Volume & Volatility on The Rise - Two Critical Elements of a Crash

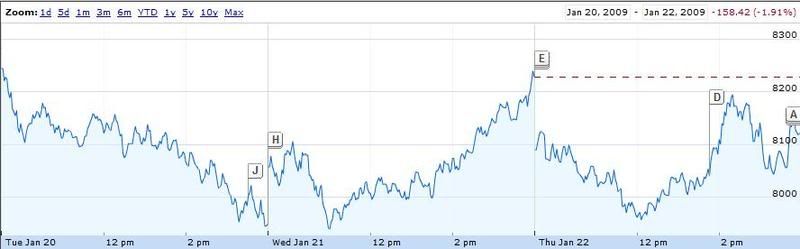

Posted On Thursday, January 22, 2009 at at 4:50 PM by Finance FanaticBy looking at today's Dow graph (below), it seems as the violent volatility is getting more and more every day. That coupled with the strong influx of volume we have received the past couple days can be a combination of disaster when tip toeing around a financial depression. With all the uncertainties out there, a big failure could send this market tanking. Lucky for the market, we happen to be in a week with almost no economic data reported, aside from our horrible home starts for December reported today, but no one pays attention to that right? Just to note it, they were expecting 605K in new housing starts for December. The actual number was only 550k. Even though many of these numbers are cast aside and not paid attention to, I definitely make note of the continual problems our market is seeing, because sooner or later it will catch up with us.

Google came in today with what they're calling good news by "beating market expectation." As a result, investors are cheering and buying up GOOG in after hours. Sure, they have beat SOME of the analyst's forecasts, but the fact is they're net still plunged 68%. So if you think that's something to cheer about go ahead and buy. A lot of times people become so caught up on the wording of events like "they beat market expectations" or "beat earnings" and they just turn around and buy without reading in between the lines. They're net income for Q4 fell from $1.2 billion to $382 million  from the same time period just last year. OUCH. Some are calling it good news, but as for myself, I'm steering clear.

from the same time period just last year. OUCH. Some are calling it good news, but as for myself, I'm steering clear.

Check out the updated Market Trend graph for SKF after today's trading (Click Here to analyze a symbol for free, you just need a name and an email!). +100, which is the highest momentum rating the tool can rank. The fundamentals are definitely pointing upward and with the continual woes hitting the banks, I have to think it's going nowhere but up this month.

It was good to see SRS get a nice bounce back today as well as FXP. Asia has been having a disaster of a time trying to explain their horrible fourth quarter reports. I will touch more on that tomorrow. Watch out for our usual Friday rallies tomorrow. As I've mentioned before, Fridays have a tendency to be bullish. Especially with the downward day today, Google's "positive earnings" and the slight pullback towards the end, we may find ourselves in the green. I didn't buy anything else to prepare for it, as I already have a small position of C and UYG. A down day would definitely yield me stronger returns, but I have some long just in case.

In any case, I would expect higher volatility levels as there remains a lot of uncertainty. With that in mind, the increasing volatility is going to make the leveraged etfs extremely volatile, as prices for options should continue to shoot up with the "fear index" increasing. This is a great time to make quick 10% profits in a short amount of time. It can be very risky, but with the use of stop losses and buying on the right bumps, you can hedge some risks and make some profits.

Warren Buffet said today that he feels the credit crisis is "softening" (ha, maybe for billionaires), but that business has slowed more. He says that the negative sentiment has really slowed down consumer spending and has made it very difficult for businesses to survive. He said he expects the recession to last a while, but wouldn't speculate when. Obviously, I think that means he's planning on it being around a couple years. I like to listen to these old dogs as they're probably the only ones who's been close to experiencing what we're in.

If tomorrow does indeed rally, I plan on bulking up a bit more on SKF and FXP. I still have a ton of shares of SRS, as I still feel there is a lot of potential for profits there. If we go down once again tomorrow, I will enjoy another day in the green for my Zecco.com trading account. That coupled with my strong Lending Club returns is making it a pretty good month for me. Here are some great free videos on stock analysis you can watch click here, definitely worth watching. Happy trading everyone, have a good evening and we'll see you tomorrow.

keep up the good work!

FF, I think two types of strategies will eventually lead to profitability:

1) Shorting on highs and keep averaging up.

2) Buying on lows and keep averaging down.

The question is which one is better. I would say, the first one is much riskier (or less profitable) unless you are sure a crash is going to happen. However, the 2nd approach is less risky as the economy will eventually rebound even if it crashes. All you guys are predicting is dow moving to 6000, right? It is only about 10-15% downside profit, and will make it a very good opportunity to buy stocks.

Now look at the chart of SRS for example. You mentioned a lot that selling SRS at the right time is the key. I am sure some investors kept the stock at $240 hoping for it to go even higher, but apparently they lost all their money due to greed. Going back to SRS chart, if someone shorted SRS (or bought URE) at the peaks of SRS, now imagine how much gain would have been obtained. I learned a lot from your posts, but I think you should really consider changing your investment strategy. You predicted the down turn right as we saw early this year, but you didn't gain anything for about 2 months on your shorts. Having an average of $64 on SRS only gives you about 10% gain if you sell it right at this time. However, you could have easily written a covered call of any of your favorite long stocks and gained that 10% with much less hassle.

Thanks and good luck.

Anon,

I definitely agree. Looking back I would have altered my strategy during the holiday months. I did not expect the shorts to take such a beating. I agree with your strategy 100% and feel it can definitely be profitable right now. I do think the bull months are behind us now and we've got new bottoms to test. Thanks for the post.

Good posts