Showing posts with label good investments. Show all posts

Showing posts with label good investments. Show all posts

My Lending Club Interview - Answers to Many of Your Questions

Posted On Saturday, January 10, 2009 at at 8:59 PM by Finance FanaticAs I had said in my last post, Thursday I had the opportunity to talk with Rob Garcia, a Director who has been with Lending Club since the beginning, and discuss the company and some of the things that sets them apart from their competitors and makes them a legitimate company to be considered as a strong investment vehicle in this market. Because of the length of info I wanted to report, I am probably going to break up this post into two separate ones, as I don't want to bombard you with too much info. As a preface, please recognize there are risks with P2P lending, so don't think of this as a "guarantee money maker." However, you can definitely make some serious returns and hopefully with some of these tips, find some good returns of your own. If you haven't read before in my posts, I have invested a small portion of cash in the program to give it a shot and I will be covering my experience and give updates on this blog. I personally feel this can be a great alternative investment for me in this current market. I do not represent the company, so I hope I get most of the facts right, but just be aware, I do no plan to, but I may misrepresent the company with wrong information, if so, I apologize.

since the beginning, and discuss the company and some of the things that sets them apart from their competitors and makes them a legitimate company to be considered as a strong investment vehicle in this market. Because of the length of info I wanted to report, I am probably going to break up this post into two separate ones, as I don't want to bombard you with too much info. As a preface, please recognize there are risks with P2P lending, so don't think of this as a "guarantee money maker." However, you can definitely make some serious returns and hopefully with some of these tips, find some good returns of your own. If you haven't read before in my posts, I have invested a small portion of cash in the program to give it a shot and I will be covering my experience and give updates on this blog. I personally feel this can be a great alternative investment for me in this current market. I do not represent the company, so I hope I get most of the facts right, but just be aware, I do no plan to, but I may misrepresent the company with wrong information, if so, I apologize.

So what is Lending Club

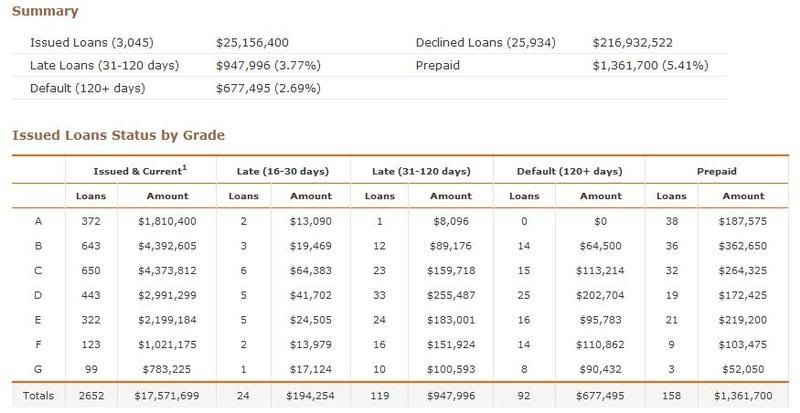

The biggest question I got from all of you which I passed on to Rob was what is the default rate? The first thing Rob said is that Lending Club prides themselves in the transparency of their information. As I went through the different links they have, I found this to be very true. For instance, the graph below shows the total amount of loans Lending Club has issued since its beginning. As you see, out of the $25,156,400 worth of loans they have issued since June of 2007, only $677,495 (or 2.69%) have defaulted. They define default as failure to make a payment over 120 days. This was a lot lower than I originally thought and actually made me feel a bit more comfortable with my invested funds, since I did not choose that risky of loans.

Lending Club does go after defaulted loans and are sometimes able to recover the funds. They continually update their collection process with every phone call they make all the way to the final bankruptcy judgement decision. They do a great job of keeping you updated.

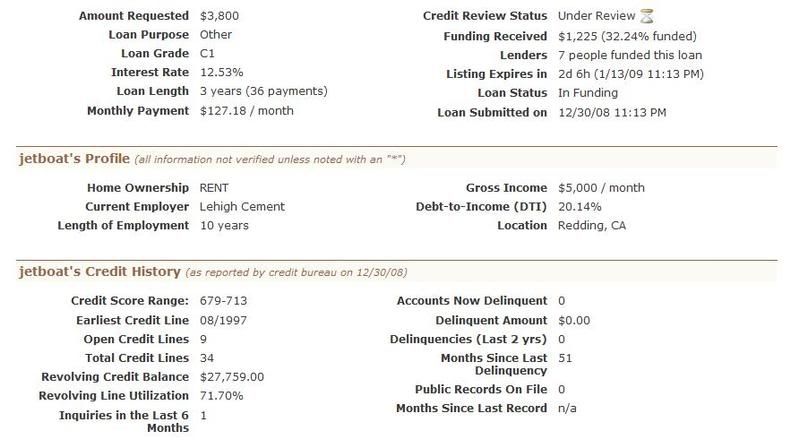

Now, when choosing a loan to invest in, Lending Club does a pretty good job of getting a lot of information from their background checks on individuals and disclosing this to the investor. Below is an example of someone who is looking for a $3800 loan.

As you can see, they have their current employment, length of employment, credit score, credit balance, etc. All of the loans issued on Lending Club are 36 month (3 year loans). So one downside, is that your money is invested for a longer term. However, as I will talk about in another post, you can sell out of your position in a loan through their secondary market to liquidate your investment.

As you can see, they have their current employment, length of employment, credit score, credit balance, etc. All of the loans issued on Lending Club are 36 month (3 year loans). So one downside, is that your money is invested for a longer term. However, as I will talk about in another post, you can sell out of your position in a loan through their secondary market to liquidate your investment.I asked Rob of loans that seem to perform better than others and he said, debt consolidation, car loans, and paying off credit cards were some that stood out as top performing loans. I did ask him ones that have not performed well and although he said nothing was black and white, he did say that a lot of wedding debt (found that funny) and student loans had some problems in the past.

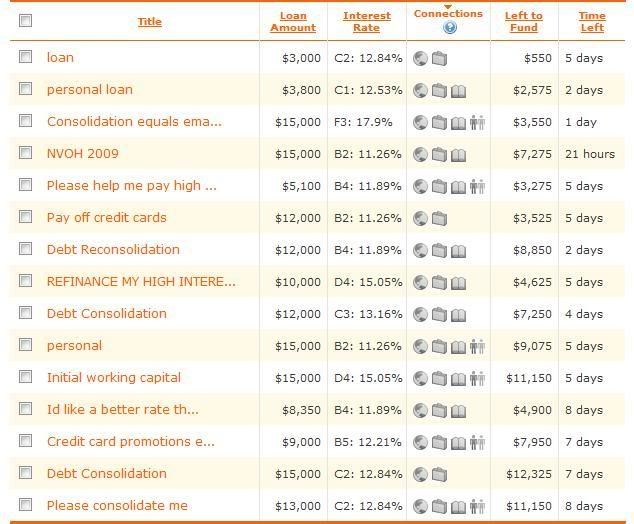

Below is a picture of what it looks like when initially browsing the loans to choose to invest in. You can either choose a target investment yield and they will automatically choose a portfolio of loans for you to approve, or you can go through individually and manually choose them. As you can see, it gives the loan description, loan balance, Lending Club's value rating of the loan along with the interest rate (the larger the interest rate, the lower the value rating). It also shows how much is left to fund and the time left until the loan is issued.

To sum things up for this first post, I asked Rob to give a couple points that separates them from competitors. First off, is that they are actually registered with SEC. Although, they haven't registered with all states, they have registered Lending Club

To sum things up for this first post, I asked Rob to give a couple points that separates them from competitors. First off, is that they are actually registered with SEC. Although, they haven't registered with all states, they have registered Lending ClubThe other big one was their platform. They are very transparent with their information and try to give the investor as much information about the loan they are investing in. The ease of use is very significant, as I was able to sign up, find loans to invest in and be finished all within 10 minutes.

I didn't want all the information crammed in a post, so I will stop here and talk more on another day about some positives about this program I have found. I see these P2P programs becoming more popular as banks continue to struggle to lend. My biggest concern is regulation, but so far I am very impressed with Lending Club