Fed Intervenes With More Bailouts - Good or Bad News?

Posted On Wednesday, March 18, 2009 at at 9:44 PM by Finance Fanatic I said there would be fireworks today and indeed there was. I have to admit, even though I was considering it as an option, I was quite surprised to see the Fed do what they did today. As most found it time to cheer and buy, I was looking deeper into the decision and wondered why they would do such a move? This decision exposes a lot of the concerns the Fed has about the economy, and although it seems as though it will bring relief to the credit crisis, the side effects of such a move could have some serious repercussions on the market.

I said there would be fireworks today and indeed there was. I have to admit, even though I was considering it as an option, I was quite surprised to see the Fed do what they did today. As most found it time to cheer and buy, I was looking deeper into the decision and wondered why they would do such a move? This decision exposes a lot of the concerns the Fed has about the economy, and although it seems as though it will bring relief to the credit crisis, the side effects of such a move could have some serious repercussions on the market.

So the day reacted in my "B" scenario of what I expected to happen in the market place. Honestly, I was leaning more towards my plan "A" scenario, which was to have the market open up, due to expectation of the meeting, with a disappointing sell off after the announcement. However, the Fed decided to surprise the world with their plan. Luckily, I set up myself prepared for either direction, however, I would have done better with an ending sell off. Indeed my FAZ options purchased yesterday took a strong hit, but a lot of those losses were eaten up by my SSO gains. The options expire in July as well, so I have plenty of time for the banks to go sour once more. I'm not too worried.

So lets break down today's announcement. The Fed announced their plan to spend $300 billion over the next 6 months in buying up long term US government bonds. In addition to that, they announced that they would spend an additional $750 billion on buying mortgage-backed securities guaranteed by Fannie Mae, which now brings the total to a whopping $1.25 trillion. Also, yes also, they will be increasing their purchase of Fannie and Freddie debt to $200 billion. Those are a lot of bullets to fire in one meeting. In fact, I was very surprised to see the market only close up 90 points after such an artillery of news. So, how do I feel about all this?Honestly, I think it shows the desperation of the Fed. Notice a big key missing ingredient of today's announcement. After Bernanke so proudly declared his expectation of the recession to maybe be over by 2009 in the CBS interview, there was absolutely no mention of a 2009 ending recession in the FOMC notes. At least they're not fudging the numbers too badly.

As with buying the government bonds, I believe it was something that needed to happen. There has recently been a scare of China pulling out a lot of their money that are in US Treasuries, which they own A LOT. Such an action from China would derail interest rates, only freezing the markets more. Instead, the move today sent Treasury rates sailing down, which in turn should hypothetically lead to lower lending rates. This is something the Fed hasn't done since the 1960's. So, if indeed China does pull out, this won't make that much of a net difference, just keep the Treasuries from plummeting.

The amount of money being put toward mortgage backed securities may put a door-ding in the debt that is hanging over these banks. Although it seems as $1.25 trillion is huge, it is nothing compared to the debt that is coming due and will be considered delinquent for CMBS loans. This makes a total of $4 trillion that the Fed has now spent (which will come out of your pocket), without asking the American people. Sorry folks.

This indeed is just more supporting my theory of massive inflation that will come later on, following the deflationary spiral hitting the markets. We have now had 3 consecutive months of declining PPI, which is very discouraging for the markets and which is why the Fed is acting in such a panic. Expect a beating from the dollar in the near future as well as more spikes from gold.

Already, many are on the wagon of the "we have reached bottom" club and are beginning to position themselves on the long side. Although I do believe we could rally a couple more weeks, especially with this recent news, I still very much believe that there are much tougher roads ahead. In fact, such news released today, only supports the models in setting up for capitulation. At least, that's my opinion. So I will remain patient, but the time is getting closer to getting back in the shorts.

So, it will be interesting to see how tomorrow reacts. I think, as with other plans that were a surprise to the market, people will begin to see the side effects of such a move, and its halo will begin to fade. For those looking for a good brokerage company, TradeKing is offering some really good rates for trades. Happy Trading everyone, see you tomorrow.

All Eyes On Bernie - Makes It or Breaks It

Posted On Tuesday, March 17, 2009 at at 5:35 PM by Finance Fanatic My fast from shorts was finally broken today as I began to make some small moves. Actually, most of the moves I made today were in anticipation of tomorrow's big FOMC meeting. It is sure to cause a lot of noise in the markets and I thought I'd try to take a run at it.

My fast from shorts was finally broken today as I began to make some small moves. Actually, most of the moves I made today were in anticipation of tomorrow's big FOMC meeting. It is sure to cause a lot of noise in the markets and I thought I'd try to take a run at it.

Today's trading was much as I expected. We saw mixed trading in the morning, flip-flopping from red to green. Once again we saw huge spreads on the FAS/FAZ combo, which may have weathered good for some of you day traders (if you went with FAS of course). News of an uptick in housing construction helped flush some confidence in market towards the middle of trading. They spoke of this increase like it was the end of the housing crisis. Well, considering January is usually one of our worst selling months for houses, it is not surprise that February happened to perform slightly better. Media loves to put their spin on things.

The buying really kicked into gear towards the end of the day, where we saw the Dow settle at 7395. Supposedly, having a close above 760 for the S&P is a strong technical move and should mean there is some momentum heading toward the 800 level. I believe it was, once again, anticipation of things to come, which really caused the market to rally at the end. Tomorrow, The Fed meets to discuss any rate changes (which I doubt there will be any) as well as the new possible plan to buy up bonds from housing authorities such as Fannie and Freddie. The bill is expected to be around the $600 billion range, and with the added discussions of buying US Treasuries and corporate bonds, the number could reach over $1 trillion. That's right, one trillion dollars.

Of course news of this degree would cause for huge cheering in the markets. The question is, will they do it? I don't see how they would announce something so quickly, yet so big, without "rolling" it out, as they've done in times past. Indeed, they may report of the possibility of such action, but I believe an announcement of "possibility" will be disappointing to investors and may put the market in a tailspin in afternoon trading. However, if by chance a significant announcement is made, a 4-5% rally could be bound. All eyes are on Bernanke at 2:15 pm Eastern to hear the results.

To prepare for the fireworks, I went in and bid on some $50, July expiring FAZ call options. During the last 20 minutes of trading, I was able to get the price from the ask of $14.90, to my bid of $12.90. There definitely were some nervous traders before close wanting to dump their contracts. As a hedge to this, I also went in and bought some SSO, in case of a bigger rally. I am placing a 5% stop loss on SSO, so that if we indeed see an afternoon tailspin, my losses are minimal. Hopefully, at that point my call option profits will far surpass my losses, for a nice quick profit.

If we see a rally, I will enjoy some strong gains with SSO, while holding onto my call options. Considering the expiration is in July, I have plenty of time to see the downfall of banks to see FAZ strengthen again. I was glad I was able to get in.

So, that's the game plan. It should be a very interesting day tomorrow, one of which could spawn some more moves on my part. I almost pulled the trigger on some SRS today, but tomorrow's announcement held me off for the time being. I am hoping that I don't regreat that and am hoping for more green in my Zecco.com account tomorrow.

Today I posted a new podcast for you subscribers, which you can listen to here. If you are wanting to subscribe, CLICK HERE. I am anticipating an exciting day tomorrow and hoping for the best. We continue to move as planned for the bear market rally. I just frequently remind myself of the crash around the corner. Happy Trading.

Big Rallies and Big Meetings

Posted On Saturday, March 14, 2009 at at 1:18 PM by Finance Fanatic Ending the week with the fourth consecutive day in the green is something we have not seen in the market since December 2008. We all remember the times of December. It was not a good time to be positioned short. Not to say that March will be the exact same, but this buying is definitely more than just a couple day fluke. It is behaving much like your standard bear market rally and may have a bit more left in it. The dangerous part is trying to guess when it ends. I keep reinforcing my choice to stay lucrative at the moment, besides my small trading I've been doing here and there. This is because I do feel there will be point where the shorts are at a price that is just too low and I want to have the capital ready and available to make my move. I think we are very close, but I do feel that there still may be some rallying the next week or two, so I am remaining fairly cautious.

Ending the week with the fourth consecutive day in the green is something we have not seen in the market since December 2008. We all remember the times of December. It was not a good time to be positioned short. Not to say that March will be the exact same, but this buying is definitely more than just a couple day fluke. It is behaving much like your standard bear market rally and may have a bit more left in it. The dangerous part is trying to guess when it ends. I keep reinforcing my choice to stay lucrative at the moment, besides my small trading I've been doing here and there. This is because I do feel there will be point where the shorts are at a price that is just too low and I want to have the capital ready and available to make my move. I think we are very close, but I do feel that there still may be some rallying the next week or two, so I am remaining fairly cautious.

I did almost pick up some SRS for two consecutive days now. However, on Thursday and Friday my $59 buy order was unable to hit. SRS enjoyed being up almost 10% on Friday, but as buying persisted, it found itself back at the $60-$62 range where it ended up closing at. SRS is definitely holding up the best during this bear market rally as it is clear that commercial real estate is just scraping the surfaces of the problems coming their way. If we indeed see SRS dip back into the $50's next week, I'll will buy my first round.

Monday is the big anticipated FASB meeting to discuss mark to market accounting principals and the possibility of altering it or completely doing away with it. I don't see how they would just do away with it all together without severe reporting problems, so I assume if they do make a move it will be an alteration that maybe allows multiple options for banks, kind of how businesses have the opportunity to choose either FIFO or LIFO for reporting their Cost of Goods sold. So all eyes will be waiting on Monday to see what is the outcome from the meeting. We do have to attribute some of this financial rally to the anticipation of an outcome, so staying in financials for all day Monday, could be a gamble. If banks get one more push Monday morning, I most likely will get out of my remaining BAC in case of a post meeting sell off. At any rate, the outcome will not eliminate banks problems and there will still be a pile of distressed debt waiting for banks to deal with, so either way I don't see much to cheer about for banks.In just a few days, we have seen the destruction of FAZ, which is the big reason I held off in buying some at this point. At $40, it's hard to pass up on it and if it indeed gets any lower, I have to start considering getting in. Even if we see FAZ drop lower, I don't see it getting lower than $30. So, as you can tell, I am becoming very antsy to get in, it's just that past experience has taught me that a bit of patience can pay off big time. So, the time is close, and I assume by this week I will begin taking positions on the short side.

One problem we face in our current economy, is the nature of our cyclical capitalistic economy and how the current government is working to try and stimulate it. Although much credit is given to FDR's plan to pulling us out of the Great Depression, I don't feel it had much to do with it. Sure, there were some benefits that helped "preserve" some jobs and keep things stable, but it was time and World War II that, in my mind, were the big driving forces pulling us out of the depression. Today, we have much of the same style of government which has the theory of big government spending, increasing taxes, and having the government try and to stimulate the economy by controlling where money will be spent and than taking care of the people. At some points, it sounds nice, but I feel it can also be a crutch to us in our recovery.

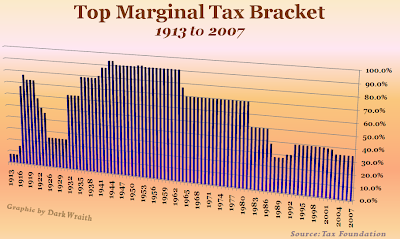

In his interview this past week, Warren Buffett said that he thought he could see an increase in taxes for the wealthy in the future, but that this was not the time to do it. Other areas need to be more focused on. From the chart below, take a look at the change of the marginal tax rate following the depression. From 1931 to 1932, it more than doubled. So you can probably expect taxes to get significantly higher in the near future. Considering over 70% of our GDP is measured by consumer spending, it is so important to make sure that consumers continue to spend! By taking half of their income in taxes, this will not create that spending. I believe we need to be focused on getting more money into consumer's pockets and really focus on job creation and preservation. Those two driving forces can have the greatest influence in increasing GDP. So, I believe if we continue to go down the road of taking money away from small businesses and consumers, it may take much longer to see us come out of this crisis.

It is for this reason I chose to run a MyCorporation banner discussing starting up LLC's or S-Corps. These entities can provide a big tax shield for those making significant incomes, especially through stocks or other investments that have large short term capital gains. An accountant or MyCorporation

can consult with you on how these vehicles can help save thousands of dollars in taxes. I, myself, am a independent contractor, so these types of entities are very appealing and provide a huge service. In the future, the terms of these entities could be changed by the government, so it's good to look into them now while they're still up and running.

My first podcast will go out today. I plan to do two to three a week (or more depending if significant news needs to be talked about). I will expound on subjects that don't make it to the post and also discuss my portfolio changes more thoroughly. The service I use is a paid service to maintain the podcast, so there is a small monthly fee to subscribe. My hopes is to provide additional information that can be useful in breaking down this market and the significant movements that will be coming in the future. As soon as it's up I will post it in this post as well as in the sidebar.

So Monday should be another day of fireworks with hearing the results of the FASB meeting. Hopefully, I can start making some moves into the shorts and can begin on the road to profits. Have a great weekend everybody, Happy Trading and see you soon.

****Update- The podcast service is up and the first podcast is available. I am making the podcasts free for a week so you can see if it's for you. Enjoy! CLICK HERE TO SUBSCRIBE TO CRASH MARKET STOCKS PODCAST

Market Rebounds From Record Lows - But Concerns Remain

Posted On Wednesday, March 4, 2009 at at 4:07 PM by Finance Fanatic Watching the end of trading today, I almost believed that once again we were going to see a close in the red. I am amazed at the power of the selling that is now going on right before close. Lucky for the bulls, the selling did not prevail this time as the market finally closed in the green today up 2.23% (6,875), however far below the intraday highs. The S&P also did rebound back from its recent below 700 level, which is a good technical sign that indeed a bear market rally could be brewing. However, many obstacles remain for the bulls in pushing this market up, so it is still looking like we are in a very unpredictable market. A big one is the scary unemployment number heading our way Friday.

Watching the end of trading today, I almost believed that once again we were going to see a close in the red. I am amazed at the power of the selling that is now going on right before close. Lucky for the bulls, the selling did not prevail this time as the market finally closed in the green today up 2.23% (6,875), however far below the intraday highs. The S&P also did rebound back from its recent below 700 level, which is a good technical sign that indeed a bear market rally could be brewing. However, many obstacles remain for the bulls in pushing this market up, so it is still looking like we are in a very unpredictable market. A big one is the scary unemployment number heading our way Friday.

First, let me point out the very large volume of trading today, 464M (compared to an average of 354M). My level two trading platform was going off the entire day. The increase in volume is definitely something to look out for, especially if markets begin to creep up again this next month. A mixture of the two could be a very critical factor influencing an upcoming crash for the market. So my eyes are watching.

It was liberating for me to see the market finally trade up. Not for any reason specifically dealing with my current holdings, but because it will most likely create some opportunities for me to make some good profits in the near future. I do have some long plays in case of anything severely violent, but nothing very significant. Although the green closing was positive and shows some signs of the possibility of a rebound here in the short term, the critical thing to watch is whether the buying can continue, even amidst negative news. We were very overdue for a technical rally, and are still, in my mind, a bit oversold in the market. So yes, a rally was a good sign for markets today, but it is so so critical to see if that buying continues into tomorrow. I worry if it doesn't it may not make it the rest of the week.China helped jump start trading today, along with Obama presenting the new plans for loan modification, and the process by which the plan is to unfold. I am very curious to see how successful this plan is, as it seems too specific in some points and far too vague in other points. I would just let nature take its place in the market and have prices correct themselves. If we don't we risk facing more problems in the future. It was also very strange to see that China had a strong up tick in their PMI, but at the same time needed to pass a huge stimulus for the country. Ha, that doesn't smell like number forging. The combination of the two sent China stocks flying and FXP crashing. However, as for me, I am staying out of China!

Other stocks that came crashing today were MGM Mirage, as they have put a hold on their new Civic center on the strip due to a lack of funds available. They are looking for financial partners to help finish the deal. Picked a great time to try and do that. Ford and GM came crashing down during after hours as their plan to "reorganize" debt was announced, which sounded a lot like bankruptcy. Citi took another 7% off today as more concerns keep growing whether or not they're going to make it alive. My guess is no.

Oil finally got the love I've been waiting for today as oil was up nearly 10%. I was a couple days early on buying my options, but it was nice to finally see some reward with oil. This may spark a rally for oil depending on how the rest of the market trades. Gold is creeping down back to the 900 range, which makes it very tempting for me to pick up some more rounds of options. Gold performed very well for me last time, and although I still believe we're a while away from inflation risk, at 900 it's looking very appealing to me. GDX and DGP are back on the radar. UUP and TBT continue to make me glad that I bought them. UUP has a Market Club report of +90, which is also very good for technicals (get your own symbol analyzed for free, all you need is a name and email, Click Here).

If indeed we do see this rally gain some ground, I think we could be in for quite the rebound for the March. Historically, March is usually a strong rally month, as it usually acts as the rebound for the beginning of the year blues. If this rally does indeed get some steam behind it, we could see a 15-20% rally for March. I'm not claiming that we've hit bottom, no way. In fact, I believe such a rally is what will ultimately set up for the market crash, probably sometime around the dreaded earnings season. By then I will want to have once again loaded up on a lot of the shorts to ride, what I believe, will be the worst down spiral we've seen this round. So I am remaining very careful not to get caught on the wrong side of one of these violent rallies for the time being.

So, tomorrow is a very critical today. If we do indeed see bears come back just as hard tomorrow, the green we saw today was in vain. If we see two days consecutive of buying, that's a very strong sign for a short term rebound. Congratulations to Nate Meyer for winning the Lending Club promotional contest. Nate also put money in it, and thus far, says he has nothing but good things to say about the company and his investment. Enjoy the $200 Nate. Have a good evening, Happy Trading and see you tomorrow.

Rally Comes Early For Hedge Funds Despite Bad News Across The Board

Posted On Friday, November 7, 2008 at at 1:41 PM by ChrisThis is why I prefaced this week with "Rave Week." News today consisted of:

- Slightly higher than expected job loss reports

- GM and Ford earnings horrible

- Retail sales lowest in 35 years

- Dollar weakening in strength

- Oil went up

So what do I do? I load up more. I am going to wait and see how we react Monday, but if we see FXP go lower, I would love top pick up some more shares. Also, my .QAADB Apple option is getting pretty close to buy price again. I usually wait for that to get down to $10, where then I load up and sell at $20.

We could very well see this market shoot up close to 10000 next week. This does not mean FXP will go to $40. FXP was especially rocked today, because of the strong performance of the China Market last night. SKF and SRS were not hurt nearly as much by the gains today. I don't see FXP going much lower than the high 60's (if that) and if I can get my hands on some shares at that price, I will be quite pleased.

For those that just got into FXP, be patient. It pays off. Today may have caused some to make a mess in their pants, but don't panic. Just as hard as it gets hit it goes up. We are still experiencing some market uncertainty with the elections and these redemptions. Like I've said before, give it a month or two on this go around. We were fortunate enough last time to have 100% gains in a week, but that was a gift. Financials got hit pretty hard today and with talks of a second bailout being discussed, UYG is a good stock to look at for next week. I still like GDX, even though it was down today. STP was up over 20% today. Solar should remain very volatile until Obama is in office. This stock is still very undervalued.

So not the kind of day I was hoping to end on for the week, but what could I expect from Rave Week? Next week should be interesting and I would love to see the S&P get a strong bump so I could load up on SDS. If we can see these shorts get slammed next week, that will tee us up perfectly for loading up for the end of year. There is no stopping the storm ahead. Have a great weekend and I will see you on Monday. Depending on the weekend, I may give a Sunday evening update. Happy Trading.