The Real Problem With Inflation

Posted On Tuesday, June 30, 2009 at at 7:48 PM by Finance Fanatic

Right now, most of the goods of the economy relate to the extreme low cost of borrowing for those that can still borrow. Record low mortgage rates are allowing our housing markets to hold on by a thread, as well as new business owners to take out a loan. However, as is always the case, it will not last forever.

Many, including myself, believe that inflation is a year or less out. What really shows me just how damaged the housing market is, is how poorly home sales remain, despite the extremely low financing. If rates of this caliber would have been available a few years ago, we would have seen an explosion of buying in the housing market. Even with the extremely large amount of bank owned houses on the market, the sales remain sluggish.Inflation will also have a big effect on our currency. During our last big inflated time in our economy, we were not nearly as dependent on foreign imports. Our economy has become such a big global economy, that a falling dollar will cause new problems for the government. This will effect the selling of government debt, as well as imports and exports.

At some point, the severe risk of inflation will be upon us, and the Fed will have no other choice but to jack those rates up. At this point, I believe we will see a very rapid jump in borrowing interest rates, which will put a whole new weight on this already beat up economy. It is because of this risk, why I feel very cautious about saying that the worst is over. I believe we will see many different stages to this recession, and inflation is that's a big worry for me.

Job Openings at $75K to $500K+

PS - I will talk more today about consumer confidence, as well as upcoming economic numbers to look out for this week on tonight's premium podcast (subscribe here)

Change in Consumer Confidence - Markets React

Posted On at at 4:06 PM by Finance Fanatic

Today's number shows that we can definitely wobble in data from time to time and that an increasing number does not always mean that it is sustainable. I will not be surprised to see if much of the data throughout the rest of the year continues to tail off, especially if we cannot sustain the type of government spending and bailouts we have issued thus far. It is no wonder why economic data looked much better this past quarter. Trillions of dollars of new money helps a bit.

SRS showed weakness today, as I expected, considering the Treasury is expected to unveil their new PPIP plan tomorrow. As a hedge, I went in today and pulled the trigger on some Kimco and Simon. If the plan indeed is unveiled, many investors could falsely see the plan as the solution to the big commercial real estate problem. I would not be surprised to see a healthy bounce from the bunch tomorrow and/or Thursday. Happy Trading.

The Oh "Exclusive" PPIP

Posted On Monday, June 29, 2009 at at 6:19 PM by Finance Fanatic News hit today of the Treasury's plan to unveil their newest PPIP program that many investors have been waiting for. On Wednesday, the Treasury plans to announce details of their long awaited Public-Private Investment Program. This is the new entity established by the government to help in disposing of toxic commercial debt. Much like the RTC program from the 90's, the PPIP will aim to find private investors who are well capitalized to partner with in taking over toxic, bank owned properties.

News hit today of the Treasury's plan to unveil their newest PPIP program that many investors have been waiting for. On Wednesday, the Treasury plans to announce details of their long awaited Public-Private Investment Program. This is the new entity established by the government to help in disposing of toxic commercial debt. Much like the RTC program from the 90's, the PPIP will aim to find private investors who are well capitalized to partner with in taking over toxic, bank owned properties.

Unfortunately, the plan sounds too good to be true, which is probably why there are very few rumored players. Two confirmed players in the program are GE Capital and Wilbur Ross Distressed Real Estate Fund. The hopes of the program is for the PPIP to partner with the private institutions to help absorb future losses the properties may have. The program looks to be structured with high favor towards the private institutions, however, there are many factors that could turn the deal sour.

First off, much like how the CMBS debt was bonded together, so will much of these "distressed properties." Most likely, these parties will not get to pick and choose from a list of distressed assets, but will be given a portfolio to look at. With the several good and promising assets that are in the portfolio, will be the many bad useless assets. Not only that, but they will most likely differ in product type, which could cause for many of these institutions to stretch outside of their comfort zone.

I know it seems that buying distressed properties, in the way the PPIP has outlined it, seems like a steal, but there are still plenty of downside risk for these groups to consider. First, how much worse will property values get. Many feel that commercial real estate is just beginning its problems. Is this the first of many bottoms? How long can these groups absorb losses. Sure, there is essentially no bottom to the Treasury's pockets, but there indeed is for GE Capital. I believe the only way we're going to see a quick recovery from commercial real estate values, is to offer up the properties to the entire market. Sure, prices would come down much more dramatically, but nature would take its course.In preparations, I may go in and play a few of these institutions long, as I expect a good possibility for a very short term bounce for some of these players. Much of the perception will be that these groups will receive great deals for an extreme discount, however, we will soon see just how well it works out. After much of the settling down, I expect to load up pretty heavily on SRS.

Today's rally was mostly fueled by a good day with oil. Volume was very light today, as we're heading into vacation season. Tomorrow we have the consumer confidence report, which will probably come in rather positive, however, I would expect that number to begin to tail off again the next few months. Also, we finish off the week with unemployment numbers, which could be quite the eye opener for investors. Stay in touch with more news through TradingSolutions: Financial analysis and investment software that combines technical analysis with neural network and genetic algorithms. Happy Trading.

Market Rebound and Buffett the Bear

Posted On Thursday, June 25, 2009 at at 7:42 PM by Finance Fanatic As expected, we saw the belated rebound rally occur today, which was sparked by not only more profit taking, but also by some favorable earnings reports. Bed, Bath and Beyond reported a rather strong earnings report, which shot their stock up near 10% today. Also, home builders got some love from buyers, as Lennar reported less "cancellations", however, their earnings report still remained rather dismal. It is important on the earnings reports to pay attention to their NET income and not just their revenues. Retailers are still having record slash to prices for their goods, that many of them are selling much more of their inventory, however, their margins have shrunk dramatically.

As expected, we saw the belated rebound rally occur today, which was sparked by not only more profit taking, but also by some favorable earnings reports. Bed, Bath and Beyond reported a rather strong earnings report, which shot their stock up near 10% today. Also, home builders got some love from buyers, as Lennar reported less "cancellations", however, their earnings report still remained rather dismal. It is important on the earnings reports to pay attention to their NET income and not just their revenues. Retailers are still having record slash to prices for their goods, that many of them are selling much more of their inventory, however, their margins have shrunk dramatically.

The 172 point rally for the Dow was sorely needed after several consecutive days of down trading for the index. Like I've said in prior posts, I still believe the momentum remains on the downside, but we can of course expect sporadic up days like today. In fact, I found it a good opportunity to pick up some more SRS and FAZ shares today, as I continue to feel that there will be weakness in the financial and commercial real estate sector.

Yesterday, Warren Buffett was interviewed on CNBC, and definitely had more discouraging things to say than encouraging, regarding the economy. Being a CEO himself, as well as having one of the most prestige stock symbols on the exchange with Berkshire Hathaway, sometimes Buffett is forced to play into politics. However, he did not hold back much yesterday, when he explained his concerns about this troubled economy.

When being questioned about the state of the economy and if we've seen some growth, Buffett gave this response:

Well, it's been pretty flat. I get figures on 70-odd businesses, a lot of them daily. Everything that I see about the economy is that we've had no bounce. The financial system was really where the crisis was last September and October, and that's been surmounted and that's enormously important. But in terms of the economy coming back, it takes a while. There were a lot of excesses to be wrung out and that process is still underway and it looks to me like it will be underway for quite a while. In the (Berkshire Hathaway) annual report I said the economy would be in a shambles this year and probably well beyond. I'm afraid that's true.No bounce, he said. Buffett's biggest resource are his vast array of companies he manages and is privileged to know the state of their balance sheets. Such knowledge definitely gives the old man a bit of an advantage to be able to see the early seeds of a turn around.

In response to being asked whether he's personally seen these so called "green shoots", he said:

(Laughs.) I looked. I wasn't seeing anything. I had a cataract operation on my left eye about a month ago and I thought maybe now I'll be able to see green shoots. We're not seeing them. Whether it's retailing, manufacturing, wherever. We have a big utility operation. Industrial demand is down like we've never seen it for a simple thing like electricity. So it hasn't happened yet. It will happen. I want to emphasize that. But it hasn't happened yet.In times past, Buffett has always tried to paint as optimistic of a picture as he could, with also stating true facts. However, much throughout his interview, he continues to stress his belief that it will be a very long road back to economic health. Sure, he does feel that some sectors have already endured the worst and that the economy will get back on track, but he feels that the road is long, and probably not ending this year.

Much is still to come in our economic crisis, in my mind. This is why I continue to hedge myself on the short side, especially as more opportunities arise. I discuss some concerns I have in the residential real estate market in tonight's premium podcast (subscribe here) as well as some more S&P data that is showing new trends. My Zecco.com account has performed quite well this past week and I will be looking forward to some more green. Happy Trading.

Stocks Up and Down, Fed Stays the Same

Posted On Wednesday, June 24, 2009 at at 7:50 PM by Finance Fanatic Stocks were all over the board today as all indexes opened up in the green today as the Fed announced their plans to keep things "status quo." However, by the end of the day, markets closed with mixed feelings, having the Dow down almost 30 points, but both the S&P and NASDAQ up. The red closing for the Dow was very surprising, considering that it was up over 100 points at one point. More negative data, and and a rather "depressing" interview with Warren Buffett (I'll talk about later) brought down investor's confidence in the afternoon.

Stocks were all over the board today as all indexes opened up in the green today as the Fed announced their plans to keep things "status quo." However, by the end of the day, markets closed with mixed feelings, having the Dow down almost 30 points, but both the S&P and NASDAQ up. The red closing for the Dow was very surprising, considering that it was up over 100 points at one point. More negative data, and and a rather "depressing" interview with Warren Buffett (I'll talk about later) brought down investor's confidence in the afternoon.

Today's economic data was also mixed. Durable orders came in much better than analysts expected and is now two consecutive months of positive growth. However, this can be very easily skewed by government spending as there is a lot of weight on aircraft and defense spending. However, new homes sales data came in far worse than many analysts expected. A reported 342K new homes sales were reported (360K expected), this will also most likely be revised to an even smaller number. Also, the number is less than last months number, which causes concerns for home owners.

So indeed the data is not sufficient to support a notion of a "recovering economy." The Fed discussed this fact in their report of their FOMC meeting. They still enjoy harping the tune "the worst is over", but are very careful to say that indeed we are bottoming. They agree that data confirms that we still show severe weakness in the economy and that there is still a lot of recovering to do before we see growth again. This is the "watered down" version, coming from our Federal Reserve, so I expect actual activity to be even worse.

The Fed also announced their plan to leave interest rates at essentially zero for the time being. To help fight climbing yields, they will also continue to purchase government notes and bonds, which they have now spent over $2 trillion already. To keep mortgage rates low, they will also continue to buy mortgage backed securities. Such continual Fed buying, mixed with government debt spending is creating an elixir of destruction, and is something that will need to be dealt with at some point, but they aren't concerned about that now.

Financials were rather strong today, but I feel they still should remain weak. I would have pulled the trigger on some FAZ shares today, if I were not out of the office. Even after several days of down trading, the markets are still showing weakness. This could be just the beginning of a rather strong downturn. Morningstar has some great valuation tools for equities that you can try free, Morningstar - Valuable insights and innovative portfolio tools. Get the Morningstar advantage with a FREE 14-day trial membership!. I expect some serious downward momentum to kick into the next gear shortly. Happy Trading.

FOMC Meeting Creates Curiousity

Posted On Tuesday, June 23, 2009 at at 4:11 PM by Finance Fanatic The Fed's recent activity is a big contributor to the recent, slow growth we've seen in some sectors. One big reason has been their massive spending they have been involved in, not only by participating in trillions of spending through corporate and bank bailouts, but also by their massive purchasing of government debt (The Fed being the #1 buyer), which has allowed the government to offer trillions in bonds and notes without much increase, relatively, to yields.

The Fed's recent activity is a big contributor to the recent, slow growth we've seen in some sectors. One big reason has been their massive spending they have been involved in, not only by participating in trillions of spending through corporate and bank bailouts, but also by their massive purchasing of government debt (The Fed being the #1 buyer), which has allowed the government to offer trillions in bonds and notes without much increase, relatively, to yields.

Another big reason is their decision to allow banks to borrow for free. Several months ago, The Fed lowered the discount rate to essentially 0, in hopes to stimulate lending and allow consumers to receive favorable rates to spur mortgage activity. As a result, we have seen moderate activity, especially in the mortgage sector, however, other aspects of lending (especially commercial real estate) have remained pretty much frozen.

Tomorrow, The Fed will report on their two day meeting, in which they announce their decision of what to do with interest rates. Most feel that the rate will remain at 0, as the economy remains in a very fragile state, especially after the losses experienced the past week in Wall Street. However, the rates will not remain at 0 forever. In fact, this is one of the biggest tools Bernanke has to help regulate inflation, when that becomes more of a problem in the future. When the rate is indeed raised again, you can expect mortgage rates to follow. As a result we could see another slump created in the residential sector. I will talk about some serious concerns in the residential market and why I don't feel we are near bottom on the podcast tomorrow.

Today, we saw some slight bounce back down in the shorts. FAZ and SRS were down slightly, mostly due to many taking profits from yesterday's big gains. Commodities rallied in the afternoon, which was not surprising when you consider the beating they took yesterday as well. Depending on tomorrow's FOMC announcement, we should see this downward trend continue. Today, we did not rebound, mostly due to the housing report, but a rebound could be bound tomorrow, which would provide an opportunity for me to load up a bit.

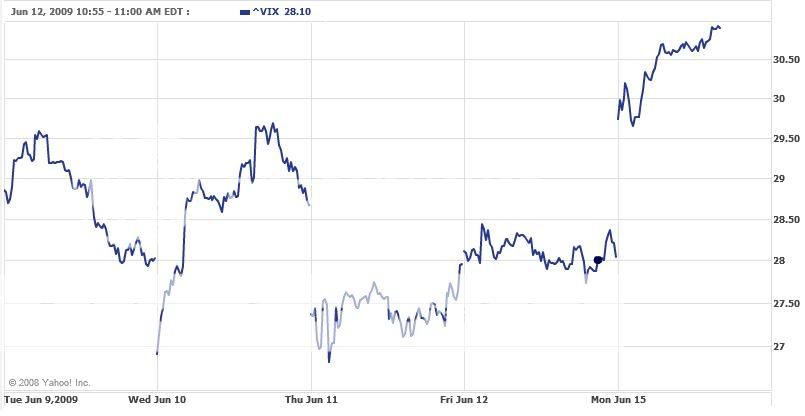

Options should start showing some strength as VIX levels continue to creep up. The fear index grows stronger as downward momentum increases. This should weather quite well for many of my options (which by the way TradeKing has great rates for option purchases). Tomorrow should have some fireworks and I will be on chat to discuss with all of you. Happy Trading.

Home Sales Dissapoint

Posted On at at 3:45 PM by Finance Fanatic Although it was the second consecutive month existing home sales increased, today's number report for May was slightly lower than many analysts expected. A rise of 4.77M existing home sales was reported for May, following April's revised 4.66M increase. However, due to us being in summer months as well as the very large amount of foreclosed inventory that is currently on the market, analysts expected better.

Although it was the second consecutive month existing home sales increased, today's number report for May was slightly lower than many analysts expected. A rise of 4.77M existing home sales was reported for May, following April's revised 4.66M increase. However, due to us being in summer months as well as the very large amount of foreclosed inventory that is currently on the market, analysts expected better.

Considering the sluggish move in homes sales, to me, shows that there are still many elements weighing heavily on this economy and the consumer. There has not been a better time to buy a house, when you consider the benefits. The Federal Government gives thousands of dollars worth of incentives (and maybe more here soon), in which many states match with their own incentives. In addition to that, interest rates are at a near historic low and most of the inventory you have to choose from are bank owned houses that are being offered at very discounted, affordable prices. Even with all of this, consumers are just not confident enough in this environment to buy and many don't have the extra income.

Investors did not take the news lightly, as the markets remained down for most of the day. Existing home sales has been a strong, reliable benchmark in times past to help determine when the economy may be rebounding. However, thus far, the housing market department has yet to provide such information, which is beginning to worry many investors. Many will also look to tomorrow as The Fed will report on their meeting and announce the future of interest rates. There has definitely been a strong shift, recently, in consumer sentiment.

Steve is the Only "Jobs" Returning For a While

Posted On Monday, June 22, 2009 at at 3:16 PM by Finance Fanatic Today certainly answered anyone's question wondering, with uncertainty, where the future direction the market was headed. Markets came dropping out of the gates this morning as trading was down the entire day with no sign of day light, as the Dow ended down over 200 points today. Not only that, but the NASDAQ, which has been relatively strong recently, was down well over 3% today as economic data is beginning to weigh very heavily on stocks. This is something I knew was eventually going to happen, as for the past several weeks we have seen nothing much besides dismal economic data, but despite the fundamentals the market kept pushing up and up. Unfortunately for bull investors, the selling is getting much more heavy as is the volume, which could get even more scary shortly.

Today certainly answered anyone's question wondering, with uncertainty, where the future direction the market was headed. Markets came dropping out of the gates this morning as trading was down the entire day with no sign of day light, as the Dow ended down over 200 points today. Not only that, but the NASDAQ, which has been relatively strong recently, was down well over 3% today as economic data is beginning to weigh very heavily on stocks. This is something I knew was eventually going to happen, as for the past several weeks we have seen nothing much besides dismal economic data, but despite the fundamentals the market kept pushing up and up. Unfortunately for bull investors, the selling is getting much more heavy as is the volume, which could get even more scary shortly.

Even with reports of Steve Jobs being back in the full swing of things for Apple, it was not enough to boost up the tech sector. Commodities continues to get slaughtered as GDX (gold ETF) was down about 7%, and DIG (OIL long ETF) was down over 10%. Moves like this in the commodities sector is right on track with my worries of deflation. Seeing such strong moves makes me consider the time is very near. We will be able to see in the next few in some charts whether or not that time is here now.

Having this week being another very large auction week for Treasuries does not help things either. The government plans to auction off another $104 billion in government debt this week, which is bound to discourage investors, both domestic and international. The government and other companies gave us a hint weeks ago that the market was a bit inflated, when they decided to offer up billions in shares to the public. This is usually a big sign that we are trading in overbought markets.After the Obama administration, earlier this year, predicted a peak in unemployment at 8%, they revised this number today, stating they expected to see us reach 10% in the next couple of months. The large degree of error on that projection shows that indeed our government could be severely wrong in several of their "projections." This makes me wonder what their end of year "out of recession" projection may get revised too. This also goes to show just how ridiculous the original bank stress tests were as we have already far surpassed every and all of our so called "stresses" in just a couple of months.

My Zecco.com account was rewarded heavily by the moves today. SRS and FAZ both performed extremely well, as are my puts with Prudential. My timing on my SDS shares are working out for me as well, as it seems that the technicals were calling it right. It will be interesting to see how strong this downward trace pushes. To see a rebound tomorrow will not be surprising, but of what degree is what interests me. Some more downward momentum and I have to consider to take some profits. If we do indeed rebound tomorrow, I will most likely use the day to take some stronger positions in SRS or FAZ. Indeed the pullback is here, Happy Trading.

**New premium podcast posted today(subscribe here)

Unemployment Recovery? I Think Not

Posted On Saturday, June 20, 2009 at at 12:33 AM by Finance Fanatic After another rather broad range of trading, Friday we saw the Dow close in red, ending the week as a whole down a few percent. The S&P closed pretty much flat, and the NASDAQ had a much better day than the others. Considering the range of trading today, and despite a what is usually a heavy buying option expiration Friday, the Dow was still able to close in the red. At this point it's hard for me to argue the point that indeed a pull back is here and I believe we're going to see that manifested even more so the next couple of weeks.

After another rather broad range of trading, Friday we saw the Dow close in red, ending the week as a whole down a few percent. The S&P closed pretty much flat, and the NASDAQ had a much better day than the others. Considering the range of trading today, and despite a what is usually a heavy buying option expiration Friday, the Dow was still able to close in the red. At this point it's hard for me to argue the point that indeed a pull back is here and I believe we're going to see that manifested even more so the next couple of weeks.

Hopes for a bettering job market were frustrated Friday by a new job report. All 50 states were studied, and as a result, 39 of the states had continuing job loss numbers. Out of those states, many of the larger states (California, Florida) reported record high unemployment numbers for the month of May. Michigan came in the highest with an unemployment rate estimated to be at 14.1%. Oregon was close behind, as was California, whom is struggling with a 11.5% rate as well as had the largest amount of total jobs lost for May (68,900). By the way if you have lost a job ResumeRabbit.com can be a great resource for finding a job, you can post your resume there.

I have always said that a recovering job market is the road back to stability. Unfortunately, as we continue to see more diminishing jobs at the large rate we've been experiencing, there is no way we can expect an increase in discretionary income or consumer spending. As such, I don't see much hope for a quick turn around in GDP numbers.

Earnings season is going to play a crucial role on how powerful this pullback becomes. Strong earnings showing hope could quickly turn around the pull back and possibly push us up into new highs, but I see that result being pretty unlikely. However, disappointing numbers would most likely send the market down faster. That mixed with the good possibility of deflation could be a recipe of disaster. As a result, I expect to see this pull back continue into next week and I will be looking to take some larger positions. Happy Trading.

More Treasuries, More Earnings

Posted On Thursday, June 18, 2009 at at 3:34 PM by Finance Fanatic As I expected, the market closed near its daily trading range, with the Dow closing up about 42 points. Instead of a rally into close, we actually found a rather aggressive sell off, which brought the Dow down about 40 points in the last 20 minutes of trading. Such activity shows the increased selling pressure that has been brought back into the market, especially as new technical barriers are breached. To see where the Dow closed, despite which should have been a rather strong day for buying when you consider a lot of the profit taking and short covering that was going on, is a pretty strong sign from bears.

As I expected, the market closed near its daily trading range, with the Dow closing up about 42 points. Instead of a rally into close, we actually found a rather aggressive sell off, which brought the Dow down about 40 points in the last 20 minutes of trading. Such activity shows the increased selling pressure that has been brought back into the market, especially as new technical barriers are breached. To see where the Dow closed, despite which should have been a rather strong day for buying when you consider a lot of the profit taking and short covering that was going on, is a pretty strong sign from bears.

RIMM came in after hours with disappointing earnings. This is a pretty big blow to the NASDAQ, considering how resilient RIMM has been in previous quarters. Such numbers show that indeed the rapid decay of the economy is slowly eating more and more into corporate profits. Although their earnings were in line with expectations (still not good), their forecasts were far worse than analysts expected. I would think to see a negative reaction in the tech sector, considering that RIMM is one of their sweetheart stocks. QID could be a nice consideration for some quick gains.

Today, The Treasury also announced the auction of $104 billion in more government debt. This is just following their previous record setting $101 billion that was auctioned off in May. It is very clear that the government is scrambling for money as more and more of their short term debt becomes due. Such actions from the Treasury are bound to eventually saturate the bond markets, as well as turn off foreign countries from purchasing anymore of our debt. But, when you spend trillions in a matter of a few months, that is really you're only option.Tomorrow should be a pretty critical day in maintaining this slight turn around we've seen this week. If markets were to close significantly down tomorrow, we could see a rather strong pull back. The video I posted showed the three different thresholds, which if we past the first one quickly, that's bad news for bulls.

I will be posting a new premium podcast tonight (subscribe here), discussing more about the technical trends in this pull back, as well as some future possibilities for gold. My Lending Club investment still remains solid at a 10.5% return, which is a good buffer to have in the portfolio. It's also a good place to consider getting a loan, especially in this type of environment. Have a good evening and Happy Trading.

Lowering Rates - Another Sign of Deflation

Posted On at at 11:12 AM by Finance Fanatic So far, following a brief red opening, The Dow shot up pretty quickly to the +50-70 range, which it has been trading at throughout most of the day. Mortgage rates dipping in the low 5% range, encouraged investors that the recent spike in yields may have just been a scare. However, many people are overlooking the real possibility of deflation becoming a real problem, which we are seeing the storm clouds begin to collide.

So far, following a brief red opening, The Dow shot up pretty quickly to the +50-70 range, which it has been trading at throughout most of the day. Mortgage rates dipping in the low 5% range, encouraged investors that the recent spike in yields may have just been a scare. However, many people are overlooking the real possibility of deflation becoming a real problem, which we are seeing the storm clouds begin to collide.

If indeed deflation is upon us, then we can expect some decreasing mortgage rates. In fact, I will be looking to refinance any existing loans I have during this period, as I worry for our next stage of inflation jacking up the rates.

You can see the signs all around us. Commodities are continuing to struggle and come down in price, as is agriculture. Gold is weakening after its recent jump in price and the dollar is slowly inching its way back up, showing stronger signs. In fact, a good hedge of deflation is considering UUP, which I am at this point, which is a bullish ETF for the dollar.

We'll see how we close out today. I expected a bit of a rebound, but I don't see us taking off as we have in times past, but you never know, especially with PPT out there. There's been some pretty strong selling resistance today that has matched the buying, which is expected at this point, and which was talked about in yesterday's Market Trend video. So far, so good. Happy Trading.

Too Much Regulation

Posted On Wednesday, June 17, 2009 at at 9:33 PM by Finance Fanatic

President Obama's plan for stricter regulation for the banks have many investors concerned of what effects such restrictions placed on the banks will have on their bottom line. Much of the success of many of the financial institutions have come from their freedom and ease to lend money. Sure, we can blame a lot of our current bank problems on the fact that underwriting got far to loose and sloppy, but I'm not sure that placing cuffs on these banks is the answer. The ultimate goal is to get banks lending responsibly again, but most of all lending. With new plans coming from the Obama administration, we could see back and forth arguments lasting for several years. In addition to that, companies like GE and Prudential, who have their private lending sector, could suffer the worst from such regulations. The last thing we need at this point is interference clogging the main arteries of lending any more than they already are.

As a result, Standard & Poor downgraded 18 major financial institutions, which caused for a very dismal day of trading for financials. Of course, this is something we have been expecting and waiting to happen, as the recent huge gains we've seen in financials was mostly due to fundamental accounting changes and government stimulus. The distressed assets and increasingly delinquent properties still exist and aren't shrinking thus far. I believe this is just the beginning of the pullback for the lending institutions.

In addition to financials, commodities are continuing to struggle. Potash (POT) took a rather strong beating today as sales have become significantly slow. Gold also continues to struggle. These are signs supporting the notion of nearing strong deflationary levels. I would expect to continue to see declining commodities as demand continues to struggle.

On top of the looming data, technicals are painting a different picture these days. I've talked before about using a variety of moving average charts to show the changes in momentum. With the recent pull back from the last couple of days, we have seen some pretty significant levels breached with the S&P that shows that a rather strong pull back could be in our near future. This and some other significant data was a big reason I decided to load up quite a bit on SDS. Click here to see the Market Trend Technical Video, a very good look at the trend.

FAZ and SRS performed quite well today, mostly due to the weakness in the financial sector. With continuing doubts effecting the banks, there could definitely be some strong opportunities once again for the two recent dogs. I would not be surprised to see a bit of a rally tomorrow as some bears may take profits. However, we are definitely seeing a different trading atmosphere as volume is increasing as well as weighted selling. I expect to see some strong moves in the coming weeks, especially if more investors come back to trading. Also, remember for those wanting to start an IRA, ETrade will give you 100 free trades, click here: Get 100 Commission Free Trades in an E*TRADE IRA. No-fee, no minimums. Happy Trading.

Industrial Production & CPI

Posted On Tuesday, June 16, 2009 at at 11:54 AM by Finance Fanatic As I said in the previous post, I was waiting to see how we closed out today's trading session to draw a lot of conclusions about the recent selling and, as a result, bears came through. After what was looking to be a modest recovery from today's lows by close, stocks sold off the last 15 minutes, lowering the Dow more than another 100 points today. This being the biggest consecutive drop in the Dow since March. Having two days of rather aggressive selling gives good support to the belief that we could see a rather significant leg down at this point. Bulls are hoping that the dip will cause for more institutional players to be able to buy in, but that is much easier said than done. Despite all of the negative economic data, I am amazed with how positive investor sentiment has been in recent months. Such optimism is very hard to maintain in this type of environment, especially when things begin to look like they aren't getting better for a while.

As I said in the previous post, I was waiting to see how we closed out today's trading session to draw a lot of conclusions about the recent selling and, as a result, bears came through. After what was looking to be a modest recovery from today's lows by close, stocks sold off the last 15 minutes, lowering the Dow more than another 100 points today. This being the biggest consecutive drop in the Dow since March. Having two days of rather aggressive selling gives good support to the belief that we could see a rather significant leg down at this point. Bulls are hoping that the dip will cause for more institutional players to be able to buy in, but that is much easier said than done. Despite all of the negative economic data, I am amazed with how positive investor sentiment has been in recent months. Such optimism is very hard to maintain in this type of environment, especially when things begin to look like they aren't getting better for a while.

Once again we saw pretty strong performances from the shorts. SRS is finally above $20 again, which is good news. FAZ is inching its way back above $5, where my basis still lies at $4.68. Emerging markets are undergoing a lot of duress as of late, especially with the ongoing battle of currencies, which makes EEV a strong consideration for me to pick up this week.Industrial production came down significantly in May, after analysts were hoping for a stronger number, especially after all of the money spent and the depletion of inventories from the past several months. This is another indicator that indeed deflation could be around the corner, which I believe is a prerequisite to the market crash.

CPI is announced tomorrow, which many eyes will be on. We still are tracking very closely to the economic woes we found in the 1930's. It is scary when you consider the many similarities of the two time periods and consider what the possible consequences are. I am just trying to prepare myself and make some money when the opportunity presents itself, which I believe it will. We are getting close to breaking new technical barriers, so a sharper downturn could be a very real possibility if the selling continues. Just as quickly as the positive sentiment returned, it can be taken a way. It's amazing to think, that even despite the huge optimism that has been present as of late, and all of the buying we've seen in the stock market recently, the Dow still remains down 3.1% FOR THE YEAR. So there are many reasons to believe that we are not in a "bull market."

Once again, sustainability only adds to the momentum. Depending on how the markets move tomorrow and the volume, I will be most likely taking some more short positions. It is clear that more and more people are being forced to liquidate, and with more of that, bears should regain confidence and enter back in, bringing up the volume even more. Adobe issued negative earnings after hours, however, they were pretty much in line with expectations, so I don't see too much activity from their end. I expect some pretty good activity in my Zecco.com account in the coming week, especially as momentum increases. Happy Trading.

Continued Selling - More Bad Retail

Posted On at at 11:13 AM by Finance Fanatic Well, today's continued selling is a strong move for bears, especially after the rather strong day the market endured yesterday. Along with the market movement, there is also some more negative economic data that is looming in headlines today, also bringing down consumer confidence. Most all the shorts are performing quite well today, but it will be how they close out, which will determine the momentum.

Well, today's continued selling is a strong move for bears, especially after the rather strong day the market endured yesterday. Along with the market movement, there is also some more negative economic data that is looming in headlines today, also bringing down consumer confidence. Most all the shorts are performing quite well today, but it will be how they close out, which will determine the momentum.

PPI data came in this morning significantly worse than expected. In fact, Core PPI came in negative again, which was worse than I was anticipating and shows that, clearly, deflation is still something to be worried about. Even in the midst of trillions being spent by the government to stimulate production, there is still a negative trend on the PPI. In a few weeks, with some other data, we will better know if how near the down spiral is, at which markets could respond very negatively.

Best Buy announced their earnings today, which was very disappointing to investors. As such, most retailers are down today. In fact, for you premium podcast subscribers, BBY was a specific short I mentioned on last week's podcast, as well as shorting the XRT. Both positions have performed quite well. I think this is only the beginning for retailer's struggles, as shrinking consumer income will eventually pay a big toll on most stores.

Watching us close this session out today will be very influential on how I view the market momentum, currently. A strong sell off to close would be a very good indicator for bears and definitely cause for more concern for bullish investors. Happy Trading.

Deflationary Indicators

Posted On Monday, June 15, 2009 at at 4:34 PM by Finance Fanatic Those that have been keeping up with this site knows that I am a big believer in a deflationary movement hitting our economy. I know that it seems with all of the recent trillions that have been spent, that inflation should be the worry, which it is, but, in my opinion, not at the current moment. Recently, we have seen a rather large bubble in commodities and energy as well as losses in the dollar, however, I do believe here in the short term, we are going to see the dollar gain value again, as well as declining commodity prices, due to deflation.

Those that have been keeping up with this site knows that I am a big believer in a deflationary movement hitting our economy. I know that it seems with all of the recent trillions that have been spent, that inflation should be the worry, which it is, but, in my opinion, not at the current moment. Recently, we have seen a rather large bubble in commodities and energy as well as losses in the dollar, however, I do believe here in the short term, we are going to see the dollar gain value again, as well as declining commodity prices, due to deflation.

Tomorrow's PPI report will be a strong measure of where we are heading, especially in regards to deflation. Last month, we did see minor improvements in the CPI and PPI readings, however, that is expected due to the massive amounts of bailouts that were issued. Also, Spring usually brings about inflated prices, as it is a higher spending season. When we look back at prior deflationary recessions, there are times when CPI and PPI do bounce back periodically, but the overall trend remains downward pointing. So I will not necessarily be looking at its move from month to month, but much more on its move from year over year.

If indeed we start to see some strong deflationary signals, that could easily open the doors for a capitulation in the markets, which would spawn a violent spur of selling. I still expect to see capitulation and feel that our recent lows were not the critical mass for this recession. So many reliable macro moving charts are just beginning to show a strong downward trend, so this recession could last much longer than many of these optimistic economist think. A few months ago, I discussed the worries I had for credit card companies, due to continuing large amounts of job losses we were experiencing, as well as the bite getting taken out of consumer's income from increasing energy and commodity prices. Reports showed record high defaults for credit card companies in May, which is usually considered as a forward looking indicator for the economy. Some are saying the big increases are largely due to the recent tax season, which cut into many consumer's savings. Whatever the reason, a 2-5% increase in credit card defaults from just one month prior is definitely something to be worried about. I continue to be bearish on the credit card companies and feel that as jobs continue to get cut, credit losses will build up.

A few months ago, I discussed the worries I had for credit card companies, due to continuing large amounts of job losses we were experiencing, as well as the bite getting taken out of consumer's income from increasing energy and commodity prices. Reports showed record high defaults for credit card companies in May, which is usually considered as a forward looking indicator for the economy. Some are saying the big increases are largely due to the recent tax season, which cut into many consumer's savings. Whatever the reason, a 2-5% increase in credit card defaults from just one month prior is definitely something to be worried about. I continue to be bearish on the credit card companies and feel that as jobs continue to get cut, credit losses will build up.

Finally, I can enjoy a rather rewarding day for the shorts that I do have. My SDS performed well, as did the options that I continue to hold (SRS Call, FAS Put, Pru Put). Considering that many of the options I still hold do not expire until Sep-Nov, they have not suffered too strong of losses. Plus, if VIX levels continue to rise, options should enjoy a nice premium like what we saw back in November.

Tomorrow, I will look to see the sustainability of today's sell off and whether or not it has some wind behind it. There are many saying that bulls are waiting for a pullback to push more funds into, however, I'm not so sure.

La-Z-Boy announced higher than expected profits, which sent the stock soaring after hours. I know several owners of La-Z-Boy buildings, in which they have received requests anywhere from 10-30% decrease in their rent. Due to desperate times for many landlords, they are approving such requests. So, I don't know how much increasing sales is affecting their bottom line or if it is just cutting their costs. At any rate, I'm pretty sure they're not soaring through this economic downturn. This is something we're seeing for many retailers across the country, which in turn has helped their bottom lines in recent months. However, the numbers still look dismal.

I came across a new online broker for stock trading that looks to have some pretty competitive trading rates as well as pretty good analysis tools. I always on the hunt for good firms, as I like to spread my accounts around. Firstrade is a brokerage firm, specializing in the online trading of mutual funds, stocks, etf accounts, etc. They look to be committed to their clients and seem to have a pretty solid customer service department. I will keep you posted on my experience with them.

I have some more data to report, that I will be doing on tonight's premium podcast (subscribe here). As we head deeper into summer months, it is looking that the market is going to make a strong move. Happy Trading.

Watch Out VIX

Posted On at at 11:06 AM by Finance Fanatic

Finally a day of trading with some movement. Not only that, but there is actually volume trading today, which was not present all last week. More negative economic data finally sparked a bit of selling Monday morning, as the light at the end of tunnel may be more distant than people thought. Factory activity in New York as well as a home builder's confidence survey, showed weaker signs in June. Not only that, but the IMF chief also expressed his opinion that indeed the worst of this recession is yet to come. The data has been coming in for the past several weeks, but unfortunately, the market never responded. The big question is whether this will be a one day fluke, like we've seen in recent times, or if this could open the door to a rather strong downward push. Tomorrow will bring a lot of those answers.

Another element concerning to many bulls is the moving of VIX levels. As you can see from the graph, today the VIX hit 30 for the first time in quite a while. Such movements can be very concerning for long investors, as higher VIX levels, usually lead to higher options prices. We saw this very prevalent back in October and November, when the market had it's big crashing period. At that point, we saw huge gains in the options markets, especially on the short side and the VIX was at record highs. I discussed this possibility in a post last week as well.

Also, we are seeing a pretty strong retracing in commodities, which I thought might happen, especially if you consider deflationary probabilities. This is why I was not too bullish on gold quite yet, and took my profits when I did, as I do feel gold's big upside will be next year.

So the signs are definitely here for a downturn, we just need to see how sustainable it is. No need to get trapped like some have in times past. Sustainability is the key both on the long and short side. Momentum will gather shortly, and when it does, I'll be ready.

Retailers React

Posted On Thursday, June 11, 2009 at at 3:03 PM by Finance Fanatic Yesterday, I discussed many of the concerns facing consumers in the near future and how that should affect the performance of retailers. I discussed this more thoroughly in yesterday's podcast, as well as discussed several retailers and funds I am eyeballing as an opportunity for profits, especially when the market turns. Today, retail sales were announced, which came right in line with expectations (.5%). However, like I said a few days ago and as we've seen with other reporting data, meeting expectations is becoming a bad thing lately, as people are realizing how low analysts are setting and revising their expectations.

Yesterday, I discussed many of the concerns facing consumers in the near future and how that should affect the performance of retailers. I discussed this more thoroughly in yesterday's podcast, as well as discussed several retailers and funds I am eyeballing as an opportunity for profits, especially when the market turns. Today, retail sales were announced, which came right in line with expectations (.5%). However, like I said a few days ago and as we've seen with other reporting data, meeting expectations is becoming a bad thing lately, as people are realizing how low analysts are setting and revising their expectations.

Despite the in line with expectation results, most retailers were down today. All of which I discussed on the podcast were down as well, as were the funds. This is a good sign, considering that much of today was trading significantly in the green. If the market momentum as a whole can reverse here shortly, there could be some serious upside in shorting the retailers. Many of them are more than double their recent lows from back in February, which I believe is a much too quick of a bounce for many of them, especially in this environment.

Another ETF holding its own today was SRS. Yes, as of late it has been rather disappointing as many of the bear leveraged ETFs have been. However, it has recently shown a bit of strength, even in the midst of positive markets. It will take more than what we've seen the past couple of days, but I still believe, when the market turns, SRS should yield some strong gains for me. I have been to several meetings this week, concerning the commercial real estate market, and all of them have been extremely dismal and depressing.More banter continues to go back and forth from Kenneth Lewis (B of A CEO) and The Fed. Lewis continues to accuse both Paulson and Bernanke of urging him to keep details of the Merrill Lynch acquisition private. This of course being after they received $50 billion in bailout funds. It is obvious there are thick strings attached to the bailout money and I believe we will see several other accusations arise along these lines. Now that Obama has in place a system to regulate these executive's salary, they may be slow to play by the rules for much longer.

Other than that, unfortunately, the markets aren't giving us much things to talk about as of recently. That will soon change. Also, many of you emailed asking me how to sign up for some of the videos I've posted on here. Here is a link, where you can sign up for them for free. Happy Trading.

Jobs Still A Worry

Posted On at at 2:16 PM by Finance Fanatic

However, as always, certain analysts have their rebuttal to a bad employment report. Now, some economists are saying that a continuing bad employment number isn't too much tied to getting GDP back in the positive. They compare it to our "recession" in 2002 and 2003 and that, despite a sluggish unemployment number we had at the time, we crossed over positive with GDP. First of all, comparing the so called recession of 2003 to our current crisis is like comparing watermelons to peas. Other than a contracting GDP and declining stocks, there is not much similarity to them. Also, it was an attack on the US that caused much of the turmoil during that time period. Today we see ourselves faced with a global crisis, both economically and dealing with currency, we've seen a giant failure in the banking sector, real estate markets reach new lows, a strong crash in the stock market, as well as all of the other economic problems we currently find ourselves in. So to compare the two is absolute ludicrous.

As I have always said, I believe residential home values and employment will lead us out of this crisis. Both are so strongly tied to consumer confidence and consumer spending, that I believe it's the combination of the two are economy needs to jump start this very frail economy. Unfortunately, I don't see much light from either of the two sectors and therefore cannot think that we are turning this ship around at the end of 2009, like many have said. So we'll see how long these economists keep THEIR jobs. Happy Trading.

Consumer Spending Parasites

Posted On Wednesday, June 10, 2009 at at 4:15 PM by Finance Fanatic It is very evident by now that indeed the market has been on one heck of a run, for whatever reason that is. At many times, it defied a lot of negative data and crumbling bankruptcies and kept pushing on through. As positive as things look in the stock market, unfortunately, a lot of economic data is not following. This is why I believe that we are currently at the place we are in with stock market, sluggish movements with very little volume. Even market optimists believe a pullback is needed to propel the next rally. At any rate, eventually the stock market and the economy will run in the same direction, that's how it works. It is consumer spending which drives the economy, so I wanted to discuss the new perfect storm that is heading right towards the consumer.

It is very evident by now that indeed the market has been on one heck of a run, for whatever reason that is. At many times, it defied a lot of negative data and crumbling bankruptcies and kept pushing on through. As positive as things look in the stock market, unfortunately, a lot of economic data is not following. This is why I believe that we are currently at the place we are in with stock market, sluggish movements with very little volume. Even market optimists believe a pullback is needed to propel the next rally. At any rate, eventually the stock market and the economy will run in the same direction, that's how it works. It is consumer spending which drives the economy, so I wanted to discuss the new perfect storm that is heading right towards the consumer.

Increasing Oil Prices

With oil prices now above $70 per barrel and climbing, this is quickly becoming a burden on the consumer. We already know consumers are saving more and spending less and the more money getting funneled to energy costs, expenses, and taxes, the less dollars that will be going into retailers, autos, hotels, etc. You can bet that a $70+ cost of oil will have a strong negative effect on the consumer. Increasing Mortgage Rates

Increasing Mortgage Rates

Just when everyone thought the bottom of the housing market was in sight, a new problem arises. I have said all along that my belief of the recent activity in the housing market was largely due to extremely low mortgage rates that were available. Also, not only are there federal incentives, but many states are matching federal incentives with state incentives to go out and buy a house. Now, as we see mortgage rates climb, be sure that this will take a toll on demand and when you consider the hundreds of thousands of houses that have been foreclosed on in the past two months (and the thousands of more that will be), we had better hope for a strong demand.

No Money Earned, No Money Borrowed

Although last month's jobless report was significantly better than expected, the unemployment rate was worse. As we continue to lose anywhere from 300-600,000 jobs a month, that's less discretionary income being spent in the markets. On top of that, when you take a $15.7 billion credit borrowing loss, it is obvious that people aren't borrowing much. So, yes, we've been able to see success with the help of a few trillion from the government and Fed, but we're beginning to see the price of taking that road costs, as Treasuries are becoming less and less desired. If there is less money coming into families, as well as less being borrowed, where will consumer spending come from?

These stand out as big concerns for me, as consumer spending makes up 70% of GDP. The stock market can respond whichever way it wants, but obviously there is not much confidence in it, as we have seen record low volume the past week. Until we see more normal, natural movements in the stock market, it's hard to use it as a measure of the state of the economy. Like I said before, eventually the two will align, but it's difficult to project when that is. I believe very soon, but that's me. Plus the best way to recreate demand for government bonds is how?...Tank the stock market. I believe I will find the best opportunities first in the retailers, which I will discuss which ones specifically on today's premium podcast (subscribe here).

A quick update on my Lending Club investment, I've experienced no late payments and my 10.5% target return is still being reached. They just posted an article saying that their average returns for investment are 9,9%. This makes sense, seeing how demand for loans must be spiking due to the illiquidity of the credit markets. Happy Trading.

More Bond Drama Brings Morning Selling

Posted On at at 10:50 AM by Finance Fanatic Worries about the stabilization of Government debt is increasing, as there continues to be a lowering demand for Treasuries. Today, the Treasury issued $19 billion worth of 10-year bonds for 3.99%, which in turn has brought down stocks with the Dow trading down over 100 points this morning. This is by far the highest yield of the year and shows the continuing weakness of our government debt. This is a problem I have been discussing for the past couple weeks, especially on the podcasts in more detail. The fate of these Treasuries has such a strong influence on the overall debt markets as a whole, which makes it very scary to see the jump in yields in such a short period of time. Like I've said before, it begins with the Treasuries, then sprinkles down to all of our consumer loans: home mortgages, auto loans, school loans, credit cards, etc. In addition to this, the bid to cover ratio was 2.62, which although was slightly better, is still rather depressing for such high yields.

Worries about the stabilization of Government debt is increasing, as there continues to be a lowering demand for Treasuries. Today, the Treasury issued $19 billion worth of 10-year bonds for 3.99%, which in turn has brought down stocks with the Dow trading down over 100 points this morning. This is by far the highest yield of the year and shows the continuing weakness of our government debt. This is a problem I have been discussing for the past couple weeks, especially on the podcasts in more detail. The fate of these Treasuries has such a strong influence on the overall debt markets as a whole, which makes it very scary to see the jump in yields in such a short period of time. Like I've said before, it begins with the Treasuries, then sprinkles down to all of our consumer loans: home mortgages, auto loans, school loans, credit cards, etc. In addition to this, the bid to cover ratio was 2.62, which although was slightly better, is still rather depressing for such high yields.

At this point, unfortunately, this isn't the Fed's only problem (them being the largest holder of government debt, so such recent movements have to be killing them). They also are absorbing the losses from Bear Stearns and AIG, which are totalling over $5 billion. Bernanke is still refusing to identify the banks, corporations and other financial institutions that have received "emergency loans", saying that by doing so he fears would cause for a run on the banks, which he is exactly right, since probably most financial institutions are on that list.

I do feel we are hovering on the crest of the rally as of now and that sentiment is slowly shifting. The government worked very hard to prop up markets the last several months, which has paid off and been reasonably successful, however, my concern was always is it sustainable? I believe not, which is why we are seeing the beginning of the consequences that come from massive government spending mixed with government printing. I think we should see some downward moving with the S&P, so SH or SDS is the option I'm looking at (I already have many shares of SDS). I also wanted to show a short informative video on deflationary/inflationary graphs. It's a great resource talking about some recent indications. Although, it talks about the probable upward moving inflationary signals, I still feel that we are not out of the woods for deflation, and that the severe problems of inflation will hit us in 2010 and 2011. Click here for the video. Happy Trading.

Flat Day - What's New?

Posted On Tuesday, June 9, 2009 at at 2:06 PM by Finance Fanatic After much pushing and pulling from both sides, we once again saw the Dow close pretty much flat today. That is now two days consecutive of very dull, low volume trading. It is obvious nerves are settling in for many investors as they've all gone away. Even the day traders are gone! It kind of feels like we are stuck watching a soundless movie from the 40's, right after we watched Lord of the Rings in high definition. At any rate, I'm not expecting to make big money on days like today.

After much pushing and pulling from both sides, we once again saw the Dow close pretty much flat today. That is now two days consecutive of very dull, low volume trading. It is obvious nerves are settling in for many investors as they've all gone away. Even the day traders are gone! It kind of feels like we are stuck watching a soundless movie from the 40's, right after we watched Lord of the Rings in high definition. At any rate, I'm not expecting to make big money on days like today.

One thing to watch for that has caught my eye, is the moving of the VIX. Even though the VIX has been dragging as of late, if you look at the regression line formed by the recent bottoms since the beginning of 2007, it is currently settling almost perfectly in line with the regression, suggesting that we may be at the bottom for the VIX. I wouldn't trade solely based on this criteria, but with the other technical signals, it's definitely significant and worth noting.Oil reached $70 per barrel today for the first time in 2009. This means more money down the drain for you and I into our gas tanks and less into consumer spending. On top of that, unfortunately, most of those profits benefit companies outside of the US, so it's almost a lose, lose for us, unless of course you are invested in oil. At any rate, like I've said before, I believe Oil has hit its temporary peak and should settle somewhere between $60 to $70 per barrel by the end of the year. We saw this coming and talked about it in January.

Retail sales come out Thursday, which I would assume after that credit spending report we got, can't be all that good. Although, analysts have once again done a great job of low balling the number, so who knows how the market will react. We are expecting a minor uptick, which I actually would still be surprised to see. I may see some opportunity to short some department stores tomorrow. I'll keep you posted. Happy Trading

Bailout Paybacks and Rising Rates

Posted On at at 11:47 AM by Finance Fanatic Well, so far it's been another pretty non-eventful day as the Dow has continued to bounce back and forth from red to green. It is yet another very low volume day, which as usual, leads me to have to consider the possibility of some manipulation going into close. As a test run, I may look at picking up some longs for the last little rally, just to see if it can produce a quick 5% pop. I'll set a strict stop loss on it. With the recent popularity of paying back TARP funds, financials have been getting a slight second wind. However, the XLF has been dragging its feet as of late, so financials may be tapped out

Well, so far it's been another pretty non-eventful day as the Dow has continued to bounce back and forth from red to green. It is yet another very low volume day, which as usual, leads me to have to consider the possibility of some manipulation going into close. As a test run, I may look at picking up some longs for the last little rally, just to see if it can produce a quick 5% pop. I'll set a strict stop loss on it. With the recent popularity of paying back TARP funds, financials have been getting a slight second wind. However, the XLF has been dragging its feet as of late, so financials may be tapped out

There still exists the very real concern of the ever increasing yields with the Treasuries. This move affects all aspects of the credit markets. Whether you're getting a mortgage loan, auto loan, or getting a new credit card, these moving yields affect you. The problem is, is that even with the current massive spending mixed with the government debt issuance, there seems to be no sign of it letting up. It has only been two months since the budget was announced, and they have already revised their deficit spending, for both 2009 and 2010. There has been a 7% revision increase in their 2010 deficit spending, in just two months!

Investors on Vacatiom - Government is Not

Posted On Monday, June 8, 2009 at at 4:17 PM by Finance Fanatic Well, just as I noted at the end of the last post I wrote this morning, never rule out the possibility of a closing run up. In our current trading conditions and with such low volume, markets can be moved and manipulated very easily. The problem is, is that the volume is getting lighter and lighter. This is one of several reasons why I believe this is not the initial "bull run up" that many believe it is. History has shown us that, in most cases, the initial move back up has some of the strongest gains as well as the largest buying volume. In our current case, the volume is only getting worse. Look at today, 189M, compared to a 384M average. That's almost half, on a Monday! Frankly, I believe more and more investors are becoming timid to trade in this market, considering the recent very unorthodox movements of the market and the fear of manipulation.

Well, just as I noted at the end of the last post I wrote this morning, never rule out the possibility of a closing run up. In our current trading conditions and with such low volume, markets can be moved and manipulated very easily. The problem is, is that the volume is getting lighter and lighter. This is one of several reasons why I believe this is not the initial "bull run up" that many believe it is. History has shown us that, in most cases, the initial move back up has some of the strongest gains as well as the largest buying volume. In our current case, the volume is only getting worse. Look at today, 189M, compared to a 384M average. That's almost half, on a Monday! Frankly, I believe more and more investors are becoming timid to trade in this market, considering the recent very unorthodox movements of the market and the fear of manipulation.

Despite the near 100 point down day the Dow sustained for most of the day, during the last minutes of trading, we were able to see yet another rally, which actually closed the Dow barely in positive territory. However, The NASDAQ remained relatively weak as did the S&P. More and more concerns are brewing about the movement of interest rates and the fate of the bonds. With the bankruptcy of GM and seeing the many problems that secured bond holders are going through, confidence in bonds are struggling. This is the last thing we need in an already very fragile economy. If problems continue in the bond markets and more doubts of the Treasury's ability to sustain confidence grows, it could cause some monumental problems in the economy.

The stock market can continue to go up, but with no volume behind it, it will only set up the market for a bigger failure. Until we can see more trending movement in the indices, it makes it a very dangerous environment to trade in. It is funny, but as you talk to real working professionals, they all seem to agree how uncomfortable the current market is. We seemed to be surrounded by nothing but bad news in our businesses and economic data, yet their remains so much optimism with government officials and in the stock market. I continue to hold my current holdings in my Zecco.com account until I get some very crucial data later this week. Happy Trading.

***New premium podcast Posted Today (subscribe here)

Monday Morning Pullback - Gold Future Planning

Posted On at at 10:58 AM by Finance Fanatic Well, we've started out the week with a rather moderate pullback, which is no big surprise to me, when you consider much of the very distressed data we received last week, and looked right over and continued buying. As I've said before, we may overlook data, but usually, it will eventually get factored in. More increasing interest rates have investors worried, as they wonder how they will effect corporate borrowing as well as the already dreary housing market.

Well, we've started out the week with a rather moderate pullback, which is no big surprise to me, when you consider much of the very distressed data we received last week, and looked right over and continued buying. As I've said before, we may overlook data, but usually, it will eventually get factored in. More increasing interest rates have investors worried, as they wonder how they will effect corporate borrowing as well as the already dreary housing market.

We've talked before of the almost certain problem to look for in the future, that being inflation. As I've said before, I do feel we are still a bit premature for inflation, but it is definitely something worth planning for. We've now seen gold pulling back, which should continue and could provide an opportunity to hedge for future inflation. One of my strong inflationary hedges is the use of a gold IRA or a 401k gold. A gold 401k is a great consideration, especially when dealing with inflation risk. We saw many investor's profits get wiped out in the 70's with their non-inflation protected investments, which eventually took their what was once a strong return, to almost nothing.

Also, as a hedge to a distressed bond market, an IRA gold can be a great option. The above linked site is a great reference of how gold can be an asset for you in your IRA and also shows, line by line, how to put gold in an IRA. I believe as gold continues to retrace down to lower levels, I will have a great opportunity to load up some in my IRA for long term protection.

Let's see if these lower trading levels remain, or if by chance we see our usual "magical" closing rally. Happy Trading.

Bond and Dow Gap Worries

Posted On Sunday, June 7, 2009 at at 3:01 PM by Finance Fanatic Well, it seems as though my prediction from my March post has pretty much come to past. Those of us believing that the worse is still to come are a small minority at this point. Sure, many agree that we could "pull back" a bit, but they assure us that indeed the worst is over. Hedge fund managers are drilling clients that this is the time to load up and not "miss this opportunity." This does not waiver me personally from my strong belief of a still upcoming capitulation, which is why I chose to write a post about it in March. If you are one of those that has agreed with the many, that's fine, and as I always say, trade in a way that you are comfortable with. We can respectfully agree to disagree.

Well, it seems as though my prediction from my March post has pretty much come to past. Those of us believing that the worse is still to come are a small minority at this point. Sure, many agree that we could "pull back" a bit, but they assure us that indeed the worst is over. Hedge fund managers are drilling clients that this is the time to load up and not "miss this opportunity." This does not waiver me personally from my strong belief of a still upcoming capitulation, which is why I chose to write a post about it in March. If you are one of those that has agreed with the many, that's fine, and as I always say, trade in a way that you are comfortable with. We can respectfully agree to disagree.

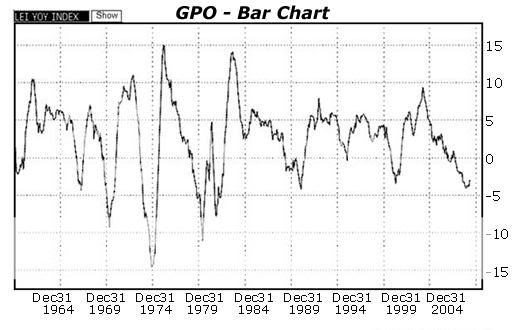

Another potential scary problem we are seeing in this market, which I find very perplexing, is the enormous gap that we are seeing between the recent Dow movement and bonds. You can see from the above graph the huge gap that separates the two. What is really unique about the graph, is that it is almost always bonds which are on top. Rarely have wee seen such a spread that currently exists and there are some serious repercussions for us if the gap continues.

It is obvious that the huge drop in prices of bonds have been due to the recent surging in interest rates. As a result, such interest rates are bound to cut into corporate profits. Naturally, what is to occur when corporate profits are being reduced (keyword being NATURALLY, without government interventions)?. Stock prices go down. So you can see why to see such a big gap is mind boggling. This is just one more problems to tack onto the list of reasons why I see big problems ahead. In my opinion, I believe this gap has to close and with there not being much let up in interest rates, I believe it will have to be the downward moving of stocks that closes the gap. Happy Trading.

No More Credit Spending

Posted On Friday, June 5, 2009 at at 4:44 PM by Finance Fanatic Well, consumer borrowing numbers came in at the end of trading and blew expectations out of the water. Analysts were surprised after expecting a $6 billion drop in consumer borrowing to see an actual $15.7 billion drop, more than twice the amount economists expected. The results show that indeed consumers are still very weary of spending in our current crisis. The scary part is, is that March's number was originally $11.1 billion, which was later revised to $16.6 billion. It will be interesting to see where this number is revised to.

Well, consumer borrowing numbers came in at the end of trading and blew expectations out of the water. Analysts were surprised after expecting a $6 billion drop in consumer borrowing to see an actual $15.7 billion drop, more than twice the amount economists expected. The results show that indeed consumers are still very weary of spending in our current crisis. The scary part is, is that March's number was originally $11.1 billion, which was later revised to $16.6 billion. It will be interesting to see where this number is revised to.

So, from today we learn that more people are losing jobs, thus reducing discretionary income. On top of that, we learned that more and more people are saving more, thus reducing spending. The combination of the two can be devastating on GDP, considering consumer spending makes up 70% of the index. Such data gives strong support of a continuing downward economy. The goal to bring us out of recessions is to spawn more consumer spending. We are only scaring consumers, causing them to save more.

Monday should be interesting as we see this new storm collide with Obama's new stimulus speech. More and more data is over ruling politician's words, and the more we see this, the more the market will begin to react. Tonight's podcast will have an update of my current positions, just to give everyone a refresh. Have a great weekend, Happy Trading.

Get 100 Commission Free Trades in an E*TRADE IRA. No-fee, no minimums.

If Recession is Over, Why More Stimulus?

Posted On at at 2:18 PM by Finance Fanatic Lately, there has been nothing but positive things coming from the mouth of the Fed and the Obama administration in regards to the current state of the economy. Chairman Bernanke even had the audacity to claim that we should be out of the recession by late 2009. The question I have, is that if everything is looking as good as rain, why on earth are we ramping up for yet another large stimulus plan, paid for by no other buy you and I? My thoughts are that actions speak louder than the words.

Lately, there has been nothing but positive things coming from the mouth of the Fed and the Obama administration in regards to the current state of the economy. Chairman Bernanke even had the audacity to claim that we should be out of the recession by late 2009. The question I have, is that if everything is looking as good as rain, why on earth are we ramping up for yet another large stimulus plan, paid for by no other buy you and I? My thoughts are that actions speak louder than the words.

On Friday, Vice President Biden announced the plans for himself and President Obama to unveil the new plans for the next stimulus this next Monday. The stimulus roots back to the $787 billion bill that Congress passed in the beginning of the year. If things were looking to get better (which I, unfortunately, do not believe), wouldn't such large stimulus spending be in vain. Perhaps, it's because the government realizes that are recent successes are from massive government spending. So how long do we keep spending ourselves further into debt? Until the dollar has become completely worthless? Beware of more stimulus rallying on Monday as I'm sure they both have a great "feel good" message for the country. The only thing I've really agreed with Obama thus far is him picking the Lakers to win the championship in six.

Unemployment Better Than Expected - Or Is It?