. Even though I feel I will have another opportunity to buy them, I did miss out on a nice, quick 15% swing. Oh well, stuff happens right?We will see tomorrow just how good/bad a decision that was for me to go to lunch, since as of now, I see the market going either way. Another mixed day of trading is what I really see happening tomorrow, which could be a good opportunity for you day traders. We may see some more of these intra-day 10-15% point swings for FAZ/FAS, which is nice for a quick profit, that is if you time it right.

Obama got a lot of flack for a survey result that polled Americans in their feelings of the recent corporate bailouts. It seems that over 80% of Americans disagree with the government's choice to write checks to the big companies and in fact over 30% are considered "very angry" in the decision. This is all happening while more news surfaces about AIG executive's cash bonuses, which can't make it any better for Obama.

I still think we have potential to see the Dow climb up back in the high 7000 range. Sure, there are going to be selling days, we're in a bear market, but last week's rally streak is a big move for technicals and should definitely stick around the next week or two, the keyword here being "potential." I never rule out the possibility of a sell off, but my current expectations are what make my short buying "light" at this time.

There are still some lingering elements, which could still cause some significant momentum in either direction. First, being the GM problem. Yes, they're still around. They are like a scab that won't go away. GM still faces the big possibility of going under. If such a thing happens, I would expect a pretty dramatic response from the market for a couple days, even though most have expected it.

Second, the uptick rule. As I have said before, I don't feel that any changes with the uptick rule will directly effect the ETF's I play, from a value standpoint, but they may effect people's confidence in them. Either way, we could see some sluggish movements for a couple days with the shorts if that's the case. It was this way when the financial short ban was announced in October. The shorts got killed the first day or two, only to end up tripling their numbers.

Lastly, new stimulus rumors of a number in the trillions. If Obama has the tenacity to unfold such a trillion dollar plan, that could have a huge influence on short term trading. Stages of planning may be in early or not at all, but if indeed signs of a plan of this measure are shown, I would expect a large short-term rally.

So March remains unsettling for me, which is why I still remain in mostly cash at this point. If shorts remain reasonable tomorrow, I will look to buy a light first round of SRS, FAZ, and maybe QID. With there still being some risk of rallying, I will make sure to not overspend myself. However, I'd like to have some, in case of a 90 degree crash.

So tomorrow should be interesting. It is amazing how many less and less cars are at my office building everyday. It's not a good sign. More and more people are trying to work from home. If you've made recent occupational moves, Try RingCentral Online FREE for 30 days, which is a great company that does phone and fax services. Rates are some of the best I've seen, and is far cheaper than going through Pac Bell or Verizon. Perfect for a job at home, or a company you are working on the side. Check it out.

Expect a podcast tomorrow for those who are subscribed. Like I said yesterday, I plan to do two or three a week (or more), depending on the significance of the day and what news was given. If you have not already and are wanting to, CLICK HERE TO SUBSCRIBE TO CRASH MARKET STOCKS PODCAST. There is a 7-day free trial for you to "feel it out." Have a great evening, Happy Trading and see you tomorrow.

What Unemployment? We've Got Obama

Posted On Saturday, February 7, 2009 at at 8:55 AM by Finance FanaticFrom trading on Friday, you would have never guessed that we received the worse job loss report in 34 years as the market blew right past that number on Friday and turned to new hope for bailouts and freedom from debts by closing the Dow up 217 points. As I said last week, currently, we are very vulnerable to these short term, violent rallies as speculation has become the steering wheel to market trading. As I also discussed earlier in the week, we knew we were expecting something from Obama to combat the dreaded unemployment number that everyone expected to be devastating. The term "Buy the rumor, Sell the news" seems to be in effect currently as everyone jumped on the bank buy train on Friday(including myself) hoping for some serious news over the weekend. The only news that happened Friday, was a pretty mediocre press conference from Obama talking about his "plan" to stimulate the economy, and the rest were a bunch of leaks that made it to the news talking about what is suppose to be announced Monday (I'm sure the government didn't mean to leak that, right?!). They estimate that over 3 million jobs have been lost since we began the "recession in December of 2007. Over half of these jobs have been lost the past three months. This is a very bad sign, as it clearly shows we have not reached the crest of this job crisis. So I continue to believe this rally will be short lived.

I woke up early on Friday in anticipation to the big day. Seeing the futures trading up, I had a feeling we were going to be experiencing the day we did. I also knew that Ken Lewis, Bank of America's CEO, was planned to be interviewed on CNBC. In most cases, CEO's go on air to sell a company to the public. If it is bad news, they usually send the accountants or lawyers. I knew Lewis would be selling B of A to death and that's exactly what he did. So, I ended up buying into BAC in the morning, even though it was already up 14%. Lewis talked of their successes and that he has not once talked of or been talked to about nationalizing Bank of America. He also said that the plan was to pay back TARP funds by three years. Just during his speech, the stock jumped another 7% and eventually got as high as 33% up. As for the validity of his words, who knows and frankly I don't plan to be in his stock for very long.

My stop loss came into effect with my FAZ and I ended up making a pretty good profit, considering FAS ended up almost 20%. Sometimes, this strategy doesn't work if we reach a volatile day with the Dow bouncing back in forth. However, I felt that Friday was going to go only one direction, and it would go that way with conviction. The market trend FAS technical score is -75, so I don't know how excited I am to stay in it much longer (get your own symbol analyzed for free, all you need is a name and email, Click Here). However, as for now, I am remaining in both my BAC and FAS for the time being.

SRS was showing a lot of strength in early hours of trading as you can see from the chart. However, during mid-day, a big sell off began. I think bailout hopes and more rumors surfacing convinced many investors to get out for the time being. I am remaining in SRS, as I feel it is one of the better shorts for 2009. I do think they are vulnerable to some losses during all this mess, so I may be averaging down as it may continue to go down.

Obama's bailout team has revisited their original stimulus plan over the weekend and have supposedly made some changes (I personally feel they did because they knew they didn't have the vote!). Anyway, it seems as if the bailout amount will be reduced to $750 billion and that there have been a lot of changes to the "bad bank" plan, which wasn't getting a lot of popularity with the media and republicans. They still will supposedly have a toxic asset protection program but are straying from the "bad bank" plan and working on a "ring fence" concept. In a sense, the "bad bank" would buy up to $500 billion in troubled assets and then perform stress test on banks to see if they need more.

Now, where market to market accounting gets changed is when these assets are transferred. As of now, a bank would have to take a loss on their books to transfer these assets, which would kill bank's balance sheets to transfer a lot of these toxic assets. So, rumor is that they may be altering the accounting system where they can "carry market value" in hopes to keep bank's balance sheets healthy. A lot of moving pieces are in this plan and a lot can go wrong. Let's hope they know what they're doing. Secretary Geithner is suppose unveil the plan on Monday. These kind of announcements make me very timid in this market, which is why I am pretty hedged right now and sitting in a lot of cash at the moment. So we'll see how it goes. That mixed with the stimulus vote, which is planned for Tuesday, could cause one crazy trading week next week. In the end, the fundamentals are still very bear, so that is where I remain. I am just waiting for the right time to get in my bear positions fully, and that time may be coming soon.

So, it will be another early morning for me on Monday. I am expecting more volatility this next week in the market as I believe there could be a lot of "exhaust selling" after all of these announcements are done with. "Buy the rumor, sell the news."

I wanted to end with a clip from CBS news featuring the Lending Club we've been talking about. They have been getting a lot of publicity lately, which continues to reinforce my decision to invest in them. So far so good! Remember, the now $200 promotion ends this month for Lending Club, so check it out if you haven't already, click here.

So, we wait until Monday. Hopefully next week yields some serious green for my Zecco.com trading account. This last week wasn't too shabby, although I could have done without Friday. Happy Trading and have a good weekend. Oh and PS, I did pick up some SKF right before close on Friday, just in case...

Aggressive Rate Cut Spawns Questions - What Does The Fed Do Now?

Posted On Wednesday, December 17, 2008 at at 5:04 PM by Finance FanaticWell, it seems as if we aren't as excited for 0% interest rates as we thought at close yesterday. It seems as though people have been digesting the thought of the huge rate cut with some serious questions. Why on earth did the Fed do such an aggressive cut? What can they do now to help stimulate the market? Even though there are still many vehicles they can do use to attempt to stimulate the market and cause for more speculative rally days, their strongest weapon is now out of bullets.

The fact that the Fed made the decision to slash the rate to the degree that they did yesterday, tells me that they think some serious problems are ahead. I mean, if the Central Bank feels they need to bottom the discount rate, like I said yesterday, this is their big finale that can hopefully carry us through the very frightening 2009. Really, the only big factor left, is the ability to continue to print money and flood markets with more capital. But Japan and Germany has shown us what can come from doing that. That is why I have loaded up on GDX and GLD. Which if you are looking for a trading account, you can get free monthly trades at Zecco.com.

Well, Chrysler announced today that their assembly plants have been put on hold. Sure, this could be a bluff to try and hurry a bailout decision. In any, case it doesn't look good, especially to foreign nations. Ford also is choosing to shut down most of their North American plants an extra week in January. I just wish we could move on with the bailout, because we are going to experience another reactive day, like yesterday, as soon as something is announced with that. Can we please move on?

None of the short etfs were dramatically better. EEV and FXP were some of the better performing ones as foreign markets continue to show frightening signs. SRS was significantly lower today due to some strong gains in the REIT sector (GGP and Kimco). I mean, remember, it was just yesterday that we just received a historical slash to the rate. For this reason, I held myself from pulling the trigger on more SRS today, although I may hate myself tomorrow. Of course real estate is going to receive a push with the rate at 0%. If it is down more tomorrow, I am just going to have to buy some more. I don't feel like this cut is going to stimulate the market. Those that can get new competitive loans, will most likely take equity out of their house just to put money in their savings account or pay off their credit card debt. It's not going to be money inserted back into the economy. I just feel that when we cool off from this fuzzy high we're on, we have some serious problems to face.

Another problem with yesterday's rate cut is that, like I said, we cannot lean on that anymore. The ability to cut the rate has single handedly been the biggest source for market recovery than anything else. Well, we have maxed that out. No longer can we factor in expectation into the markets when the Fed meets. These are just a few things I feel people came to realize after yesterday's closing.

Sure, we are still very vulnerable for some more rallying. This is a massive rate cut, and with the help of other nations doing the same (probably Japan) and the auto bailout, we may still rally some more. But are bailouts our drying up. I do plan on picking up some more of the longs I discussed yesterday to give me some more hedge, but I still am staying very strong with my short. January is approaching very quickly, and there are a lot of problems which have been pushed to "next year" that will come back to haunt us.

I don't see us going much past 9200. If so, maybe after the holidays, I expect some serious consecutive days of selling. There has been a lot of money made on the long side the past month, and I would like to believe many of these people would be cashing in their chips. Tomorrow will be an interesting day, as a pretty aggressive sell off spurred right before close today. This trend could push through tomorrow and create some more selling on the trading floor. Either way, I am expecting both red and green throughout the day, with a pretty aggressive punch in either direction the last 10 minutes. I have some making up to do on my shorts, but I still feel that we've got a ways to go before we start to get better in our economy. Have a good night and we'll see you tomorrow.

Market Rallies In Auto Bailout Anticipation - Are We Done With Green?

Posted On Wednesday, December 10, 2008 at at 4:33 PM by Finance Fanatic Another day down which resulted in similar trading trends that we have been seeing these past couple weeks. With the anticipation of the bailout, traders (I dare not call them investors anymore, because the investments that are yielding profits right now are about as solid as junk bonds in my opinion) pushed the market into the green for most of the day. We did see the market dip down into the red, as people began doubtful, there being talks that the bailout could face some problems with the Republicans. However, you and I both know this deal will be done and in my opinion this bailout was factored in two weeks ago when they announced they would be meeting about it. But I am sure the market will have something to cheer about when it gets announced, but it may not last more than a day, there being no more bailouts in the current pipeline.

Another day down which resulted in similar trading trends that we have been seeing these past couple weeks. With the anticipation of the bailout, traders (I dare not call them investors anymore, because the investments that are yielding profits right now are about as solid as junk bonds in my opinion) pushed the market into the green for most of the day. We did see the market dip down into the red, as people began doubtful, there being talks that the bailout could face some problems with the Republicans. However, you and I both know this deal will be done and in my opinion this bailout was factored in two weeks ago when they announced they would be meeting about it. But I am sure the market will have something to cheer about when it gets announced, but it may not last more than a day, there being no more bailouts in the current pipeline.

Emerging markets and China have been receiving UNBELIEVABLE amount of praise from investors. This weekend I will write a detailed post of why I feel FXP is getting killed so much, so look out for it. China is forking out money left and right into their airlines, banks and major business just to keep them afloat. Somehow, this is perceived in the market that this is a positive sign. I mean come one, how blind are these people. China announced yesterday that their Producer Price Inflation fell 2 percent from January to November. This is far more than predicted and is very scary for China. They have a major risk of inflation as energy costs begin to rise and global economic problems persist. Yet traders brushed that news off just as they did the horrific employment number we received on Friday.

This is a dangerous time in the market, because there is very low volume and it seems as if the main bulk of traders are not fundamental traders. It is clear to me that hedge funds and institutions are waiting. Until, we get some fundamental movement based on actual numbers, the market is one big roulette table. This is why I am choosing to stick with my few fundamental picks and just wait. EEV and FXP have been utterly destroyed the past month. I don’t dare call “bottom” during this end of the year market run, but if I had to guess, I would say we have to be close with those two. If you haven’t bought in those yet, you are loving these incredibly low prices! Bring on 2009 and the new batch of problems.

The next item up for shorting are Treasury bills. With the recent, enormous popularity in our treasury bills with the billions of dollars being flushed into them, this makes treasuries prime for shorting in my book. As the US economy continues to show signs of severe weakness, our foreign neighbors will grow fearful of keeping their money with us. TBT is the Proshares Ultra short that shorts the Lehman 20+ year treasury. With the amount of government spending, coupled with foreign countries pulling their money out of our treasuries, this should weather very well for TBT. It may take a month to get jump started, but I believe we are low enough now. I plan on picking some up later in the week.

GDX and DIG are proving their resilience and I don’t see them slowing down much in the coming months. Sure they may get hit a day or two, but I think we will see an upward trend from here on out. The Saudi’s are closely watching oil and will not let the prices get lower. All commodities are receiving a lot of love due to the global weakening currencies. I am getting the urge more and more to look into trading currencies as I have been using Forexmentor.com for research. You might want to look into it if it’s your cup of tea. I see GDX and DIG continuing to move strong. SRS hurt today with strong gains in the REIT sector. There are no fundamental reasons for these gains other than them getting caught up with the bailout bust. These should be going down just as fast as they shot up in my opinion. Like I’ve said before, SRS is a rock star in my book.

We may see a bailout pass tomorrow. Either way, the market should move with that decision. If we see it pass, expect a nice little cheer rally. This could be the peak for the longs. I may sell out of the rest of my longs, except for GDX and DIG. If there is still complications with the bailout, we could see some selling tomorrow. Either way, I believe after this bailout is passed, people are going to once again realize the reality behind their two weeks of hallucinating. I hope everyone has a good evening, Happy Trading and see you tomorrow.

Bears Hibernate While Bulls Fight Through Unemployment Numbers

Posted On Friday, December 5, 2008 at at 1:15 PM by Finance Fanatic

Well, it seems as if the bears have called it quits for the time being and are letting the bulls have their fun. Not even having the job loss report by 233,000 more than the market expected can cause a bear victory for the day. I'll give you one thing, Friday's are hard to paint red.

Unemployment jumped to 6.7% from last month's 6.5%. This was 1% lower than market expectation. Many believe this is because many of the college students have just gone back to school, so they are not considered. Even though we have seen big strength in buying this week, I still feel that this trend will be short lived. For whatever reasons, this market is getting shoved up everyday despite very bad news. And I laugh at headlines like the one I saw on cnbc that say "Despite Huge Job Losses, The Worse Could Be Over." I am amazed that headlines like that exist on respectable sites. No one, including myself, has lived through the kind of downfall our economy will experience the next few years. The perfect storm that has combined is one that is yet to be seen in our economic past and to try and predict the bottom of it is pointless. I just don't think we are not even near to it.

After today, the market has proven that its going to fight this out. Now how long will that last? Graphically speaking, we could see this rally go somewhere between 9200-9500, and maybe even more. We will probably see it continue to climb up until the end of the year. Then we will hit January.

January should be an interesting month. This is the month I believe we will start to see a lot of crap hit the fan. I already know of 3 major retailers/restaurants, who have not yet announced, that will be going bankrupt Q1 2009. Even with Obama coming in, which I believe we will get a little rally before and after. But ultimately, I believe this is when the bears will wake up again.

I still feel we are very vulnerable for very bad sell off days like we saw this past Monday, which makes me hesitant to buy anything long. So I have accepted the fact that I may just continue to take some losses the next few weeks. I don't mind hibernating with the rest of the bears until the markets ready.

I have heard many people speculate that we could have reached the bottom and that the worst is over. However there are many reasons that I disagree with this. Here are some reasons why:

1) Housing market is still in the Pits

We should not be confident that anything is getting better as long as our housing market struggles. People underestimate just how important that number is. Housing values are the number one driver of consumer sentiment, because in most cases it is people's biggest investment. All across the county, most people's biggest "deal" has lost anywhere from 20-40%, depending on the market. That takes a lot out of peoples expectations. As long as our housing market remains in the gutter (which our most recent numbers have confirmed), I believe we are not done hurting.

2) Many retailers plan to go bankrupt next year

Think of hundreds of mini GM scenarios going across the country. Even though many of these retailers will not have the giant influences that the big 3 autos do, they still will do their damage. They have people that rely on their pension, and laborers across the country. With the continuing loss of small and large businesses, I don't think you can call now the bottom.

3) Commercial real estate foreclosures

This could be one of the biggest factors. Look what the initial sub prime crisis did to the market from 2007 to 2008. Well, commercial real estate is running about a year behind them. We have just begun to see foreclosures begin in the commercial market. These are going to pile up in 2009. The amount of debt that will be handed back to banks is unreal. It will be World War 3 when that happens, which makes me feel we're not at the bottom.

4) Beginning of the year blues

Historically, the stock market can have very bad months in the beginning of the year. Due to taxes, year end expenses, new years budgets and other elements, the beginning of the year can cause a blood bath for the stock market. Considering that we have just spent that past three usual bull months (except for the last week) in misery, doesn't make me think that will change when we get to the new year. Even after Obama is inaugurated, there will be plenty of things to going awry to make this market suffer.

So these are my thoughts on considering whether we have hit bottom. Although I feel that we could see a lot of green the next few weeks, I still think it will be short lived. I believe in the beginning of the 2009, the bears are going to wake back up and they're going to be hungry. So keep on your toes, get your cash in order, if you don't have a trading account, you can sign up for one and get free trades every month at Zecco.com. Also, for those that have cashed out and are waiting for definition in the market, these guys are offering a good savings account deal with strong interest and FDIC insured. See more at Earn 3.00% APY* in Online Savings.

Just to remind everyone, SRS is under $100. So see, there are many things to be excited about. It is Black Friday for the shorts for the next couple of weeks. Get them while they're hot! I hope everyone has a good weekend. Mondays have tended to be a selling day, but who knows what information will come out this weekend. Happy Trading everyone.