"Bad Bank" Plan Bad Idea?

Posted On Wednesday, January 28, 2009 at at 4:13 PM by Finance FanaticThere sure was a lot of hustle and bustle on the floor today as hopes for Obama's new plan filled buyers with confidence, especially concerning financials. Sure, myself was included in the mass of buyers, but for me it was not an emotional buy. It was purely just buying knowing that there would be many believing that Obama's new plans will push us through this depression and financials crisis and on to greener pastures. I surely did enjoy profiting off of the emotional compulsiveness of other investors and plan to do it more often. So what was today all about?

Wells Fargo up 30%, Citi up 20%, and Bank of America up 15%. Wow, that's some strong pushes, what on earth could have happened today? To be frank, not much. Sure there were a lot of talks and whispers in headlines throughout the day, but fundamentally, not much changed and unfortunately these kind of "emotional rallies" can really tee up a strong market crash.

First, news came last night that Obama plans to push this stimulus through ASAP. No need to cross the T's and dot the I's, just get it signed. Considering "checks and balances" no longer exist in our government currently (as democrats control all the powers), there shouldn't be much delay in getting this passed. Some may think this is just the beginning of the road back up, especially with the banks. As for me, I took most of my profits and ran.

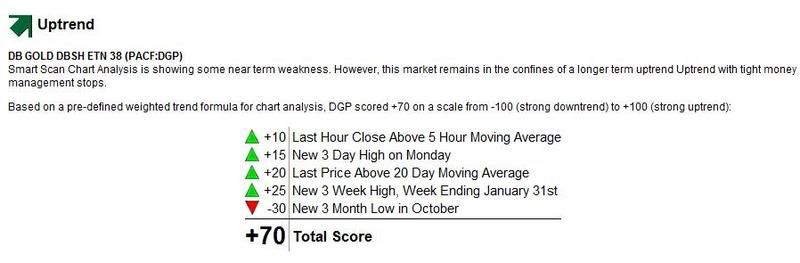

So, yes, I did get out of most of my position in financials today, before the close. What I have learned recently is that you can't be greedy in this market, and getting a 14% return in a day is fine by me. So I took most of my money out, just leaving some in case of another day running. Believe it or not, but I took a lot of my earnings and put it into SRS and DGP (a Deutsche Bank Double Gold fund, see trend analysis below, get your own symbol analyzed for free, all you need is a name and email, Click Here). I think we went a bit overboard in the buying today and I expect some serious pull back either tomorrow or Friday, especially with GDP news coming up, and here's why.

One announcement that has seemed to cause excitement with financials is the new "bad bank" plan. This is, in a sense, a plan for the FDIC to take control of the bad assets and hold on to them until values once again appreciate. So far, the way of doing this is unclear, but many speculate that many of the banks deemed "bad banks" would essentially be temporarily ran by The FDIC, or in a sense, the government. So in other terms, "nationalizing" a lot of these banks. A similar program was adapted during the last real estate catastrophe, where the government issued an RTC program to buy back troubled assets. The problem is that our debt is far greater than that of the RTC days and our length of this recession/depression is unknown and is most likely to much, much longer. What I don't get is why are so many people buying up financials, when in fact if some of these banks do become nationalized, shareholder's equity most likely will get wiped out? Analysts are warning (well the smart ones) of this, but investors have tuned them out as they listen to the new songs of "bank bailouts". My point is, I do not want to be stuck with a slue of bank stocks as the governmental begins to experiment with different nationalizing ideas.

Then we go on to the new Obama stimulus plan itself. Have you read it? This thing is suppose to be devoted to assist in job creation and we're spending $350 million of tax dollars on STD education and prevention? How is that going to help? I mean at least if STD's are still flourishing there will be money spent on pharmaceuticals and doctor visits (a joke). Also, there's a allocation of funds to landscaping the capital building. Who cares? We are in a depression and you want to worry about landscaping. Truly, there is a lot of wasted money in this bill and if we are only dedicating 50 cents to the dollar to actually assisting in job creation and the buying of bad debt, it will take over $5 trillion in bailout funds to begin to do something. Get it together guys.

I do believe that above all, banks need keep the consumer's confidence. That was the biggest cause of the Great Depression. People lost faith in the banks and banks failed. However, I believe there are many ways to keep banks lending, and help manage their current "over leveraged" state. They just need to tweak things back at the drawing board.

Starbucks gave some more bad news today as they are looking to close even more stores down. The worst part about these rallies, is many times, real economic data sometimes gets tossed aside as people are"high" with emotion. Hey, even the US mail is struggling. They are toying with the idea of only delivering mail five days a week instead of six. The point is the rest of the world is going on behind this bailout fluff, and it doesn't look pretty.

At any rate, I'm glad to be out. Sure, we may indeed rally more tomorrow, but like I said, I can't be greedy. Indeed I feel if our government is not careful with how we spend these next trillions, we could end up spending our way to death. Hopefully, Obama can round his people together to find a good solution, I just still believe there is A LOT of work to be done to their proposed plans. Tomorrow should be interesting. Seeing how we open will determine whether I make any moves, but as for now, my Zecco.com account is staying put. I will keep you updated on what I do in the comments section. I hope everyone has a good evening, Happy Trading and we'll see you tomorrow.

Great blog!

How long do you hold the SRS? As you know, double inverse ETFs suffer from time decay/tracking error and for them to effectively work there needs to be consecutive movements in one direction to get the compounding effect.

Thanks!

reading your daily comment has become my first thing to do as for planing what tomorrow would look like, is there any where we can reach u during the day?

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aoYWRjvFjftE

REITs in U.S. Consider Paying Dividends in Stock to Save Cash

SRS to the moon!

I like to read your comments, being someone who still rather perfers the US econ to come out strong, I need someone to really set the opposite tone. Great blog btw, still as bad as the financials are atm, SFK is still rather high including compounding, I think UYG will ultimately reach a decent high with SFK at a new low before we reverse. What do you think?

5U,

The time decay of the leveraged ETFs arent as black and white as some of those articles make them out to be. It all depends on the momentum levels and VIX levels. So it depends how long I hold them for. I try to get a 10-15% return.

Anon,

The best way to try and reach me during the day is to leave a comment, I am constantly checking them during the day.

Anon2,

It's tough to tell. We may see a bit of a rally the next couple weeks with the bailouts coming. I think we'll get a good reading of how strong this rally is by how the market reacts tomorrow. Nice comments guys, thanks for sharing.

good read, and i appreciate the consistency.

keep up the good work.

Finance Fanatic,

Always an excellent read, many thanks & keep up the good work :]

whats you thoughts on skf at this level after the big pull back? thanks

FF, the market is acting exactly what u said..

can u share a bit what u see any the trend would be today?

I think with the California bankruptcy fears and bad GDP expectations, we're staying in the red. It will probably stay in the -60 to the -200 range. Im shaving some of my FAZ profits from yesterday, b/c Fridays always make me a little nervous.

we really have had some bad news today, we may see a big sell off before close. we'll see how the day progresses.

i took some off too, will look for better buy. thanks FF.

wymen

FF,

looks like we are trading in that 200s rang, will u look something to swing or cash out today?

Wymen,

Tough to say at the time. They have set some very low expectations for GDP where even 2% under the expectations would still be devastating, but I fear that media would spin it as good news as they do with all other negative economic data.

There has been a lot of bad news to digest today, and if it wern't for our recent "Friday Rallies" I would definitely be short for tommorow. Im keeping my DGP for a while, and will most likely remain mostly in short to end the week.

I'm thinking a SELLOFF during the last hour today ~

Who in their right mind would want to be IN with GDP coming out before the opening bell tomorrow?...Usually, traders get out until after they hear how good/bad the numbers are...This time, I get a feeling they are going to be much worse than the average expectations...Of course, this is just all IMO...

Hi wymen I totaly agree with you on that. I see big gap down at the open tomorrow 300-500 pts down then follow by rally and drop all day till close of 300-500pts down.

I don"t hear any bulls today SAYING we Bottom,we Bottom,we Bottom. I guess they were ALL Wrong LOL. FF nice call on GLD and GDX a few weeks ago. ALL i got say you bulls is get ready for dow 6,000 cause its coming soon friends and bears that were you want to sell all the bear etfs.

I think, there is definitely going to be some selling pressure come 10 minutes before close. The only move I plan on making thus far is putting some more of my gains from yesterday into TBT. It has done very well for me thus far, and I feel that it should continue to go up, especially with our spending.

What time do the GDP numbers report?

FF, do you think we will open lower tomorrow?

Are you holding SRS & SKF for tomorrow?

Jan 30 8:30 AM GDP-Adv.

I see gap down 300-500pts on before market or open market.

Iam holding SRS,FXP,FAZ,GLD, not just tomorrow. For the DOW 6,000 target.

markets expecting GDP -5.4%

I have a gut feeling we get a

-7% or -8% on GDP.

Man is this going to put investors and funds in the Red and Fear.Good Luck Bulls cause you will need it tomorrow.

Found out GDP report comes out at 8:30am EST.

Also, consumer sentiment index for January is due to be released at 10 AM ET on Friday.

Looks like a down day to me.

John, 300 pts. is a lot to go down in one day in this market.

FF, you were right on about the selling pressure at the last 10 minutes. By the way, I enjoy your blog.

I could see tomorrow being green. The excuse would be, "it was not as bad as expected." Nevertheless, it would be an opportunity to buy some FAZ bet. 39-42 and some srs bet. $48-51.

Pops and Drops

Gainers Change Mkt Cap

Barrick Gold Corporation ... ABX 6.22% 33.64B

PROSH DJ-AIG CRUDE SCO 3.90% 42.72B

Goldcorp Inc. (USA) GG 5.43% 21.49B

3M Company MMM 2.04% 39.19B

Royal Dutch Shell plc (AD... RDS.A 0.49% 159.50B

Losers Change Mkt Cap

Exxon Mobil Corporation XOM -3.09% 390.65B

China Mobile Ltd. (ADR) CHL -5.37% 179.52B

JPMorgan Chase & Co. JPM -8.06% 94.93B

Wells Fargo & Company WFC -11.37% 62.45B

General Electric Company GE -5.56% 133.82B

Tomorrow is up I think. Amazon beats the expectations and is shooting to the sky. People are using every excuse for a rally. I also expect GDP to come out "as expected" or "slightly better than expected" plus "Friday" + anticipation of a weekend meeting or surprise from government = rally

The arguments for which direction are good on both sides. If we were in a "fundamentally" driven market, I would say that tomorrow would most definitely be down. However, Fridays mixed with Obama expectation and bailout hopes could very well end in a green day.

I'm sticking with my shorts and did today, because even if we do not end red tomorrow, I think next week should suffer some aftershocks and selling.

Amazon was no surprise as they announced their strongest month ever in November. Thats why I said they're on of my favorites for this year and they're in my IRA.

The banks are a basket case.