Obama Brings Hope To Investors - For Better or For Worse

Posted On Tuesday, January 27, 2009 at at 3:37 PM by Finance Fanatic Call it a hunch or call it an overdose of OSD (Obama Stimulus Decisions), but I actually made a SHORT TERM move into longs today. Many more speed bumps have arrived into this road to destruction of our economy than I first anticipated and in order to maximize my value, I'm looking to try and play both sides a bit more, for the time being. Currently, investors are very vulnerable to just announcements of hope and with the new President being busy and active, I definitely feel there will be many more announcements to come in his first months of office. Please don't misunderstand me, I still strongly believe that our economy is still very much spiraling downward, I just feel I can make some extra $$$ on the bumps. Call it the day trader in me. I don't plan on actually "day trading" per say, but my trade volume should definitely be going up. I'm still very bullish in my current short positions, I would just like to make some cash on the bumps up to load up on my shorts at lower levels, because in the end, I believe the market will come crashing...and fast.

Call it a hunch or call it an overdose of OSD (Obama Stimulus Decisions), but I actually made a SHORT TERM move into longs today. Many more speed bumps have arrived into this road to destruction of our economy than I first anticipated and in order to maximize my value, I'm looking to try and play both sides a bit more, for the time being. Currently, investors are very vulnerable to just announcements of hope and with the new President being busy and active, I definitely feel there will be many more announcements to come in his first months of office. Please don't misunderstand me, I still strongly believe that our economy is still very much spiraling downward, I just feel I can make some extra $$$ on the bumps. Call it the day trader in me. I don't plan on actually "day trading" per say, but my trade volume should definitely be going up. I'm still very bullish in my current short positions, I would just like to make some cash on the bumps up to load up on my shorts at lower levels, because in the end, I believe the market will come crashing...and fast.

Today I sold off my remaining SKF and put them into BAC and C. With Obama just being put in office, he is wanting quick action. I expect to see things turn much quicker that we did with the Bush administration. Sure, this can eventually lead to worse things for the economy and probably will, but the point is the market will probably rally from it in the short term. These are the reasons to justify my longs. I do still have a strong short position in SRS, FXP and EEV. I just feel these can hold up better during these rallies than SKF and FAZ.

Either way, my holding of these stocks will be very short lived. In fact, I would like to be completely liquidated from them before Thursday's close, at latest. I do not want to be stuck with financials going into GDP announcements. By doing this, I plan to throw my gains from the hopeful quick rally into more short positions, which will, I believe, ultimately yield strong gains.

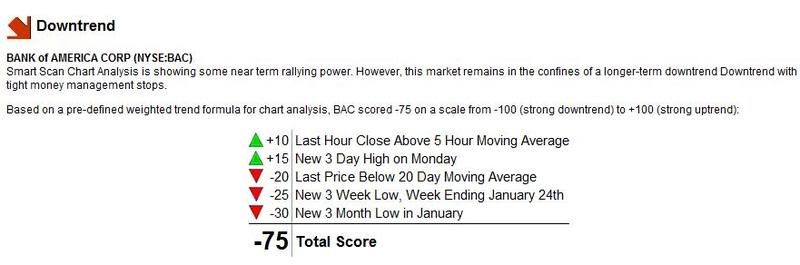

So far my plan seems to be working out for me as it looks as though Obama is trying to get his stimulus plan (maybe $900 billion) to pass ASAP. Although, he is getting a lot of opposition from the GOP, signs are looking good for the ability to get something passed as early as maybe next week. Just whispers of this has sent financials up almost 10% in after hours. If this sticks into tomorrow, I will most definitely shave some profits off the top, as with all speculative announcements, the cheering is usually short-lived. Also, as you can see, momentum charts for Bank of America do not look pretty. -75, OUCH. Get your own symbol analyzed for free, all you need is a name and email, Click Here.

Yahoo also announced "better than expected" earnings, however yielding a loss for the quarter. But, as usually, investors think of this as a good sign as the stock is trading up 5% in after hours. I actually like yahoo, even before the earnings announcement. I believe over the next five years, a lot of focus is going to be shifted over to e-commerce, which should indeed boost value for Yahoo. Plus, I also think at Yahoo's recent low stock price, they are still very vulnerable for a hostile takeover. I think something should happen, definitely before the end of the year.

Keep an eye out for FOMC's meeting notes tomorrow. We shouldn't expect much as far as a rate cute (since we're pretty much already at 0%), but they are definitely still capable of moving a market in either direction depending on their economic outlook. If something substantial is announced, we can expect to see a strong run in which ever direction it heads. I personally feel we will have an up day of trading tomorrow as the hope of new stimulus could really ignite the buying the next couple of days, pending that something largely significant is not announced.

New home sales and GDP numbers are still to come at the end of the week. As I said earlier, I would like to be fully out of my longs before that GDP number is given. In fact, I believe Thursday we may trade down just expecting a bad number. Analysts have tried to soften the landing by projecting an enormous -5.4% result. Their hopes is that anything even slightly lower than this number can be manipulated to investors as a positive sign and erasing the memory that our GDP just did indeed fall almost 5%. Sadly, I am not as easily fooled. Anything below 3% and I am running for the hills. Why roll the dice with longs right now when I can just stay in cash and earn 2.45% APY* with HSBC Direct Online Savings, all FDIC insured. I will be able to sleep better at night, that's for sure. So I don't see me in BAC and C longer than a week.

Well, let's see how tomorrow goes for my new long positions. I am a bit more nervous going long in this market as I feel it is more of a gamble, but I do see some opportunity in it. Check out these free INO technical stock trading videos, very informative, click here. Happy Trading everyone and have a good night.

New President, New Record Lows and New Worries

Posted On Tuesday, January 20, 2009 at at 3:52 PM by Finance FanaticDid you say Obama rally? People were shocked this morning as they woke up to see a monumental time in US history and Wall Street react as a spoiled child throwing a tantrum. Maybe if Obama could have broken off a bit of that $170 million dollar party today to give to the banks, the result wouldn't have been so bad. Seriously though, clearly today is evidence that bank's problems are far from over. This is not something new to this site, as we have been discussing those problems for months now, but it seemed to hit home with investors today as the Dow closed down over 4%. Bank of America, Wells Fargo, and Citi were just a few of the banks all down over 20%. These types of movements, especially during what people thought could be a huge day for stocks, should be detrimental to the market. Bulls were expecting a big victory today. It also doesn't help that Obama's big stimulus plan may not be completed for approval until mid February. I am sure today has added some incentive to get that in the works ASAP.

Well, what a day for my shorts, wow. I haven't had a day like this since October. SRS up 20%, SKF up 29%, and FXP up 16.8%. Just as I discussed yesterday, the VIX level increased 22.86% today! With the VIX increasing at this rate, these inverse leveraged etfs have the potential to be making a lot of money. Today it closed at 56. If it gets back in the 65-75 range, look out. By that time SRS should be $100+ and quickly on its way higher.

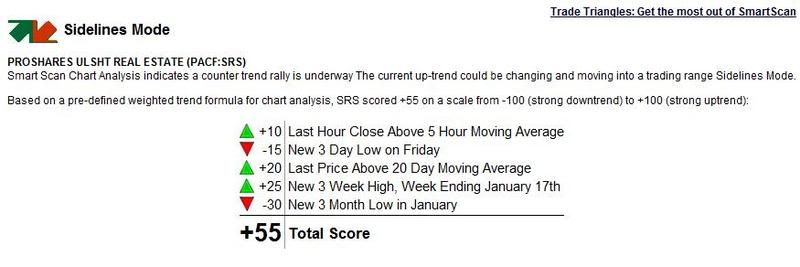

I wanted to show you a breakdown of SRS trends (see below) done from market trade (you can get a symbol analyzed for free, all they need is your email, Click Here!) Notice how they break down the moving trends of the stock/fund and give it a score at the end. SRS was give a +55. The range is from -100(being strong downward trend) to +100(being strong upward trend). So at +55, there is definitely some good momentum behind the fund. SKF and FAZ, wow. FAZ closed up just about 40%! I don't think many articles are being written today about the failure of these fund's ability to produce strong returns. As I have said time and time again. It is all about being on the right side of the momentum, and right now, momentum is downward.

Tomorrow makes me very curious. As all the energy in my body tells me the market will continue to plow downward as surely there was great devastation done today, a part of me feels that we could have an up day tomorrow. I don't expect Obama to kick back for a few days and get settled. I'm sure we can expect some sort of action before week's end to try and re-instill some confidence in the lending institutions. Also, IBM reported better than expected earnings after the close today, which has given a little bump to the tech stocks in after hours after their slaughtering today. However, world markets are responding very negatively to the horrific US trading day, which could continue to put a downer on the market into tomorrow.

Tomorrow makes me very curious. As all the energy in my body tells me the market will continue to plow downward as surely there was great devastation done today, a part of me feels that we could have an up day tomorrow. I don't expect Obama to kick back for a few days and get settled. I'm sure we can expect some sort of action before week's end to try and re-instill some confidence in the lending institutions. Also, IBM reported better than expected earnings after the close today, which has given a little bump to the tech stocks in after hours after their slaughtering today. However, world markets are responding very negatively to the horrific US trading day, which could continue to put a downer on the market into tomorrow.

So there are a lot of spinning wheels going on at once and tomorrow is a bit of a mystery for me. However, the momentum is definitely downward and no matter what tomorrow yields, I believe we're heading for the high 6000's - low 7000's here in the next couple of weeks. Either way, expect a pretty volatile day tomorrow as there should be pretty strong forces on both sides.

Another down day like tomorrow and I will be putting some serious money in gold. With a huge stimulus plan like the one Obama is cooking, you can expect gold prices to shoot up due to future inflation worries. Quite a bit of GDX or GLD is looking to be in my near future.

Just a quick update on my progress with Lending Club. So far all the payments have been made on time and I am still on track for my 10.5% return. I may throw some more cash at it to up my principal invested as I am slowly becoming more comfortable with the company and am having success thus far. I do feel it can be good alternative investment vehicle, especially with the lack of confidence with commercial banks.

Check out this featured video of the week from Market Club showing their track record, (click here). I know it can be difficult to spend money on tools in this type of market, but as you can see from the video, they really do a good job of bringing in profits by diversification. I have been using many of their tools the past week and learned a lot. You can try a free trial of their videos, Click Here, they just need your email and name. It can be tough to find good tools out there so I flock to the ones that seem to work.

Tomorrow should be just as an exciting day to watch as today. There is definitely that nip in the air that we felt back in October where there is a lot of uncertainty. We shall see. Happy Trading and we'll see you tomorrow.

Dow Closes Under 8000 For First Time In 5 Years - Still More Pain To Come

Posted On Wednesday, November 19, 2008 at at 1:43 PM by Finance FanaticIt looks like reality is beginning to settle in for traders around the world as we continue to be caught up in a whirl wind of havoc and bad news. Today we saw that the market has little patience or mercy for the doubts and fears going on in the world. Wow, there's a lot to talk about today...

Today is the first time the Dow has closed under 8000 in 5 years. It dipped below 8000 last month but came back above before the end of the day. Another historical number we saw today was our CPI numbers. We fell 1% for the month of October, which was far greater than expectations and is the single biggest monthly loss in CPI since the index began tracking in 1947. Housing starts fell 4.5%, which was near market expectation (but still depressing). Coupled with that we had a slew of bad earnings report from retailers as well as the auto bailout fiasco which still continues. Overall, it was a bad day for your average stock trader.

These are the things we have been discussing for a month now. No matter what new bailout news we receive, or little light given by government regulators, nature will take its course. And until the government allows it, unfortunately, I believe we will be in this continual roller coaster that can give traders a splitting headache. Not to say that I am a pessimist and wish the economy to crumble. I just saw the signs a while back and know that's what needs to happen in order to get things back on track, so why not make some money on the way, right?

So lets talk auto bailout. I still believe a lack of intervention from the government and the auto companies going under could be the shove the market needs to capitulate, especially now. I don't know if the government is ready to deal with that. I think we will see some agreement happen, even though I disagree with it. But until it does, it leaves uncertainty, which the market hates. Uncertainty and fear are key signs to capitulation.

So what else led to the downfall today? The FOMC minutes were released today from their prior meeting from a few weeks ago. In it they discussed of the probability of negative GDP growth for the next 4 quarters. Even though many of us have already expected at least that, to hear it come out of "The Fed's" mouth causes even more concern. Their suppose to be our super heroes right? You can see their minutes here.

In the midst of all this turmoil, I am still a believer of the good possibility of a rather strong rally in this bear market. In fact, call me crazy, but I picked up some UYG options (.UUFLF), considering UYG was down over 20% today. Financials have taken the worst beating of them all, and probably will continue to, but I just felt like it was low enough to give me some good profits for the next rally. These are those "defining days" I talk about that I like to wait for to buy. That was my only move today. Our "Rock Stars" looked great today. SRS and SKF were both were over $220, impressive. EEV is up to $110, and FXP is closing in on $88 (All were up anywhere from 15-25%).

My long options were down today, but not by much, surprisingly. GDX and Apple are weathering through the storm pretty well. DIG was hit hard do to demand uncertainty. Gold futures were up today and it's only a matter of time when oil is creaching back towards $90. When the next rally comes, they should perform pretty well. Plus, my positions in these are significantly lower than my short positions.

Tomorrow is a critical day. We have seen a lot of resistance at around 7800. If we punch through that bottom tomorrow, watch out. However, being in this fragile state, with a bailout announcement or some positive news, we could see a pretty strong bear market rally. It will take something pretty significant though, I would think. Which ever way we turn, expect some serious volatility and strong moves in whatever direction we're headed. Remember, this is options week, which usually entails some manipulation, so we could see some interesting moves before Friday. Either way, I believe FXP should be at $100 shortly, as China is sure to be dragged down with us in our bad news. If we do indeed rally strong Thursday or Friday, I will look to get out of most of my options and putting them right into EEV.

I hope everyone survived today and that your bleeding green. No one can be 100% right in this market. If you are, give me your contact information. Thanks for the insights with your comments. Happy Trading and have a good night.

Obama Wins - Wall Street Loses

Posted On Tuesday, November 4, 2008 at at 1:14 PM by Chris

As we progress further into "Rave Week", we continue to find surprises. Although, we did anticipate a rally this week, with the fact that historically stocks have rallied following elections. One thing is for sure, Wall Street does not like uncertainty, which is why in most cases there is a slowing prior before elections. However, with certainty comes a rally. In this case, with the polls strongly favoring Obama to win today, it seems as though Wall Street has already made up its mind, finishing the day over 9600. It seems as if they feel the uncertainty is over. Remember, I cautioned for the possibility of a rally towards 10000, since the 9200 threshold was reached. But tomorrow will be tricky. As when news is expected to be announced, like the Fed Rate cut, or high earnings, there is usually a bigger run before hand factoring in the expectations. I believe we have experienced that "anticipation" of the election today. However, when the excitement settles and America "sobers" up, we will still be in the same financial crisis we started months ago, and this time Head Deep. Look for a new bottom to be established in December or January.

Tomorrow, I believe we have a good chance to keep this rally going. Foreign markets should respond well this evening to the election and strong performance in Wall street, which should carry over into tomorrow. However, I think this rally could be put to a sharp halt on Thursday and/or Friday. Like I said yesterday, employment news is announced on Friday, and that can't be good.

The only thing keeping the market above 9000 the next couple of weeks will be the short squeeze we are experiencing, because of Redemptions due in Mid November. Until then, we may see this awkward stimulated market, with the help of some market manipulation. Just remember, we aren't even labeled a "recession" yet. We have a ways to go.

So what to do. As expected, we saw big moves in GDX and AIG. I think I will look to sell AIG as it approaches $3. GDX looks like a good sell for me at $25. Both have been great this past week and still should move. GDX has moved 30% in the past few days where AIG has almost doubled.

LOAD UP ON FXP, Wow! I was extactic to see it go below $80 today. I picked up another good load of shares today at $74. People, I know it's hard to see the sharp decline in buy into it, but this is a steal. The harsh times that lie ahead for the end of the year will directly show in the value of FXP. I believe we will hit the $200 price by January.

For Tomorrow, expect another rally, maybe not as strong as today. This may be the last day to get FXP at this strong, discounted price. If you still are in GDX or AIG, you may want to consider selling of some if not all your shares tomorrow, before the market gets struck. SKF and SRS are getting very close to purchasing price, I'm just waiting a bit longer (although that is a gamble, because this could be the lowest it goes). Be patient, like I said in prior posts, in this round of FXP, we aren't going to see a double in a week like we did last time. We may have to wait a month or two this time. So be patient, Happy Trading and we'll look to see what this market does tomorrow. Oh and if McCain somehow wins tomorrow, who knows what the market will do, all bets are off. See you Tomorrow.

Stocks May Rally - Halloween Sparks Confidence

Posted On Friday, October 31, 2008 at at 4:10 PM by Chris Despite continual economic woes, we still see the marketing battling hard to stay above water. This is exactly why I said we're heading into "Rave Week". On the bright side, even in the up day, we still saw FXP take a little hop from yesterday's closing. That should show you the resilience of this ETF. Today, the market broke a critical barrier of 9300, which some believe was a threshold the market needed to beat to see a healthy run. Many believe that the market may rally close to 10000 this next week because this threshold was reached. As for me, it's Rave Week, so I won't bet on it.

Despite continual economic woes, we still see the marketing battling hard to stay above water. This is exactly why I said we're heading into "Rave Week". On the bright side, even in the up day, we still saw FXP take a little hop from yesterday's closing. That should show you the resilience of this ETF. Today, the market broke a critical barrier of 9300, which some believe was a threshold the market needed to beat to see a healthy run. Many believe that the market may rally close to 10000 this next week because this threshold was reached. As for me, it's Rave Week, so I won't bet on it.

I am very happy to only be in FXP currently. In fact I would not mind a healthy rally on Monday to send the shorts down further to lower my basis. Currently, SRS is becoming very tempting at $115, but I am going to continue to wait until it is under $100.

As I have said before, historically, the stock market takes a little bounce after an election and with the short squeeze on going with the Hedge Funds, we are set up for a nice little rally. Even though I am predicting a rally next week, I am going to wait on the sidelines and only stock up on my short position if prices fall. Look to continue to pick up shares of FXP if they fall $85 and below as well as SRS if it falls below $100. An investment to be considering in the near future is Gold. Next week I will discuss why it is a buy and how we can make some quick cash on it. We ended the week with a little bit of unexcitement, but we are set up to do quite well this next month. Have a Good Halloween and lets make some money next week. We'll see you Monday.

The Dow up over 10% - Did You Get On The Wave?

Posted On Tuesday, October 28, 2008 at at 6:02 PM by ChrisLike I said patience is a virtue. You should have not been too surprised, because we here at Crash Market Stock said it was coming. In any regard, I hope that you are finding ways to make money in this market, because the opportunities are ALL AROUND YOU!

So here we are, a huge rally, up over 10% for the Dow today. All of the options we discussed are up anywhere from 30-90% depending on which ones you bought. And after completely liquidating my FXP, there was not any downside today. So what now...

Tomorrow will be a very interesting day and I'm going to be very cautious to what I advise. There are many elements constantly pounding on the market everyday telling us Bad News. I mean, even today we got the worst consumer sediment report in 30 years. You would think that would devastate a market. However, this time, I believe there was more positive pounding, temporarily, to give us this huge run. But there is a lot less positive to work with than negative, which is why we need to be careful when playing the long. In fact, GDP reports come out Thursday, which I am sure will now show a recession.

As for tomorrow, we have the big announcement. Now, no doubt most of the reaction of the cut was factored today, but not all. This puts us in a sticky situation. Most are expecting around a 50 basis point cut in the rate. Anything less than that, will probably send this market down tanking (coupled with the people taking profits from today). If they cut to expectations or more, I believe we'll see another healthy rally tomorrow. Remember, there are billions of dollars out there sitting on the sidelines waiting for the "bottom", and as soon as they see signs of life, they dump it in.

As For me, I plan on keeping my option contracts and hopefully selling them tomorrow for a healthy gain. Then, depending on how the market moves, I would love to get back into a short position. Notice below the chart for FXP. See the trends? As you can see, there is a pretty correlating trend with spikes in this ETF. Good fluctuation from $80-90 up to $190. For me, as soon as it gets below $100, its a buy, and look what we found last week. The great news is after today, it took such a beating, its back down to $113. Another day of that and I am back in. For your options, look to hold on tomorrow and think about liquidating at the peak of the day tomorrow. Remember, it may be better to sell it before the Fed's announcement, because as we saw from the Bailout vote, action can cause the market to move down. If we see FXP hit $92 or below, I would get back in. There is too much bad news to come to keep that stock below $150. Good luck, Happy Trading, and we will see you tomorrow.

As you can see, there is a pretty correlating trend with spikes in this ETF. Good fluctuation from $80-90 up to $190. For me, as soon as it gets below $100, its a buy, and look what we found last week. The great news is after today, it took such a beating, its back down to $113. Another day of that and I am back in. For your options, look to hold on tomorrow and think about liquidating at the peak of the day tomorrow. Remember, it may be better to sell it before the Fed's announcement, because as we saw from the Bailout vote, action can cause the market to move down. If we see FXP hit $92 or below, I would get back in. There is too much bad news to come to keep that stock below $150. Good luck, Happy Trading, and we will see you tomorrow.

Patience is a Virtue... Even With The Stock Market

Posted On Monday, October 27, 2008 at at 5:00 PM by Chris And we were so close. From now on, you may just want to save yourself the time and only turn on your computer to check the status of the stock market between 12:50 and 1:00pm (PST), because lately the last ten minutes we have seen this market move anywhere from 3-5%. We enjoyed a majority of the day in the green and saw, for a brief time, increases in gold, oil, Rim, and Apple. However, that was quickly wiped out the last five minutes of the market. Don't worry, all is not lost.

And we were so close. From now on, you may just want to save yourself the time and only turn on your computer to check the status of the stock market between 12:50 and 1:00pm (PST), because lately the last ten minutes we have seen this market move anywhere from 3-5%. We enjoyed a majority of the day in the green and saw, for a brief time, increases in gold, oil, Rim, and Apple. However, that was quickly wiped out the last five minutes of the market. Don't worry, all is not lost.

On the bright side, we saw FXP hit $184, wow. So for all who heeded the call at my $92 buy in, has now doubled their investment on that stock in 1 week. No need to thank me, I'm riding the wave with you. Although it looks as if this stock will never be halted, I found it time to unload a majority of my position. I mean how greedy can we get. We may see it creep close to $200, depending on the market the next few days, but I don't want to roll the dice.

One dilemma this puts me in, is now I am not in a short position to cover my longs. Sure, I still have a minor stake FXP, but nothing that will hedge my longs. The good news is, all of my long purchases were option contracts, so there is a maximum to my downside risk.

So why go long in this market? Do I think that we have reached the bottom? NO! But I believe there is enough news in the next two weeks to encourage a healthy 1000+ rally and it could happen on any day. What are these reasons?

- Fed is meeting to discuss and is expected to make another cut to the rate. Historically, this has been a great way to stimulate the market. Depending, on how big the cut is, the market could really take off. It could take off tomorrow just in anticipation for it. If they cut it 50+ basis points, watch out.

- Elections. Historically, the market always slows prior to an election, but than usually gets a healthy bump afterwords. As it looks as though Mr. Obama will be elected, that can easily stimulate a run.

- Hedge fund redemptions expire Mid November. It is in their best interest to have the market as high as possible for these redemptions, so look for maybe a manipulated run in that regard.

The Dow is still going Down, Down and Down. More Opportunity For You!

Posted On Friday, October 24, 2008 at at 9:09 PM by ChrisWell, we have seen yet another Red day in the Stock Market and while most people are outside banging their heads on the wall, I am excited for the new opportunities that are presented to make some money in the market. It is for this reason why I recommended the initial load up of FXP. Today, we did see a decline of the Apple (AAPL) options, however, FXP hit $160, still giving us strong gains for the day. It is essential in this market (at least at this point), that whenever you are long, also hedge it with a short position, because for the next year I see this market struggling.

Because of continual days of red in the market, I think we are due for a rally. I did say yesterday that I thought that rally would have been today, but that's ok. KEY DATE: The Fed meets October 30 to discuss the economy. You can bet that if the market is still trending downward, we may see a historical 1 point cut to the fed funds rate. If so, watch out! We will probably see a 1000 + day movement on the DOW. So I foresee some expectation of the cut beforehand.

I think some opportunities to look at are Gold. Commodities have been slammed this month and gold is at a 52 week low. With the FED cutting the rate, some will fear inflation, boosting up Gold. On Monday, look to see the trend of the market. If it looks to be up in the pre-market, considering selling a big portion of your short position and maybe load up on some January expiring, either GLD or GDX options. This should give you plenty of time for a nice good pop in gold. If it looks to be down on Monday, let FXP make you some more thousands and towards the end of the day, maybe look into loading up on the Gold options. I think next week is a Green Week. See you Monday.

Take A Ride On the Dow Roller Coaster

Posted On Thursday, October 23, 2008 at at 3:22 PM by Chris

Return Update - Did you make money this week?

Posted On Wednesday, October 22, 2008 at at 11:09 AM by Chris It has been 2 days since my advice of positions to take and although it may seem like it's too soon to discuss big returns, this is the market we are in today.

It has been 2 days since my advice of positions to take and although it may seem like it's too soon to discuss big returns, this is the market we are in today. FXP Update and Stock Buy Tips for Tuesday, October 21st

Posted On Tuesday, October 21, 2008 at at 9:44 AM by ChrisYesterday I discussed a move I made to buy into FXP, an Ultrashort ETF fund, that shorts the China Stock Market. For more about this ETF click here. Yesterday the buy in was close to $90. Currently it is trading at $101.39, up 12.92%. I plan on holding this for a bit until we see it hit $120-130. This is one of several ETF shorts I have been playing, which, as you can see, have been performing very well and act as a great hedge for your long securities that you may still be holding onto to not take the loss. Today, the market is reacting to a variety of poor earnings reports, which, in my opinion, there will be a lot of this month. With that, Apple (AAPL) is down close to 5%.

Don't lose faith in Apple quite yet. I still like apple as a buy, especially as a call option. I think they should weather well on their earnings report today after the close and we should see a good 6-15% jump in their stock tomorrow. Of course there is always the chance they do not perform up to market's expectation, I just don't find that very probable with their fundamentals. Pending on earnings reports tomorrow, we could see a pretty healthy rally, especially in the NASDAQ.

Another play worth noting is oil. In playing oil, I play the stocks DIG and DUG. DIG is an Ultra Long choice and DUG is shorting the Oil sector. Oil has taken a beating this past month, reaching their 52 week low. It is down another 5.71%, reaching $70 dollars today. A lot of this is due to lack of demand from Countries like China and India, as well as the weakening dollar. However, OPEC, the body which oversees Oil production, has a critical meeting tomorrow where they will decide if they will cut production of oil, and if so, by how much. I am expecting a pretty decent cut in production, which should cause some upward momentum in oil. DIG is currently trading at about $30 per share. Consider bulking up on some DIG share for a nice healthy bump tomorrow.

Weekly Tip - Apple To Report Earnings Tomorrow

Posted On Monday, October 20, 2008 at at 4:26 PM by ChrisFriday I bought April expiring call options for Apple (AAPL) when the stock was at $94 dollars. Even though I believe we are a downward trending market for the next 12 months, there are still times where I like going long in the market. The reason why I like this play is that I believe a lot of good companies have been brought down to ridiculous prices because of the overall status of Wall Street. Apple is one of those companies.

When looking at the fundamentals, in my eyes, there is no reason that Apple should be below $140, let alone $100. They have barely any debt and a brand that should weather pretty well even in a recession. When people have to sell, they sell it all. So I take it as a great opportunity for me. The reason why I like this stock this week, is because Apple announces earnings tomorrow after the market closes. So far this month, IBM and Google have both produced strong earnings and slaughtered market expectations. I don't see Apple breaking this trend.

Pending on this good news, I see Apple jumping anywhere from $110 to $120 in the next week or so. I decided to go with the call option, just to hedge some risk against bad news that could bring the stock down further. Look for a $110 to $120 January - April expiring contract before tomorrow's close. I will keep you updated on where I sell mine at.

Crash Market Stocks: An Introduction To This Site

Posted On Friday, September 19, 2008 at at 2:48 PM by ChrisBy definition, recession means "a contraction phase of the business cycle." Although, in early stages, most economists dodged that word by saying we were a "slowing economy," I am pretty sure that all agree that the recession is here. The plan is to hopefully put it off until the economy is back on the upswing and we can look back and call the time a recession. No one likes to admit that we are currently in one. However, I believe if you can recognize it, prepare for it, you can come out of it more successful than you are today.

Signs of the Times

We first began to feel the heat on the economy when the sub prime market fell out in early 2007. This began a ripple effect which halted the purchasing of new homes, then lead to a surplus of houses on the market, then leading to a decline housing prices throughout the country. This resulted in new housing projects to be put on hold or cancelled.

Losing equity in your house is usually the biggest influence on a person's disposable income. Hey, you've always got your house, right? When you've lost 30-50% value in your house in 2 years, you tend to tighten the belt a bit. National retailers banked on new growth areas and a booming economy to sell their inventory which they pay for after they sell.

As a result, we have retailers like Linen's & Things, Starbucks, Circuit City, Mervyn's and many more, who then make the decision to either file for Chapter 7, or close several stores to prevent bankruptcy. In 2007, commercial real estate owners should have realized it was only a matter of time until the same problems that plagued the residential market would eventually come to the commercial side. What is that problem? No Lenders.

CMBS Market

From 2000 to 2005, CMBS financing became very popular by offering new financing terms that had never been seen. CMBS can be explained by taking a group of different loans and packaging them into a bond rating (ie AAA, BBB) depending on their strength of credit. These rated bonds would then be traded on wall street and sold to investors depending on their credit rating. This in turn allowing lenders to provide very competitive interest rates and terms.

However, the underwriting standards became sloppy and banks were being loose with their lending. This in turn led to the eventual collapse of the CMBS market all together. In short, the banks were lending out AAA money to CCC properties which artificially pushed property prices into the roof. Buying buildings for $400 per foot in secondary and tertiary markets was unheard of. It became a reality.

It was only a matter of time until this bubble popped. Now with the turmoil of the banks (Lehman Brothers, Freddie and Fannie, AIG), this has stepped up the crisis one more notch. Not too mention the oil crisis, weak dollar, inflation, commodity scarcity due to global economy, and the upcoming election. All of these elements combine to provide the vehicle into maybe one of the worst economical positions the US has seen since the Great Depression.

Goal Of This Site

Knowing the signs, you can prepare for the worst, but hope for the best. Living within your means is the key. In this site, I will provide the tools, warnings, strategies, and vehicles that have helped me to weather these storms. Living in a land that promotes "free economy," we must live with a Cyclical Economy. There is no way around it. The goal is to know when the cycles are coming and change our lives accordingly.