Watch Out VIX

Posted On Monday, June 15, 2009 at at 11:06 AM by Finance Fanatic

Finally a day of trading with some movement. Not only that, but there is actually volume trading today, which was not present all last week. More negative economic data finally sparked a bit of selling Monday morning, as the light at the end of tunnel may be more distant than people thought. Factory activity in New York as well as a home builder's confidence survey, showed weaker signs in June. Not only that, but the IMF chief also expressed his opinion that indeed the worst of this recession is yet to come. The data has been coming in for the past several weeks, but unfortunately, the market never responded. The big question is whether this will be a one day fluke, like we've seen in recent times, or if this could open the door to a rather strong downward push. Tomorrow will bring a lot of those answers.

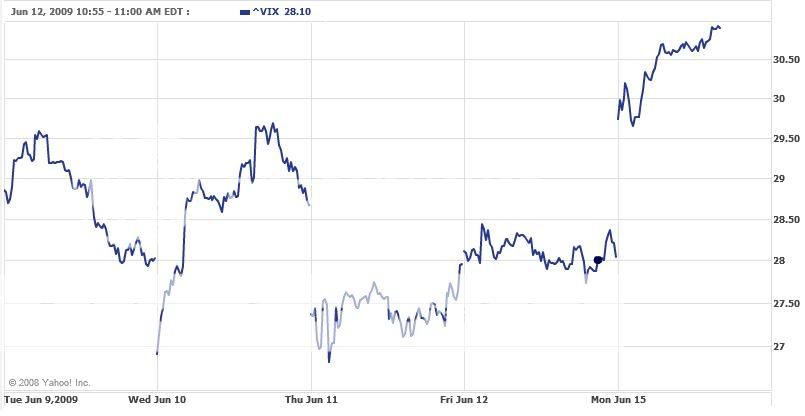

Another element concerning to many bulls is the moving of VIX levels. As you can see from the graph, today the VIX hit 30 for the first time in quite a while. Such movements can be very concerning for long investors, as higher VIX levels, usually lead to higher options prices. We saw this very prevalent back in October and November, when the market had it's big crashing period. At that point, we saw huge gains in the options markets, especially on the short side and the VIX was at record highs. I discussed this possibility in a post last week as well.

Also, we are seeing a pretty strong retracing in commodities, which I thought might happen, especially if you consider deflationary probabilities. This is why I was not too bullish on gold quite yet, and took my profits when I did, as I do feel gold's big upside will be next year.

So the signs are definitely here for a downturn, we just need to see how sustainable it is. No need to get trapped like some have in times past. Sustainability is the key both on the long and short side. Momentum will gather shortly, and when it does, I'll be ready.