A Shift in Confidence Brings Reward - Watch Out For GDP

Posted On Wednesday, October 28, 2009 at at 4:20 PM by Finance Fanatic Due to some measured changes in consumer sentiment and other weakening economic data, markets have seen some opposition the past few days, which continued into today as the Dow closed down again over 100 points. With deflationary indicators strengthening, my gut tells me that we should indeed start to see a rather strong turn in the markets. However, there are still some lingering elements which keep me guarded at this point. I have seen some great results from my most recent positions, with my GDX put options performing very well, as well as my DRV and UUP longs. Here's a great video talking about reasons why there should be more weakness for gold in the near future. Click Here

Due to some measured changes in consumer sentiment and other weakening economic data, markets have seen some opposition the past few days, which continued into today as the Dow closed down again over 100 points. With deflationary indicators strengthening, my gut tells me that we should indeed start to see a rather strong turn in the markets. However, there are still some lingering elements which keep me guarded at this point. I have seen some great results from my most recent positions, with my GDX put options performing very well, as well as my DRV and UUP longs. Here's a great video talking about reasons why there should be more weakness for gold in the near future. Click Here

Both consumer confidence and new home sales came in worse than expected, which is giving investors some doubts. Tomorrow, we have the big GDP report, which is a big factor that is holding me back at this point from taking more positions. The fact is, that most likely we will see a positive number for GDP tomorrow. Now remember, GDP is measured on a quarterly basis and is compared to the previous quarter. Year over year, we will most likely still remain negative, but we are sure to get a positive quarterly move. Here are some reasons why. Net imports is a subtracting factor of GDP. As of late, we have cut imports to record lows, due to the slamming of the dollar and other recessionary problems. This should give some boost to GDP. In addition to that, government spending pushes up GDP levels, which recently we have seen record amounts of. Such factors is bound to create a slight upward movement in GDP.

With this positive number, by all means, does not mean we are out of this recession. Many times in our history we have seen strengthening quarters only to be followed by even more weakening GDP numbers. There still exists plenty of economic factors that continue to show weakness as well as a massive deflation risk that is at the door. However, as for this number released tomorrow, I would highly expect media to have a field day with it. Many analysts have already been calling that we are out of the recession and they feel that tomorrow's number will prove that. Indeed, fundamentally, it will not, but you can be sure many investors will buy into it. For this reason, I am holding back on purchasing some more short positions as I see big potential for a rally tomorrow.

Need a New Broker? Get $2.95 Flat-Rate Stock Trades at OptionsHouse.

The opportunity for me is at the door. The fundamental data, although delayed, is growing stronger and economic factors are growing weaker. I plan to take advantage of this next round and hopefully make some good returns from it. I want nothing more than for us to come out of this downturn stronger, but unfortunately, I don't see that happening for a while. I will keep you updated as well as put a new podcast up tomorrow. Happy Trading.

Yesterday's Profits Erased - All Eyes on GDP

Posted On Thursday, January 29, 2009 at at 5:23 PM by Finance Fanatic Well, as expected, we experienced a pretty aggressive selling day as yesterday's gains, and then some, were wiped out today with the Dow closing at 8149. I was glad to have sold out of almost all of my bank positions yesterday, as most of the profits were wiped out from today's selling. Tomorrow is a pretty critical day in deciding the future movement of this market. Another devastating day of selling could be enough to put the Dow below 8000, which would be a critical point of closing, especially with the market mostly trading up the first part of the week. As I've said in the comments, I'm a bit torn at which way it will go since so much depends on the GDP announcement and how it is spun with the media.

Well, as expected, we experienced a pretty aggressive selling day as yesterday's gains, and then some, were wiped out today with the Dow closing at 8149. I was glad to have sold out of almost all of my bank positions yesterday, as most of the profits were wiped out from today's selling. Tomorrow is a pretty critical day in deciding the future movement of this market. Another devastating day of selling could be enough to put the Dow below 8000, which would be a critical point of closing, especially with the market mostly trading up the first part of the week. As I've said in the comments, I'm a bit torn at which way it will go since so much depends on the GDP announcement and how it is spun with the media.

I didn't make many moves with my Zecco.com account today, as I still feel I want to be mostly short for the time being. I did, however, pick up some more TBT for myself. It has performed so well for me since I first wrote about buying it last month and I see it going nowhere but up this year. US treasuries have been so over bought, it's ridiculous. The yield with Treasuries hit 0%! It is very clear that Obama's plan is to spend our way out of this crisis and by doing so will even more saturate the market with more, already oversold Treasuries. Plus, as our government continues to print money, other nations will continue pulling their money out of Treasuries and putting them into corporate bonds, because their dividends are much more stronger. So I expect TBT to continue to do just fine for me.

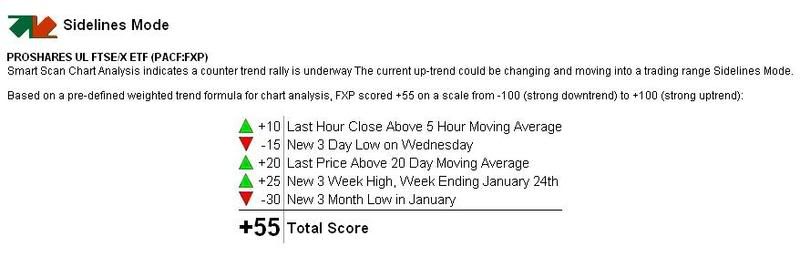

I would expect big numbers from my FXP tomorrow, as Asia is currently looking like a market crash. Surprisingly, FXP is holding up pretty strong fundamentally, as they have a market trend score of +55 (see below. Get your own symbol analyzed for free, all you need is a name and email, Click Here). I did shave off some of FAZ earnings today as there was some huge gains today from it (almost 20%). It's not that I don't think there is more to grow with FAZ, it's just like I said yesterday, I can't be greedy.

My DGP performed well for me today, already being up close to 5%. This is one I plan on hanging on for a while. I sold some of my GDX for a pretty strong profit (first bought in at $18). I am seeing more upside for DGP in the long run than GDX. I think gold is bound to spike sometime throughout the year with this overspending.

So we all wait and see what the GDP Gods shall bring us. The number is going to be bad, no doubt about it. The next GDP announcement should be even worse. I cannot believe the devastation we have already experienced in January. Consumer sentiment is another one to keep your eye on, although I do feel it will be overshadowed by GDP. If indeed sellers take over this market tomorrow, which has usually been buyer's territory, I would expect that momentum to push harder into next week.

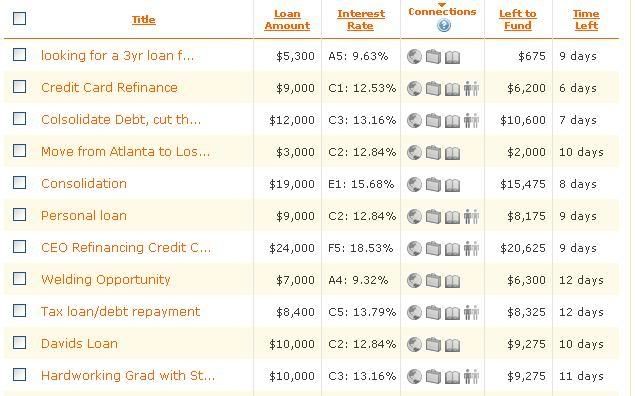

My Lending Club account is doing great so far. Payments are being made and my returns are looking to be strong. It's good to be diversified and helps me sleep a bit better at night. Below is an example of notes that are available to invest for 10%+ gains. I chose to pick higher valued loans, and not shoot for the 20% returns. Remember, my $100 promotion for Lending Club ends in a couple days. It's free to sign up, click here for instructions.

I will be on the comments tomorrow so check back and share your thoughts. I will probably be making some moves mid-day tomorrow so we'll see what happens. Have a good night and Happy Trading.

Free Trading Analysis Video click here