What Unemployment? We've Got Obama

Posted On Saturday, February 7, 2009 at at 8:55 AM by Finance FanaticFrom trading on Friday, you would have never guessed that we received the worse job loss report in 34 years as the market blew right past that number on Friday and turned to new hope for bailouts and freedom from debts by closing the Dow up 217 points. As I said last week, currently, we are very vulnerable to these short term, violent rallies as speculation has become the steering wheel to market trading. As I also discussed earlier in the week, we knew we were expecting something from Obama to combat the dreaded unemployment number that everyone expected to be devastating. The term "Buy the rumor, Sell the news" seems to be in effect currently as everyone jumped on the bank buy train on Friday(including myself) hoping for some serious news over the weekend. The only news that happened Friday, was a pretty mediocre press conference from Obama talking about his "plan" to stimulate the economy, and the rest were a bunch of leaks that made it to the news talking about what is suppose to be announced Monday (I'm sure the government didn't mean to leak that, right?!). They estimate that over 3 million jobs have been lost since we began the "recession in December of 2007. Over half of these jobs have been lost the past three months. This is a very bad sign, as it clearly shows we have not reached the crest of this job crisis. So I continue to believe this rally will be short lived.

I woke up early on Friday in anticipation to the big day. Seeing the futures trading up, I had a feeling we were going to be experiencing the day we did. I also knew that Ken Lewis, Bank of America's CEO, was planned to be interviewed on CNBC. In most cases, CEO's go on air to sell a company to the public. If it is bad news, they usually send the accountants or lawyers. I knew Lewis would be selling B of A to death and that's exactly what he did. So, I ended up buying into BAC in the morning, even though it was already up 14%. Lewis talked of their successes and that he has not once talked of or been talked to about nationalizing Bank of America. He also said that the plan was to pay back TARP funds by three years. Just during his speech, the stock jumped another 7% and eventually got as high as 33% up. As for the validity of his words, who knows and frankly I don't plan to be in his stock for very long.

My stop loss came into effect with my FAZ and I ended up making a pretty good profit, considering FAS ended up almost 20%. Sometimes, this strategy doesn't work if we reach a volatile day with the Dow bouncing back in forth. However, I felt that Friday was going to go only one direction, and it would go that way with conviction. The market trend FAS technical score is -75, so I don't know how excited I am to stay in it much longer (get your own symbol analyzed for free, all you need is a name and email, Click Here). However, as for now, I am remaining in both my BAC and FAS for the time being.

SRS was showing a lot of strength in early hours of trading as you can see from the chart. However, during mid-day, a big sell off began. I think bailout hopes and more rumors surfacing convinced many investors to get out for the time being. I am remaining in SRS, as I feel it is one of the better shorts for 2009. I do think they are vulnerable to some losses during all this mess, so I may be averaging down as it may continue to go down.

Obama's bailout team has revisited their original stimulus plan over the weekend and have supposedly made some changes (I personally feel they did because they knew they didn't have the vote!). Anyway, it seems as if the bailout amount will be reduced to $750 billion and that there have been a lot of changes to the "bad bank" plan, which wasn't getting a lot of popularity with the media and republicans. They still will supposedly have a toxic asset protection program but are straying from the "bad bank" plan and working on a "ring fence" concept. In a sense, the "bad bank" would buy up to $500 billion in troubled assets and then perform stress test on banks to see if they need more.

Now, where market to market accounting gets changed is when these assets are transferred. As of now, a bank would have to take a loss on their books to transfer these assets, which would kill bank's balance sheets to transfer a lot of these toxic assets. So, rumor is that they may be altering the accounting system where they can "carry market value" in hopes to keep bank's balance sheets healthy. A lot of moving pieces are in this plan and a lot can go wrong. Let's hope they know what they're doing. Secretary Geithner is suppose unveil the plan on Monday. These kind of announcements make me very timid in this market, which is why I am pretty hedged right now and sitting in a lot of cash at the moment. So we'll see how it goes. That mixed with the stimulus vote, which is planned for Tuesday, could cause one crazy trading week next week. In the end, the fundamentals are still very bear, so that is where I remain. I am just waiting for the right time to get in my bear positions fully, and that time may be coming soon.

So, it will be another early morning for me on Monday. I am expecting more volatility this next week in the market as I believe there could be a lot of "exhaust selling" after all of these announcements are done with. "Buy the rumor, sell the news."

I wanted to end with a clip from CBS news featuring the Lending Club we've been talking about. They have been getting a lot of publicity lately, which continues to reinforce my decision to invest in them. So far so good! Remember, the now $200 promotion ends this month for Lending Club, so check it out if you haven't already, click here.

So, we wait until Monday. Hopefully next week yields some serious green for my Zecco.com trading account. This last week wasn't too shabby, although I could have done without Friday. Happy Trading and have a good weekend. Oh and PS, I did pick up some SKF right before close on Friday, just in case...

Dangerous Times - Obama Tries to Fuel Market

Posted On Saturday, January 31, 2009 at at 9:40 AM by Finance FanaticWhat an interesting way to close the market on Friday. I think it was pretty clear that there was someone waiting with a button to make sure that the market closed above 8000, as that is a pretty strong technical point for momentum. I literally watched it jump from 7992 to 8000 in the absolute last second of the market. At any rate, it was still big for the market to be as down as it was with: 1. Having GDP numbers be better than expected, 2. Having two strong days of selling after beginning the week in the green, 3. Having a Friday end as a red day is a rare things these days. So, I think we definitely have some downward momentum, but not quite enough yet in my opinion.

It is very clear that deflation is here, as we can see with the huge drop in real estate prices, oil, and precious metals. Eventually, I believe this deflation is going to lead to a deflationary down spiral and eventually capitulate. I do think we're very close, but we're not quite there. I heard a good analogy yesterday describing the state of the S&P. Under 820, the market has a cold, under 800 the market has caught pneumonia, and under 780, we're on our death bed. The technicals show us very close, but not there yet. As a result, we are vulnerable to these quick, short-term rallies that can be very, very violent. So, as I said a couple days ago, I have adjusted my investment strategy to make quicker trades and shoot for lower returns. I'm not ready to go all short, but I am very close.

So I did sell off most of my FAZ on Friday and a bit of my SRS shares that I had purchased a couple of days ago to pocket the return. I sill have plenty of short to reward me for another down day Friday, but I have a lot more conservative plays as well. I'm playing this market a bit more conservative than usual as I feel with the possibility of these violent rallies, I don't want to be caught with as many shares that I have usually been holding. Weekends always tend to have surprises as the government likes to let new hopes brew with investors over the weekend. This is why I have big positions in DGP, GDX, TBT, and UUP(see the market trend report below for UUP +90, Get your own symbol analyzed for free, all you need is a name and email, Click Here). Yes of course I have my FXP, SRS and EEV, which I continually have, I've just lowered my positions a bit until we see some more technicals triggered. Don't you worry, they're coming. As for now, I don't want to roll any dice with Mondays as who knows what news come out this weekend. Obama has already attempted a "premature hope rally", by announcing his "promises" to increase liquidity in the banks and get the flow of money started. Sure, anything else Obama? Why don't you just create mana bread for all American families. He's obviously hoping to dupe the not so wise investors again, and oddly it may work for one or two days, but unless he has the secret to life, there is not much anyone can do to unfreeze the markets currently.

As for now, I don't want to roll any dice with Mondays as who knows what news come out this weekend. Obama has already attempted a "premature hope rally", by announcing his "promises" to increase liquidity in the banks and get the flow of money started. Sure, anything else Obama? Why don't you just create mana bread for all American families. He's obviously hoping to dupe the not so wise investors again, and oddly it may work for one or two days, but unless he has the secret to life, there is not much anyone can do to unfreeze the markets currently.

At any rate I plan on waiting around to see how the market reacts on Monday and make my move. It's a toss up at this point. I would expect to maybe see some green rallies next week, and maybe even become quite violent if announcements come forth. So, I'll play it by ear. These rallies make the market even more vulnerable for failure.

I thought I would end on a funny story that happened in China the past week. In Hong Kong, it is tradition for their equivalent of a "CFO" of the country to perform a stick shaking ceremony, in which generates a fortune for the country for the next year. In shaking a bundle of sticks, one stick falls out of the bundle and corresponds with a sequence of numbers, that in turn generates a fortune. Well, this past week, the fortune which was given was horrible. It talked of depression, economic turmoil, and much suffering. The people of China take this ritual so seriously, it caused quite an uprising and even some rioting, as people feared the fate of their country. The Governor eventually had to make a press statement to say that the ceremony was only traditional and did not actually reflect the future of the country. I found this story amusing, since so many people think China is good place for investment. Ahhh, the naive.

So we'll see how it goes. Some people had mention Zecco.com trading their rates. The new minimum balance of 25,000 for free trades is true, however, you can also get free trades if you make more than 25 trades a month, which I assume most of you, like me, are doing. Still one of the best deals I've seen out there. So there's some information for you. Also, just a reminder, only 2 more days for the Lending Club promotion, win $100, see here. Have a good weekend everyone, Happy Trading and we'll see you tomorrow.

"Bad Bank" Plan Bad Idea?

Posted On Wednesday, January 28, 2009 at at 4:13 PM by Finance FanaticThere sure was a lot of hustle and bustle on the floor today as hopes for Obama's new plan filled buyers with confidence, especially concerning financials. Sure, myself was included in the mass of buyers, but for me it was not an emotional buy. It was purely just buying knowing that there would be many believing that Obama's new plans will push us through this depression and financials crisis and on to greener pastures. I surely did enjoy profiting off of the emotional compulsiveness of other investors and plan to do it more often. So what was today all about?

Wells Fargo up 30%, Citi up 20%, and Bank of America up 15%. Wow, that's some strong pushes, what on earth could have happened today? To be frank, not much. Sure there were a lot of talks and whispers in headlines throughout the day, but fundamentally, not much changed and unfortunately these kind of "emotional rallies" can really tee up a strong market crash.

First, news came last night that Obama plans to push this stimulus through ASAP. No need to cross the T's and dot the I's, just get it signed. Considering "checks and balances" no longer exist in our government currently (as democrats control all the powers), there shouldn't be much delay in getting this passed. Some may think this is just the beginning of the road back up, especially with the banks. As for me, I took most of my profits and ran.

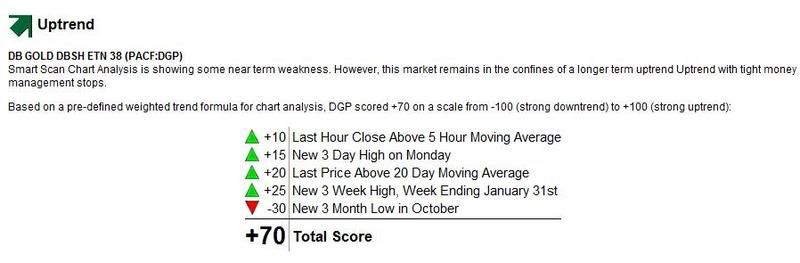

So, yes, I did get out of most of my position in financials today, before the close. What I have learned recently is that you can't be greedy in this market, and getting a 14% return in a day is fine by me. So I took most of my money out, just leaving some in case of another day running. Believe it or not, but I took a lot of my earnings and put it into SRS and DGP (a Deutsche Bank Double Gold fund, see trend analysis below, get your own symbol analyzed for free, all you need is a name and email, Click Here). I think we went a bit overboard in the buying today and I expect some serious pull back either tomorrow or Friday, especially with GDP news coming up, and here's why.

One announcement that has seemed to cause excitement with financials is the new "bad bank" plan. This is, in a sense, a plan for the FDIC to take control of the bad assets and hold on to them until values once again appreciate. So far, the way of doing this is unclear, but many speculate that many of the banks deemed "bad banks" would essentially be temporarily ran by The FDIC, or in a sense, the government. So in other terms, "nationalizing" a lot of these banks. A similar program was adapted during the last real estate catastrophe, where the government issued an RTC program to buy back troubled assets. The problem is that our debt is far greater than that of the RTC days and our length of this recession/depression is unknown and is most likely to much, much longer. What I don't get is why are so many people buying up financials, when in fact if some of these banks do become nationalized, shareholder's equity most likely will get wiped out? Analysts are warning (well the smart ones) of this, but investors have tuned them out as they listen to the new songs of "bank bailouts". My point is, I do not want to be stuck with a slue of bank stocks as the governmental begins to experiment with different nationalizing ideas.

Then we go on to the new Obama stimulus plan itself. Have you read it? This thing is suppose to be devoted to assist in job creation and we're spending $350 million of tax dollars on STD education and prevention? How is that going to help? I mean at least if STD's are still flourishing there will be money spent on pharmaceuticals and doctor visits (a joke). Also, there's a allocation of funds to landscaping the capital building. Who cares? We are in a depression and you want to worry about landscaping. Truly, there is a lot of wasted money in this bill and if we are only dedicating 50 cents to the dollar to actually assisting in job creation and the buying of bad debt, it will take over $5 trillion in bailout funds to begin to do something. Get it together guys.

I do believe that above all, banks need keep the consumer's confidence. That was the biggest cause of the Great Depression. People lost faith in the banks and banks failed. However, I believe there are many ways to keep banks lending, and help manage their current "over leveraged" state. They just need to tweak things back at the drawing board.

Starbucks gave some more bad news today as they are looking to close even more stores down. The worst part about these rallies, is many times, real economic data sometimes gets tossed aside as people are"high" with emotion. Hey, even the US mail is struggling. They are toying with the idea of only delivering mail five days a week instead of six. The point is the rest of the world is going on behind this bailout fluff, and it doesn't look pretty.

At any rate, I'm glad to be out. Sure, we may indeed rally more tomorrow, but like I said, I can't be greedy. Indeed I feel if our government is not careful with how we spend these next trillions, we could end up spending our way to death. Hopefully, Obama can round his people together to find a good solution, I just still believe there is A LOT of work to be done to their proposed plans. Tomorrow should be interesting. Seeing how we open will determine whether I make any moves, but as for now, my Zecco.com account is staying put. I will keep you updated on what I do in the comments section. I hope everyone has a good evening, Happy Trading and we'll see you tomorrow.