Dangerous Times - Obama Tries to Fuel Market

Posted On Saturday, January 31, 2009 at at 9:40 AM by Finance FanaticWhat an interesting way to close the market on Friday. I think it was pretty clear that there was someone waiting with a button to make sure that the market closed above 8000, as that is a pretty strong technical point for momentum. I literally watched it jump from 7992 to 8000 in the absolute last second of the market. At any rate, it was still big for the market to be as down as it was with: 1. Having GDP numbers be better than expected, 2. Having two strong days of selling after beginning the week in the green, 3. Having a Friday end as a red day is a rare things these days. So, I think we definitely have some downward momentum, but not quite enough yet in my opinion.

It is very clear that deflation is here, as we can see with the huge drop in real estate prices, oil, and precious metals. Eventually, I believe this deflation is going to lead to a deflationary down spiral and eventually capitulate. I do think we're very close, but we're not quite there. I heard a good analogy yesterday describing the state of the S&P. Under 820, the market has a cold, under 800 the market has caught pneumonia, and under 780, we're on our death bed. The technicals show us very close, but not there yet. As a result, we are vulnerable to these quick, short-term rallies that can be very, very violent. So, as I said a couple days ago, I have adjusted my investment strategy to make quicker trades and shoot for lower returns. I'm not ready to go all short, but I am very close.

So I did sell off most of my FAZ on Friday and a bit of my SRS shares that I had purchased a couple of days ago to pocket the return. I sill have plenty of short to reward me for another down day Friday, but I have a lot more conservative plays as well. I'm playing this market a bit more conservative than usual as I feel with the possibility of these violent rallies, I don't want to be caught with as many shares that I have usually been holding. Weekends always tend to have surprises as the government likes to let new hopes brew with investors over the weekend. This is why I have big positions in DGP, GDX, TBT, and UUP(see the market trend report below for UUP +90, Get your own symbol analyzed for free, all you need is a name and email, Click Here). Yes of course I have my FXP, SRS and EEV, which I continually have, I've just lowered my positions a bit until we see some more technicals triggered. Don't you worry, they're coming. As for now, I don't want to roll any dice with Mondays as who knows what news come out this weekend. Obama has already attempted a "premature hope rally", by announcing his "promises" to increase liquidity in the banks and get the flow of money started. Sure, anything else Obama? Why don't you just create mana bread for all American families. He's obviously hoping to dupe the not so wise investors again, and oddly it may work for one or two days, but unless he has the secret to life, there is not much anyone can do to unfreeze the markets currently.

As for now, I don't want to roll any dice with Mondays as who knows what news come out this weekend. Obama has already attempted a "premature hope rally", by announcing his "promises" to increase liquidity in the banks and get the flow of money started. Sure, anything else Obama? Why don't you just create mana bread for all American families. He's obviously hoping to dupe the not so wise investors again, and oddly it may work for one or two days, but unless he has the secret to life, there is not much anyone can do to unfreeze the markets currently.

At any rate I plan on waiting around to see how the market reacts on Monday and make my move. It's a toss up at this point. I would expect to maybe see some green rallies next week, and maybe even become quite violent if announcements come forth. So, I'll play it by ear. These rallies make the market even more vulnerable for failure.

I thought I would end on a funny story that happened in China the past week. In Hong Kong, it is tradition for their equivalent of a "CFO" of the country to perform a stick shaking ceremony, in which generates a fortune for the country for the next year. In shaking a bundle of sticks, one stick falls out of the bundle and corresponds with a sequence of numbers, that in turn generates a fortune. Well, this past week, the fortune which was given was horrible. It talked of depression, economic turmoil, and much suffering. The people of China take this ritual so seriously, it caused quite an uprising and even some rioting, as people feared the fate of their country. The Governor eventually had to make a press statement to say that the ceremony was only traditional and did not actually reflect the future of the country. I found this story amusing, since so many people think China is good place for investment. Ahhh, the naive.

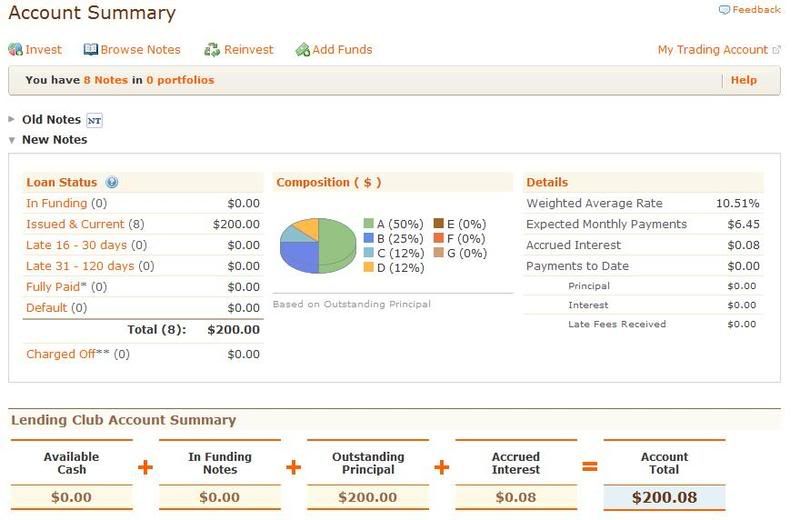

So we'll see how it goes. Some people had mention Zecco.com trading their rates. The new minimum balance of 25,000 for free trades is true, however, you can also get free trades if you make more than 25 trades a month, which I assume most of you, like me, are doing. Still one of the best deals I've seen out there. So there's some information for you. Also, just a reminder, only 2 more days for the Lending Club promotion, win $100, see here. Have a good weekend everyone, Happy Trading and we'll see you tomorrow.

Yesterday's Profits Erased - All Eyes on GDP

Posted On Thursday, January 29, 2009 at at 5:23 PM by Finance Fanatic Well, as expected, we experienced a pretty aggressive selling day as yesterday's gains, and then some, were wiped out today with the Dow closing at 8149. I was glad to have sold out of almost all of my bank positions yesterday, as most of the profits were wiped out from today's selling. Tomorrow is a pretty critical day in deciding the future movement of this market. Another devastating day of selling could be enough to put the Dow below 8000, which would be a critical point of closing, especially with the market mostly trading up the first part of the week. As I've said in the comments, I'm a bit torn at which way it will go since so much depends on the GDP announcement and how it is spun with the media.

Well, as expected, we experienced a pretty aggressive selling day as yesterday's gains, and then some, were wiped out today with the Dow closing at 8149. I was glad to have sold out of almost all of my bank positions yesterday, as most of the profits were wiped out from today's selling. Tomorrow is a pretty critical day in deciding the future movement of this market. Another devastating day of selling could be enough to put the Dow below 8000, which would be a critical point of closing, especially with the market mostly trading up the first part of the week. As I've said in the comments, I'm a bit torn at which way it will go since so much depends on the GDP announcement and how it is spun with the media.

I didn't make many moves with my Zecco.com account today, as I still feel I want to be mostly short for the time being. I did, however, pick up some more TBT for myself. It has performed so well for me since I first wrote about buying it last month and I see it going nowhere but up this year. US treasuries have been so over bought, it's ridiculous. The yield with Treasuries hit 0%! It is very clear that Obama's plan is to spend our way out of this crisis and by doing so will even more saturate the market with more, already oversold Treasuries. Plus, as our government continues to print money, other nations will continue pulling their money out of Treasuries and putting them into corporate bonds, because their dividends are much more stronger. So I expect TBT to continue to do just fine for me.

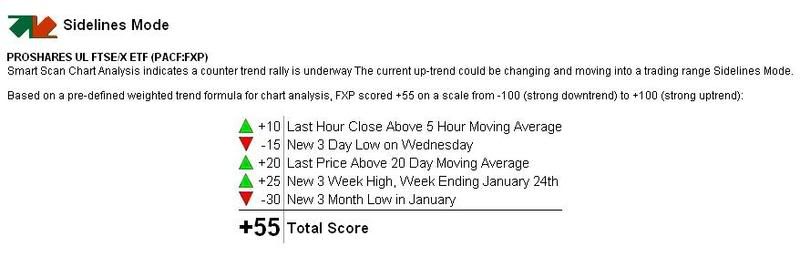

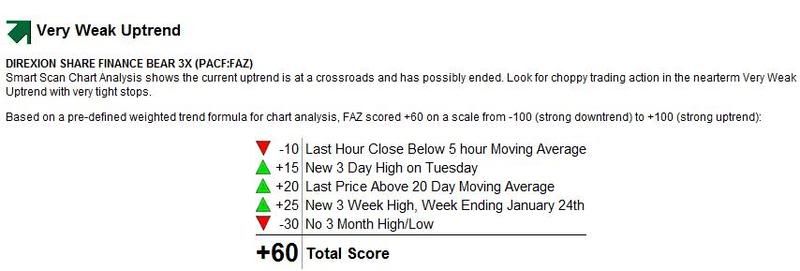

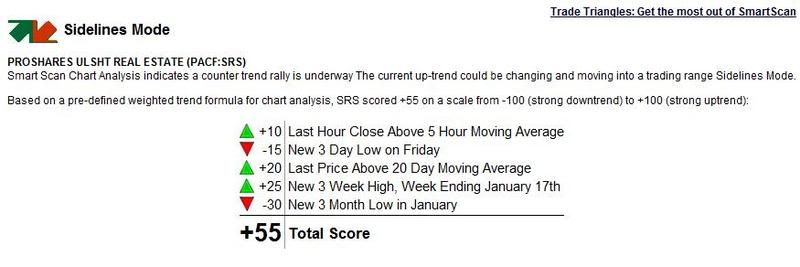

I would expect big numbers from my FXP tomorrow, as Asia is currently looking like a market crash. Surprisingly, FXP is holding up pretty strong fundamentally, as they have a market trend score of +55 (see below. Get your own symbol analyzed for free, all you need is a name and email, Click Here). I did shave off some of FAZ earnings today as there was some huge gains today from it (almost 20%). It's not that I don't think there is more to grow with FAZ, it's just like I said yesterday, I can't be greedy.

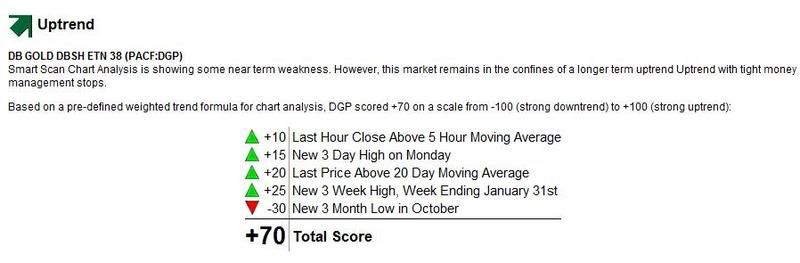

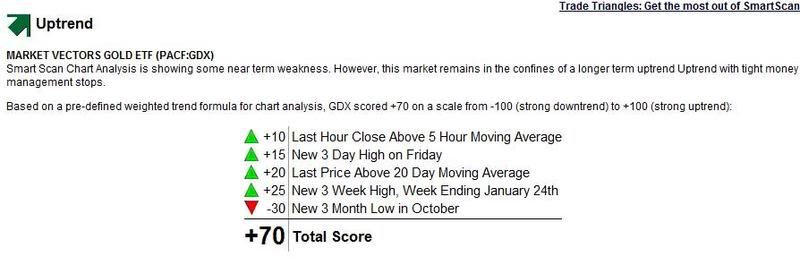

My DGP performed well for me today, already being up close to 5%. This is one I plan on hanging on for a while. I sold some of my GDX for a pretty strong profit (first bought in at $18). I am seeing more upside for DGP in the long run than GDX. I think gold is bound to spike sometime throughout the year with this overspending.

So we all wait and see what the GDP Gods shall bring us. The number is going to be bad, no doubt about it. The next GDP announcement should be even worse. I cannot believe the devastation we have already experienced in January. Consumer sentiment is another one to keep your eye on, although I do feel it will be overshadowed by GDP. If indeed sellers take over this market tomorrow, which has usually been buyer's territory, I would expect that momentum to push harder into next week.

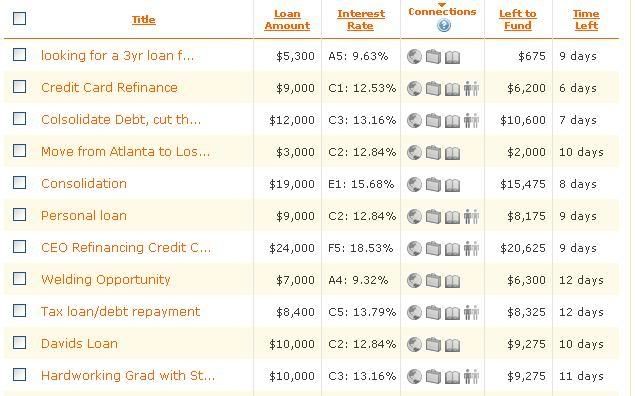

My Lending Club account is doing great so far. Payments are being made and my returns are looking to be strong. It's good to be diversified and helps me sleep a bit better at night. Below is an example of notes that are available to invest for 10%+ gains. I chose to pick higher valued loans, and not shoot for the 20% returns. Remember, my $100 promotion for Lending Club ends in a couple days. It's free to sign up, click here for instructions.

I will be on the comments tomorrow so check back and share your thoughts. I will probably be making some moves mid-day tomorrow so we'll see what happens. Have a good night and Happy Trading.

Free Trading Analysis Video click here

"Bad Bank" Plan Bad Idea?

Posted On Wednesday, January 28, 2009 at at 4:13 PM by Finance FanaticThere sure was a lot of hustle and bustle on the floor today as hopes for Obama's new plan filled buyers with confidence, especially concerning financials. Sure, myself was included in the mass of buyers, but for me it was not an emotional buy. It was purely just buying knowing that there would be many believing that Obama's new plans will push us through this depression and financials crisis and on to greener pastures. I surely did enjoy profiting off of the emotional compulsiveness of other investors and plan to do it more often. So what was today all about?

Wells Fargo up 30%, Citi up 20%, and Bank of America up 15%. Wow, that's some strong pushes, what on earth could have happened today? To be frank, not much. Sure there were a lot of talks and whispers in headlines throughout the day, but fundamentally, not much changed and unfortunately these kind of "emotional rallies" can really tee up a strong market crash.

First, news came last night that Obama plans to push this stimulus through ASAP. No need to cross the T's and dot the I's, just get it signed. Considering "checks and balances" no longer exist in our government currently (as democrats control all the powers), there shouldn't be much delay in getting this passed. Some may think this is just the beginning of the road back up, especially with the banks. As for me, I took most of my profits and ran.

So, yes, I did get out of most of my position in financials today, before the close. What I have learned recently is that you can't be greedy in this market, and getting a 14% return in a day is fine by me. So I took most of my money out, just leaving some in case of another day running. Believe it or not, but I took a lot of my earnings and put it into SRS and DGP (a Deutsche Bank Double Gold fund, see trend analysis below, get your own symbol analyzed for free, all you need is a name and email, Click Here). I think we went a bit overboard in the buying today and I expect some serious pull back either tomorrow or Friday, especially with GDP news coming up, and here's why.

One announcement that has seemed to cause excitement with financials is the new "bad bank" plan. This is, in a sense, a plan for the FDIC to take control of the bad assets and hold on to them until values once again appreciate. So far, the way of doing this is unclear, but many speculate that many of the banks deemed "bad banks" would essentially be temporarily ran by The FDIC, or in a sense, the government. So in other terms, "nationalizing" a lot of these banks. A similar program was adapted during the last real estate catastrophe, where the government issued an RTC program to buy back troubled assets. The problem is that our debt is far greater than that of the RTC days and our length of this recession/depression is unknown and is most likely to much, much longer. What I don't get is why are so many people buying up financials, when in fact if some of these banks do become nationalized, shareholder's equity most likely will get wiped out? Analysts are warning (well the smart ones) of this, but investors have tuned them out as they listen to the new songs of "bank bailouts". My point is, I do not want to be stuck with a slue of bank stocks as the governmental begins to experiment with different nationalizing ideas.

Then we go on to the new Obama stimulus plan itself. Have you read it? This thing is suppose to be devoted to assist in job creation and we're spending $350 million of tax dollars on STD education and prevention? How is that going to help? I mean at least if STD's are still flourishing there will be money spent on pharmaceuticals and doctor visits (a joke). Also, there's a allocation of funds to landscaping the capital building. Who cares? We are in a depression and you want to worry about landscaping. Truly, there is a lot of wasted money in this bill and if we are only dedicating 50 cents to the dollar to actually assisting in job creation and the buying of bad debt, it will take over $5 trillion in bailout funds to begin to do something. Get it together guys.

I do believe that above all, banks need keep the consumer's confidence. That was the biggest cause of the Great Depression. People lost faith in the banks and banks failed. However, I believe there are many ways to keep banks lending, and help manage their current "over leveraged" state. They just need to tweak things back at the drawing board.

Starbucks gave some more bad news today as they are looking to close even more stores down. The worst part about these rallies, is many times, real economic data sometimes gets tossed aside as people are"high" with emotion. Hey, even the US mail is struggling. They are toying with the idea of only delivering mail five days a week instead of six. The point is the rest of the world is going on behind this bailout fluff, and it doesn't look pretty.

At any rate, I'm glad to be out. Sure, we may indeed rally more tomorrow, but like I said, I can't be greedy. Indeed I feel if our government is not careful with how we spend these next trillions, we could end up spending our way to death. Hopefully, Obama can round his people together to find a good solution, I just still believe there is A LOT of work to be done to their proposed plans. Tomorrow should be interesting. Seeing how we open will determine whether I make any moves, but as for now, my Zecco.com account is staying put. I will keep you updated on what I do in the comments section. I hope everyone has a good evening, Happy Trading and we'll see you tomorrow.

Obama Brings Hope To Investors - For Better or For Worse

Posted On Tuesday, January 27, 2009 at at 3:37 PM by Finance Fanatic Call it a hunch or call it an overdose of OSD (Obama Stimulus Decisions), but I actually made a SHORT TERM move into longs today. Many more speed bumps have arrived into this road to destruction of our economy than I first anticipated and in order to maximize my value, I'm looking to try and play both sides a bit more, for the time being. Currently, investors are very vulnerable to just announcements of hope and with the new President being busy and active, I definitely feel there will be many more announcements to come in his first months of office. Please don't misunderstand me, I still strongly believe that our economy is still very much spiraling downward, I just feel I can make some extra $$$ on the bumps. Call it the day trader in me. I don't plan on actually "day trading" per say, but my trade volume should definitely be going up. I'm still very bullish in my current short positions, I would just like to make some cash on the bumps up to load up on my shorts at lower levels, because in the end, I believe the market will come crashing...and fast.

Call it a hunch or call it an overdose of OSD (Obama Stimulus Decisions), but I actually made a SHORT TERM move into longs today. Many more speed bumps have arrived into this road to destruction of our economy than I first anticipated and in order to maximize my value, I'm looking to try and play both sides a bit more, for the time being. Currently, investors are very vulnerable to just announcements of hope and with the new President being busy and active, I definitely feel there will be many more announcements to come in his first months of office. Please don't misunderstand me, I still strongly believe that our economy is still very much spiraling downward, I just feel I can make some extra $$$ on the bumps. Call it the day trader in me. I don't plan on actually "day trading" per say, but my trade volume should definitely be going up. I'm still very bullish in my current short positions, I would just like to make some cash on the bumps up to load up on my shorts at lower levels, because in the end, I believe the market will come crashing...and fast.

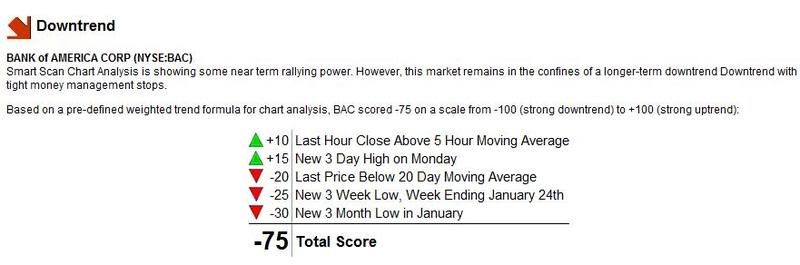

Today I sold off my remaining SKF and put them into BAC and C. With Obama just being put in office, he is wanting quick action. I expect to see things turn much quicker that we did with the Bush administration. Sure, this can eventually lead to worse things for the economy and probably will, but the point is the market will probably rally from it in the short term. These are the reasons to justify my longs. I do still have a strong short position in SRS, FXP and EEV. I just feel these can hold up better during these rallies than SKF and FAZ.

Either way, my holding of these stocks will be very short lived. In fact, I would like to be completely liquidated from them before Thursday's close, at latest. I do not want to be stuck with financials going into GDP announcements. By doing this, I plan to throw my gains from the hopeful quick rally into more short positions, which will, I believe, ultimately yield strong gains.

So far my plan seems to be working out for me as it looks as though Obama is trying to get his stimulus plan (maybe $900 billion) to pass ASAP. Although, he is getting a lot of opposition from the GOP, signs are looking good for the ability to get something passed as early as maybe next week. Just whispers of this has sent financials up almost 10% in after hours. If this sticks into tomorrow, I will most definitely shave some profits off the top, as with all speculative announcements, the cheering is usually short-lived. Also, as you can see, momentum charts for Bank of America do not look pretty. -75, OUCH. Get your own symbol analyzed for free, all you need is a name and email, Click Here.

Yahoo also announced "better than expected" earnings, however yielding a loss for the quarter. But, as usually, investors think of this as a good sign as the stock is trading up 5% in after hours. I actually like yahoo, even before the earnings announcement. I believe over the next five years, a lot of focus is going to be shifted over to e-commerce, which should indeed boost value for Yahoo. Plus, I also think at Yahoo's recent low stock price, they are still very vulnerable for a hostile takeover. I think something should happen, definitely before the end of the year.

Keep an eye out for FOMC's meeting notes tomorrow. We shouldn't expect much as far as a rate cute (since we're pretty much already at 0%), but they are definitely still capable of moving a market in either direction depending on their economic outlook. If something substantial is announced, we can expect to see a strong run in which ever direction it heads. I personally feel we will have an up day of trading tomorrow as the hope of new stimulus could really ignite the buying the next couple of days, pending that something largely significant is not announced.

New home sales and GDP numbers are still to come at the end of the week. As I said earlier, I would like to be fully out of my longs before that GDP number is given. In fact, I believe Thursday we may trade down just expecting a bad number. Analysts have tried to soften the landing by projecting an enormous -5.4% result. Their hopes is that anything even slightly lower than this number can be manipulated to investors as a positive sign and erasing the memory that our GDP just did indeed fall almost 5%. Sadly, I am not as easily fooled. Anything below 3% and I am running for the hills. Why roll the dice with longs right now when I can just stay in cash and earn 2.45% APY* with HSBC Direct Online Savings, all FDIC insured. I will be able to sleep better at night, that's for sure. So I don't see me in BAC and C longer than a week.

Well, let's see how tomorrow goes for my new long positions. I am a bit more nervous going long in this market as I feel it is more of a gamble, but I do see some opportunity in it. Check out these free INO technical stock trading videos, very informative, click here. Happy Trading everyone and have a good night.

Bad News... And More Bad News - But We Still Trade Up

Posted On Monday, January 26, 2009 at at 4:38 PM by Finance FanaticI don't know if it was all the media time Obama's new projected stimulus plan got this weekend or the perceived "good news" from the existing-home sales, but whatever the case, the market was some how able to stay up in the midst of some seriously bad employment news and other negative economic data. The Dow did spend some time in the red, but quickly recovered and closed the day up 38 points. Many perceived the 6.5% increase in home sales as good news and an indicator that we may be starting to see the bottom of the residential crisis. However, once again, people have failed to read between the lines.

There are two huge elements which helped increase this number. First, the median of housing prices are down 15% just from last year. Many of the houses that were sold were bank owned and were sold for a loss. Sure, if McDonald's lowered the price of Big Macs to 50 cents, they would probably sell more, but their profits would be down.

Second, THE DISCOUNT RATE IS AT 0%. For those that enjoy good credit, with the help of the FED, people buying houses are seeing rates in the low to high 4% range. At this rate, you could buy a mansion, rent it to a dog, and still probably be able to cover your monthly debt service. The point is, only a 6% rise in home sales with a 15% in price and 4-5% borrowing, is not encouraging at all.

Also, today we were slammed with a whole new round of job cuts. Our unemployment rate is quickly moving towards 9% and up into the teens. They are projecting another 500,000 job loss month for January, however at this rate, we're looking to be closer to the 800,000-900,000 range. I thought I would make a list of all the recent job cuts that have been announced the last week as it may become tough to keep track. I hope none of your companies are on this list:

* Caterpillar to Cut 20,000 Jobs

* Sprint Nextel to Cut Up to 8,000 Jobs

* Home Depot to Cut 7,000 Jobs

* Microsoft to Cut Up to 5,000 Jobs

* Intel to Cut Up to 6,000 Jobs

* UAL Layoffs Planned

* BofA Could Cut 4,000 Jobs

* Cerberus May Lay off 10% of Staff

* Clear Channel Cutting 1.500 Jobs

* GE Capital to Slash Up to 11,000

* Conoco to Lay Off 4%

* Pfizer to Cut Up to 2,400 Jobs

* AMD to Lay Off 1,000

* WellPoint to Lay Off 1,500

* Hertz to Cut More than 4,000 Jobs

* Motorola to Slash 4,000 More Jobs

* Google to Cut 100 Recruiter Positions

* Seagate Cutting 6% of Workforce

* Barnes & Noble Slashes 100 Jobs

* Oracle Cuts Several Hundred Jobs

* Boeing to Cut 4,500 Jobs

* Cigna to Slash About 1,100 Jobs

* U.S. chemical maker Huntsman said it plans to cut about 1,175 jobs, or about 9 percent of its workforce, by year-end to reduce costs and tackle the huge slump in chemical demand.

* Microsoft announced it would cut up to 5,000 jobs and said it could no longer offer profit forecasts for the rest of the fiscal year.

* Intel said it would close sites in Asia and scale back operations in the United States as part of a restructuring that could affect as many as 6,000 jobs.

* UAL announced it will further reduce the number of salaried and management employees by approximately 1,000 positions by the end of 2009. This is in addition to the 1,500 positions the company announced in the second quarter.

* Diversified U.S. manufacturer Eaton said it planned to cut 5,200 jobs, or about 6 percent of its work force, in an effort to further slash costs in the face of a struggling economy.

* Time Warner's Warner Bros. Entertainment said it would cut about 800 jobs, or 10 percent of its worldwide staff in coming weeks.

* Lee Enterprises, which publishes 49 daily newspapers including the St. Louis Post-Dispatch, said its quarterly profit on a preliminary basis fell 69 percent and cut its staffing by more than 10 percent.

* Rohm and Haas said it plans to cut 900 jobs, or 5.5 percent of its workforce, in a bid to tackle the slump in demand and widespread market weakness.

* Bank of America may slash as much as 4,000 jobs in its capital markets units starting this week. The cuts are expected to be in New York and reflect the consolidation of the bank’s sales and trading businesses after it bought Merrill Lynch three weeks ago.

Last month, I discussed the extreme over buying of treasuries, which pushed the yield to almost 0% numbers and pressed me to buy into TBT, the 20-year Lehman treasury UltraShort. As you can see from the graph, it has done quite well for me since I got into it. I expect this short to continue to remain strong as Obama tries to spend our way out of this mess and foreign nations begin to pull their money out of our treasuries.

Here also is the momentum graph for TBT. As you can see it is currently holding a +70 score, which is pretty strong momentum. I would expect it to keep going up for a bit more. Get your own symbol analyzed for free, all you need is a name and email, Click Here.

Banks came down later in the day due to more concerns of their ability to survive. Hello, why did these concerns ever go away? It didn't help that Fannie Mae is wanting $16 billion more from the Fed to keep a float and trust me, these secondary askings for money is just the beginning. In the next month or two all of them will be back at the table with their hands open. The debt coming due is monumental.

Banks came down later in the day due to more concerns of their ability to survive. Hello, why did these concerns ever go away? It didn't help that Fannie Mae is wanting $16 billion more from the Fed to keep a float and trust me, these secondary askings for money is just the beginning. In the next month or two all of them will be back at the table with their hands open. The debt coming due is monumental.

American Express and Texas Instruments reported horrible earnings and with the anticipation of a rocky GDP number this week, I would expect some days of down trading. However, the new Mr. Smart secretary who doesn't pay his taxes was sworn in today, and knowing this market, it could somehow cause some praiseworthy trading tomorrow. I'm sticking with my shorts and gold for the time being. I think the ticking time bomb is close enough to zero for me.

Well, tomorrow should be an interesting day. After hours are up, but that doesn't mean anything anymore. Take advantage of the free trial of INO video, because I believe it won't be offered much longer, click here. I hope to wake up in the morning to see some green in my Zecco.com account. We'll see. Happy trading and we'll see you tomorrow.

8000/825 Seem To Be The Magic Number - Forces Colliding

Posted On Friday, January 23, 2009 at at 3:53 PM by Finance Fanatic Whether it be 8000 for the Dow or 825 for the S&P, it seems as though investors have found a base to set up camp as the market may go up and down a bit, but is staying close to those numbers. The continual battle between stimulus hopes and deflation depression is causing some violent jolts in volatility, as people are not quite sure what to believe or if things are going to get a lot worse. Even if the largest stimulus considered is passed, history has shown us that in most cases, there is severe lag time for the economy to respond to an economic stimulus. Also, let me remind you that our current situation is very unique as it is a global crisis, so I would expect that lag time to be much more severe. There seems to be a definite mood change currently that is very similar to the one back in November. Even with today's Friday wanting to rally, there was a strong opposing force selling. Currently, much of the movement is a result from all the day traders, as the momentum is moving like clock work as the shorts are covered. With next week thick of economic news and earnings, including GDP, I would expect a serious move to be made.

Whether it be 8000 for the Dow or 825 for the S&P, it seems as though investors have found a base to set up camp as the market may go up and down a bit, but is staying close to those numbers. The continual battle between stimulus hopes and deflation depression is causing some violent jolts in volatility, as people are not quite sure what to believe or if things are going to get a lot worse. Even if the largest stimulus considered is passed, history has shown us that in most cases, there is severe lag time for the economy to respond to an economic stimulus. Also, let me remind you that our current situation is very unique as it is a global crisis, so I would expect that lag time to be much more severe. There seems to be a definite mood change currently that is very similar to the one back in November. Even with today's Friday wanting to rally, there was a strong opposing force selling. Currently, much of the movement is a result from all the day traders, as the momentum is moving like clock work as the shorts are covered. With next week thick of economic news and earnings, including GDP, I would expect a serious move to be made.

I personally feel we are getting closer and closer to retesting the bottom and this time when we're down there, we're going to go straight through it. All of the focus is on the banks right now, and everyone's chips go with them. Let me give a few reasons why I believe the banks have much more problems ahead and why I link SKF (Financials Short) and SRS (Real Estate Short) directly go together and why I am bullish on both.

Bank of America has an estimated $64.7 billion in commercial debt and says that it considers $3.9 billion or 6% currently non-performing. Most of this current delinquency they say is from home builders who are struggling with cash flow. This doesn't even take into account the other several billions that are just now beginning to default on their loans. You can expect that number to rise dramatically. Lately it seems as if these banks are more concerned with using the TARP funds to furnish new executive offices and payoff their chauffeur. It's ridiculous. Check out the latest free videos from INO, good stuff, click here.US Bancorp's delinquencies jumped to 3.34% during Q4, which was way up from the 1% reported the year prior. It is expected that these default rates should increase for at least the next 12 months in the commercial sector. It is also projected that over $400 billion worth of debt is to come due during this year and that there is a refinancing shortfall of anywhere between $125 to $150 billion. Where's that money going to come from? Obama perhaps? These aren't even including all of the other defaults going on behind the scenes. It is also estimated that there is over $3.5 trillion in outstanding commercial debt and that 40% of that are on bank's balance sheets, while 26% as CMBS debt. I can assure you that most of those loans are very high leveraged, anywhere from 70-80% LTV. Banks aren't lending like that anymore.

With these kind of numbers it is no wonder why I am long on SKF and SRS. I believe there is going to be more bank consolidation and maybe some government controlling until this debt problem can be sorted out. The residential credit crunch was the a taste of what is to come.

Another significant trend to note today was that Gold and the value of the dollar were not inversely related. This is very good news for my GDX and GLD options. Having GDX up almost 9%, with the dollar being up as well, shows that the inverse relationship may be breaking and they may be taking their own paths. Plus check out the fundamentals for GDX below(Click Here to analyze a symbol for free, you just need a name and an email!). I have great hope for my gold. DIG could be also taking this same route, as we saw oil jump with another OPEC cut.

Big week next week with big news. GDP should be a momentum changer, whatever it may be. I would expect some sorry numbers to set the mood for selling next week. I did put some more money into my Lending Club investment, as my 10.5% return has held up thus far, and if I can keep that consistent, it can be a good buffer for my portfolio. My $100 promotional contest I am running for them ends next week, so get in it for free for a chance to win an easy $100, click here for more. I got out of my Citi today, as I feel Monday is going to be bloody (unless of course Obama has a weekend secret for everyone which, recently, they have loved doing). Time shall tell. Have a great weekend everyone and Happy Trading.

Big week next week with big news. GDP should be a momentum changer, whatever it may be. I would expect some sorry numbers to set the mood for selling next week. I did put some more money into my Lending Club investment, as my 10.5% return has held up thus far, and if I can keep that consistent, it can be a good buffer for my portfolio. My $100 promotional contest I am running for them ends next week, so get in it for free for a chance to win an easy $100, click here for more. I got out of my Citi today, as I feel Monday is going to be bloody (unless of course Obama has a weekend secret for everyone which, recently, they have loved doing). Time shall tell. Have a great weekend everyone and Happy Trading.

Volume & Volatility on The Rise - Two Critical Elements of a Crash

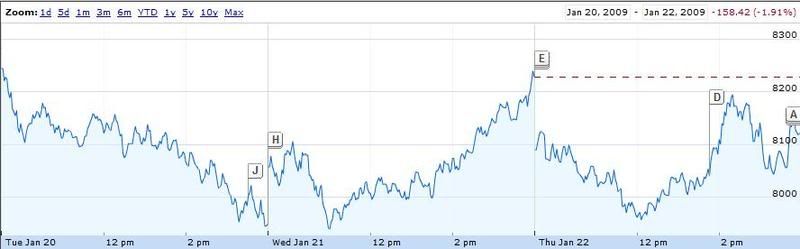

Posted On Thursday, January 22, 2009 at at 4:50 PM by Finance FanaticBy looking at today's Dow graph (below), it seems as the violent volatility is getting more and more every day. That coupled with the strong influx of volume we have received the past couple days can be a combination of disaster when tip toeing around a financial depression. With all the uncertainties out there, a big failure could send this market tanking. Lucky for the market, we happen to be in a week with almost no economic data reported, aside from our horrible home starts for December reported today, but no one pays attention to that right? Just to note it, they were expecting 605K in new housing starts for December. The actual number was only 550k. Even though many of these numbers are cast aside and not paid attention to, I definitely make note of the continual problems our market is seeing, because sooner or later it will catch up with us.

Google came in today with what they're calling good news by "beating market expectation." As a result, investors are cheering and buying up GOOG in after hours. Sure, they have beat SOME of the analyst's forecasts, but the fact is they're net still plunged 68%. So if you think that's something to cheer about go ahead and buy. A lot of times people become so caught up on the wording of events like "they beat market expectations" or "beat earnings" and they just turn around and buy without reading in between the lines. They're net income for Q4 fell from $1.2 billion to $382 million  from the same time period just last year. OUCH. Some are calling it good news, but as for myself, I'm steering clear.

from the same time period just last year. OUCH. Some are calling it good news, but as for myself, I'm steering clear.

Check out the updated Market Trend graph for SKF after today's trading (Click Here to analyze a symbol for free, you just need a name and an email!). +100, which is the highest momentum rating the tool can rank. The fundamentals are definitely pointing upward and with the continual woes hitting the banks, I have to think it's going nowhere but up this month.

It was good to see SRS get a nice bounce back today as well as FXP. Asia has been having a disaster of a time trying to explain their horrible fourth quarter reports. I will touch more on that tomorrow. Watch out for our usual Friday rallies tomorrow. As I've mentioned before, Fridays have a tendency to be bullish. Especially with the downward day today, Google's "positive earnings" and the slight pullback towards the end, we may find ourselves in the green. I didn't buy anything else to prepare for it, as I already have a small position of C and UYG. A down day would definitely yield me stronger returns, but I have some long just in case.

In any case, I would expect higher volatility levels as there remains a lot of uncertainty. With that in mind, the increasing volatility is going to make the leveraged etfs extremely volatile, as prices for options should continue to shoot up with the "fear index" increasing. This is a great time to make quick 10% profits in a short amount of time. It can be very risky, but with the use of stop losses and buying on the right bumps, you can hedge some risks and make some profits.

Warren Buffet said today that he feels the credit crisis is "softening" (ha, maybe for billionaires), but that business has slowed more. He says that the negative sentiment has really slowed down consumer spending and has made it very difficult for businesses to survive. He said he expects the recession to last a while, but wouldn't speculate when. Obviously, I think that means he's planning on it being around a couple years. I like to listen to these old dogs as they're probably the only ones who's been close to experiencing what we're in.

If tomorrow does indeed rally, I plan on bulking up a bit more on SKF and FXP. I still have a ton of shares of SRS, as I still feel there is a lot of potential for profits there. If we go down once again tomorrow, I will enjoy another day in the green for my Zecco.com trading account. That coupled with my strong Lending Club returns is making it a pretty good month for me. Here are some great free videos on stock analysis you can watch click here, definitely worth watching. Happy trading everyone, have a good evening and we'll see you tomorrow.

Banks Bounce Back Thanks To Obama Fever - Apple Crushes Earnings

Posted On Wednesday, January 21, 2009 at at 1:34 PM by Finance Fanatic It didn't take long to get speculative hopes back in the market. Today, the market got off to a bit of a slow start and even went red for a bit, but after the remarks of Geithner (the new secretary), investors felt a lot more comfortable with the future of the banks. Almost everything that was taken away yesterday was given right back. I was very happy to have sold out of most of my SKF before the aftermath, however, SRS had a much less than stellar day and I chose to hold on to those, my mistake. I did get the gains I was finally looking for out of Citi, but not much after the crash yesterday. It did help the banks that many of the CEO's bought back lots of shares to help instill confidence. I still ended up quite positive in my Zecco.com account after the two days and look to reboot my strategies as we are kind of at ground zero again. However, I think I am going to transfer some more money over from my ING Direct savings account to trade with, as the next few weeks could be prime for good money making.

It didn't take long to get speculative hopes back in the market. Today, the market got off to a bit of a slow start and even went red for a bit, but after the remarks of Geithner (the new secretary), investors felt a lot more comfortable with the future of the banks. Almost everything that was taken away yesterday was given right back. I was very happy to have sold out of most of my SKF before the aftermath, however, SRS had a much less than stellar day and I chose to hold on to those, my mistake. I did get the gains I was finally looking for out of Citi, but not much after the crash yesterday. It did help the banks that many of the CEO's bought back lots of shares to help instill confidence. I still ended up quite positive in my Zecco.com account after the two days and look to reboot my strategies as we are kind of at ground zero again. However, I think I am going to transfer some more money over from my ING Direct savings account to trade with, as the next few weeks could be prime for good money making.

It is funny, because during the interview, Geithner did not want to speculate on timelines and likely avenues the government would be taking, saying that by doing so in the past had caused premature speculations and radically effected the market. Well, even by avoiding the questions, he was still able to help radically move the market. How ironic. People are looking for the slightest bit of hope to help spur optimism.

So even though the Obama rally showed up a day late, it's here. Now, how long will it last is the magic question. Anytime momentum like that is stopped in its tracks and reversed to the degree we saw today causes some serious jolts in technicals. Although this rally should and could very well lead on into tomorrow, there are some deafening news that could reverse this day of high hopes. One day of Obama in office did not make the bank crisis's everyone feared yesterday go away. The debt outstanding is still substantially more than they can handle, and commercial vacancies haven't even hit half the number they're expected too. We're not out of the woods yet.

Google announces earnings tomorrow. This outcome could provide a big influence on where the market moves. With massive budget cuts, be assured that "online advertising" is one of the first things crossed off the list. Being that advertising revenue is a bulk of Google's earnings, they may struggle a bit. We lucked out this week with not much economic data being reported, but tomorrow we do have housing starts, which I cannot see being a strong number. That could effect some trading, but I don't expect it to be that influential. People should be clinging to headlines tomorrow to try and pull out any sort of negative or positive perception they can find. Whatever the case may be, I think the outcome will be very volatile, bouncing from red to green and higher volume. Did you see today? 408M trading volume, wow. This is the most we have seen in a while. With volume back and volatility increasing, we're heading back into market crash danger zone. Stay on your toes.

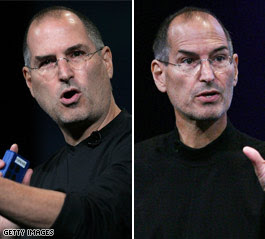

Apple knocked earnings out of the park after close today, sending after hours trading up almost 10%. This is not surprising to me, as I have liked apple all year (one of my top picks for long). All this news of Job's health and their ability to stay competitive is nonsense. Too much cash on hand and too much innovation. Apple should leap quite a bit and could definitely set the standard for up trading tomorrow. Lets see if Google can follow.

Due to the extreme uncertainty and volatility right now I am playing my bets with energy and commodities. Obama's only ammo to throw at this beast is more government spending (and even that can only slow the pain in my mind). He is going to have to spend trillions just to make a dent. Doing so is going to give gold, silver, and other commodities a pretty face of value. I'm bulling up on a lot of gold, DIG, and other commodities tomorrow to keep during this time of uncertainty. I've lowered my short position (still plenty left) until some definition is back and have a little bit of long financials as a hedge. Either way, tomorrow should pave the way of some new momentum.

Like I said yesterday, don't expect Obama to roll over and die his first few months in office. He should be working around the clock to ways to pump this market up. I still think we're heading to new lows shortly, we just need the Obama fluff to wear off a bit. Below is the market trend score (analyze a symbol here free) and movement for FAZ, which momentum score is still relatively strong at +60.

I hope everyone has a good evening. With this volatility, we are able to make some serious cash in quick moves. It's all about timing the bumps right. Happy Trading and see you tomorrow. Check out the new videos at INO TV, great stuff and it's free.

New President, New Record Lows and New Worries

Posted On Tuesday, January 20, 2009 at at 3:52 PM by Finance FanaticDid you say Obama rally? People were shocked this morning as they woke up to see a monumental time in US history and Wall Street react as a spoiled child throwing a tantrum. Maybe if Obama could have broken off a bit of that $170 million dollar party today to give to the banks, the result wouldn't have been so bad. Seriously though, clearly today is evidence that bank's problems are far from over. This is not something new to this site, as we have been discussing those problems for months now, but it seemed to hit home with investors today as the Dow closed down over 4%. Bank of America, Wells Fargo, and Citi were just a few of the banks all down over 20%. These types of movements, especially during what people thought could be a huge day for stocks, should be detrimental to the market. Bulls were expecting a big victory today. It also doesn't help that Obama's big stimulus plan may not be completed for approval until mid February. I am sure today has added some incentive to get that in the works ASAP.

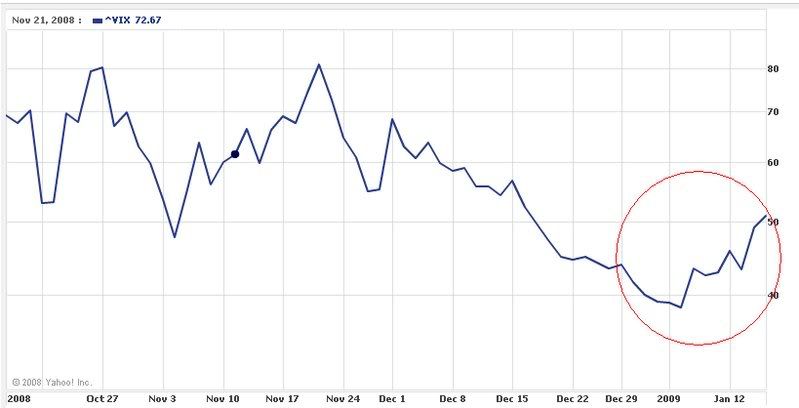

Well, what a day for my shorts, wow. I haven't had a day like this since October. SRS up 20%, SKF up 29%, and FXP up 16.8%. Just as I discussed yesterday, the VIX level increased 22.86% today! With the VIX increasing at this rate, these inverse leveraged etfs have the potential to be making a lot of money. Today it closed at 56. If it gets back in the 65-75 range, look out. By that time SRS should be $100+ and quickly on its way higher.

I wanted to show you a breakdown of SRS trends (see below) done from market trade (you can get a symbol analyzed for free, all they need is your email, Click Here!) Notice how they break down the moving trends of the stock/fund and give it a score at the end. SRS was give a +55. The range is from -100(being strong downward trend) to +100(being strong upward trend). So at +55, there is definitely some good momentum behind the fund. SKF and FAZ, wow. FAZ closed up just about 40%! I don't think many articles are being written today about the failure of these fund's ability to produce strong returns. As I have said time and time again. It is all about being on the right side of the momentum, and right now, momentum is downward.

Tomorrow makes me very curious. As all the energy in my body tells me the market will continue to plow downward as surely there was great devastation done today, a part of me feels that we could have an up day tomorrow. I don't expect Obama to kick back for a few days and get settled. I'm sure we can expect some sort of action before week's end to try and re-instill some confidence in the lending institutions. Also, IBM reported better than expected earnings after the close today, which has given a little bump to the tech stocks in after hours after their slaughtering today. However, world markets are responding very negatively to the horrific US trading day, which could continue to put a downer on the market into tomorrow.

Tomorrow makes me very curious. As all the energy in my body tells me the market will continue to plow downward as surely there was great devastation done today, a part of me feels that we could have an up day tomorrow. I don't expect Obama to kick back for a few days and get settled. I'm sure we can expect some sort of action before week's end to try and re-instill some confidence in the lending institutions. Also, IBM reported better than expected earnings after the close today, which has given a little bump to the tech stocks in after hours after their slaughtering today. However, world markets are responding very negatively to the horrific US trading day, which could continue to put a downer on the market into tomorrow.

So there are a lot of spinning wheels going on at once and tomorrow is a bit of a mystery for me. However, the momentum is definitely downward and no matter what tomorrow yields, I believe we're heading for the high 6000's - low 7000's here in the next couple of weeks. Either way, expect a pretty volatile day tomorrow as there should be pretty strong forces on both sides.

Another down day like tomorrow and I will be putting some serious money in gold. With a huge stimulus plan like the one Obama is cooking, you can expect gold prices to shoot up due to future inflation worries. Quite a bit of GDX or GLD is looking to be in my near future.

Just a quick update on my progress with Lending Club. So far all the payments have been made on time and I am still on track for my 10.5% return. I may throw some more cash at it to up my principal invested as I am slowly becoming more comfortable with the company and am having success thus far. I do feel it can be good alternative investment vehicle, especially with the lack of confidence with commercial banks.

Check out this featured video of the week from Market Club showing their track record, (click here). I know it can be difficult to spend money on tools in this type of market, but as you can see from the video, they really do a good job of bringing in profits by diversification. I have been using many of their tools the past week and learned a lot. You can try a free trial of their videos, Click Here, they just need your email and name. It can be tough to find good tools out there so I flock to the ones that seem to work.

Tomorrow should be just as an exciting day to watch as today. There is definitely that nip in the air that we felt back in October where there is a lot of uncertainty. We shall see. Happy Trading and we'll see you tomorrow.

When to Invest in Leveraged ETF's

Posted On Monday, January 19, 2009 at at 3:22 PM by Finance Fanatic In recent weeks, there has been a lot of talk of these inverse etfs we discuss so frequently on this site and whether they are a legitimate vehicle for investment in this market. Some analysts, such as Cramer, feel that these funds should be taken off the market. Although Cramer can say some educational things sometimes, his banter on this subject must be from a personal vendetta he has with the funds, because his argument is just plain nonsense. When I look into my portfolio from Zecco.com, I notice that most of my portfolio is made up of these etfs right now. I have made a lot money from these in the past. I have also lost some. The point is, although there are flaws (if you want to call them that) to the funds and they can cause a lot of stress, there can still be A LOT of money made with playing them at the right time and in the right way.

In recent weeks, there has been a lot of talk of these inverse etfs we discuss so frequently on this site and whether they are a legitimate vehicle for investment in this market. Some analysts, such as Cramer, feel that these funds should be taken off the market. Although Cramer can say some educational things sometimes, his banter on this subject must be from a personal vendetta he has with the funds, because his argument is just plain nonsense. When I look into my portfolio from Zecco.com, I notice that most of my portfolio is made up of these etfs right now. I have made a lot money from these in the past. I have also lost some. The point is, although there are flaws (if you want to call them that) to the funds and they can cause a lot of stress, there can still be A LOT of money made with playing them at the right time and in the right way.

A key element to the success of these etfs, is the VIX level. VIX (Volatility Index of the S&P) has proven to have a strong correlation with the performances of these funds. As the VIX index is higher, so is the volatility. In turn, having the "fear index" raised during the more volatile times puts even higher premiums on the purchase of options. These funds consist largely of swaps and option purchases. This is why you see the greatest gains from these funds during the highes peaks of the VIX. And even more so downward on the low peaks (see below).

As you can see from the graph below, SKF and SRS (two of Proshares most popular 2x inverse etfs) track almost directly with the VIX , just more exaggerated. The separation is even worse on the down swing. This is why when people analyze the funds on 1 year+ holding terms, the numbers don't equal out, because the number can fall at a more rapid rate than it went up. This is largely due to where the VIX levels are at and where the momentum is. These past two months, the market became very consistently bullish, which shot down the prices of these funds much dramatically then they went up. Because of the sophisticated nature of these funds, with the swaps and options, as well as the management fees, these funds can move at a much larger rate than their claimed 2X leveraged of their measured fund. This can be a two edged sword as they can indeed yield stronger gains than just 2x the funds movement or lose more on the way down.

It is for this reason everyone is hating these funds right now, because they have lost so much value recently. However, with the combination of the even more so weakening economy and the VIX levels reaching over 50 on Friday (lows were at 38 and highs were at 80), I am more and more seeing big opportunities for these etfs again. Just from the 38 to 50 move in the index, Many of these funds have jumped 20-35% in a week. They are obviously to be played on momentum and volatility. If the VIX continues to move higher the next couple of weeks, there could be some serious gains by these funds.

It is hard to just pick a day on a calender and do a yearly analysis on these funds as you would a normal stock or mutual fund. Because of the rate of change that these funds can move at, it can be up 150% in 2 weeks or vise versa. Two months ago, no one was questioning the return abilities of them. At the time they were all $200+! It is all about timing the bumps right and getting on the right side of the momentum. Keep your eye on the VIX levels, because if it continues to push upward, you can expect to see strong gains from these funds. To sum it up, I'm a bull on SRS, SKF, FXP(or FAZ) and EEV.

UYG is one to be considered just for this week as Obama is put into office, but I'm not going to hold it for long. Banks should get some love as hopes for the biggest bailout ever is present. However, as we discussed last week, the crater to fill is much deeper than the shovels of dirt he plans to throw on it.

Here is a great trend analysis site ( Click Here) where they will take any symbol your tracking and do a great fundamental analysis on it. I've used it on these funds, and they work well. They are also offering a free video tutorial on expert training and technical analysis, Click Here. Definitely worth learning about in this market. Check them out, they'll give you free trials, all they need is your email and name.

Have a good evening everyone. Happy MLK day and lets see if Obama can tackle the biggest financial crisis this country has ever seen. Happy Trading.

Bailouts Beat Out Bad News

Posted On Friday, January 16, 2009 at at 7:01 PM by Finance Fanatic The Friday rally returns. And in the midst of so much adversity too. I was surprised today to see my Zecco.com account in the red today when I first checked this morning. This definitely has to be the Obama anticipation rally, because I can't think of anything else that would end today green other than that. The belief in Obama's ability to continue to print money is ringing much louder in everybody's ears than the fact that there is much to be worried about in the near future.

The Friday rally returns. And in the midst of so much adversity too. I was surprised today to see my Zecco.com account in the red today when I first checked this morning. This definitely has to be the Obama anticipation rally, because I can't think of anything else that would end today green other than that. The belief in Obama's ability to continue to print money is ringing much louder in everybody's ears than the fact that there is much to be worried about in the near future.

Circuit City announced today that it's official. They have been unable to reorganize their business and will move to the next step, liquidation. For those who have been reading my site for a while, we knew this back in November. There goes another tens of thousands worth of jobs as well as an American business that has been around for more than 20 years. GE capital, Conoco, AMD and Pfizer are also in the plans for some massive layoffs. January-April's unemployment numbers are going to atrocious. Every single sector of business is somehow struggling in this market. There is no immunity.

As I said I was going to do yesterday, I picked up some Citi shares today. Due to their unfavorable earnings and their splitting, at $3.50, it is low enough for me to make the gamble. I predict some serious bank rallies next week as Obama gets put into office and begins to unfold his huge bailout plan. Although I feel this won't fix anything in the long term, it should make some serious movements in the bank stocks. Hopefully I can make a 30-40% return and get out of it before it comes down again. Sure it's a risk, but I'll take it.

I also picked up some more GDX options today. With the huge bailout plans, will come some serious money printing. Gold is sure to get a good bounce as Obama looks to unload a good chunk of cash. Just today, gold was up $35. This should be even more next week.

Bank of America and Chrysler got another check from the Fed today. Now people are wondering whether Circuit City should get a piece too. Why not? Everyone else has. They failed to draw the line with the autos, so they have opened this door and now have to deal with it. It really does scare me of what our deficit will be when all of this is done. I do recognize the principle of backing the banks, no matter what, but it should end there.

For all you Californians, enjoy your IOU from Arnold concerning your tax refunds. Due to the $41.6 billion California deficit, Arnold is looking to either issue IOU's or postpone the payment. Either way, holding tax returns will not stimulate the economy and should cause for even more problems. State government IOU's, are you serious? California is desperate.

It was another volatile day going from 100 up to 100 down and back up again. We are nearing market conditions from past October and it is beginning to become thin ice with trading again. After the Obama change, what is left to cheer? More bailouts? Either way, I think we're in for a tough run until May.

With the Vix getting back into the 50's, it's prime for buying the 2x inverse etfs again soon. Since they are momentum movers, the higher the VIX, the better, as long as you're going the right way. I hope you all have a good weekend. Next week is the big one, lets hope for some serious dollar signs. Happy Trading.

PS - I am running a promotional contest to win a quick $100 on behalf of Lending Club to try and instill some curiosity in the company. We've talked a bit about it on the site and I do feel they are worth checking into. So if you are interested, than go here for details. It requires no money to enter the contest, just filling out a form and poking around the site. I'm just trying to stimulate some curiosities.

Bailout Breaths Cause For Market Turnaround

Posted On Thursday, January 15, 2009 at at 7:05 PM by Finance FanaticI don't know whether it was Bush's departure speech or our newest fix of bailouts that pulled off a huge momentum change in the middle of day today. The Dow dipped below 8000, before immediately turning around and actually closing up at 8212. Amazing, especially after the series of events which have transpired throughout the week. These days I never underestimate the market's ability to start buying out of pure speculation. In any event, today's miracle puts a bit of a different light of what I was planning to do with my portfolio the next couple weeks. This turnaround today, could indeed be the ones that continues to go on into Obama's inauguration. Once again, it is all based on government intervention, no actual numbers, and a false hope that, in my opinion, is once again just going to temporarily slow the pain.

So what happened today? Well, one item that seemed to make people happy is that Congress did not pass the bill that would put a hold on the remaining $350 billion of the TARP funds. This tees up Obama quite well to do whatever pleases him with the remaining funds. Lets hope that the second half of the funds go a bit farther than the first did. The problem is that there is such a big deficit of debt to fill, it's like trying to fill a meteor crater with shovels of dirt. It's going to take a long time.

Another element worth noting is the VIX level slowly climbing up. Many people say we are not vulnerable for a crash right now, because the volume's not there and the volatility is not there. As that can be partially true, the VIX level has definitely been rising the past week and should continue to rise as uncertainty continues and more woes hit the headlines. If volatility levels do indeed reach those October levels and beyond, watch out.

Citi is expecting a loss in their earnings tomorrow, which could be bad for their already $3.83 stock price. Call me crazy, but Citi is becoming appealing to me as a buy. I know people worry of another Lehman, but I do not feel the government will let this one go. Sure they're going to have their continual share of problems, but if they have another beating of a day with their stock price tomorrow due to earnings, I plan on picking up 1000 shares. With an announcement from Obama, as well as the probability of Bank of America getting $15 billion more from the Fed, Citi is very capable of having a 50%+ day, easily. So we'll see how tomorrow plays out, but it is definitely on the radar. For you first time traders or those that are unhappy with your online accounts, you can get free monthly trades at Zecco.com, worth checking out.

Well, Fridays can be interesting. It wasn't long back that every Friday was a rally. That hasn't been the case lately, but today's powerful turnaround could bring some optimism to end the week. However, a bad enough number from Citi could definitely set a selling tone for the day. Either way, I'm happy about my current position and hope for some good gains tomorrow. Definitely watch SKF and FAZ tomorrow. Have a great night and Happy Trading.

Jobs Steps Aside – Turmoil Brews For Tomorrow

Posted On Wednesday, January 14, 2009 at at 3:50 PM by Finance Fanatic It couldn’t have come at a worse time for Apple and for the rest of the market. On Wednesday, Steve Jobs (CEO of Apple) announced that he would be taking a leave of absence from his duties at the company until the end of June to focus on getting back to health. He said major decisions would still run through him, but day to day operations would be handled by the COO. This news sent Apple stock down as bad as 10% in after hours trading. Just rumors of bad health with Jobs caused the stock to drop 5%. I would expect a very serious blow to apple’s stock price tomorrow.

It couldn’t have come at a worse time for Apple and for the rest of the market. On Wednesday, Steve Jobs (CEO of Apple) announced that he would be taking a leave of absence from his duties at the company until the end of June to focus on getting back to health. He said major decisions would still run through him, but day to day operations would be handled by the COO. This news sent Apple stock down as bad as 10% in after hours trading. Just rumors of bad health with Jobs caused the stock to drop 5%. I would expect a very serious blow to apple’s stock price tomorrow.

Given that, if Apple gets hammered too much tomorrow, I actually may pick some up. I mean come on, I know the company is Job’s baby, but lets be honest, they’re not going anywhere for a while. Plus, they have $25 billion of cash in the bank! Just their cash on hand along with their other liquid assets has got to be worth at least $40 per share. So I will keep my eye on that. It was bad news for me, as I still have a couple of apple options. Thanks Steve.

Well, I’m sure we can certainly expect this to affect the market tomorrow as there are plenty of other things going wrong around us. Good luck Obama. Steve had to wait until after the worst trading day since December 1st (-248 pts) to break the news. Even without the announcement, things were not looking good for tomorrow. There is serious downside momentum and as we near breaking the 8000 (we could reach tomorrow) mark again, people are starting to anticipate a new bottom. Possibility in the 6000’s.

Today, retail sales was also confirmed to be horrible for December, as the National Retail Federation announced a 2.8% decline in retail sales for the month of December. This being the first time there has been a decrease since they started tracking the number in 1995. We also had two more members join the bankruptcy club today. Retailers Gottschalks and Goody’s filed for BK today, which is just the beginning of which I feel by the end of the year will be a club with standing room only. With those, comes more job losses. Motorola announced a 4,000 job cut today. As I have said before, this year, the retail will be the backbone of this downfall. With the failure of the retailers, will come the failure of the real estate. Then the trillions in outstanding debt will turn into the bank’s problem once again. What does this mean. Long on SRS and SKF. In fact all of the inverse etfs were up big today. My portfolio is starting to look like it did back in October. And I still feel we’re ankle deep.

I expect to see a horrific day of trading tomorrow. Apple has become the face of the US market, especially the NASDAQ, and such a devastating day is bound to bring down the rest of trading, let alone all the other crap that is present. I don’t know how long this selling spree will go until we get an up day, but as of now, I can’t perceive anything that people can find as “good news.” Even Bank of America getting more aid from the Fed. At any rate, I’m hoping to see another big day for my inverse etfs. If they go big enough, I may consider shaving some of my SRS earnings and putting them into Apple. We’ll see.

I also wanted to give a little update on my Lending Club experience. As you can see I have received my first interest payment. Big money! But as you can see, the platform is very easy to use and makes tracking your investments quite simple. It looks like my monthly payment is just over $6. So lets hope my 10.5% return stays in tact. So far so good.

I hope everyone has a good evening. We have been talking about these problems for some time on this site and are just now finally starting to see the market begin to suffer the symptoms of our economy. There is still a ways to go. Happy Trading and we’ll see you tomorrow.

I hope everyone has a good evening. We have been talking about these problems for some time on this site and are just now finally starting to see the market begin to suffer the symptoms of our economy. There is still a ways to go. Happy Trading and we’ll see you tomorrow.

Signs of Deflation - Are We Here?

Posted On Tuesday, January 13, 2009 at at 5:15 PM by Finance FanaticToday there was a lot of mixed trading as we saw the Dow teeter-totter from red to green throughout the day. The Dow dipped as low as 8376 but ended a bit higher (still down) at 8448. I was pretty surprised to see the resistance today, especially since there was really not that bad of news today, and even a little good news. This is really telling of the bear motivation in the market right now and that the momentum is definitely downward. In fact, another day of selling tomorrow (I'd say more than 100 points), we could be on a steep path downward. Obama may not provide as big of bump as some people hoped, although I do still feel there will be some green next week.

It's looking more and more that Citi will be splitting up their different branches. Quite frankly, I don't know how Citi is going to survive this year. If it were not for the government having their back, they would have been gone a while ago. At any case, we should probably expect some serious job cuts, everywhere. I'm sure sites like RiseSmart.com (Job Finders for $100K + jobs) are probably spilling with business as more and more executives are looking for jobs.

One issue that seems to be more and more of an issue is the risk of deflation that, in my opinion, is very near if not already here. I feel we are going to start experiencing some serious deflation and then catapult straight into inflation. Anyway, here are some signs of deflation, how it effects us, and some of my plans to hedge against it.

First, as you can see from the graph, the wealth destruction is far greater than any bailout plan that has been proposed. At the rate we're going, we can expect a $7.8 trillion in total wealth loss, which would be about 8 times larger than the biggest stimulus that has been proposed thus far. You can very well expect deflation to creep up with those numbers as upcoming stimulus plans won't put dents in that number.

Another factor is that government programs are showing that they are not doing much good. The first $600 per person stimulus was quickly swallowed up by paying off debt or buying a plasma. The $700 billion hasn't shown its face or made any change to the lending markets. These signs can also contribute to a deflationary market.

One of the biggest signs is the huge amount of debt liquidation that has been going on. We are especially seeing big activity in the short-term commercial paper. In Q3 of 2008 mortgage debt outstanding lessened at an annual rate of $317 billion, while corporate bonds lessened at an annual rate of $755 billion! They call this a credit crunch, but a better term for it is debt liquidation. Instead of creating debt, we have destroyed it. In turn this is what is killing the residential and commercial property prices.

Lastly, we have already been experiencing pricing deflation. Copper -66%, Oil -73%, lead and nickel -73%, and platinum -66%. Ya, so that pretty much proves that point. These deflationary prices are also what contributed to the Dow downfall. At any rate, I believe the signs are here and deflation is inevitable.

To help hedge against deflation, I plan on picking up some UUP (US dollar Index Bullish Fund). As the dollar gains on competing currencies, this fund is bound to get some bounce. Hopefully, I can profit off this as well as my short inverse funds, as we are bound to continue to see severe job loss and turmoil in the financial and real estate markets. Forexmentor.com can be a great tool for those interested in trading currencies. It can get confusing, but a lot of money can be made, especially in this market.

Well, tomorrow will be a telling day for the market. There has been a lot of bearish movements and if this continues into tomorrow, we could be heading down for a while. In the end, I still expect to see gains from FXP, SRS and SKF as we head down a bit more. It will be interesting to see if we start to retest some bottoms that we saw back in October. Have a good night everybody, Happy Trading and We'll see you tomorrow.

Banks Could Be In More Trouble As Commercial Debt Hits

Posted On Monday, January 12, 2009 at at 6:27 PM by Finance FanaticWelcome back to what looks to be another wild week of trading, as the Dow finished down another 125 points today as confidence continues to struggle with more negative outlook and bad earnings projections. Then to really rub it in, after close, Alcoa announced far greater losses than the market was expecting. They came in announcing a .28 per share loss, when the market was only expecting .10 per share. The same time period last year, they announced earnings of .36 per share. This can’t be a help to the already downtrodden market. However, I do think a green day is due, now that we’ve endured four straight days of downward trading. Also, the S&P didn’t close under 870 today, which was a pretty big momentum point. Plus, each day we get closer to Obama’s big day, may bring a bit more optimism. In any case, don’t expect the green to last long, if it even does at all.

There has been some debate on this site and throughout the news of whether the financial markets and real estate values are going to start coming back soon. If you have been following this site, than you probably know where I stand. I just wanted to share some serious data that doesn’t just affect real estate, but the entire market. Real estate, specifically commercial, has a pretty strong correlation with the movement of the economy. If the data out there is correct, than we are far from over and have a lot more bumps to endure. Also, as I have said before, I specialize in the Real Estate industry, so I hear what’s happening first hand everyday and feel I have a pretty good read on what is going on in that market. Whatever the case, it reemphasizes my bull in SRS and even SKF or FAZ.

In 2006, it was estimated that commercial banks held $1.28 trillion in mortgages. In 1991, that same number is estimated to be $410 billion. As you can see, our banking systems have taken big strides into penetrating this market and adding to volume. How were they able to do that in such a short amount of time? This is largely due to commercial mortgage backed securities (CMBS) and collateralized debt obligation (CDO). Through the help of these vehicles, commercial banks were able to unload a lot of these loans and recover a lot of equity by selling them as securities to consumers. As a result, they were able to put that extra equity into more issued loans. In turn, this has created a ridiculous amount of debt.

One of the main reasons many people believe we started this crisis was the failure in the residential sub-prime market. Well, if that’s the case, then we’re in for a rude awakening. The FDIC estimates that commercial banks own $2.1 trillion of the outstanding debt for residential real estate. They also estimate that commercial banks own $3.4 trillion of the commercial debt. With this huge increase in debt amount, coupled with the current state of our economy, we could be set up the biggest financial crisis we have seen. This doesn't even factor in the ones that don't default, but will be up for refinance, since many of the loans issued were 5-year, interest only loans. I know today Bush said financial markets were “thawing”, but the numbers sure do not read that way. I’ll believe it when I see it.

As a result, that’s why I remain very bullish on my SRS (up over 12% today) and SKF or FAZ. With the huge hit to gold, I also picked up some more GDX today, considering I sold a lot of my options last week. Gold took a $35 hit today and has nowhere to go but up in my opinion. FXP has also enjoyed some serious gains lately. I have really enjoyed my portfolio this past week. I hope you enjoyed the Lending Club update. I will probably post the second half later this week. My first payments are scheduled for this week, so far so good. I got a lot of good feedback from people who are finding success with it as well. I wish you all the best in pursuing your financial future. Happy Trading and we’ll see you tomorrow.