Banks and Earnings

Posted On Friday, July 17, 2009 at at 10:51 AM by Finance Fanatic Two big banks reported earnings this morning (BAC and Citi) and investors have taken the news with mixed feelings. Citi gave a much more favorable earnings report than expected, however, much of the big numbers came from the structured sale of Smith Barney, which investors discounted. Bank of America also gave a better than expected earnings report. However, Ken Lewis, CEO of Bank of America, followed up the report with some comments that were not very positive. He said despite their success in the first half of 2009, the second half would be more difficult to earn profits. He also said that because deteriorating credit quality, their difficulties are expected to last the rest of year and into 2010.

Two big banks reported earnings this morning (BAC and Citi) and investors have taken the news with mixed feelings. Citi gave a much more favorable earnings report than expected, however, much of the big numbers came from the structured sale of Smith Barney, which investors discounted. Bank of America also gave a better than expected earnings report. However, Ken Lewis, CEO of Bank of America, followed up the report with some comments that were not very positive. He said despite their success in the first half of 2009, the second half would be more difficult to earn profits. He also said that because deteriorating credit quality, their difficulties are expected to last the rest of year and into 2010.

Banks having problems is no surprise to anyone who is tracking fundamental, economic data. An increasing unemployment rate, with less consumer spending will not help un-thaw the very frozen lending market. As a result, FAZ and SRS have been relatively strong today, which is a bit of a refreshment. I'd like to hear your thoughts on the banks and the winners and losers, comment below.

Bailouts Beat Out Bad News

Posted On Friday, January 16, 2009 at at 7:01 PM by Finance Fanatic The Friday rally returns. And in the midst of so much adversity too. I was surprised today to see my Zecco.com account in the red today when I first checked this morning. This definitely has to be the Obama anticipation rally, because I can't think of anything else that would end today green other than that. The belief in Obama's ability to continue to print money is ringing much louder in everybody's ears than the fact that there is much to be worried about in the near future.

The Friday rally returns. And in the midst of so much adversity too. I was surprised today to see my Zecco.com account in the red today when I first checked this morning. This definitely has to be the Obama anticipation rally, because I can't think of anything else that would end today green other than that. The belief in Obama's ability to continue to print money is ringing much louder in everybody's ears than the fact that there is much to be worried about in the near future.

Circuit City announced today that it's official. They have been unable to reorganize their business and will move to the next step, liquidation. For those who have been reading my site for a while, we knew this back in November. There goes another tens of thousands worth of jobs as well as an American business that has been around for more than 20 years. GE capital, Conoco, AMD and Pfizer are also in the plans for some massive layoffs. January-April's unemployment numbers are going to atrocious. Every single sector of business is somehow struggling in this market. There is no immunity.

As I said I was going to do yesterday, I picked up some Citi shares today. Due to their unfavorable earnings and their splitting, at $3.50, it is low enough for me to make the gamble. I predict some serious bank rallies next week as Obama gets put into office and begins to unfold his huge bailout plan. Although I feel this won't fix anything in the long term, it should make some serious movements in the bank stocks. Hopefully I can make a 30-40% return and get out of it before it comes down again. Sure it's a risk, but I'll take it.

I also picked up some more GDX options today. With the huge bailout plans, will come some serious money printing. Gold is sure to get a good bounce as Obama looks to unload a good chunk of cash. Just today, gold was up $35. This should be even more next week.

Bank of America and Chrysler got another check from the Fed today. Now people are wondering whether Circuit City should get a piece too. Why not? Everyone else has. They failed to draw the line with the autos, so they have opened this door and now have to deal with it. It really does scare me of what our deficit will be when all of this is done. I do recognize the principle of backing the banks, no matter what, but it should end there.

For all you Californians, enjoy your IOU from Arnold concerning your tax refunds. Due to the $41.6 billion California deficit, Arnold is looking to either issue IOU's or postpone the payment. Either way, holding tax returns will not stimulate the economy and should cause for even more problems. State government IOU's, are you serious? California is desperate.

It was another volatile day going from 100 up to 100 down and back up again. We are nearing market conditions from past October and it is beginning to become thin ice with trading again. After the Obama change, what is left to cheer? More bailouts? Either way, I think we're in for a tough run until May.

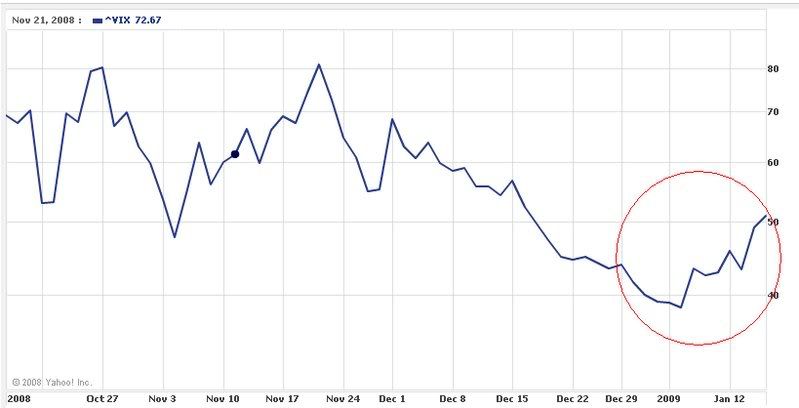

With the Vix getting back into the 50's, it's prime for buying the 2x inverse etfs again soon. Since they are momentum movers, the higher the VIX, the better, as long as you're going the right way. I hope you all have a good weekend. Next week is the big one, lets hope for some serious dollar signs. Happy Trading.

PS - I am running a promotional contest to win a quick $100 on behalf of Lending Club to try and instill some curiosity in the company. We've talked a bit about it on the site and I do feel they are worth checking into. So if you are interested, than go here for details. It requires no money to enter the contest, just filling out a form and poking around the site. I'm just trying to stimulate some curiosities.

Bailout Breaths Cause For Market Turnaround

Posted On Thursday, January 15, 2009 at at 7:05 PM by Finance FanaticI don't know whether it was Bush's departure speech or our newest fix of bailouts that pulled off a huge momentum change in the middle of day today. The Dow dipped below 8000, before immediately turning around and actually closing up at 8212. Amazing, especially after the series of events which have transpired throughout the week. These days I never underestimate the market's ability to start buying out of pure speculation. In any event, today's miracle puts a bit of a different light of what I was planning to do with my portfolio the next couple weeks. This turnaround today, could indeed be the ones that continues to go on into Obama's inauguration. Once again, it is all based on government intervention, no actual numbers, and a false hope that, in my opinion, is once again just going to temporarily slow the pain.

So what happened today? Well, one item that seemed to make people happy is that Congress did not pass the bill that would put a hold on the remaining $350 billion of the TARP funds. This tees up Obama quite well to do whatever pleases him with the remaining funds. Lets hope that the second half of the funds go a bit farther than the first did. The problem is that there is such a big deficit of debt to fill, it's like trying to fill a meteor crater with shovels of dirt. It's going to take a long time.

Another element worth noting is the VIX level slowly climbing up. Many people say we are not vulnerable for a crash right now, because the volume's not there and the volatility is not there. As that can be partially true, the VIX level has definitely been rising the past week and should continue to rise as uncertainty continues and more woes hit the headlines. If volatility levels do indeed reach those October levels and beyond, watch out.

Citi is expecting a loss in their earnings tomorrow, which could be bad for their already $3.83 stock price. Call me crazy, but Citi is becoming appealing to me as a buy. I know people worry of another Lehman, but I do not feel the government will let this one go. Sure they're going to have their continual share of problems, but if they have another beating of a day with their stock price tomorrow due to earnings, I plan on picking up 1000 shares. With an announcement from Obama, as well as the probability of Bank of America getting $15 billion more from the Fed, Citi is very capable of having a 50%+ day, easily. So we'll see how tomorrow plays out, but it is definitely on the radar. For you first time traders or those that are unhappy with your online accounts, you can get free monthly trades at Zecco.com, worth checking out.

Well, Fridays can be interesting. It wasn't long back that every Friday was a rally. That hasn't been the case lately, but today's powerful turnaround could bring some optimism to end the week. However, a bad enough number from Citi could definitely set a selling tone for the day. Either way, I'm happy about my current position and hope for some good gains tomorrow. Definitely watch SKF and FAZ tomorrow. Have a great night and Happy Trading.