Banks Bounce Back Thanks To Obama Fever - Apple Crushes Earnings

Posted On Wednesday, January 21, 2009 at at 1:34 PM by Finance Fanatic It didn't take long to get speculative hopes back in the market. Today, the market got off to a bit of a slow start and even went red for a bit, but after the remarks of Geithner (the new secretary), investors felt a lot more comfortable with the future of the banks. Almost everything that was taken away yesterday was given right back. I was very happy to have sold out of most of my SKF before the aftermath, however, SRS had a much less than stellar day and I chose to hold on to those, my mistake. I did get the gains I was finally looking for out of Citi, but not much after the crash yesterday. It did help the banks that many of the CEO's bought back lots of shares to help instill confidence. I still ended up quite positive in my Zecco.com account after the two days and look to reboot my strategies as we are kind of at ground zero again. However, I think I am going to transfer some more money over from my ING Direct savings account to trade with, as the next few weeks could be prime for good money making.

It didn't take long to get speculative hopes back in the market. Today, the market got off to a bit of a slow start and even went red for a bit, but after the remarks of Geithner (the new secretary), investors felt a lot more comfortable with the future of the banks. Almost everything that was taken away yesterday was given right back. I was very happy to have sold out of most of my SKF before the aftermath, however, SRS had a much less than stellar day and I chose to hold on to those, my mistake. I did get the gains I was finally looking for out of Citi, but not much after the crash yesterday. It did help the banks that many of the CEO's bought back lots of shares to help instill confidence. I still ended up quite positive in my Zecco.com account after the two days and look to reboot my strategies as we are kind of at ground zero again. However, I think I am going to transfer some more money over from my ING Direct savings account to trade with, as the next few weeks could be prime for good money making.

It is funny, because during the interview, Geithner did not want to speculate on timelines and likely avenues the government would be taking, saying that by doing so in the past had caused premature speculations and radically effected the market. Well, even by avoiding the questions, he was still able to help radically move the market. How ironic. People are looking for the slightest bit of hope to help spur optimism.

So even though the Obama rally showed up a day late, it's here. Now, how long will it last is the magic question. Anytime momentum like that is stopped in its tracks and reversed to the degree we saw today causes some serious jolts in technicals. Although this rally should and could very well lead on into tomorrow, there are some deafening news that could reverse this day of high hopes. One day of Obama in office did not make the bank crisis's everyone feared yesterday go away. The debt outstanding is still substantially more than they can handle, and commercial vacancies haven't even hit half the number they're expected too. We're not out of the woods yet.

Google announces earnings tomorrow. This outcome could provide a big influence on where the market moves. With massive budget cuts, be assured that "online advertising" is one of the first things crossed off the list. Being that advertising revenue is a bulk of Google's earnings, they may struggle a bit. We lucked out this week with not much economic data being reported, but tomorrow we do have housing starts, which I cannot see being a strong number. That could effect some trading, but I don't expect it to be that influential. People should be clinging to headlines tomorrow to try and pull out any sort of negative or positive perception they can find. Whatever the case may be, I think the outcome will be very volatile, bouncing from red to green and higher volume. Did you see today? 408M trading volume, wow. This is the most we have seen in a while. With volume back and volatility increasing, we're heading back into market crash danger zone. Stay on your toes.

Apple knocked earnings out of the park after close today, sending after hours trading up almost 10%. This is not surprising to me, as I have liked apple all year (one of my top picks for long). All this news of Job's health and their ability to stay competitive is nonsense. Too much cash on hand and too much innovation. Apple should leap quite a bit and could definitely set the standard for up trading tomorrow. Lets see if Google can follow.

Due to the extreme uncertainty and volatility right now I am playing my bets with energy and commodities. Obama's only ammo to throw at this beast is more government spending (and even that can only slow the pain in my mind). He is going to have to spend trillions just to make a dent. Doing so is going to give gold, silver, and other commodities a pretty face of value. I'm bulling up on a lot of gold, DIG, and other commodities tomorrow to keep during this time of uncertainty. I've lowered my short position (still plenty left) until some definition is back and have a little bit of long financials as a hedge. Either way, tomorrow should pave the way of some new momentum.

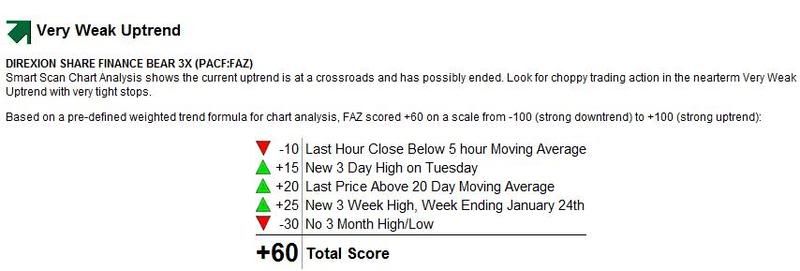

Like I said yesterday, don't expect Obama to roll over and die his first few months in office. He should be working around the clock to ways to pump this market up. I still think we're heading to new lows shortly, we just need the Obama fluff to wear off a bit. Below is the market trend score (analyze a symbol here free) and movement for FAZ, which momentum score is still relatively strong at +60.

I hope everyone has a good evening. With this volatility, we are able to make some serious cash in quick moves. It's all about timing the bumps right. Happy Trading and see you tomorrow. Check out the new videos at INO TV, great stuff and it's free.